This version of the form is not currently in use and is provided for reference only. Download this version of

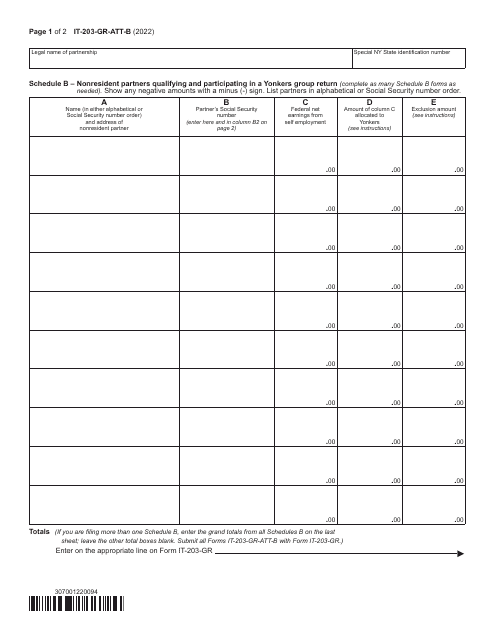

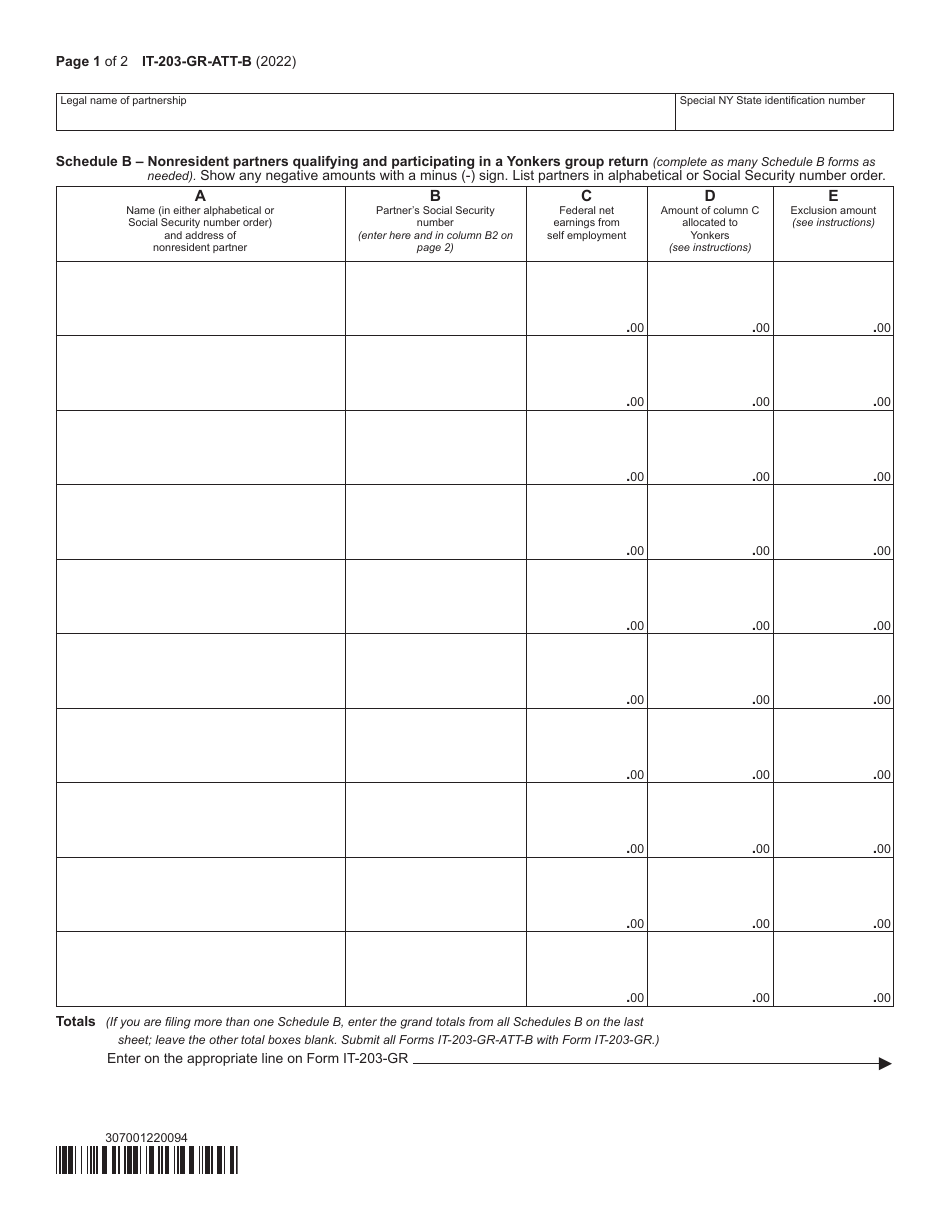

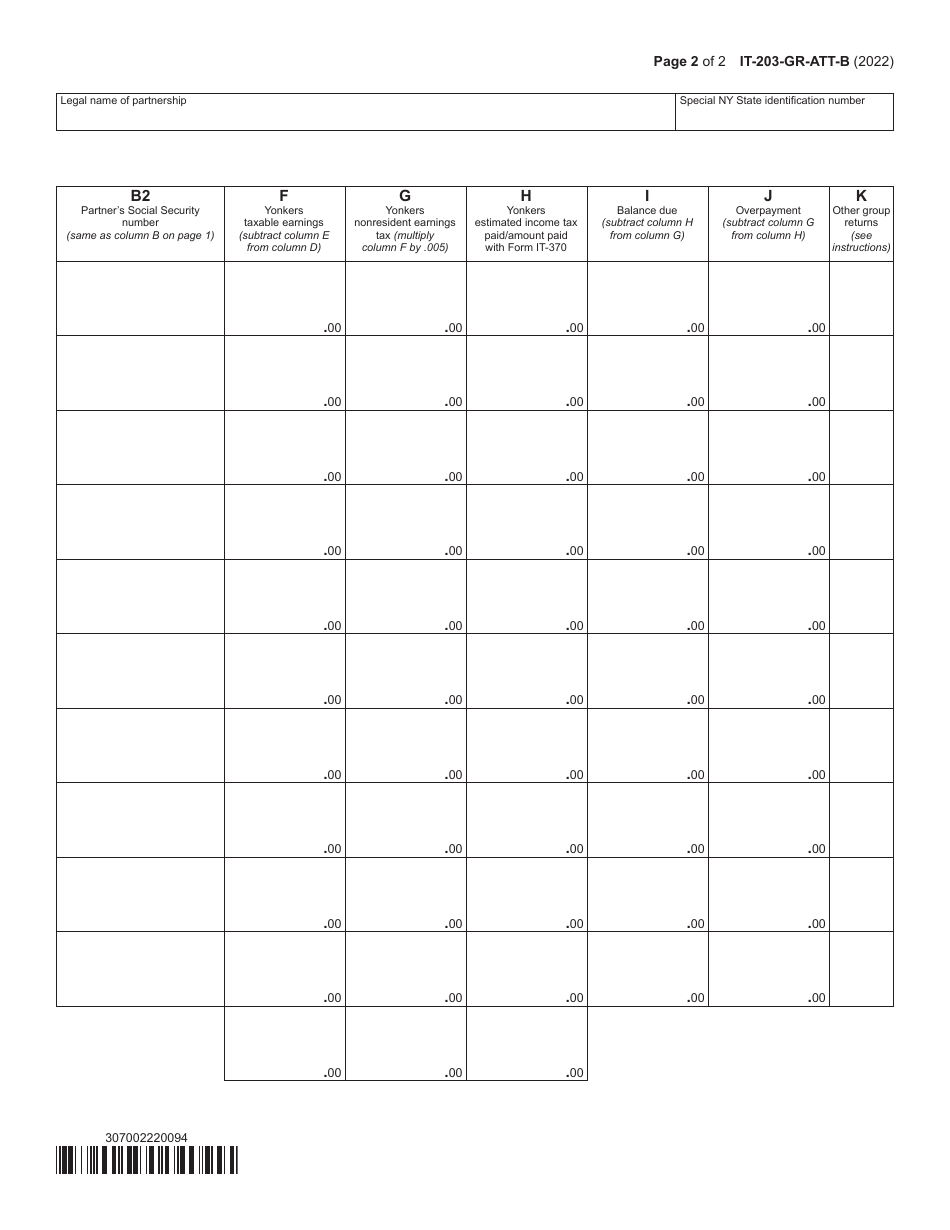

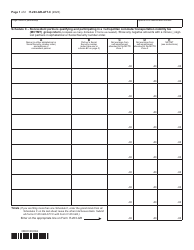

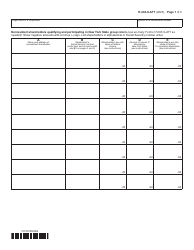

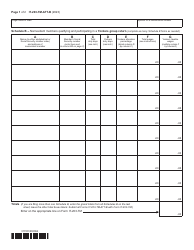

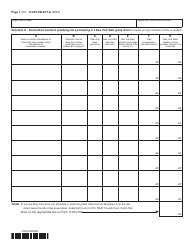

Form IT-203-GR-ATT-B Schedule B

for the current year.

Form IT-203-GR-ATT-B Schedule B Nonresident Partners Qualifying and Participating in a Yonkers Group Return - New York

What Is Form IT-203-GR-ATT-B Schedule B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-203-GR-ATT-B?

A: Form IT-203-GR-ATT-B is a schedule to be filed with the New York State tax return.

Q: Who needs to file Form IT-203-GR-ATT-B?

A: Nonresident partners who qualify and participate in a Yonkers Group Return in New York need to file Form IT-203-GR-ATT-B.

Q: What is the purpose of Form IT-203-GR-ATT-B?

A: The purpose of Form IT-203-GR-ATT-B is to provide information about nonresident partners who are part of a Yonkers Group Return.

Q: Is Form IT-203-GR-ATT-B applicable only to residents of Yonkers?

A: No, Form IT-203-GR-ATT-B is applicable to nonresident partners who qualify and participate in a Yonkers Group Return, regardless of where they reside.

Q: When should Form IT-203-GR-ATT-B be filed?

A: Form IT-203-GR-ATT-B should be filed along with the New York State tax return by the due date.

Q: Are there any penalties for not filing Form IT-203-GR-ATT-B?

A: Yes, there may be penalties for not filing Form IT-203-GR-ATT-B or for providing incorrect or incomplete information on the form.

Q: Can Form IT-203-GR-ATT-B be filed electronically?

A: Yes, Form IT-203-GR-ATT-B can be filed electronically using approved tax software or through a tax professional.

Q: Do I need to include any additional documents with Form IT-203-GR-ATT-B?

A: It is important to review the instructions for Form IT-203-GR-ATT-B to determine if any additional documents need to be included.

Q: Can I amend Form IT-203-GR-ATT-B?

A: Yes, if you need to make changes to Form IT-203-GR-ATT-B after filing, you can file an amended Form IT-203-GR-ATT-B.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-203-GR-ATT-B Schedule B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.