This version of the form is not currently in use and is provided for reference only. Download this version of

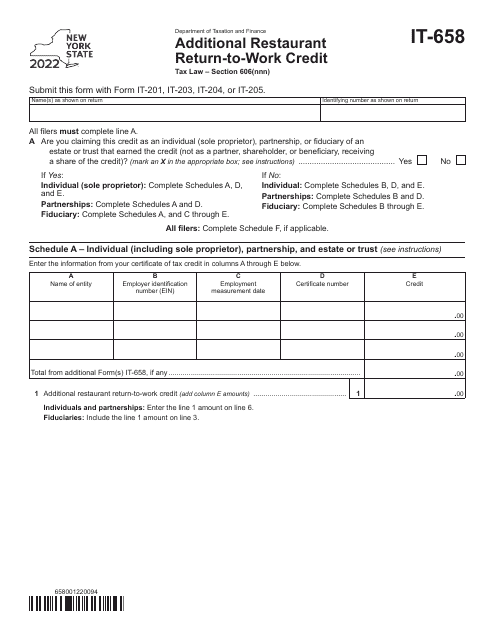

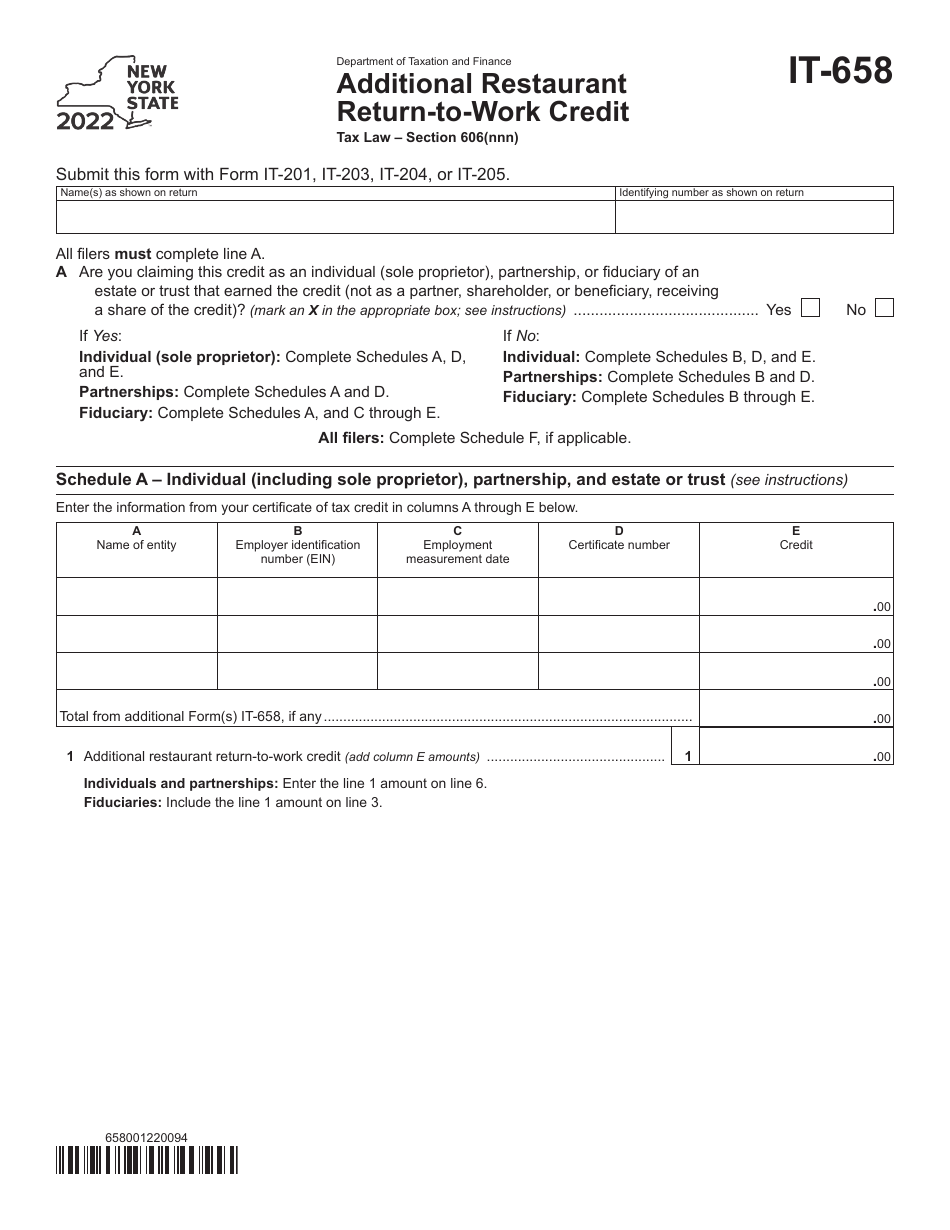

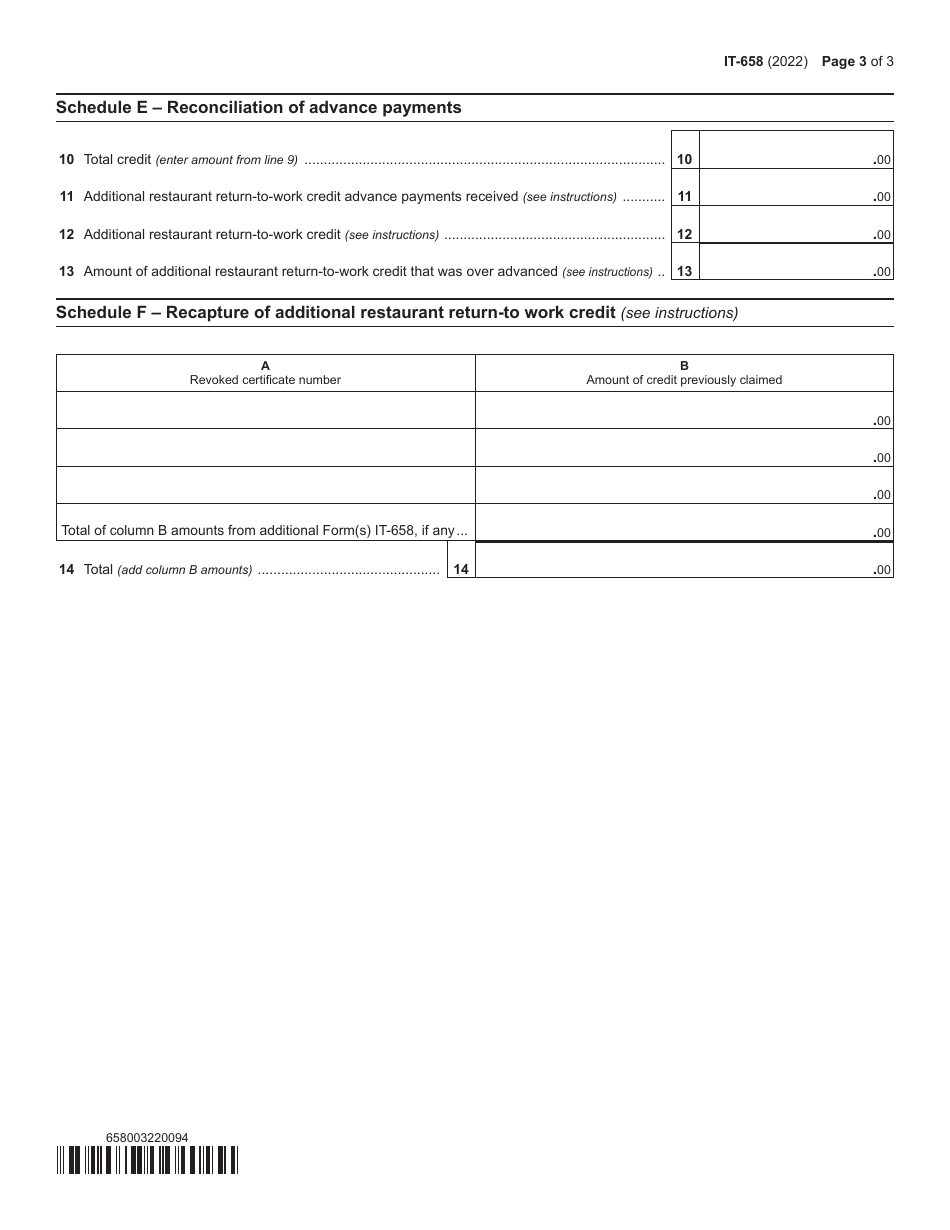

Form IT-658

for the current year.

Form IT-658 Additional Restaurant Return-To-Work Credit - New York

What Is Form IT-658?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-658?

A: Form IT-658 is a tax form used in New York to claim the Additional Restaurant Return-To-Work Credit.

Q: What is the Additional Restaurant Return-To-Work Credit?

A: The Additional Restaurant Return-To-Work Credit is a tax credit available to certain restaurants in New York that were impacted by the COVID-19 pandemic and have rehired workers.

Q: Who can claim the Additional Restaurant Return-To-Work Credit?

A: Restaurants in New York that meet certain eligibility criteria can claim the Additional Restaurant Return-To-Work Credit.

Q: What is the purpose of the Additional Restaurant Return-To-Work Credit?

A: The purpose of the Additional Restaurant Return-To-Work Credit is to provide financial support to restaurants that have rehired workers and are working towards recovery from the effects of the COVID-19 pandemic.

Q: Are there any deadlines for filing Form IT-658?

A: Yes, there are deadlines for filing Form IT-658. It is recommended to check the instructions for the form or consult with a tax professional for specific deadlines.

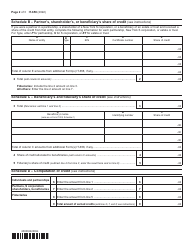

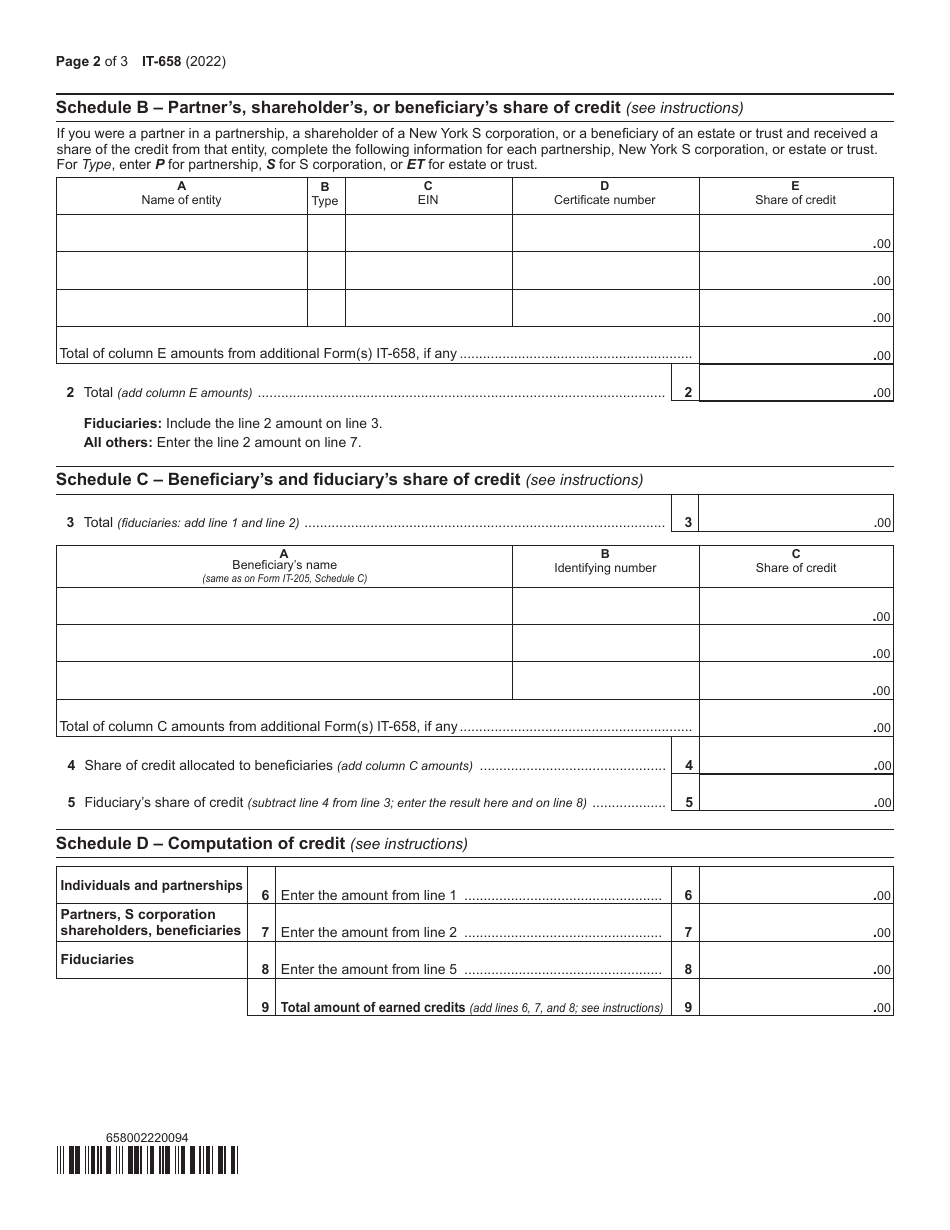

Q: What information do I need to complete Form IT-658?

A: To complete Form IT-658, you will need information about your restaurant's rehiring activities and any other details required by the form.

Q: Can I claim the Additional Restaurant Return-To-Work Credit if I am a non-restaurant business?

A: No, the Additional Restaurant Return-To-Work Credit is specifically for restaurants and is not available to non-restaurant businesses.

Q: Is the Additional Restaurant Return-To-Work Credit refundable?

A: Yes, the Additional Restaurant Return-To-Work Credit is refundable, meaning that if the amount of the credit exceeds your tax liability, you may receive a refund for the difference.

Q: Are there any limitations or restrictions on the Additional Restaurant Return-To-Work Credit?

A: Yes, there are limitations and restrictions on the Additional Restaurant Return-To-Work Credit. It is recommended to review the instructions for Form IT-658 or consult with a tax professional for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-658 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.