This version of the form is not currently in use and is provided for reference only. Download this version of

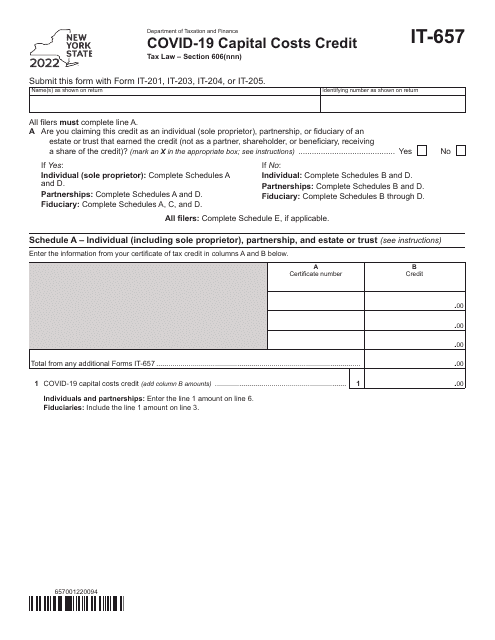

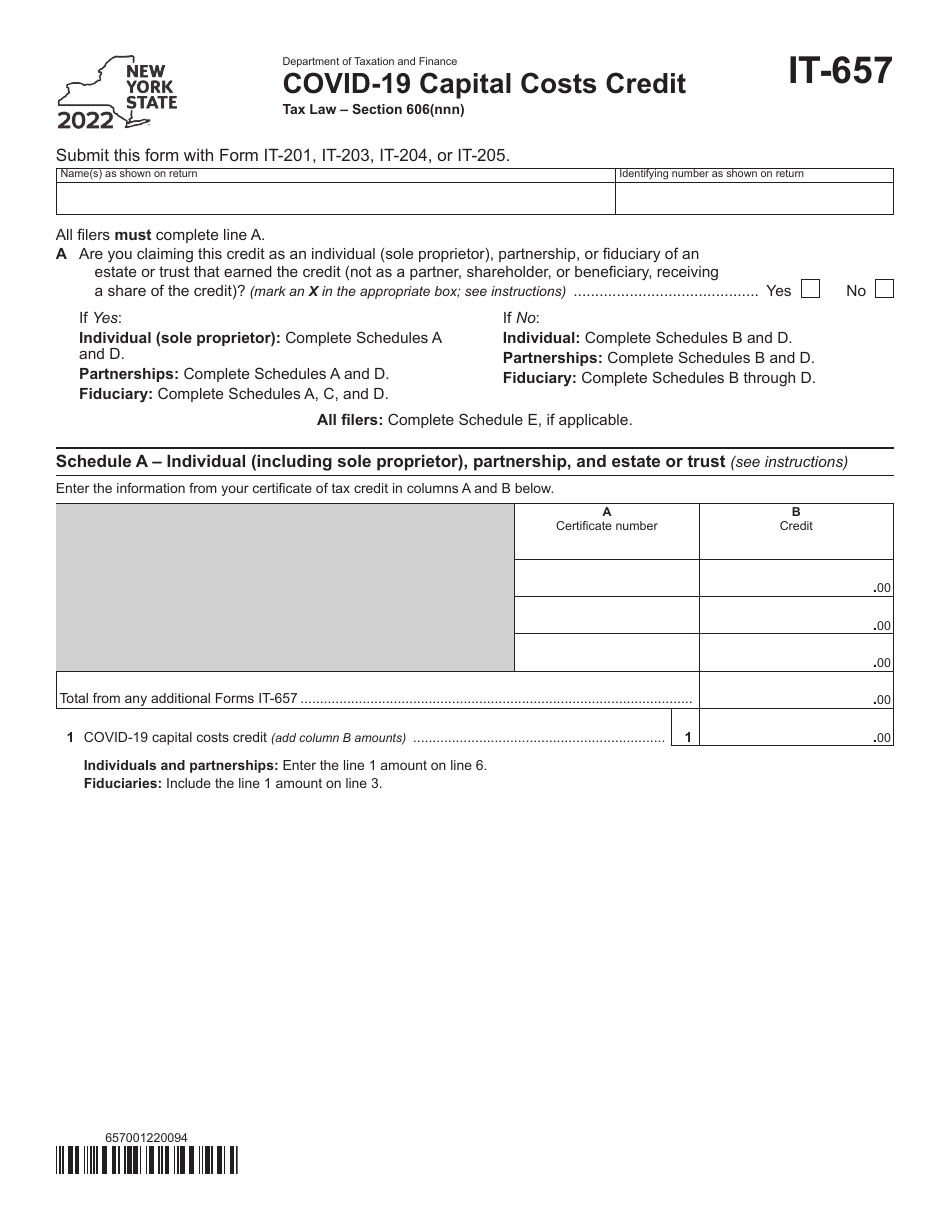

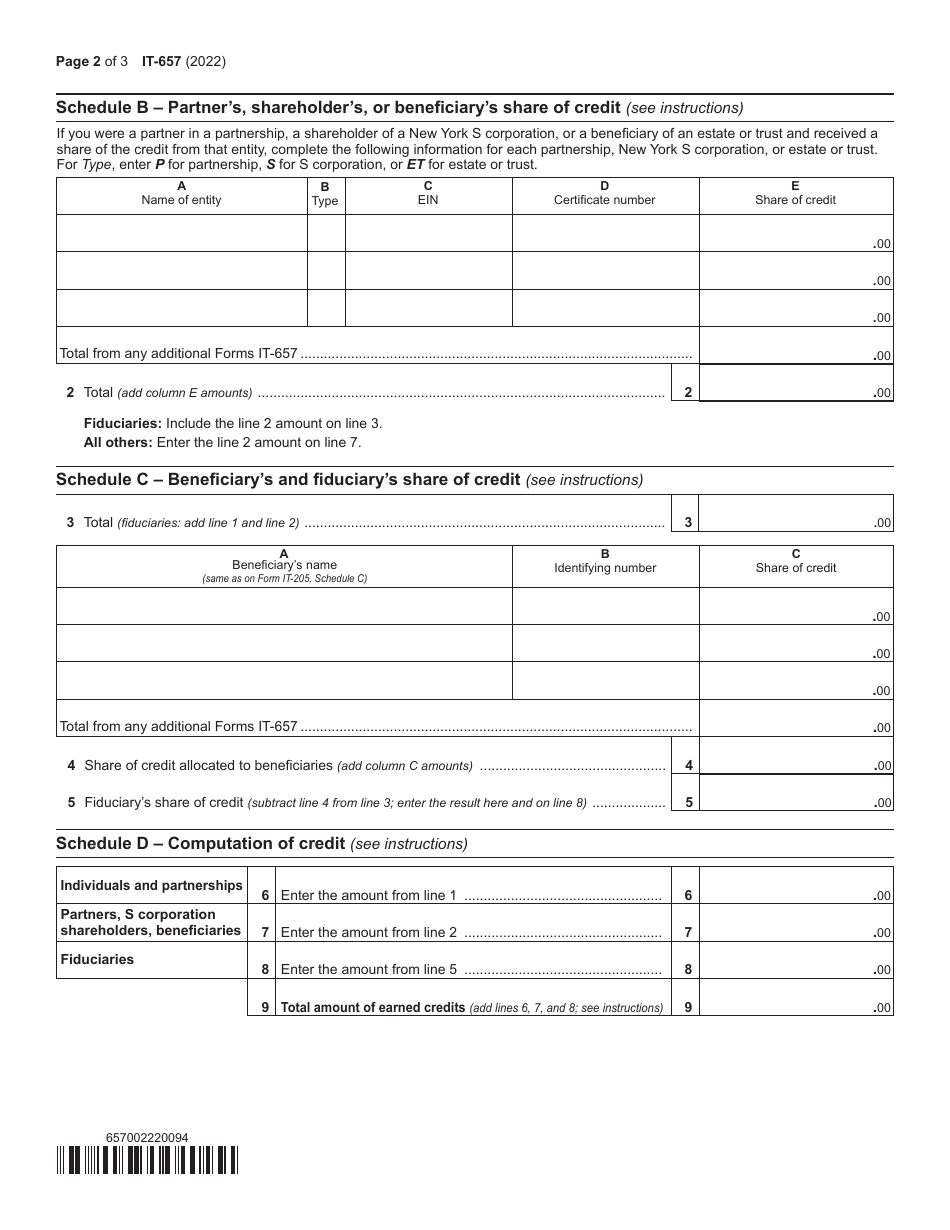

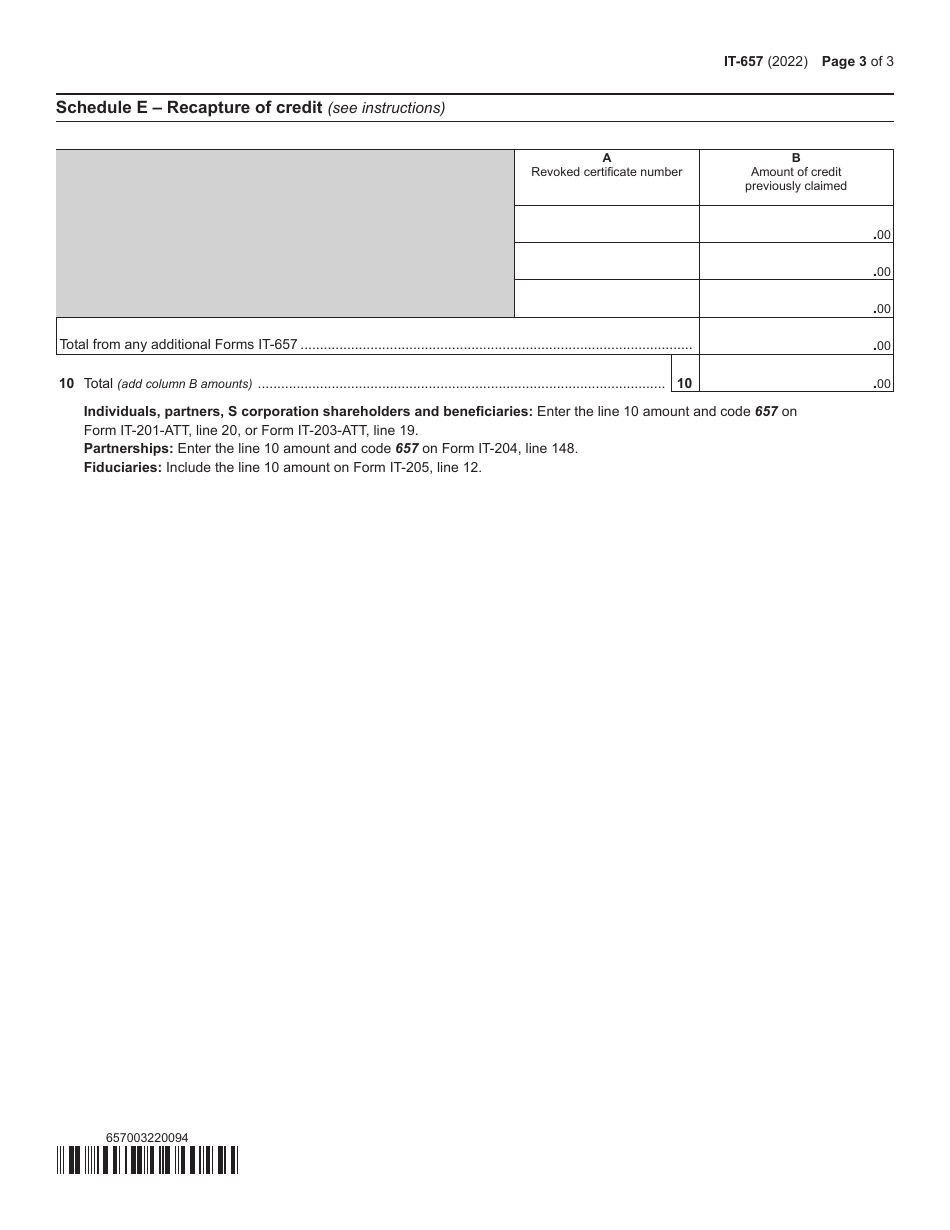

Form IT-657

for the current year.

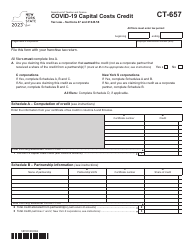

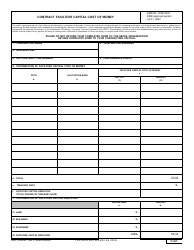

Form IT-657 Covid-19 Capital Costs Credit - New York

What Is Form IT-657?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IT-657?

A: Form IT-657 is a specific form used in New York to claim the Covid-19 Capital Costs Credit.

Q: What is the Covid-19 Capital Costs Credit?

A: The Covid-19 Capital Costs Credit is a tax credit available to businesses in New York to help offset expenses related to pandemic-related safety measures.

Q: Who is eligible to claim the Covid-19 Capital Costs Credit?

A: Businesses in New York that have incurred capital costs for Covid-19 safety measures are eligible to claim this credit.

Q: What expenses can be offset with the Covid-19 Capital Costs Credit?

A: The Covid-19 Capital Costs Credit can be used to offset expenses related to personal protective equipment, ventilation improvements, and other COVID-19 safety measures.

Q: How do I claim the Covid-19 Capital Costs Credit?

A: To claim the credit, you must complete and file Form IT-657 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines for claiming the Covid-19 Capital Costs Credit?

A: You must file Form IT-657 and claim the credit within three years from the original due date of your tax return for the tax year in which the expenses were incurred.

Q: Can individuals claim the Covid-19 Capital Costs Credit?

A: No, the Covid-19 Capital Costs Credit is only available to businesses in New York.

Q: Are there any limitations on the amount of the credit?

A: Yes, the credit is limited to 50% of the taxpayer's liability for the tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-657 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.