This version of the form is not currently in use and is provided for reference only. Download this version of

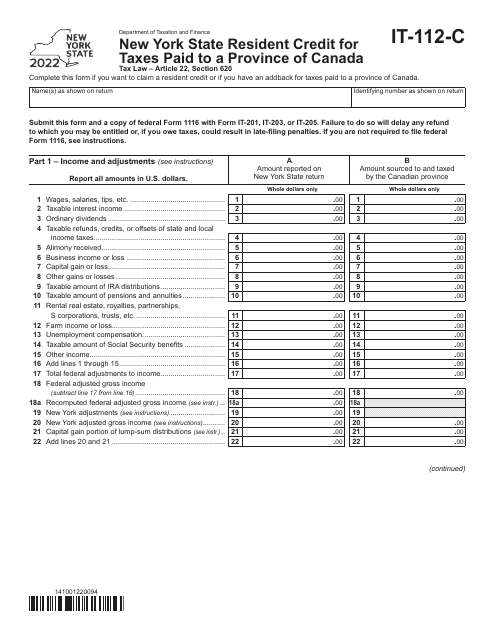

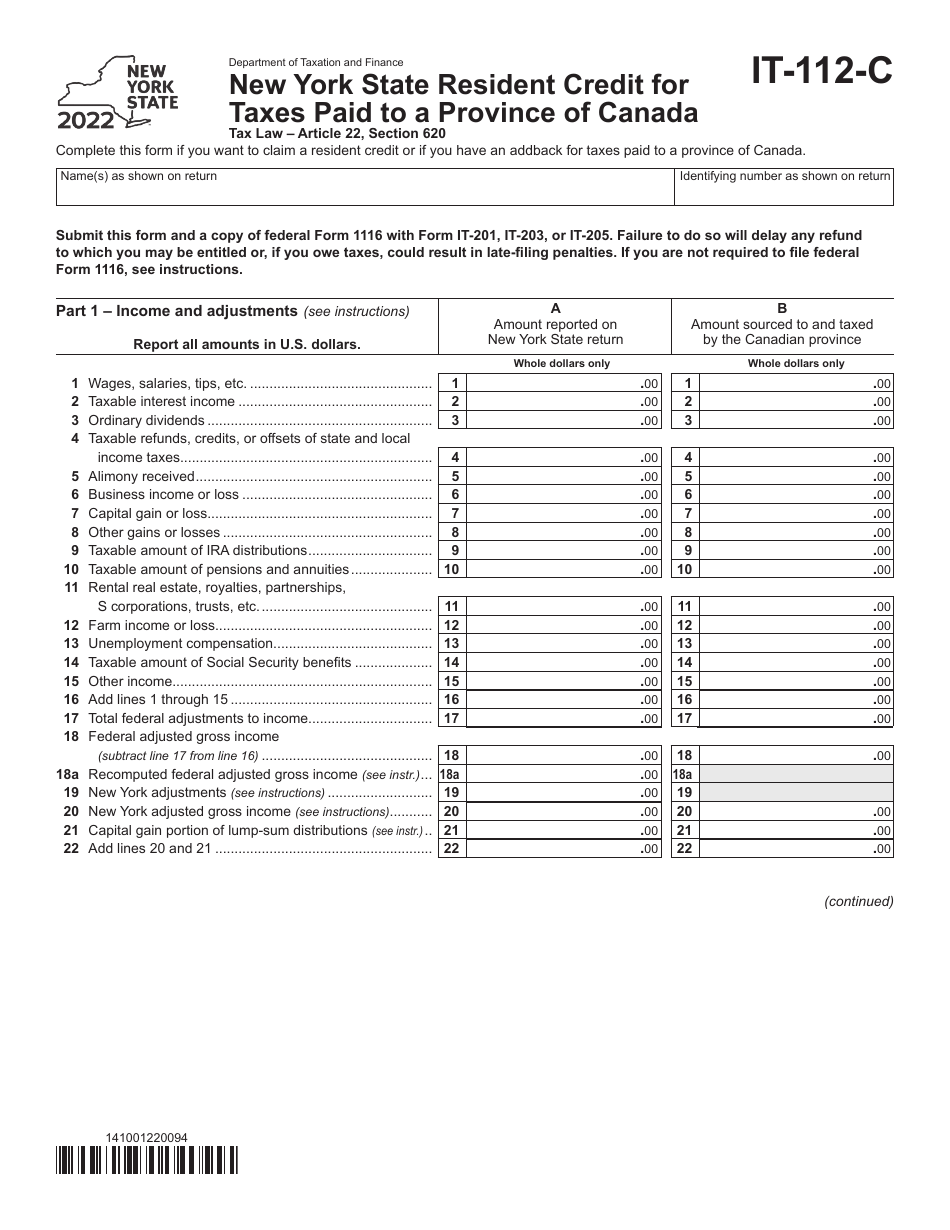

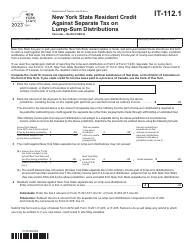

Form IT-112-C

for the current year.

Form IT-112-C New York State Resident Credit for Taxes Paid to a Province of Canada - New York

What Is Form IT-112-C?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-112-C?

A: Form IT-112-C is the New York State Resident Credit for Taxes Paid to a Province of Canada.

Q: Who can use Form IT-112-C?

A: New York State residents who have paid taxes to a province of Canada can use Form IT-112-C.

Q: What is the purpose of Form IT-112-C?

A: The purpose of Form IT-112-C is to claim a credit for taxes paid to a province of Canada on your New York State income tax return.

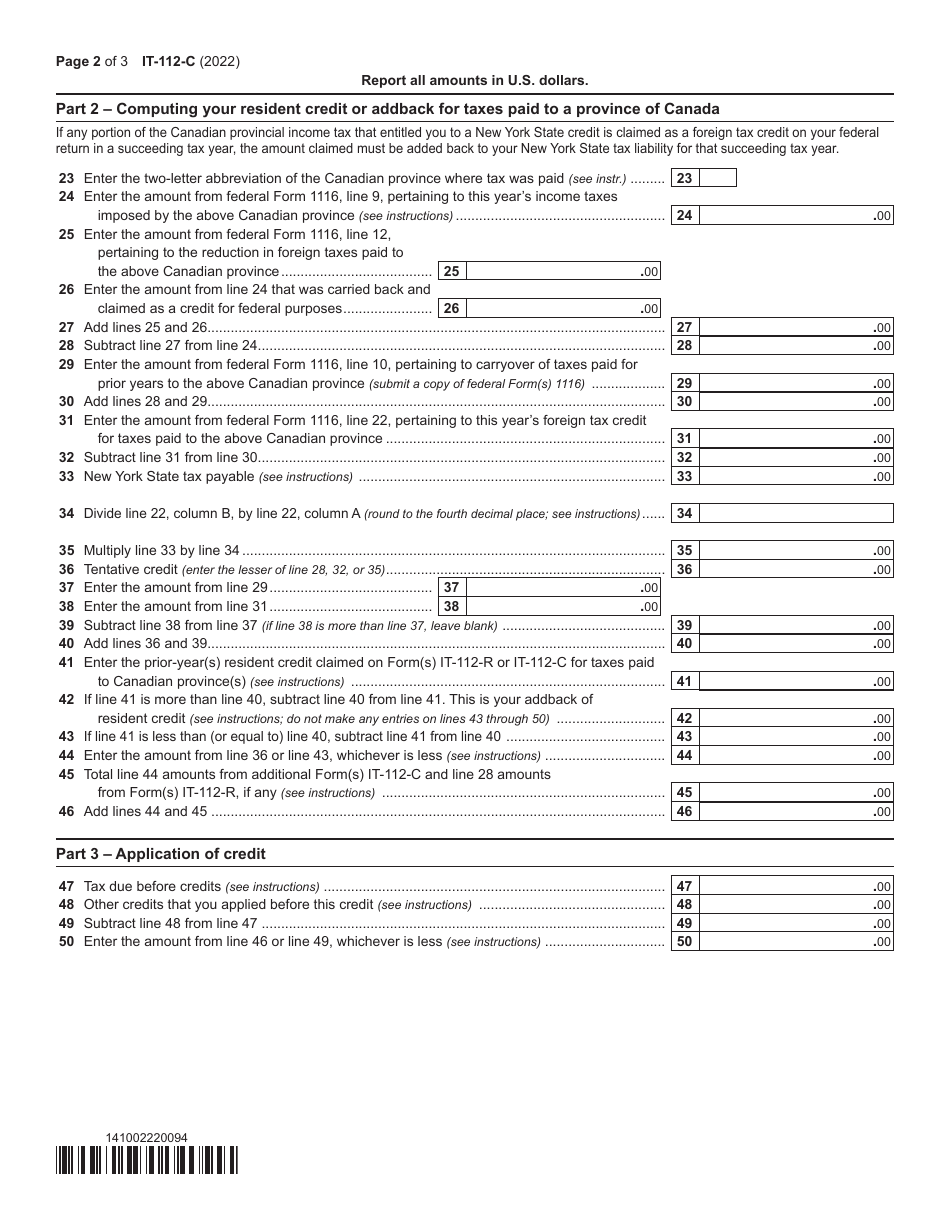

Q: Which taxes can be claimed on Form IT-112-C?

A: You can claim income taxes, general sales taxes, and motor fuel taxes paid to a province of Canada on Form IT-112-C.

Q: Is there a time limit for filing Form IT-112-C?

A: Yes, Form IT-112-C must be filed within three years from the due date of your New York State income tax return.

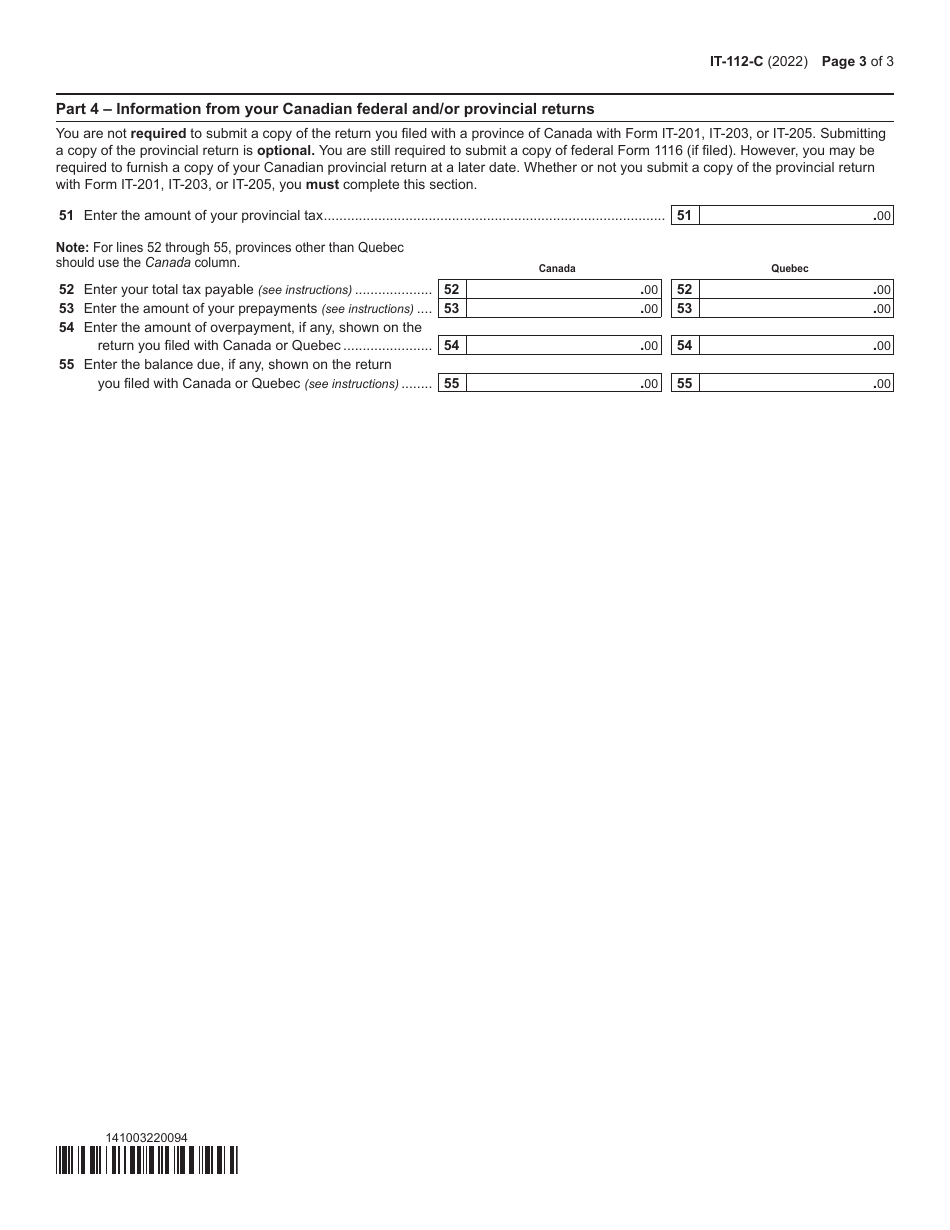

Q: What supporting documents should I include with Form IT-112-C?

A: You should include copies of your Canadian tax returns and any other documents that support the taxes paid to a province of Canada.

Q: Can I e-file Form IT-112-C?

A: No, Form IT-112-C cannot be e-filed and must be filed by mail.

Q: Can I claim the credit for taxes paid to a province of Canada on my federal income tax return?

A: No, the credit can only be claimed on your New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-112-C by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.