This version of the form is not currently in use and is provided for reference only. Download this version of

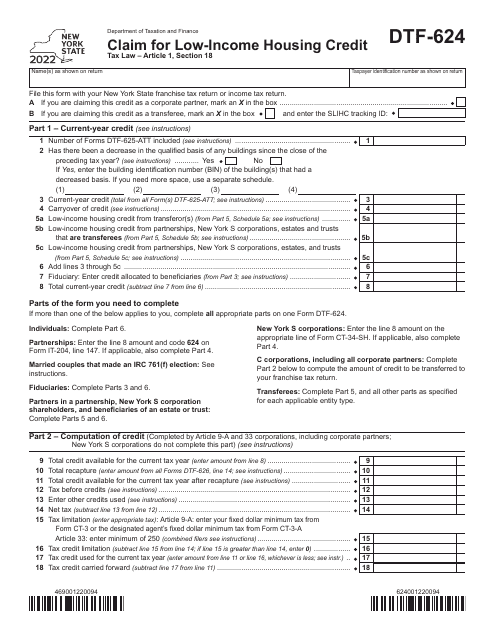

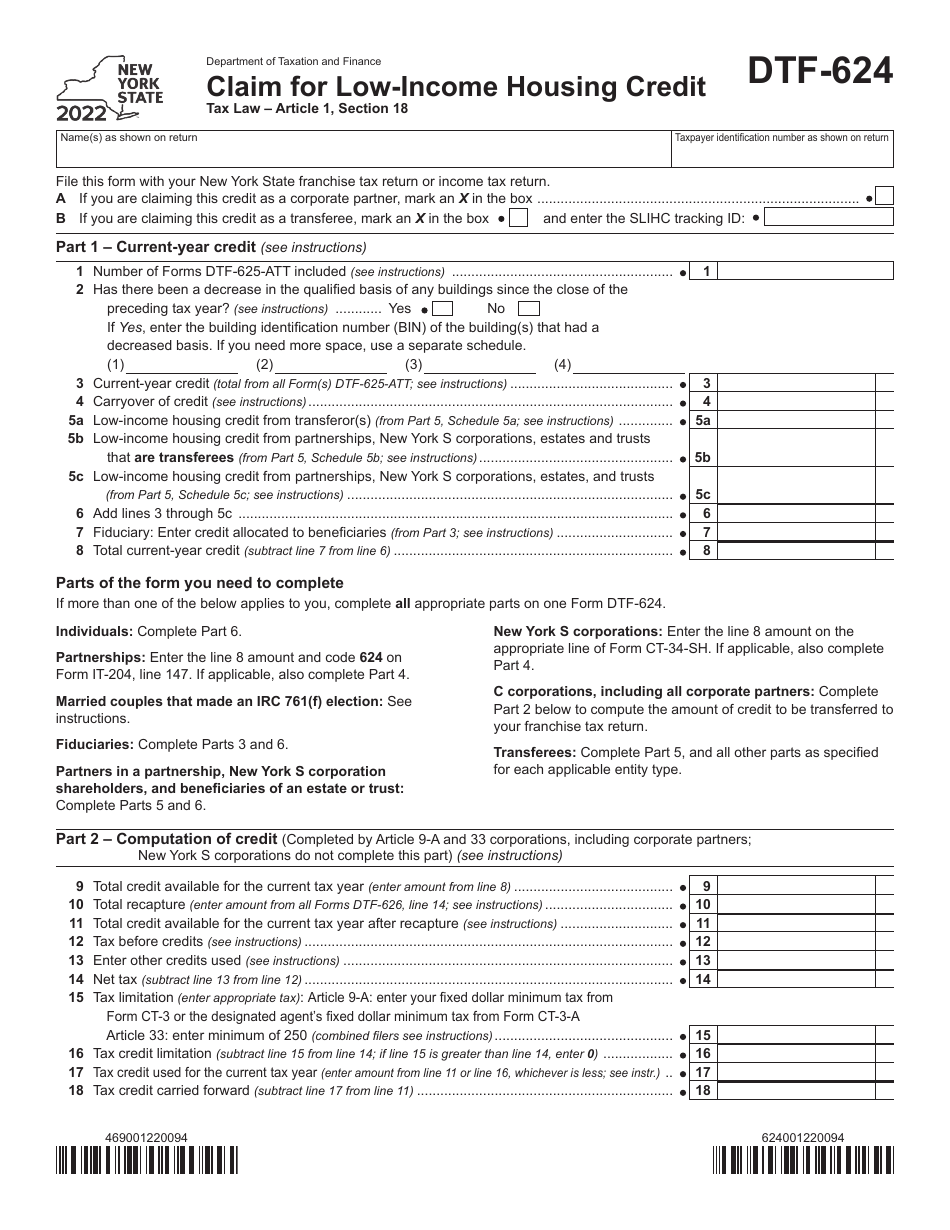

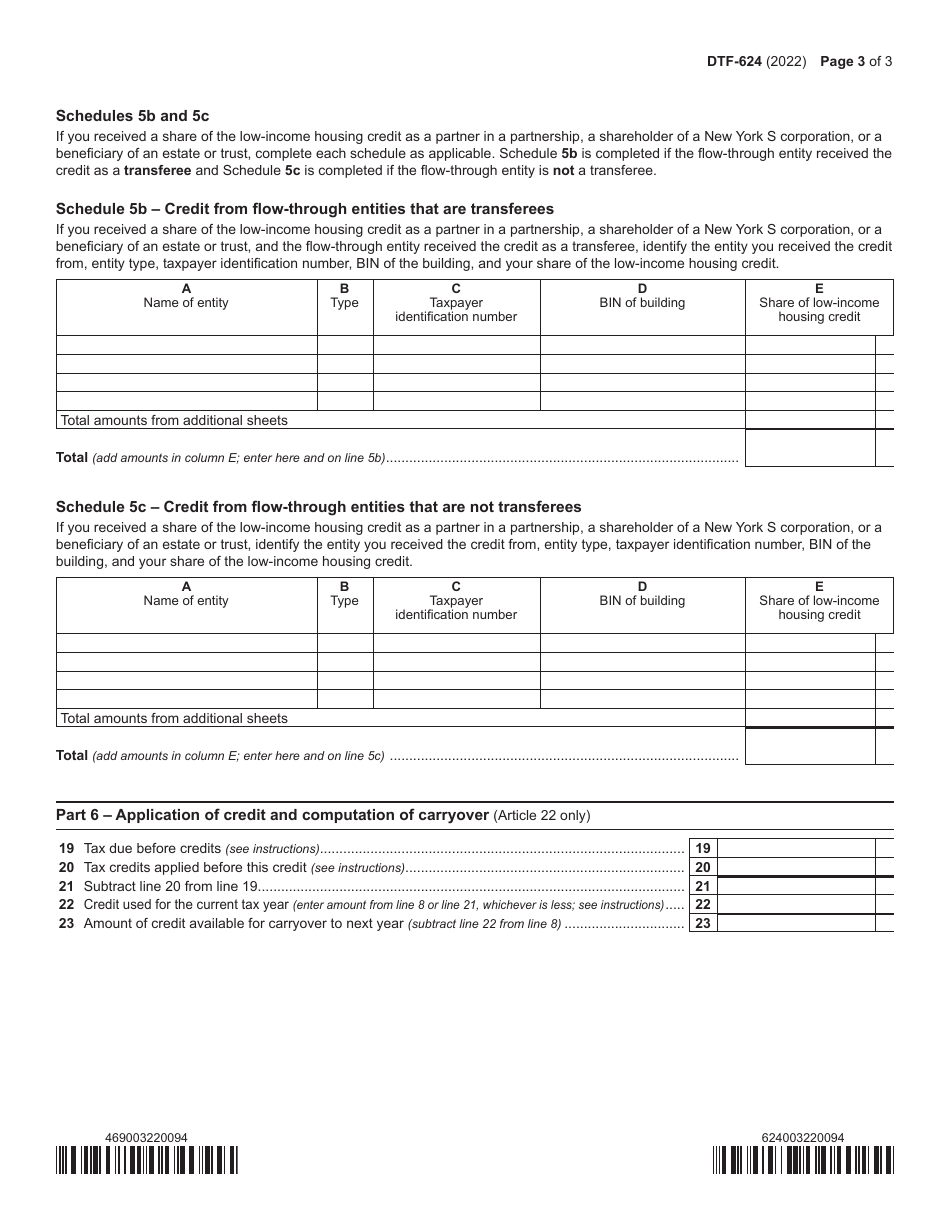

Form DTF-624

for the current year.

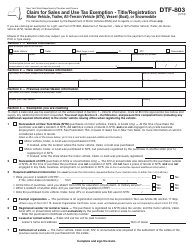

Form DTF-624 Claim for Low-Income Housing Credit - New York

What Is Form DTF-624?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-624?

A: Form DTF-624 is a claim form for the Low-Income Housing Credit in New York.

Q: Who can use Form DTF-624?

A: Individuals or entities in New York who are eligible for the Low-Income Housing Credit can use Form DTF-624 to claim the credit.

Q: What is the Low-Income Housing Credit?

A: The Low-Income Housing Credit is a tax credit that supports the development and preservation of affordable rental housing for low-income individuals and families.

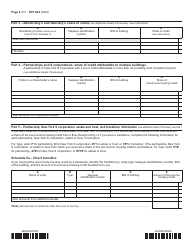

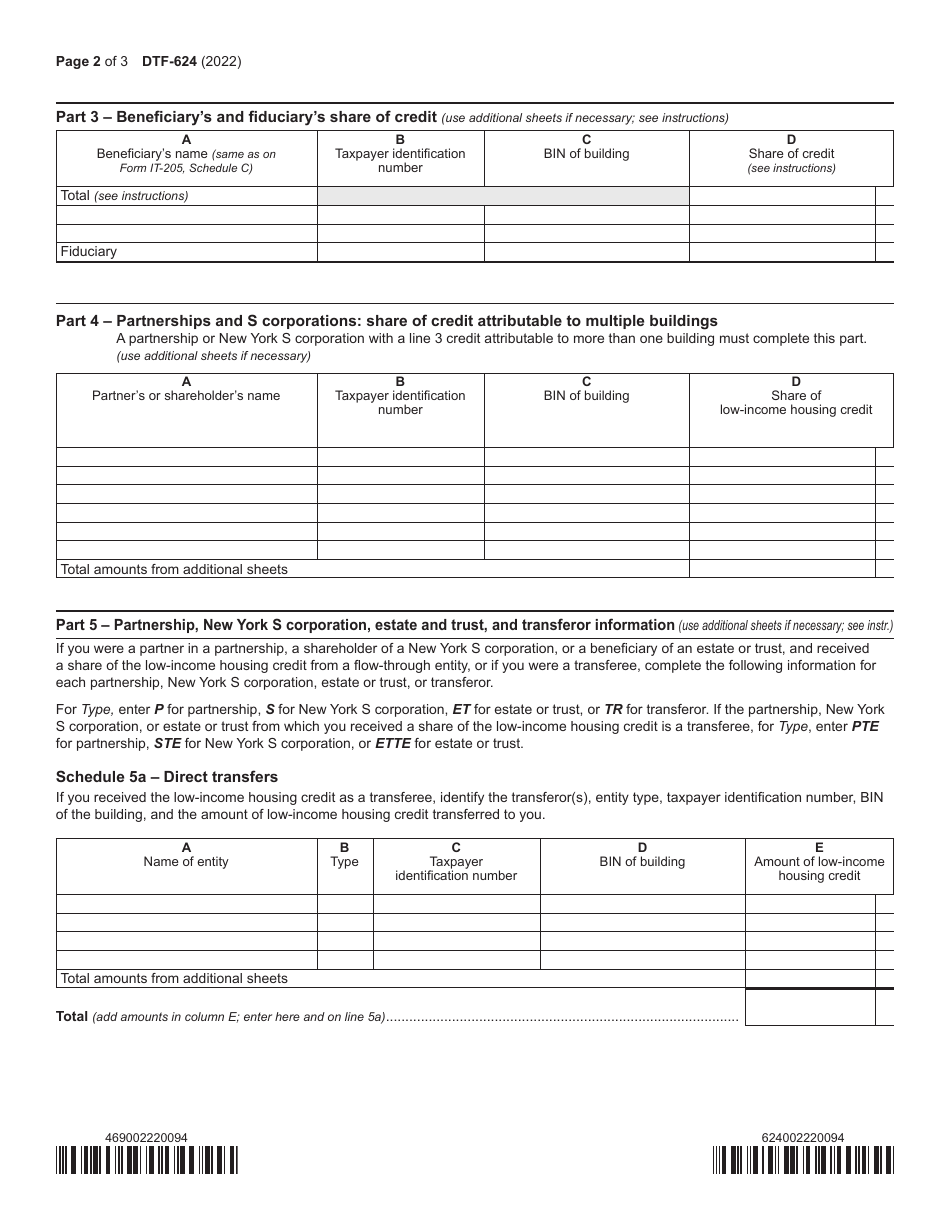

Q: How do I fill out Form DTF-624?

A: To fill out Form DTF-624, you will need to provide information about the low-income housing project, the qualified building, and the eligible basis. Instructions for completing the form are included with the form itself.

Q: Is there a deadline for filing Form DTF-624?

A: Yes, there is a deadline for filing Form DTF-624. The specific deadline can be found on the form or in the instructions.

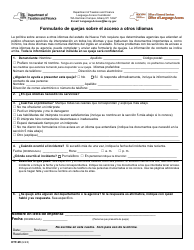

Q: What should I do if I have questions or need assistance with Form DTF-624?

A: If you have questions or need assistance with Form DTF-624, you can contact the New York State Department of Taxation and Finance for guidance and support.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-624 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.