This version of the form is not currently in use and is provided for reference only. Download this version of

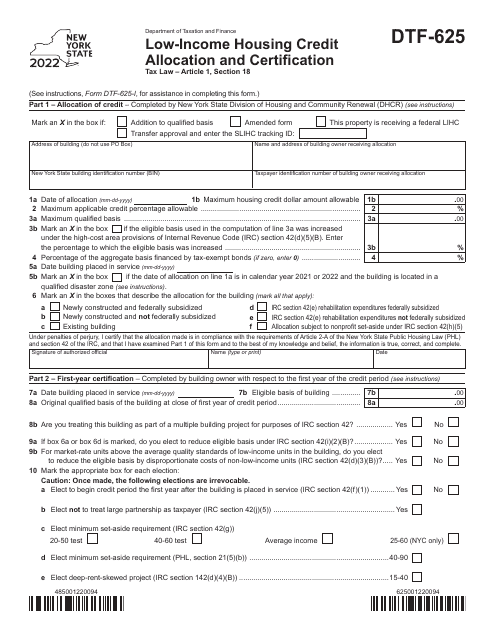

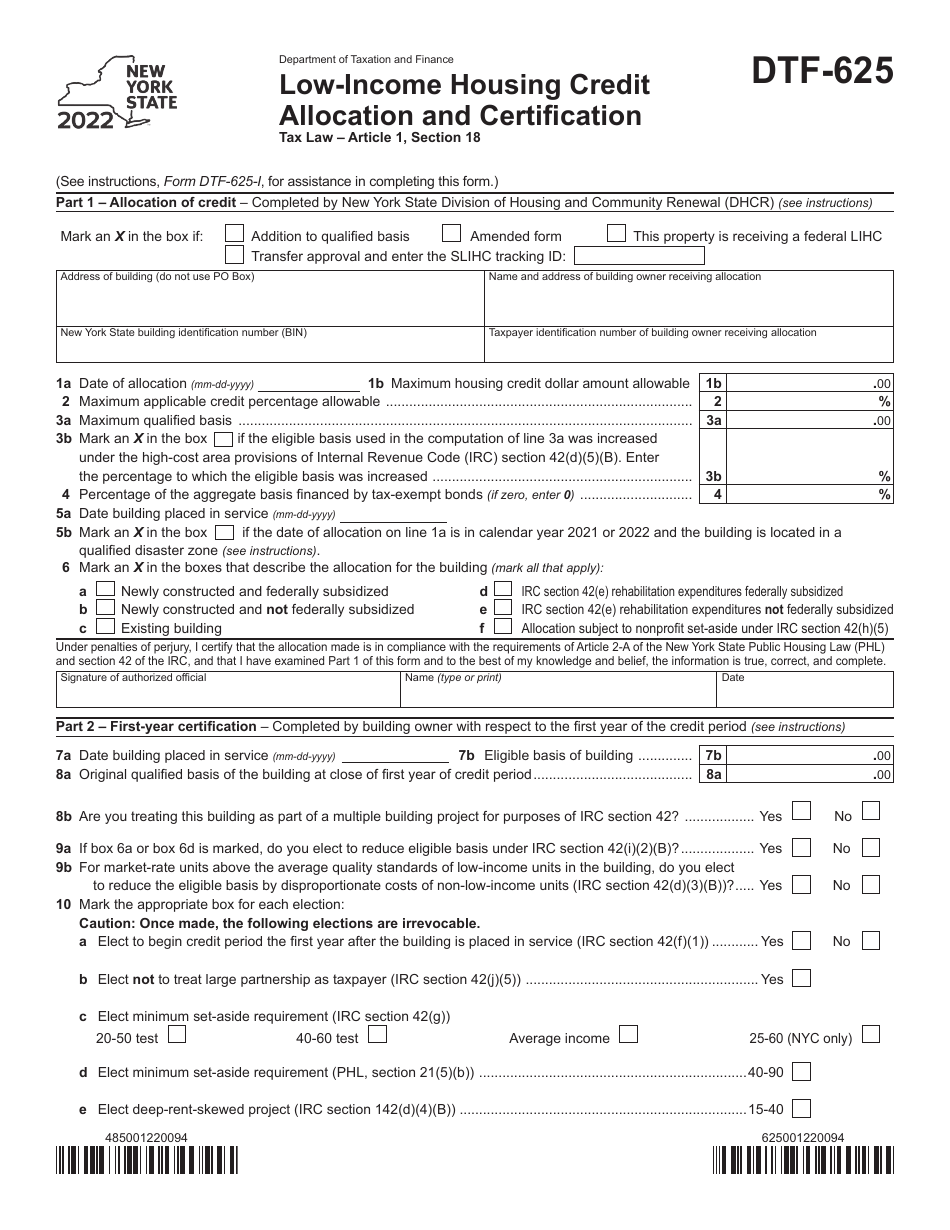

Form DTF-625

for the current year.

Form DTF-625 Low-Income Housing Credit Allocation and Certification - New York

What Is Form DTF-625?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-625?

A: Form DTF-625 is the Low-Income Housing Credit Allocation and Certification form specifically used in New York.

Q: What is the purpose of Form DTF-625?

A: The purpose of Form DTF-625 is to apply for the Low-Income Housing Credit Allocation and Certification in New York.

Q: Who needs to file Form DTF-625?

A: Developers or owners of low-income housing projects in New York who want to apply for the Low-Income Housing Credit Allocation and Certification need to file Form DTF-625.

Q: What information is required on Form DTF-625?

A: Form DTF-625 requires information about the low-income housing project, including the project name, address, developer's or owner's name, and details about the housing units.

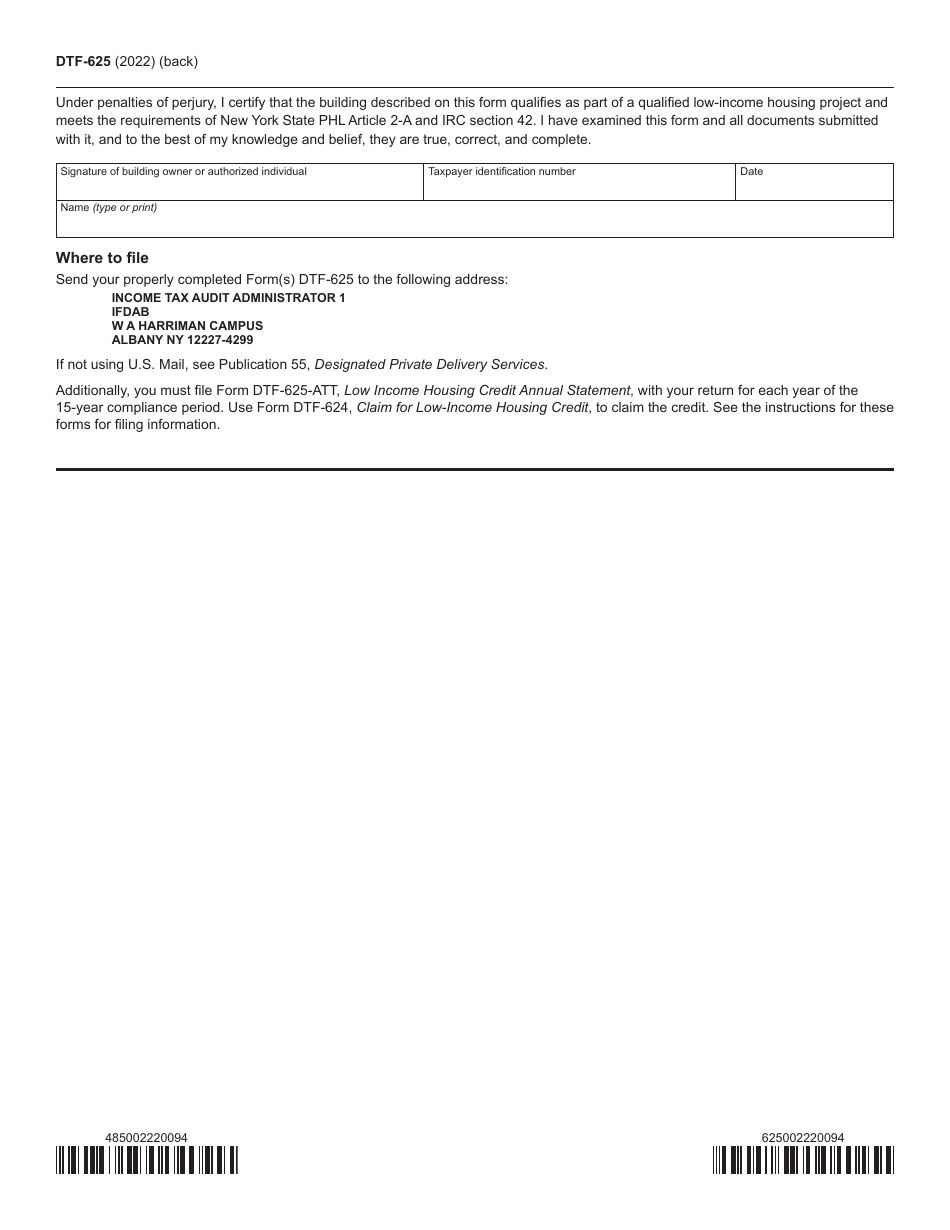

Q: Are there any filing fees for Form DTF-625?

A: Yes, there may be filing fees associated with Form DTF-625. The specific fees and instructions for payment should be mentioned in the instructions accompanying the form.

Q: When is the deadline to submit Form DTF-625?

A: The deadline for submitting Form DTF-625 may vary each year. It is important to refer to the instructions and guidelines provided by the New York State Department of Taxation and Finance.

Q: What happens after filing Form DTF-625?

A: After filing Form DTF-625, the New York State Department of Taxation and Finance will review the application and determine the eligibility for the Low-Income Housing Credit Allocation and Certification.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-625 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.