This version of the form is not currently in use and is provided for reference only. Download this version of

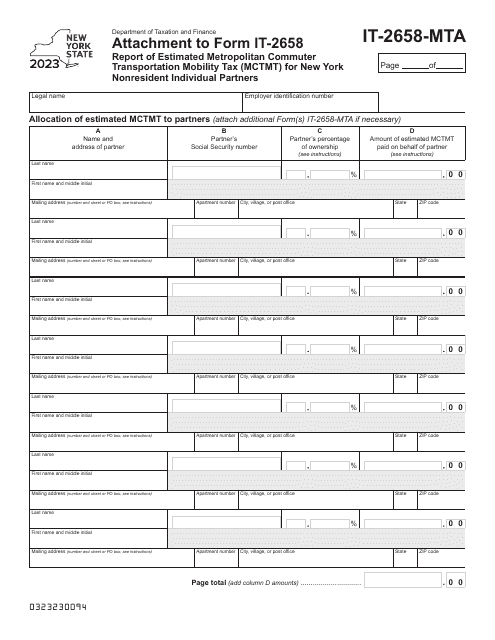

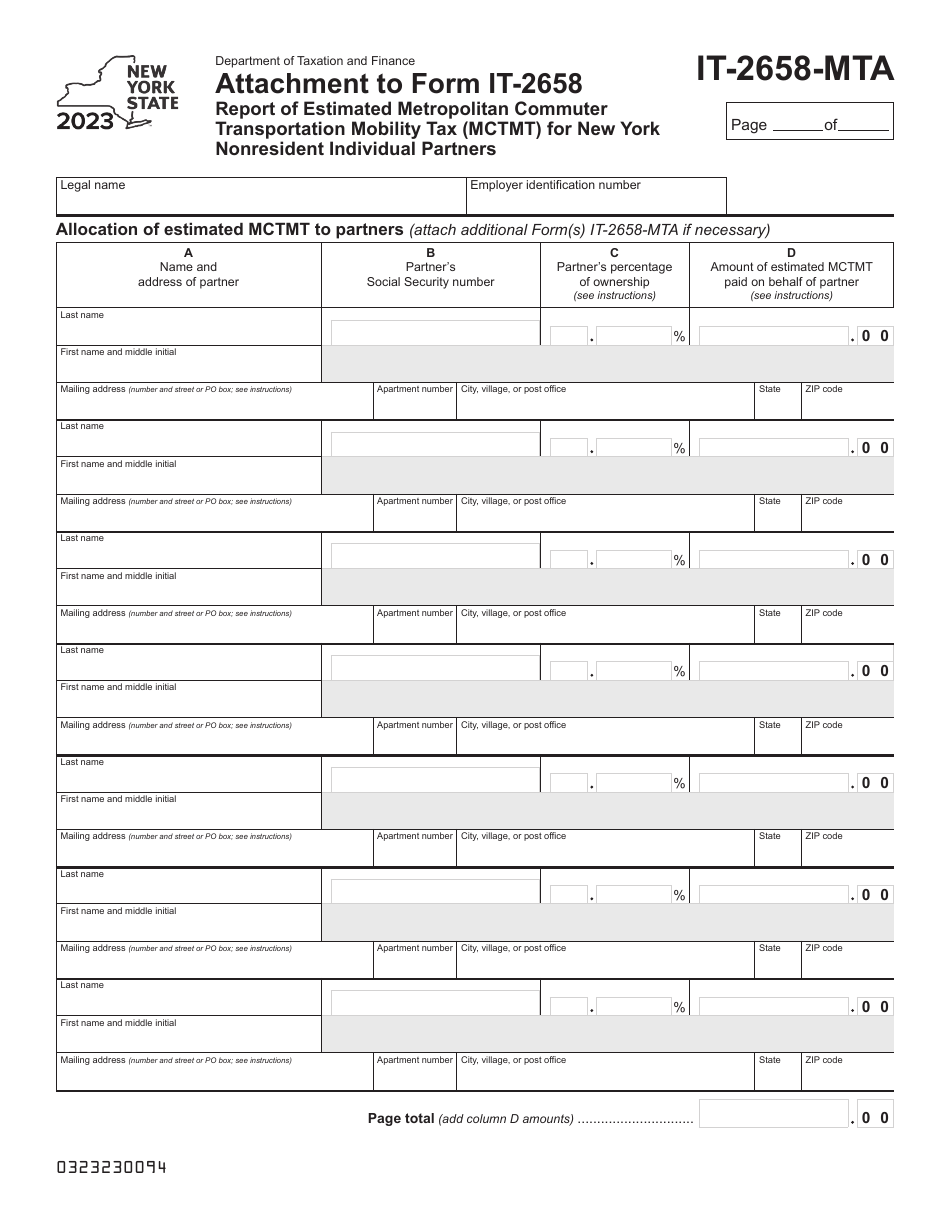

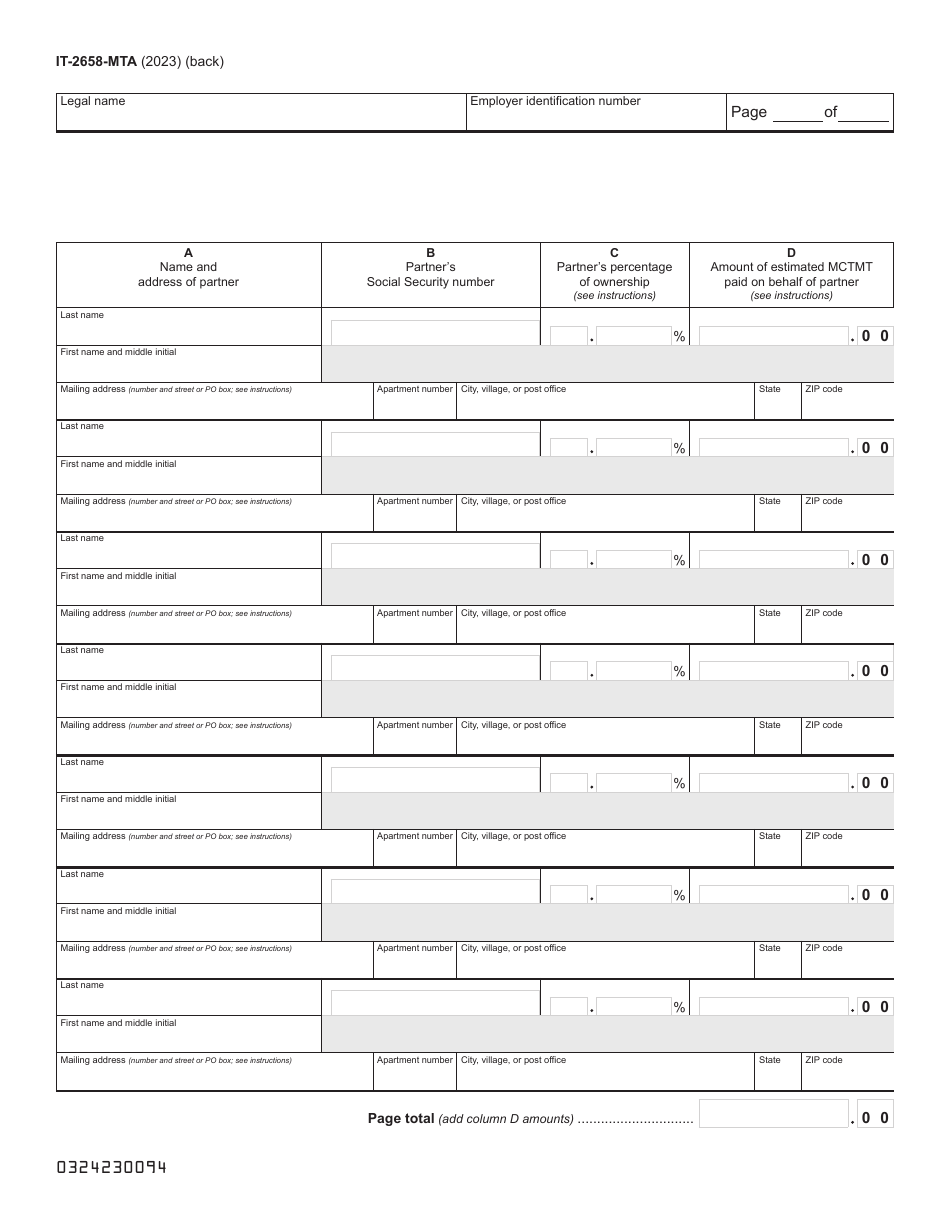

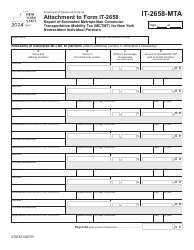

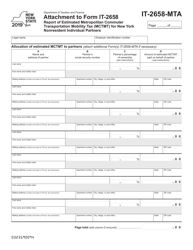

Form IT-2658-MTA

for the current year.

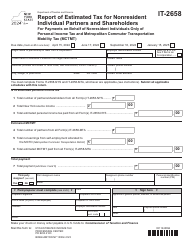

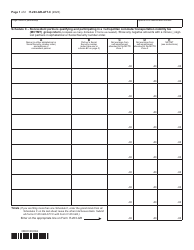

Form IT-2658-MTA Report of Estimated Metropolitan Commuter Transportation Mobility Tax (Mctmt) for New York Nonresident Individual Partners - New York

What Is Form IT-2658-MTA?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT-2658-MTA form?

A: The IT-2658-MTA form is used to report the Estimated Metropolitan Commuter Transportation Mobility Tax (MCTMT) for New York nonresident individual partners.

Q: Who needs to file the IT-2658-MTA form?

A: Nonresident individual partners in New York who are subject to the Metropolitan Commuter Transportation Mobility Tax (MCTMT) need to file the IT-2658-MTA form.

Q: What is the purpose of the Metropolitan Commuter Transportation Mobility Tax (MCTMT)?

A: The Metropolitan Commuter Transportation Mobility Tax (MCTMT) is used to help fund public transportation services in the metropolitan commuter transportation district.

Q: What information is required to complete the IT-2658-MTA form?

A: The IT-2658-MTA form requires information such as the individual partner's name, address, partnership information, and calculations for the MCTMT.

Q: When is the deadline for filing the IT-2658-MTA form?

A: The deadline for filing the IT-2658-MTA form is typically on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of the IT-2658-MTA form?

A: Yes, late filing of the IT-2658-MTA form may result in penalties and interest charges.

Q: Is the IT-2658-MTA form only for nonresident individual partners?

A: Yes, the IT-2658-MTA form is specifically for nonresident individual partners in New York.

Q: What should I do if I have questions about the IT-2658-MTA form?

A: If you have questions about the IT-2658-MTA form, you should contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2658-MTA by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.