This version of the form is not currently in use and is provided for reference only. Download this version of

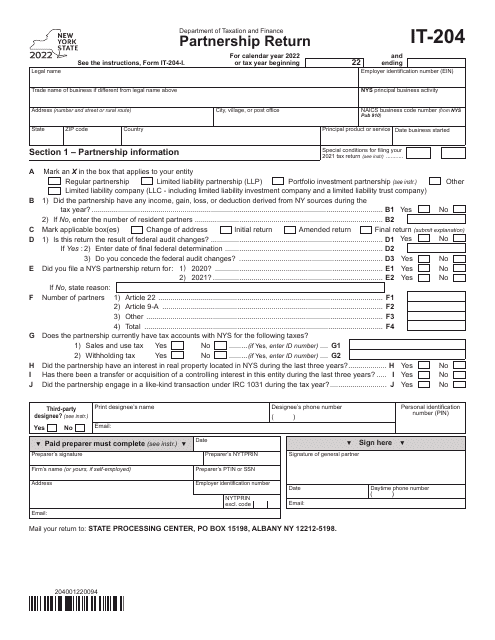

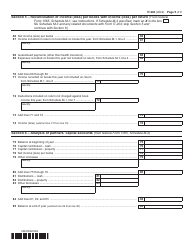

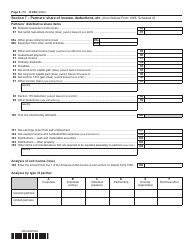

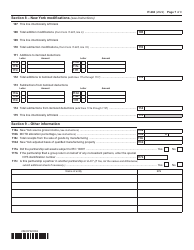

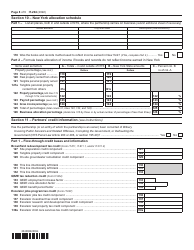

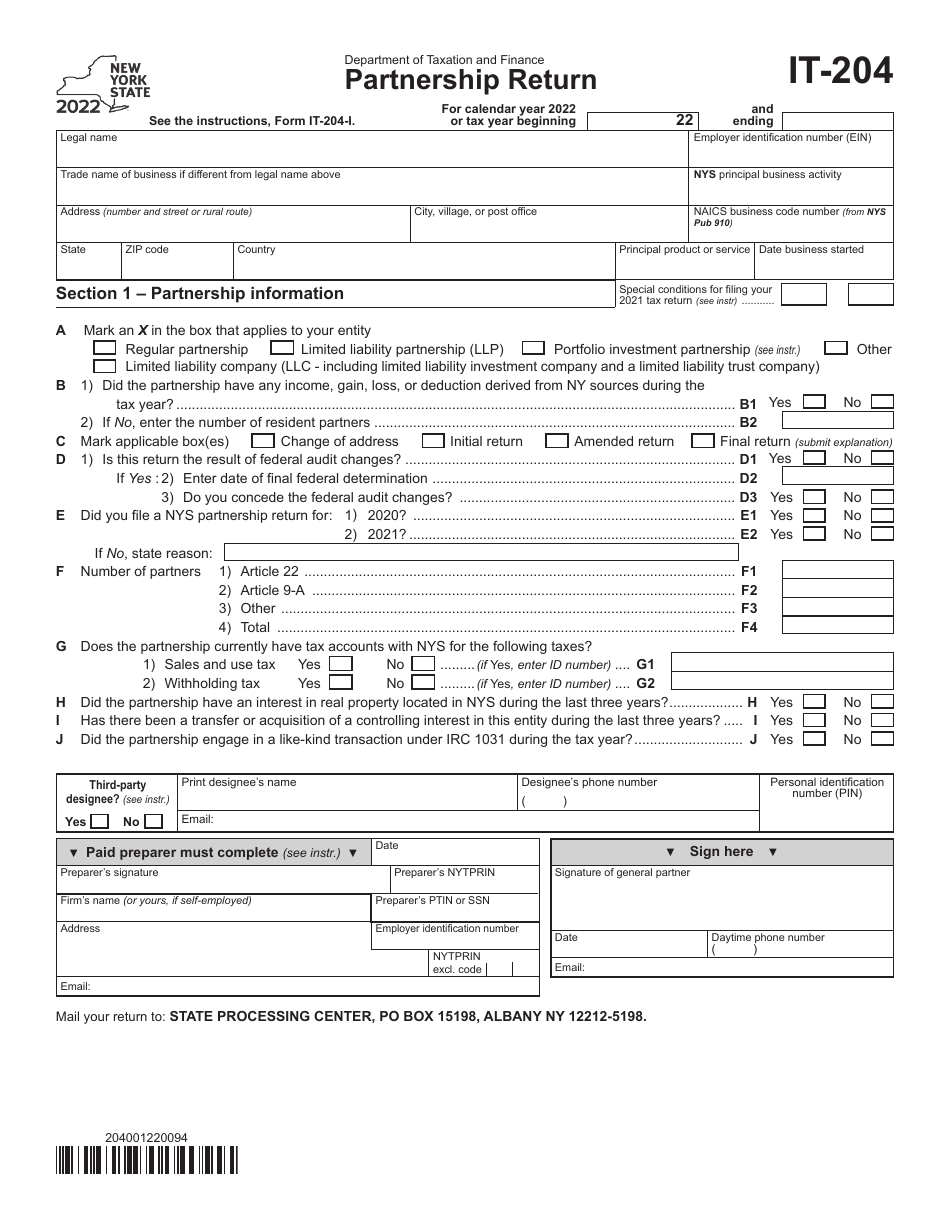

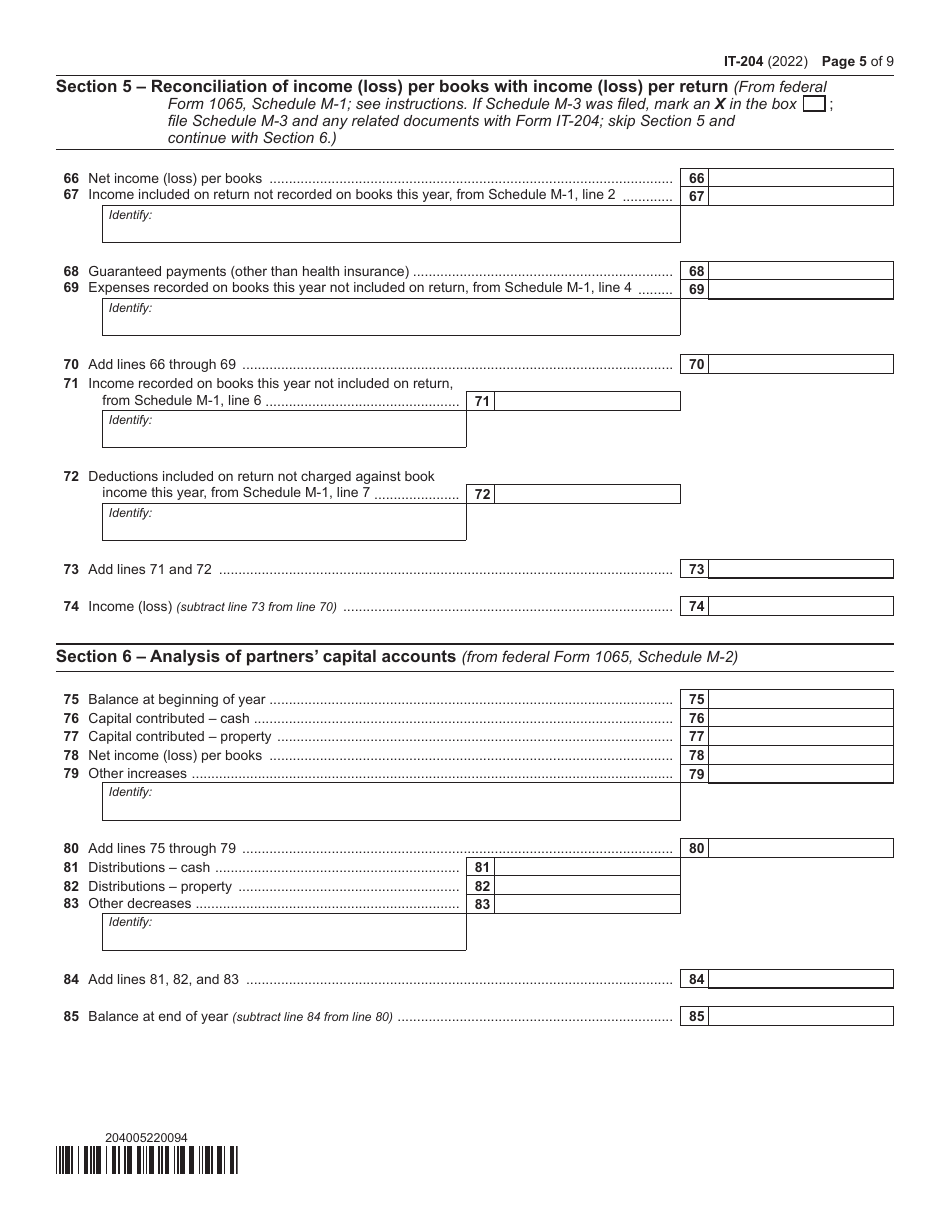

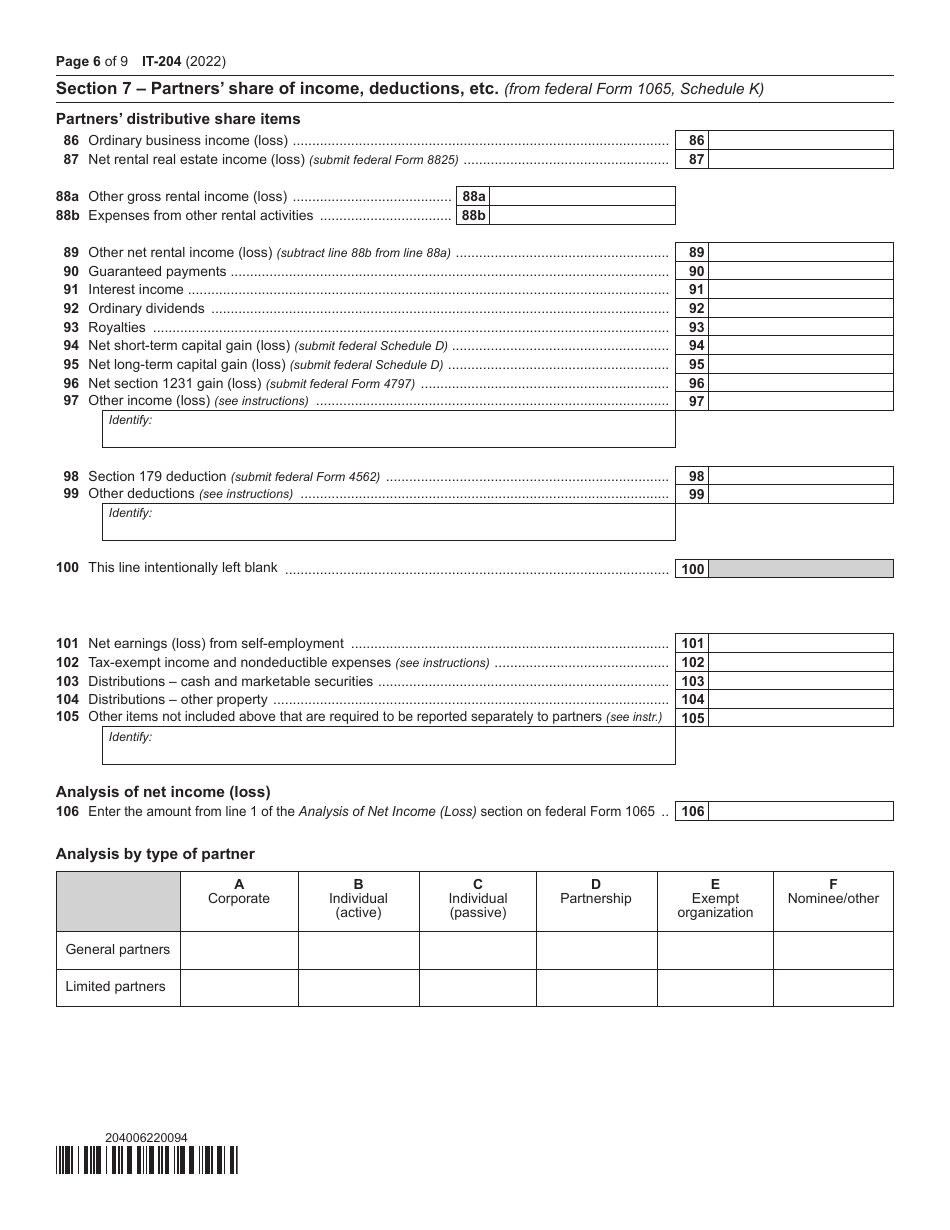

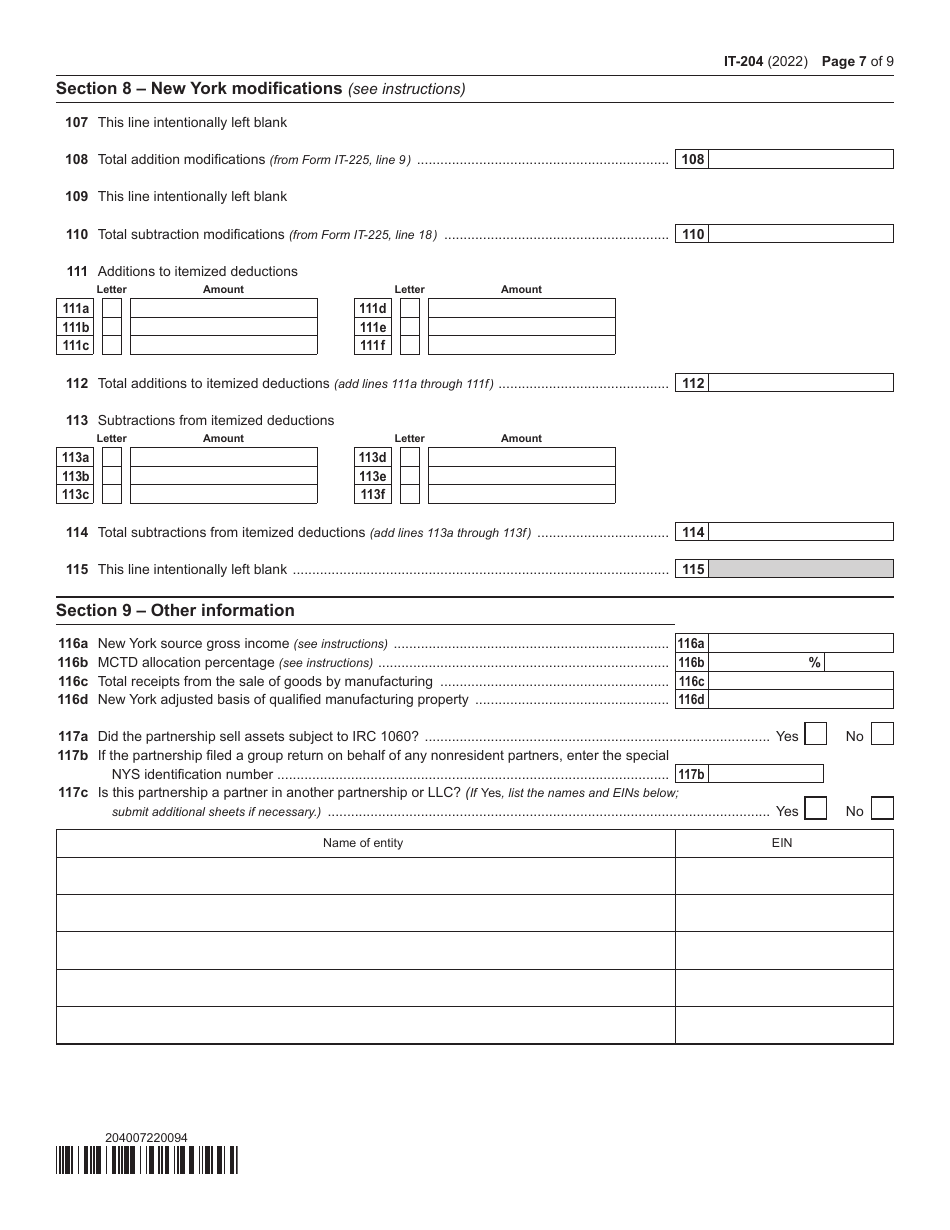

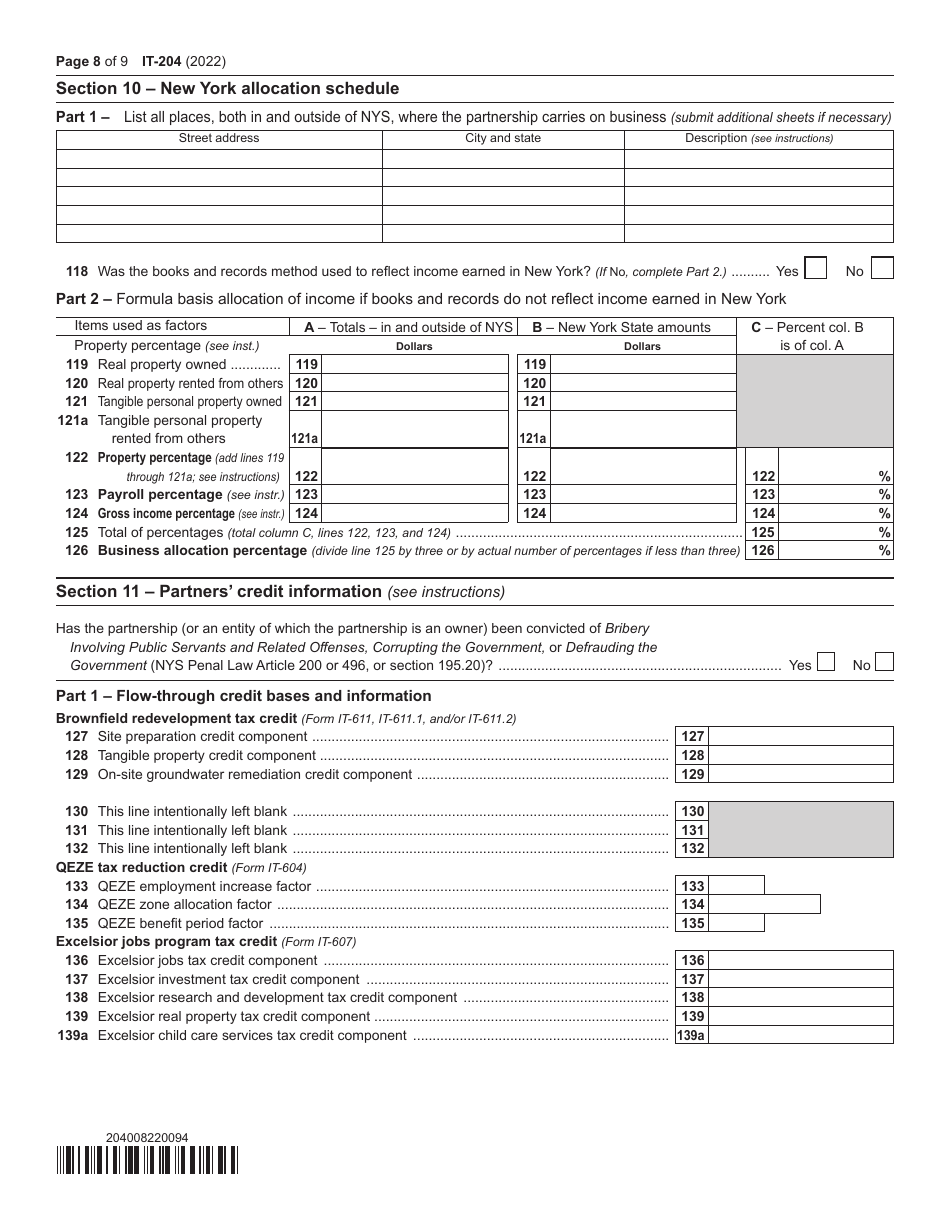

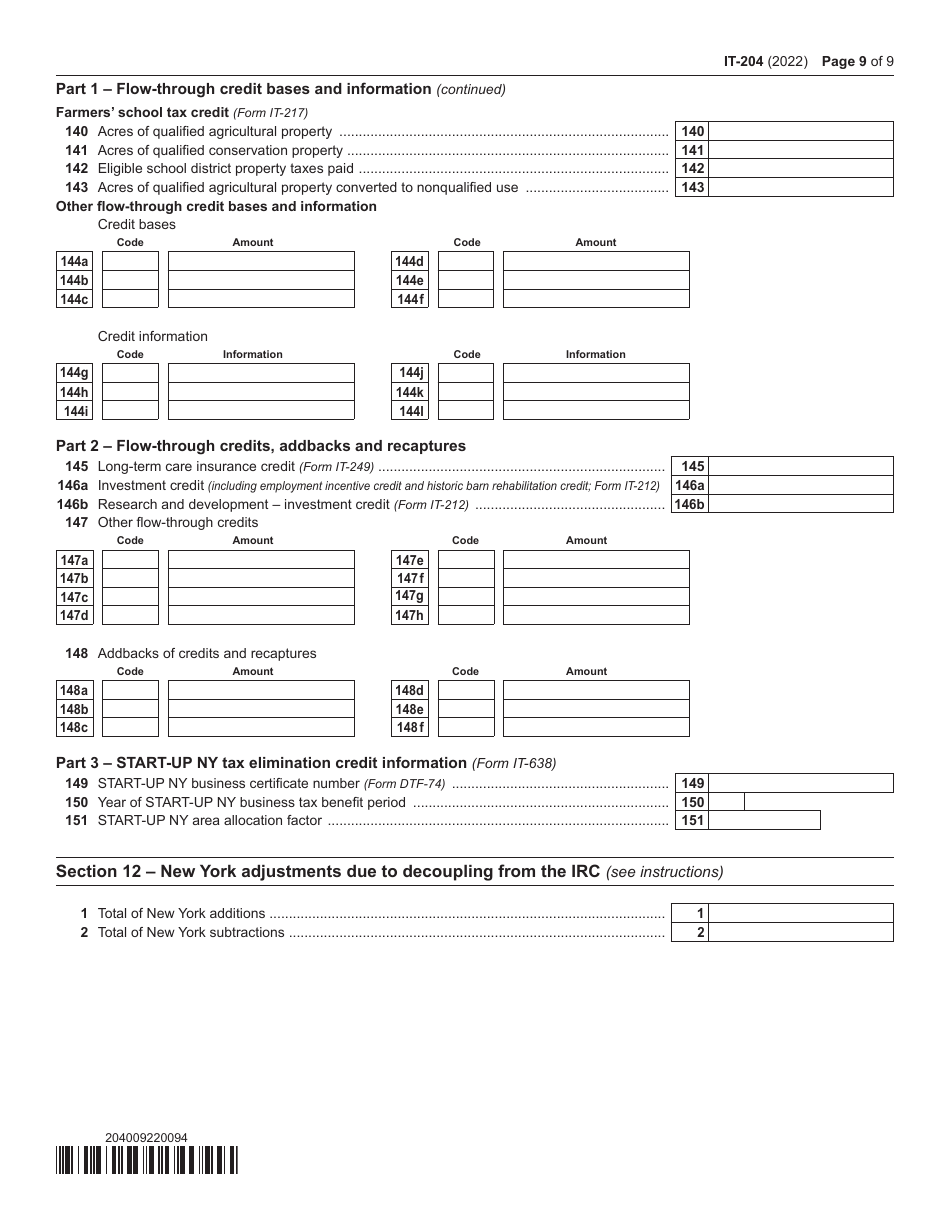

Form IT-204

for the current year.

Form IT-204 Partnership Return - New York

What Is Form IT-204?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-204?

A: Form IT-204 is the Partnership Return form for New York.

Q: Who needs to file Form IT-204?

A: All partnerships with income derived from New York sources, or with New York partners, need to file Form IT-204.

Q: When is the due date to file Form IT-204?

A: For calendar year partnerships, the due date to file Form IT-204 is April 15th.

Q: Are there any filing fees for Form IT-204?

A: No, there are no filing fees for Form IT-204.

Q: Can Form IT-204 be filed electronically?

A: Yes, Form IT-204 can be filed electronically using approved software or through approved vendors.

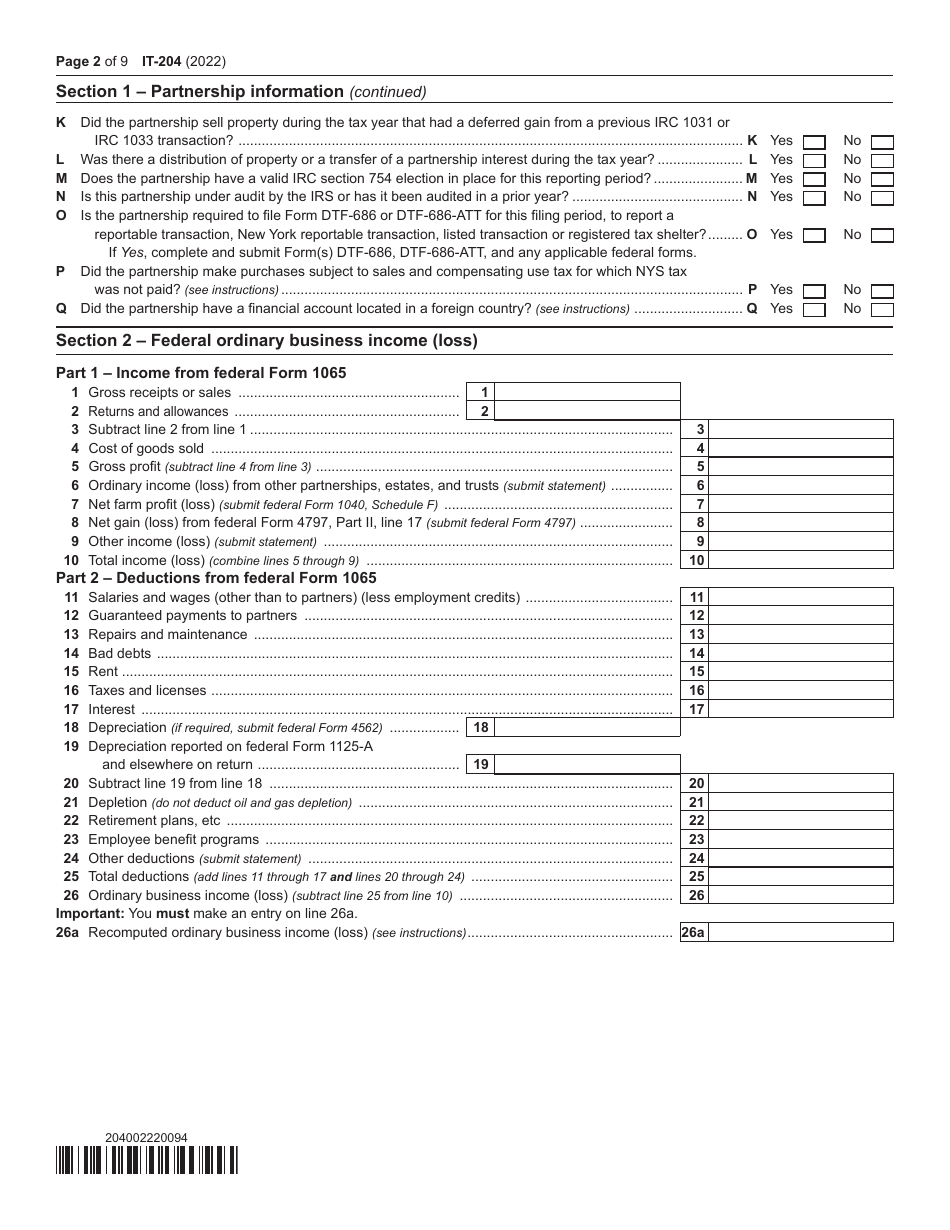

Q: What supporting documents need to be attached to Form IT-204?

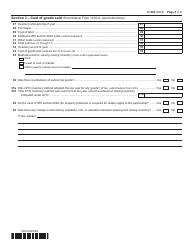

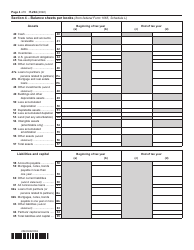

A: Partnerships need to attach a copy of federal Schedule K-1 and any other necessary supporting documents to Form IT-204.

Q: What if I need an extension to file Form IT-204?

A: You can request an extension to file Form IT-204 by filing Form IT-370, Application for Automatic Extension of Time to File for Partnerships.

Q: What if I have further questions about Form IT-204?

A: You can contact the New York State Department of Taxation and Finance for further assistance with Form IT-204.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.