This version of the form is not currently in use and is provided for reference only. Download this version of

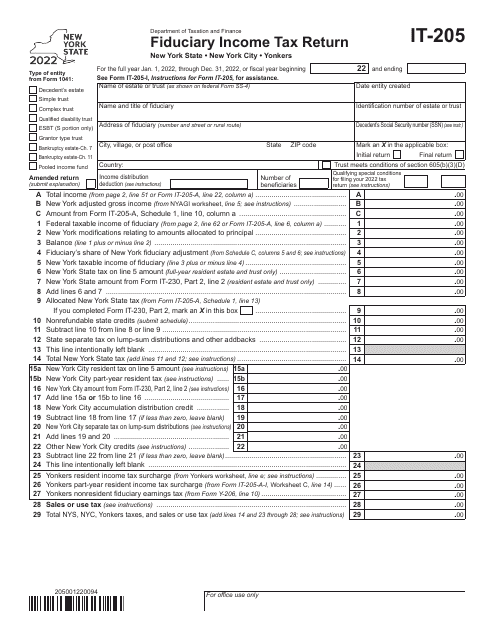

Form IT-205

for the current year.

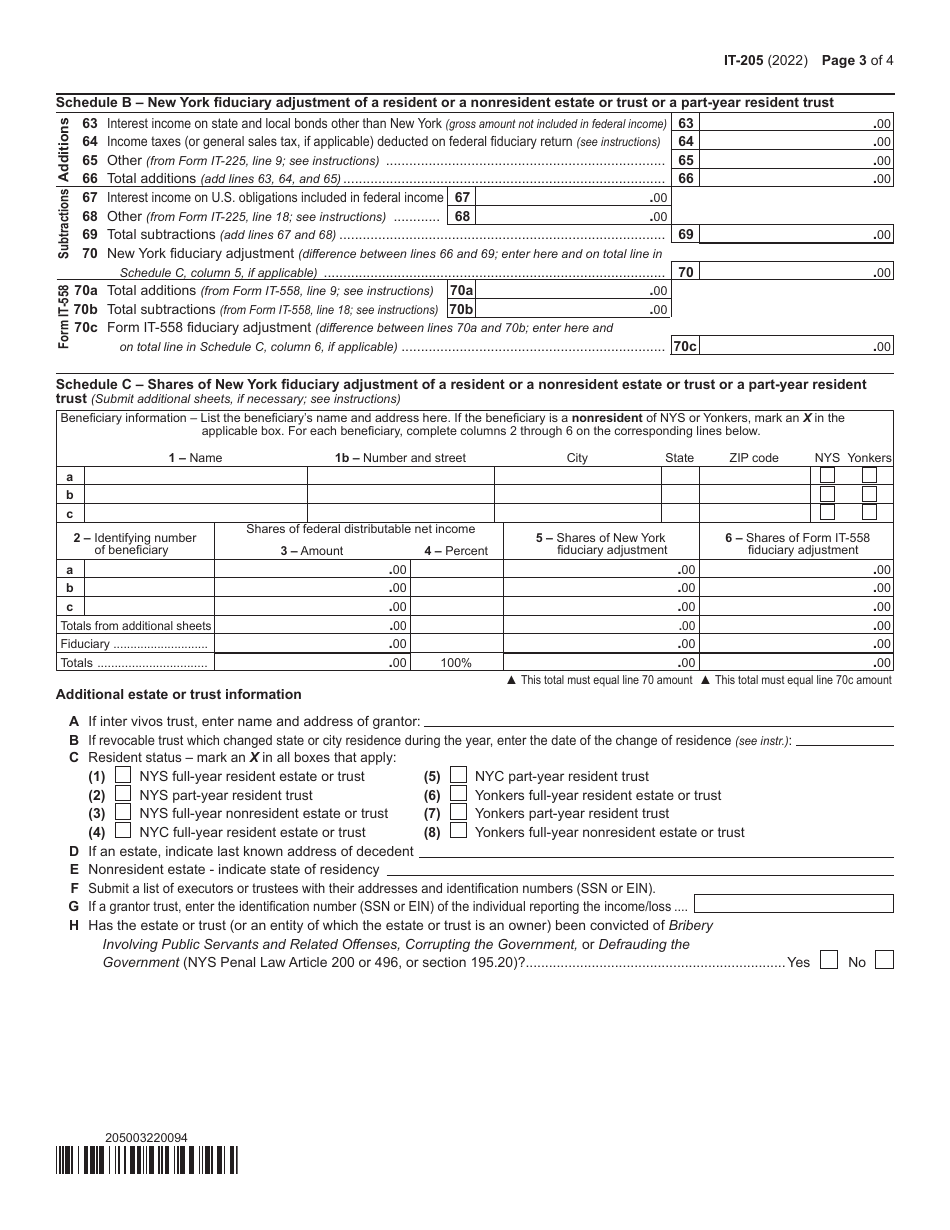

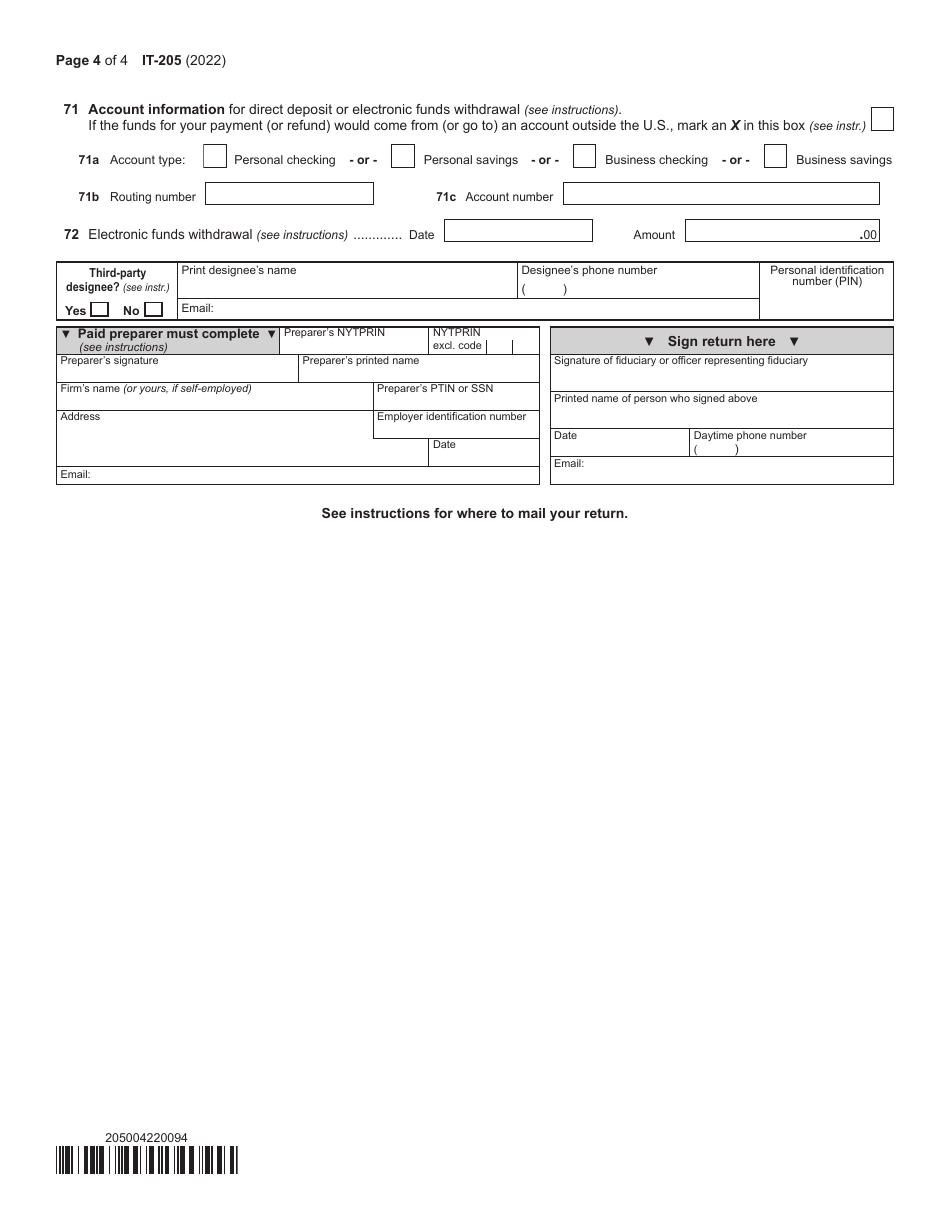

Form IT-205 Fiduciary Income Tax Return - New York

What Is Form IT-205?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205?

A: Form IT-205 is the Fiduciary Income Tax Return for the state of New York.

Q: Who should file Form IT-205?

A: Form IT-205 should be filed by fiduciaries, such as administrators or executors of estates, trustees, or guardians of property, who have income or loss from New York sources.

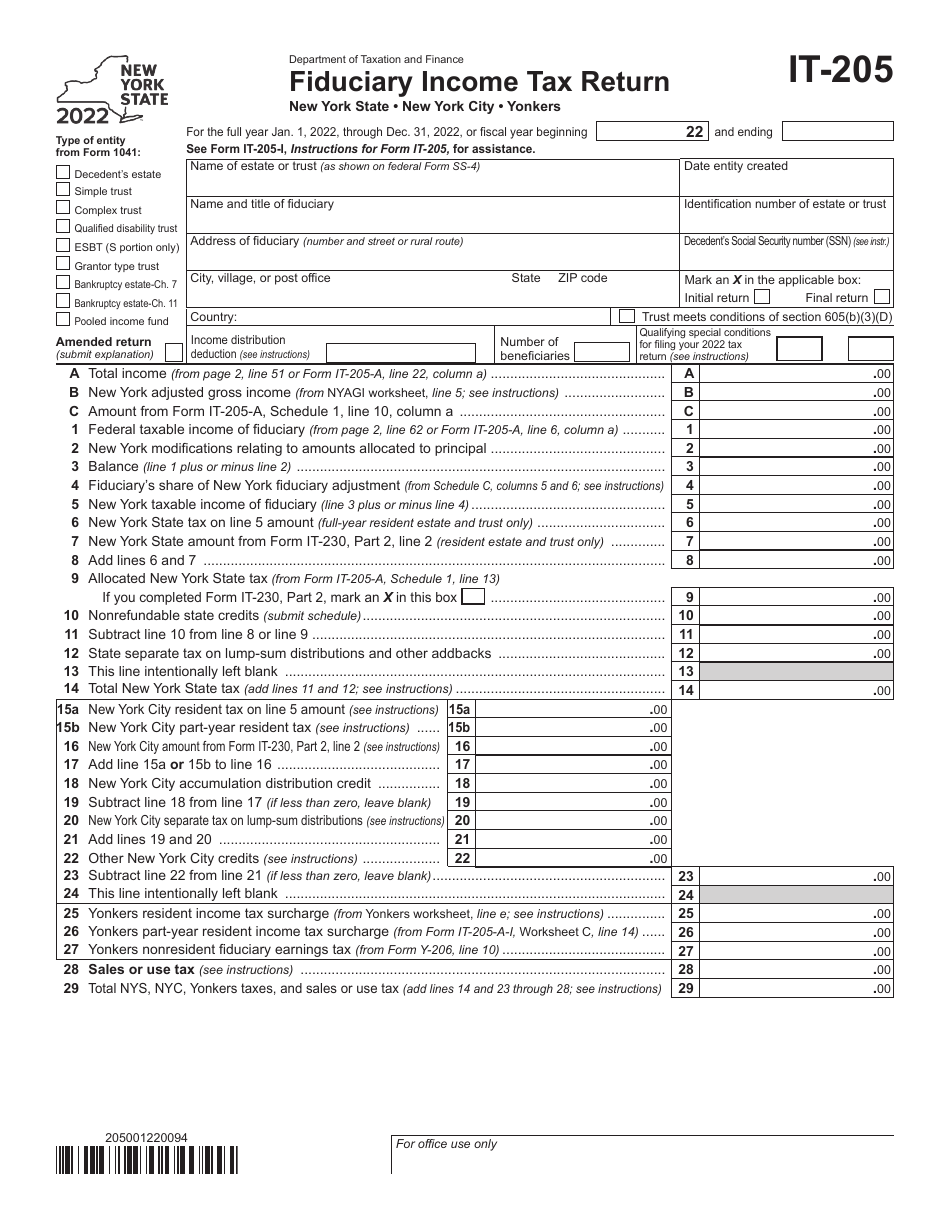

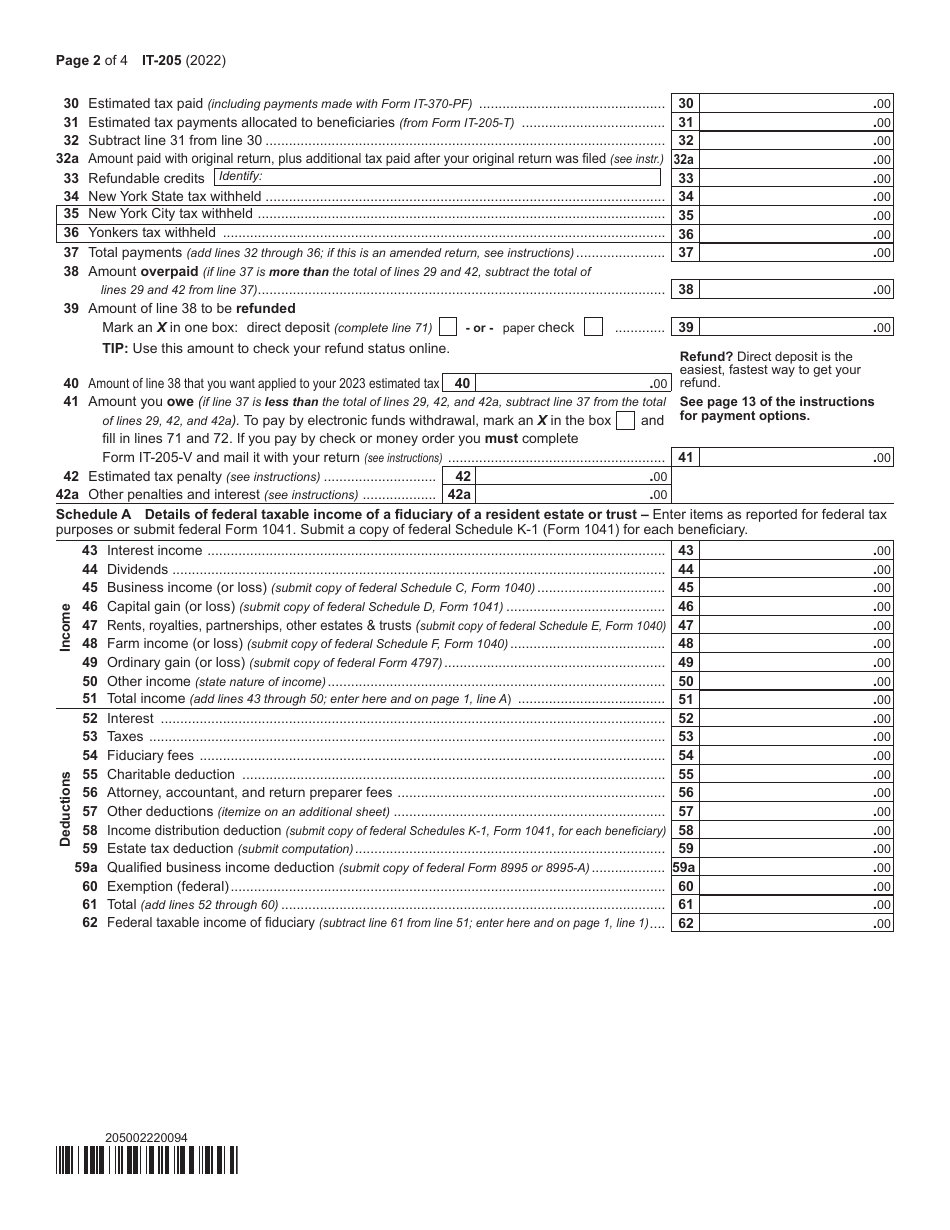

Q: What information is required to complete Form IT-205?

A: You will need to provide information about the estate or trust, including income, deductions, credits, and taxes withheld.

Q: When is the deadline to file Form IT-205?

A: Form IT-205 is generally due on or before April 15th of the year following the close of the taxable year.

Q: Are there any extensions available for filing Form IT-205?

A: Yes, you may request an extension of time to file Form IT-205 by filing Form IT-370, Application for Automatic Extension of Time to File for Fiduciary and by paying any estimated tax due.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.