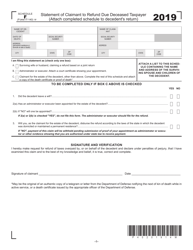

This version of the form is not currently in use and is provided for reference only. Download this version of

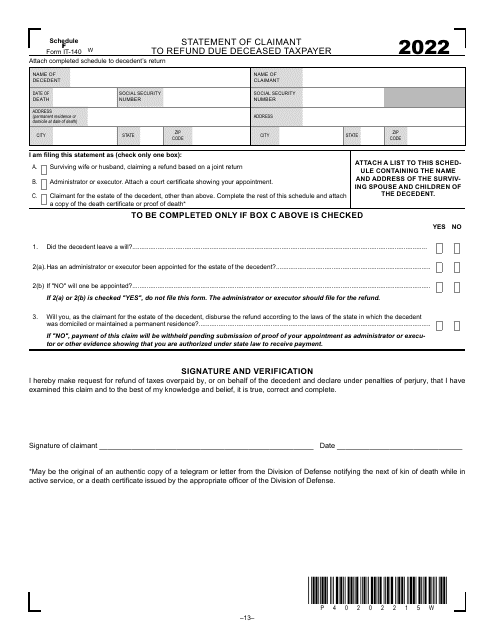

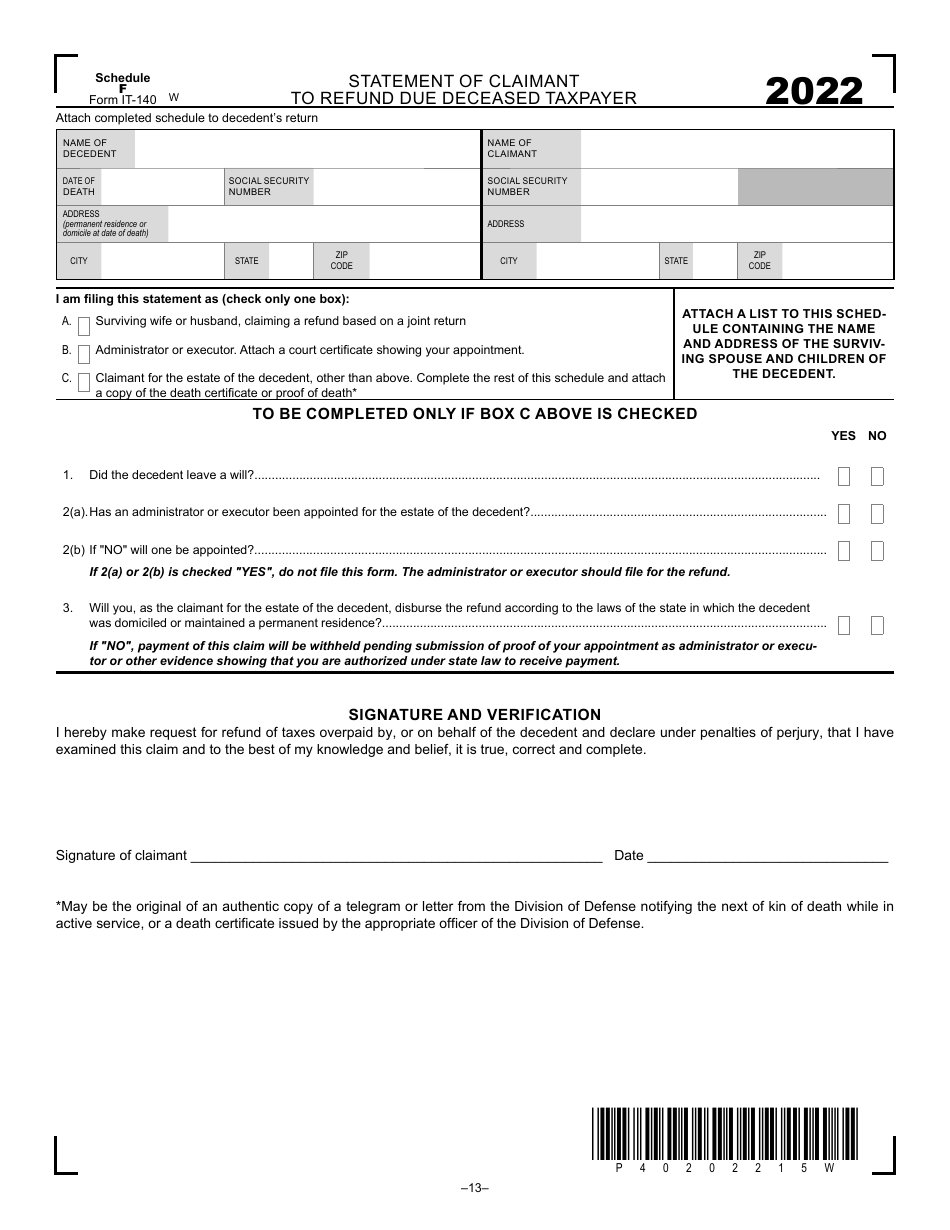

Form IT-140 Schedule F

for the current year.

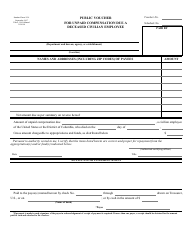

Form IT-140 Schedule F Statement of Claimant to Refund Due Deceased Taxpayer - West Virginia

What Is Form IT-140 Schedule F?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form IT-140, West Virginia Personal Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-140?

A: Form IT-140 is a tax form used in West Virginia for filing state income tax returns.

Q: What is Schedule F?

A: Schedule F is a part of Form IT-140 that is used to report the claimant's information for a refund due to a deceased taxpayer.

Q: Who can use Schedule F?

A: Schedule F is used by individuals who are claiming a refund on behalf of a deceased taxpayer.

Q: What information is required on Schedule F?

A: Schedule F requires the claimant's name, address, relationship to the deceased taxpayer, and other relevant information.

Q: Why would someone need to file Schedule F?

A: Someone would need to file Schedule F if they are entitled to a refund on behalf of a deceased taxpayer.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-140 Schedule F by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.