This version of the form is not currently in use and is provided for reference only. Download this version of

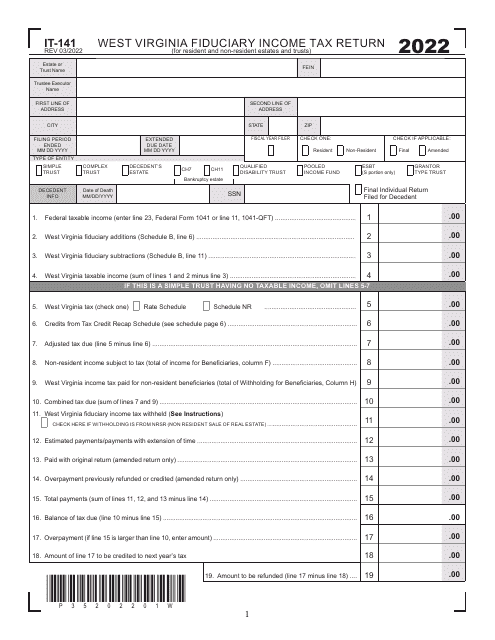

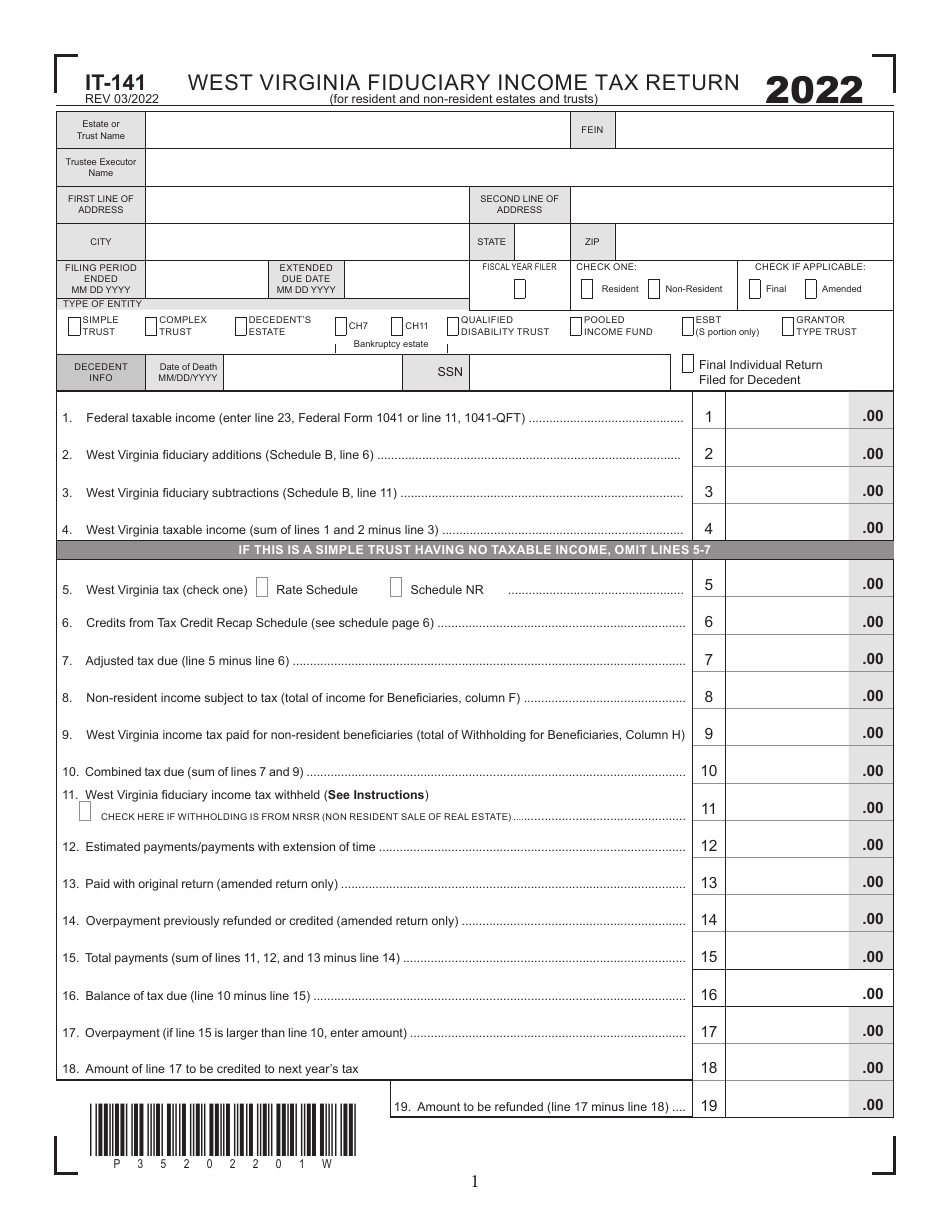

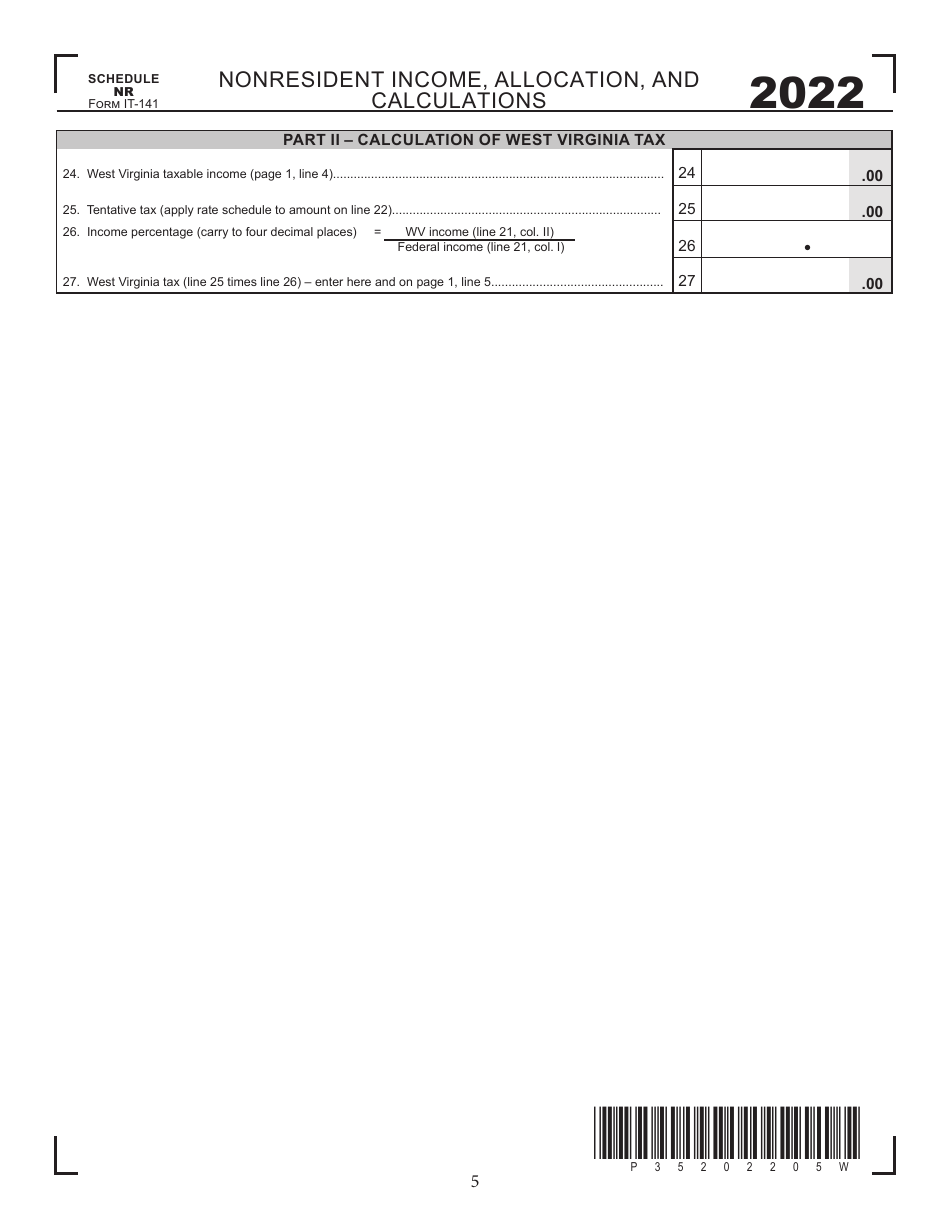

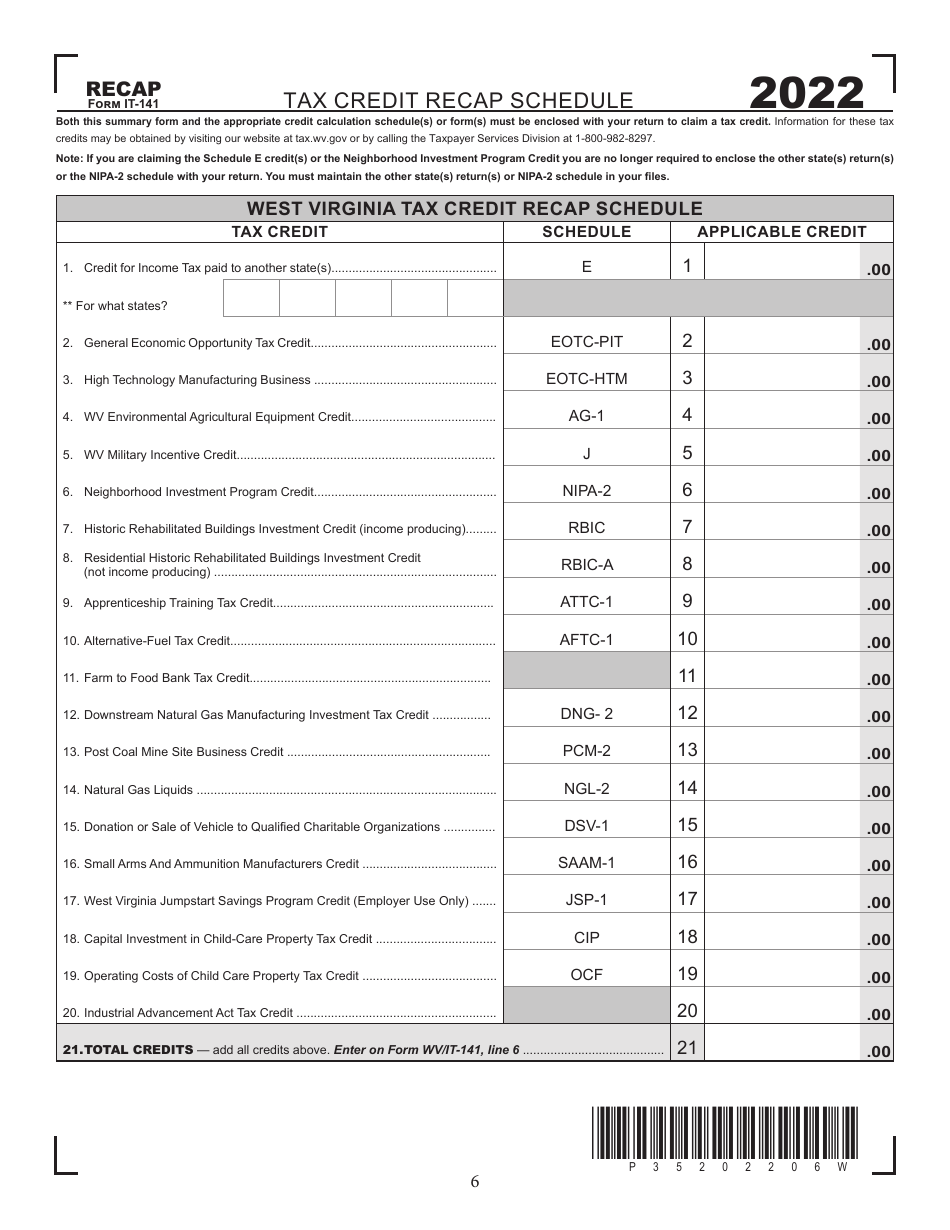

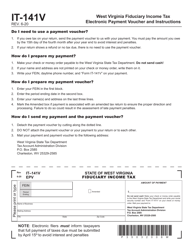

Form IT-141

for the current year.

Form IT-141 West Virginia Fiduciary Income Tax Return - West Virginia

What Is Form IT-141?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-141?

A: Form IT-141 is the West Virginia Fiduciary Income Tax Return.

Q: Who needs to file Form IT-141?

A: Individuals or entities acting as fiduciaries, such as trustees, executors, or administrators, need to file Form IT-141 if they have taxable income from a West Virginia source.

Q: What is the purpose of Form IT-141?

A: The purpose of Form IT-141 is to report and calculate the fiduciary incometax liability for West Virginia.

Q: When is Form IT-141 due?

A: Form IT-141 is due on April 15th of each year or the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing or non-filing of Form IT-141?

A: Yes, there are penalties for late filing or non-filing of Form IT-141. It is important to file the form and pay any tax due on time to avoid penalties and interest charges.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT-141 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.