This version of the form is not currently in use and is provided for reference only. Download this version of

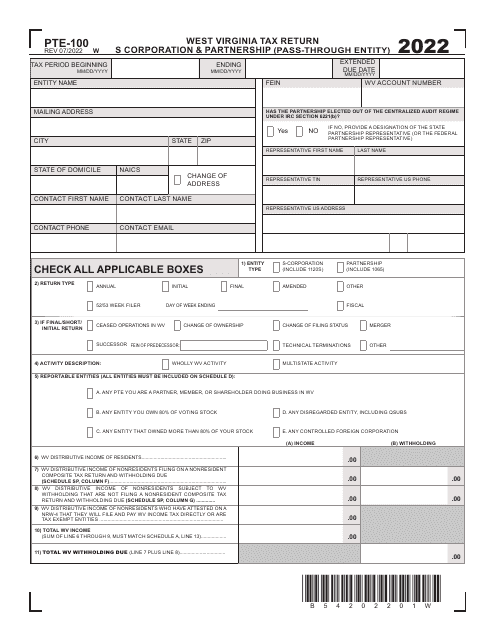

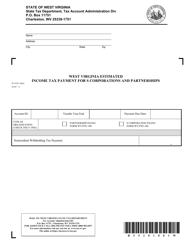

Form PTE-100

for the current year.

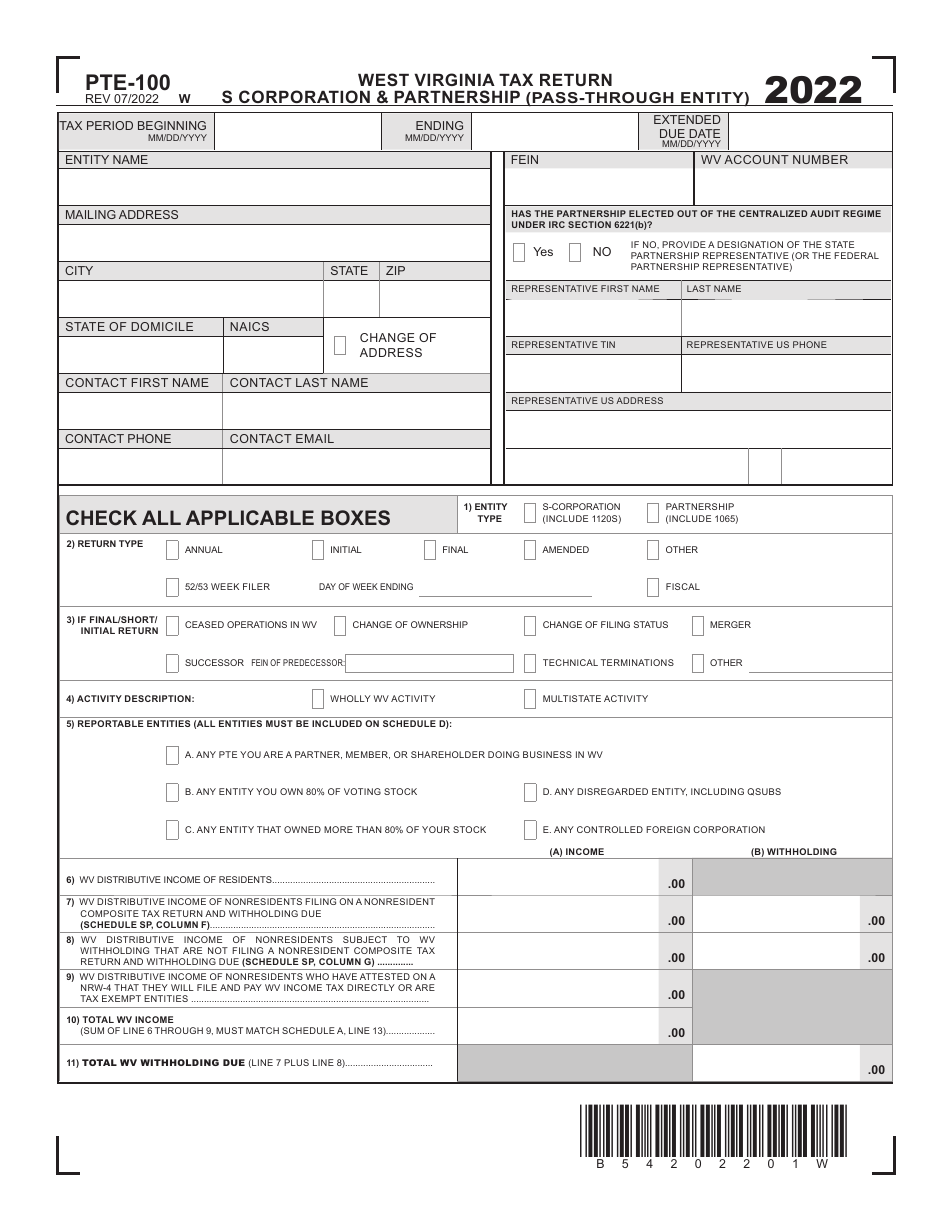

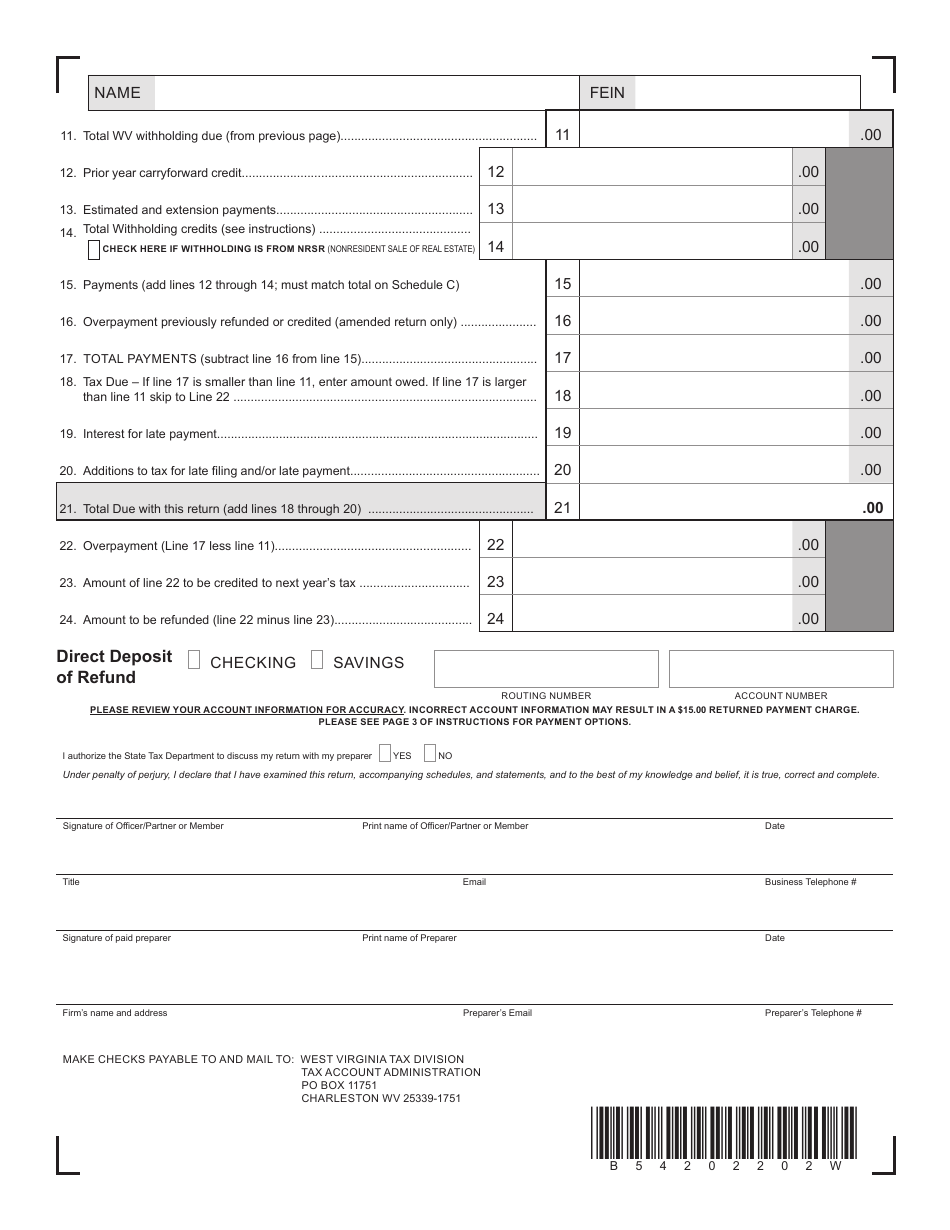

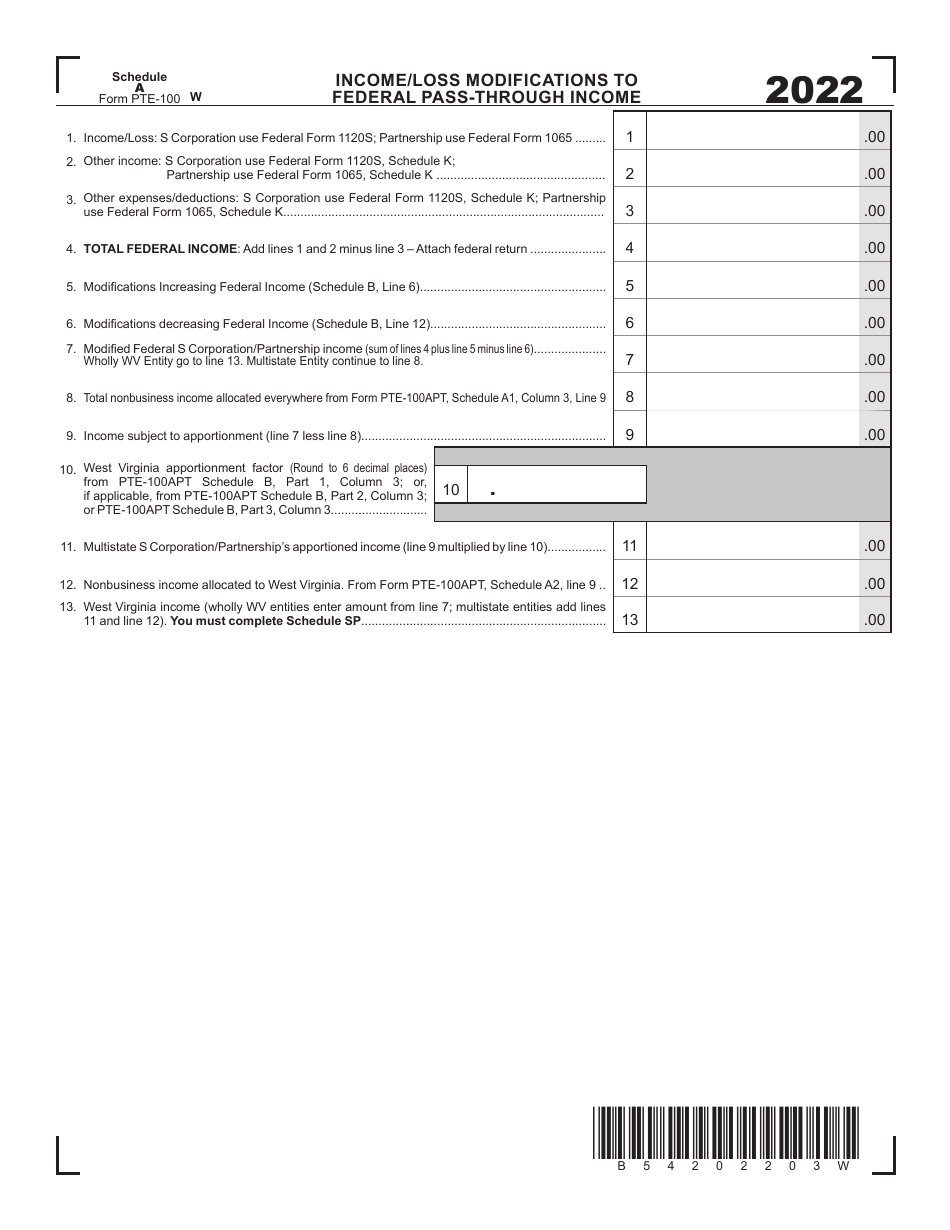

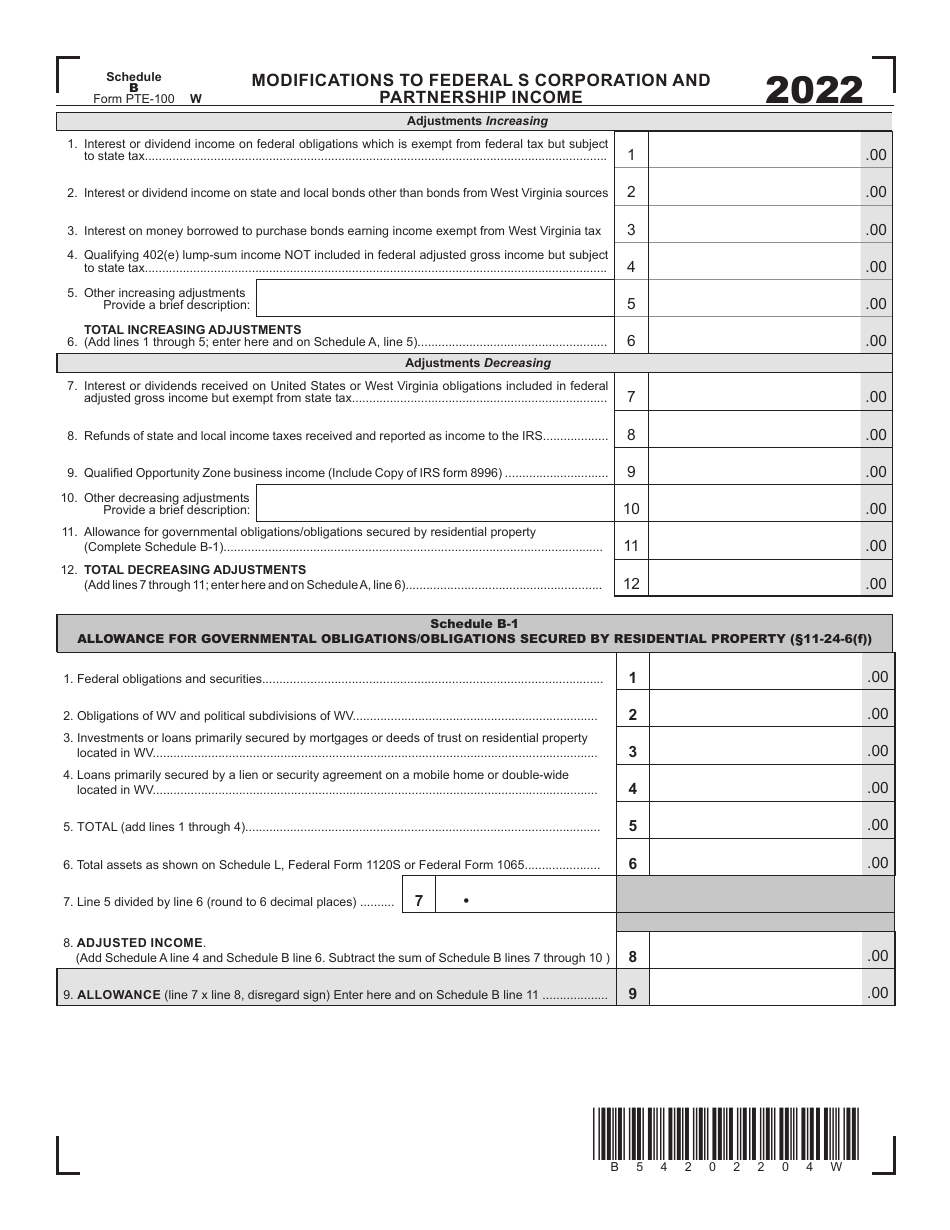

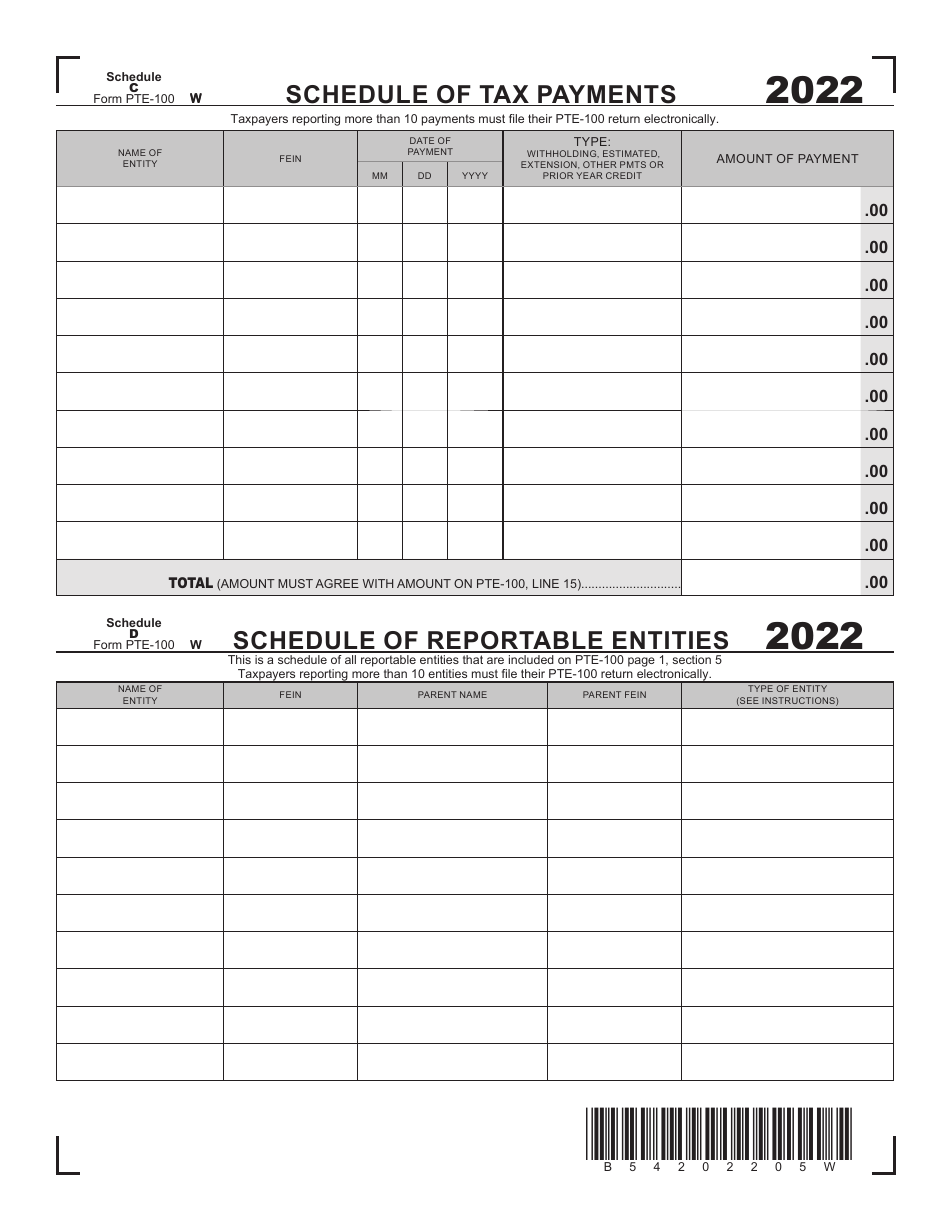

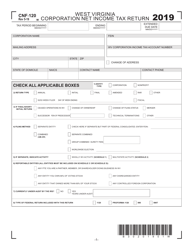

Form PTE-100 West Virginia Income Tax Return S Corporation and Partnership (Pass-Through Entity) - West Virginia

What Is Form PTE-100?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the PTE-100 form?

A: PTE-100 form is the West Virginia Income Tax Return for S Corporations and Partnerships (Pass-Through Entities).

Q: Who needs to file the PTE-100 form?

A: S Corporations and Partnerships (Pass-Through Entities) in West Virginia need to file the PTE-100 form.

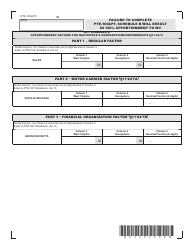

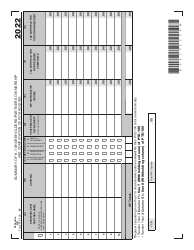

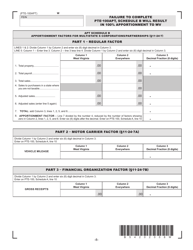

Q: What information is required on the PTE-100 form?

A: The PTE-100 form requires information about the income, deductions, and credits of the S Corporation or Partnership.

Q: When is the deadline to file the PTE-100 form?

A: The PTE-100 form must be filed by the 15th day of the fourth month following the end of the tax year.

Q: What happens if I don't file the PTE-100 form?

A: Failure to file the PTE-100 form may result in penalties and interest.

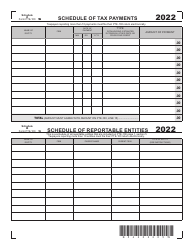

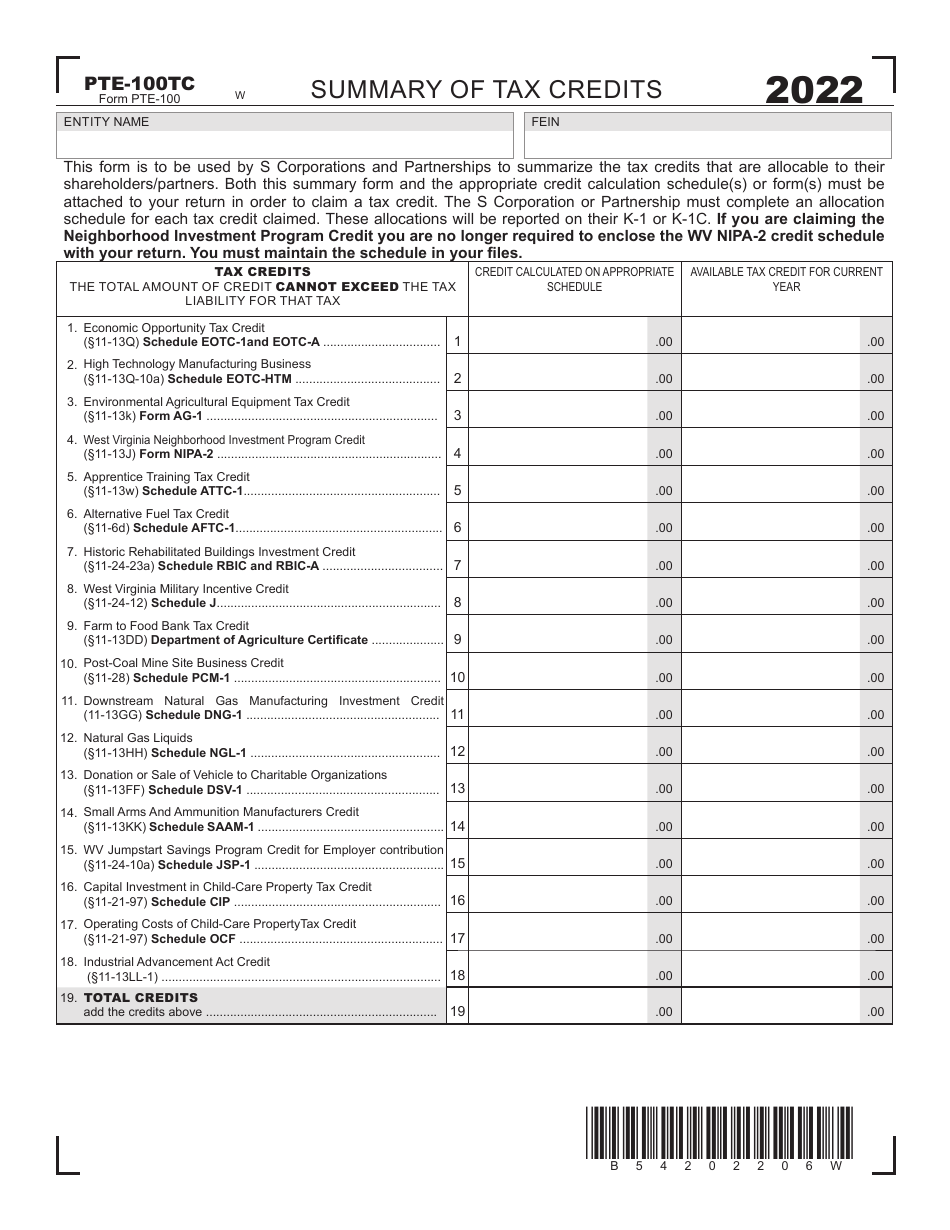

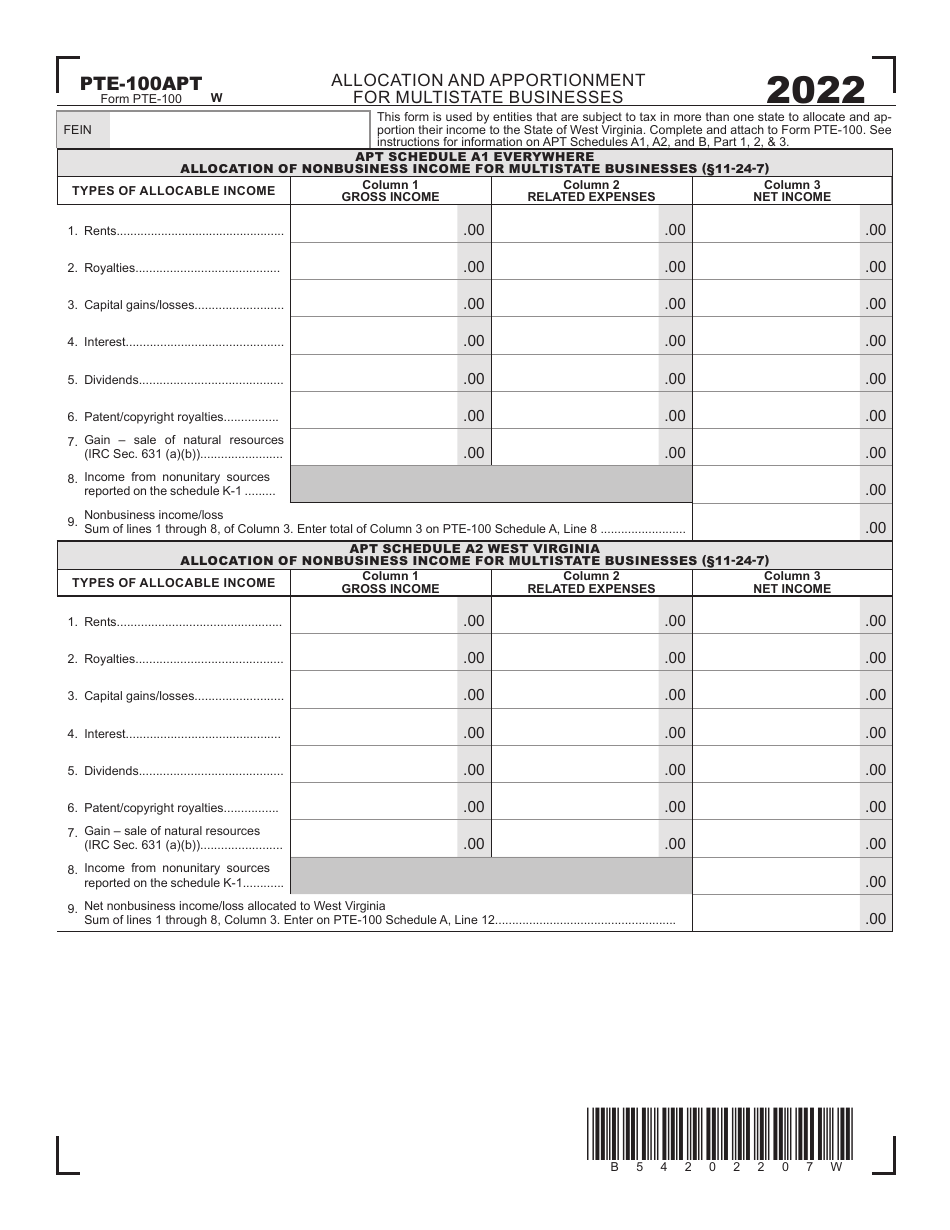

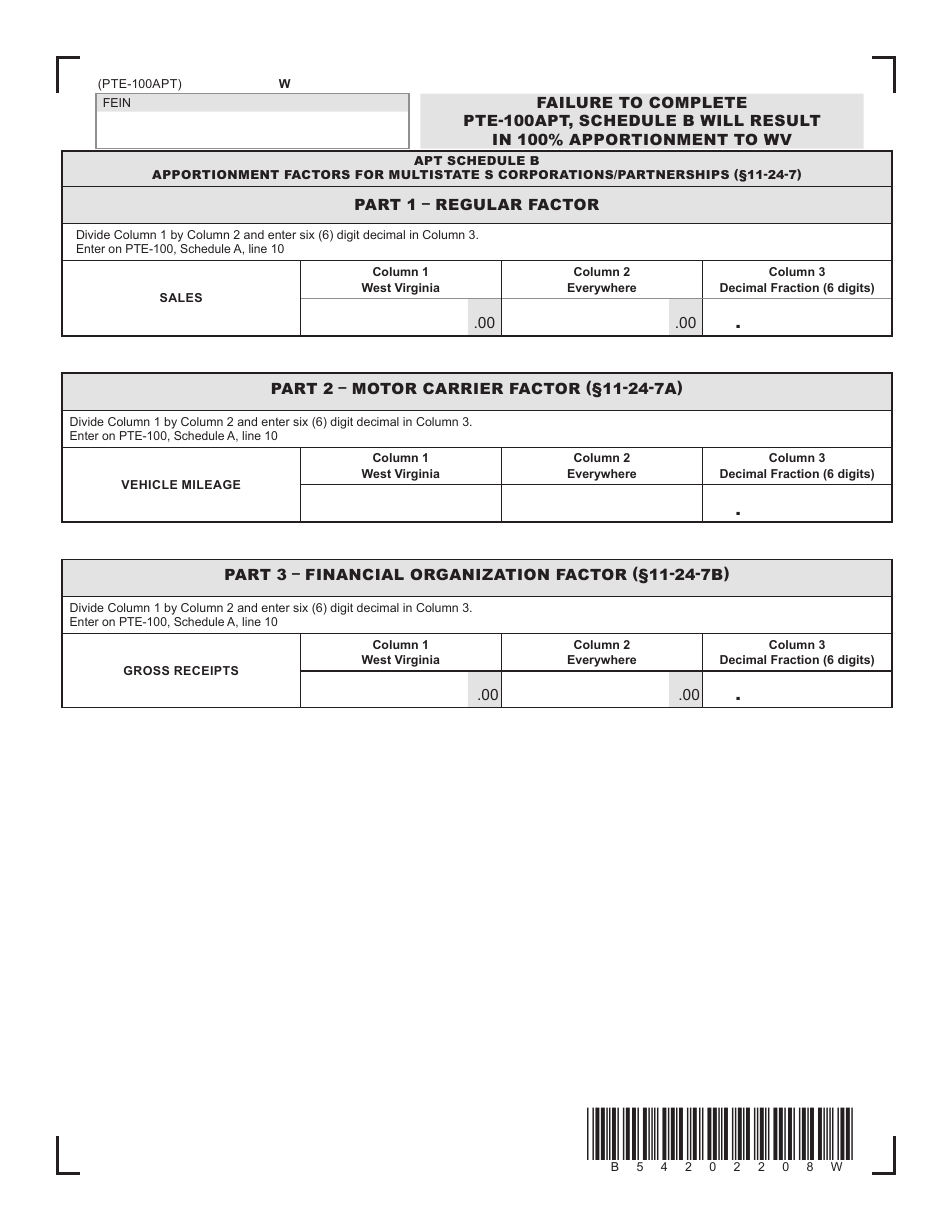

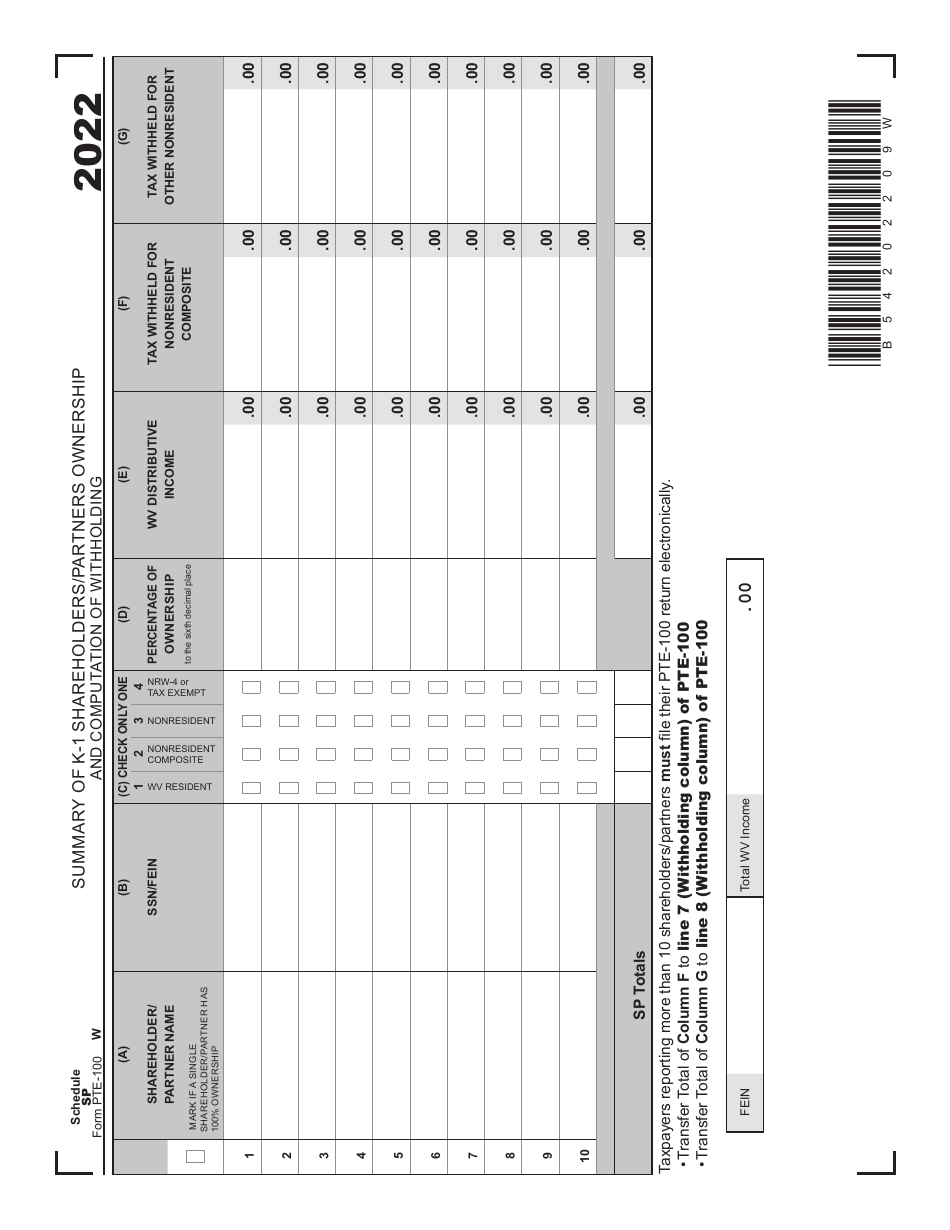

Q: Are there any additional forms or schedules that need to be filed with the PTE-100 form?

A: Additional forms or schedules may need to be filed depending on the specific circumstances of the S Corporation or Partnership.

Q: Are there any specific instructions for completing the PTE-100 form?

A: Yes, the PTE-100 form comes with instructions that provide guidance on how to complete and file the form correctly.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.