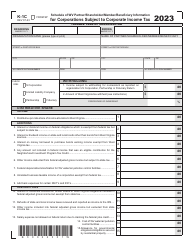

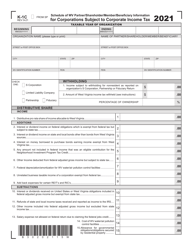

This version of the form is not currently in use and is provided for reference only. Download this version of

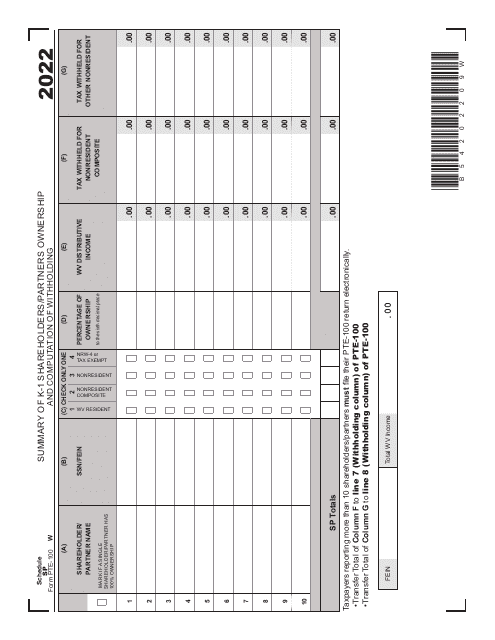

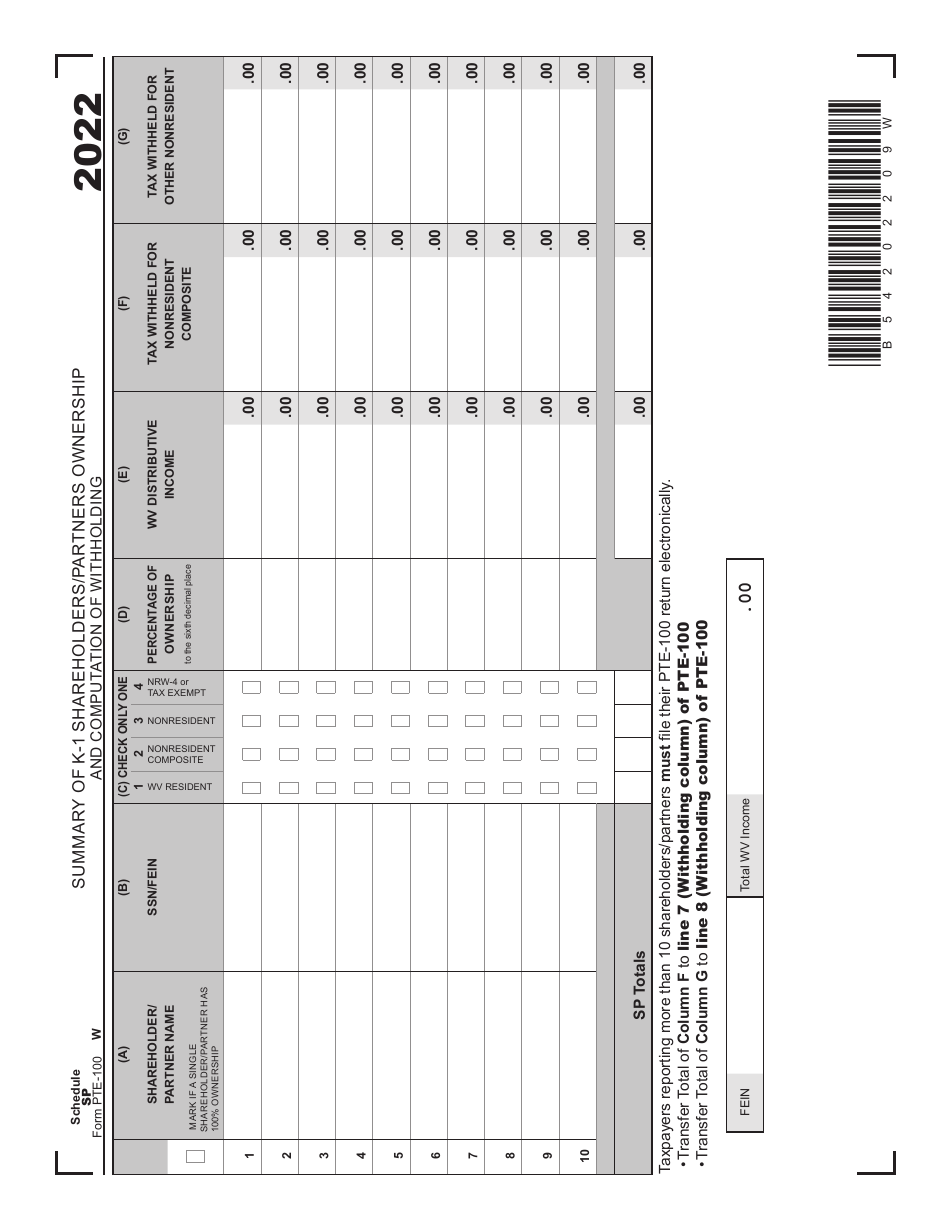

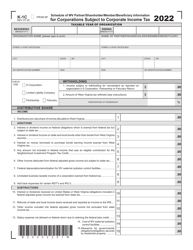

Form PTE-100 Schedule SP

for the current year.

Form PTE-100 Schedule SP Summary of K-1 Shareholders / Partners Ownership and Computation of Withholding Tax - West Virginia

What Is Form PTE-100 Schedule SP?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form PTE-100, West Virginia Income Tax Return S Corporation and Partnership (Pass-Through Entity). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100?

A: Form PTE-100 is a tax form used in West Virginia by pass-through entities to report the ownership and withholding tax information of K-1 shareholders/partners.

Q: What is Schedule SP?

A: Schedule SP is a part of Form PTE-100 that summarizes the ownership and includes the computation of withholding tax for K-1 shareholders/partners.

Q: What is a K-1 shareholder/partner?

A: A K-1 shareholder/partner is an individual or entity that receives income from a pass-through entity, such as a partnership or S corporation.

Q: Why is withholding tax important?

A: Withholding tax ensures that the appropriate amount of state tax is set aside and paid to the government on behalf of K-1 shareholders/partners.

Q: Who needs to use Form PTE-100 Schedule SP?

A: Pass-through entities in West Virginia with K-1 shareholders/partners need to use Form PTE-100 Schedule SP to report their ownership and withholding tax information.

Q: When is the deadline to file Form PTE-100 Schedule SP?

A: The deadline to file Form PTE-100 Schedule SP is generally the same as the due date for the pass-through entity's annual tax return, which is usually April 15th.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form PTE-100 Schedule SP. It is important to file the form by the deadline to avoid any potential penalties or additional fees.

Q: Is Form PTE-100 Schedule SP specific to West Virginia?

A: Yes, Form PTE-100 Schedule SP is specific to West Virginia. Other states may have similar forms or requirements for reporting ownership and withholding tax of K-1 shareholders/partners.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 Schedule SP by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.