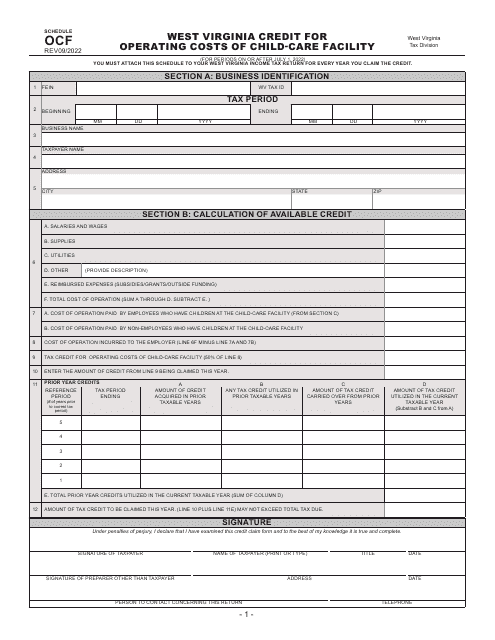

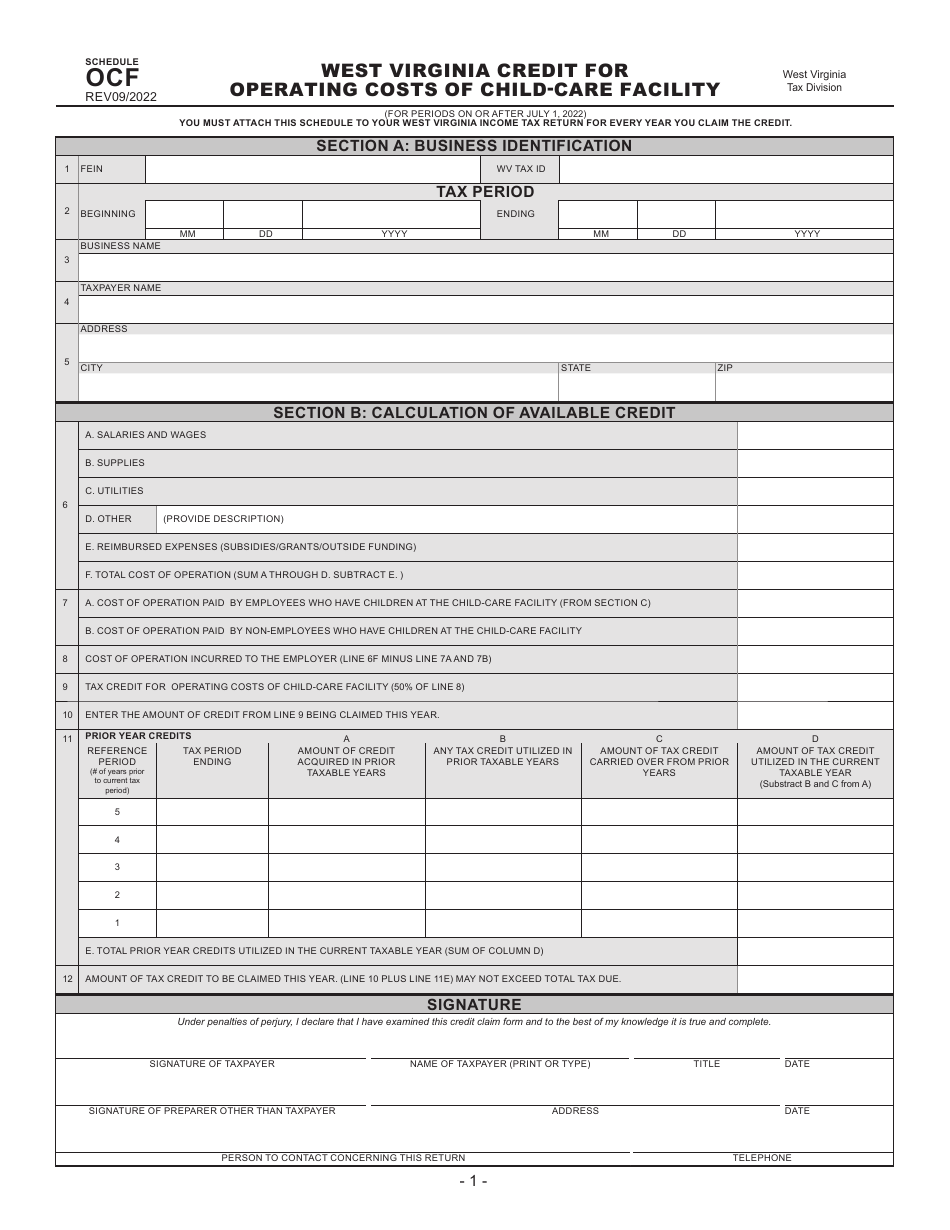

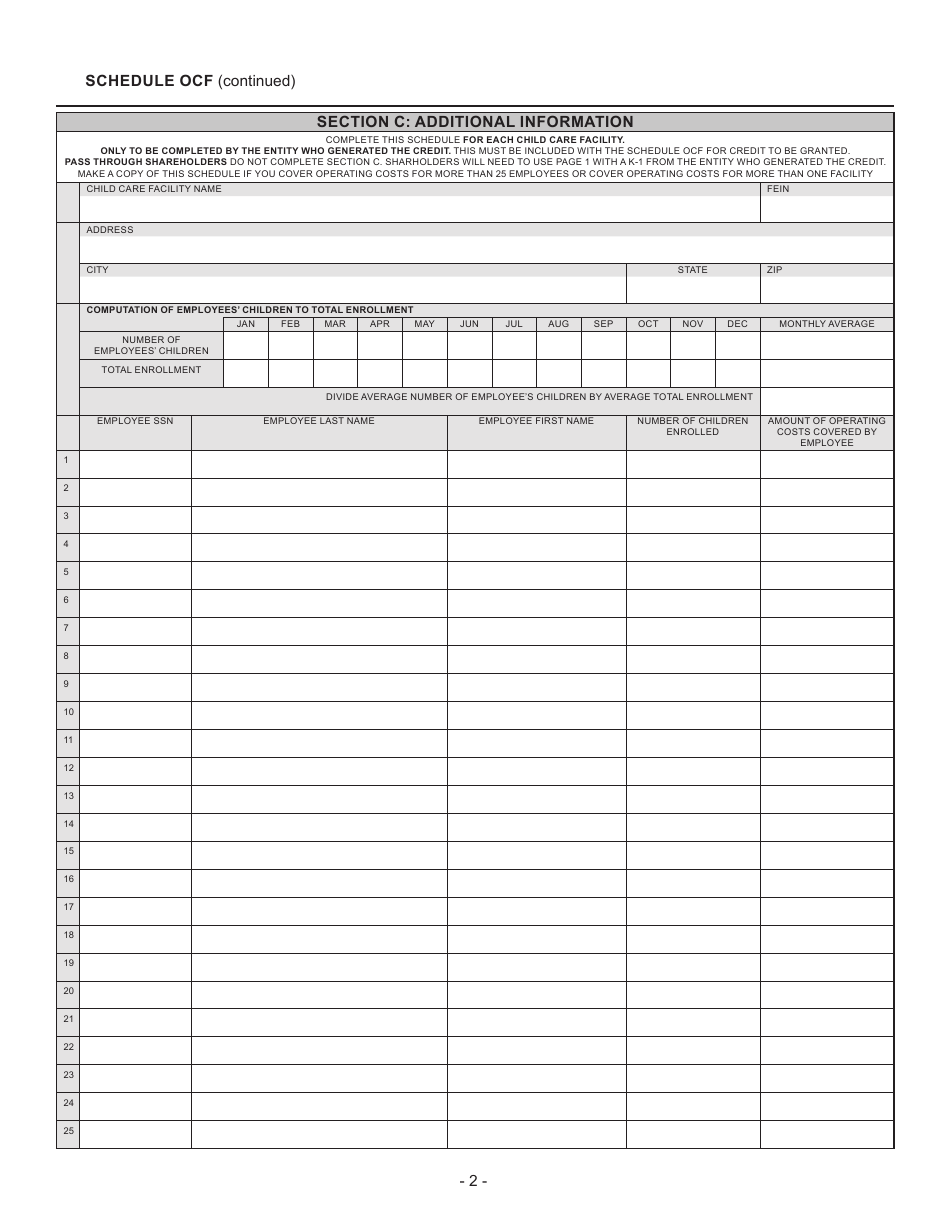

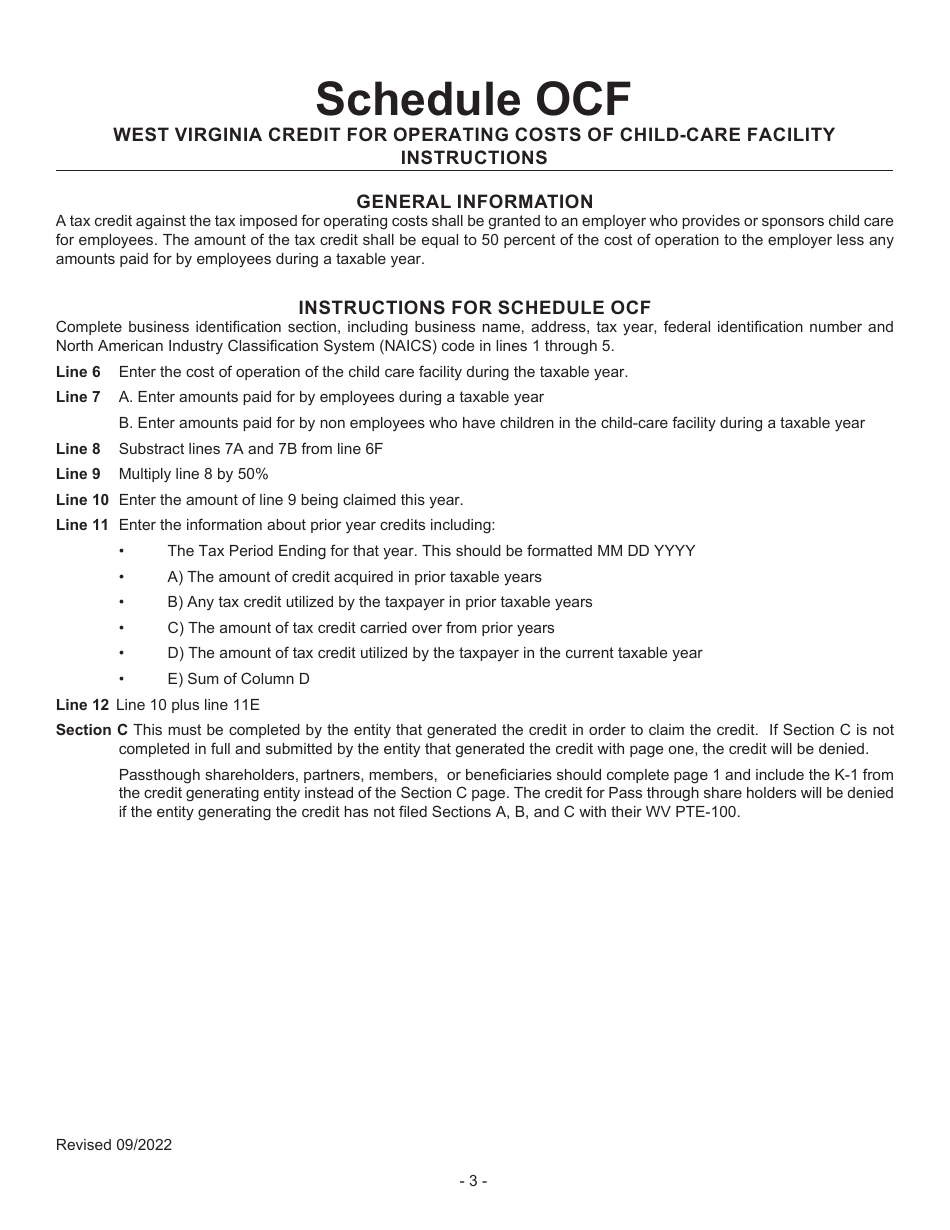

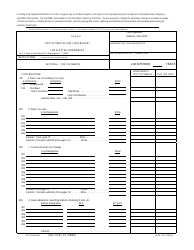

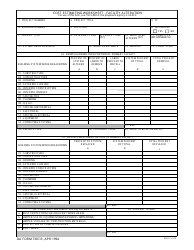

Schedule OCF West Virginia Credit for Operating Costs of Child-Care Facility - West Virginia

What Is Schedule OCF?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule OCF West Virginia Credit for Operating Costs of Child-Care Facility?

A: Schedule OCF West Virginia Credit for Operating Costs of Child-Care Facility is a form used in West Virginia to claim a tax credit for operating costs of a child-care facility.

Q: Who can claim this tax credit?

A: Individuals and businesses who operate child-care facilities in West Virginia may be eligible to claim this tax credit.

Q: What expenses can be claimed as operating costs?

A: Expenses related to the operation of a child-care facility, such as salaries, rent, utilities, and supplies, can be claimed as operating costs.

Q: How much is the tax credit?

A: The amount of the tax credit varies and is based on a percentage of the qualifying operating costs.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule OCF by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.