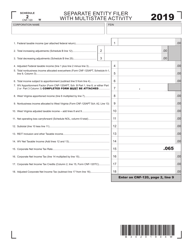

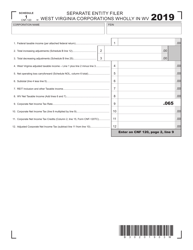

This version of the form is not currently in use and is provided for reference only. Download this version of

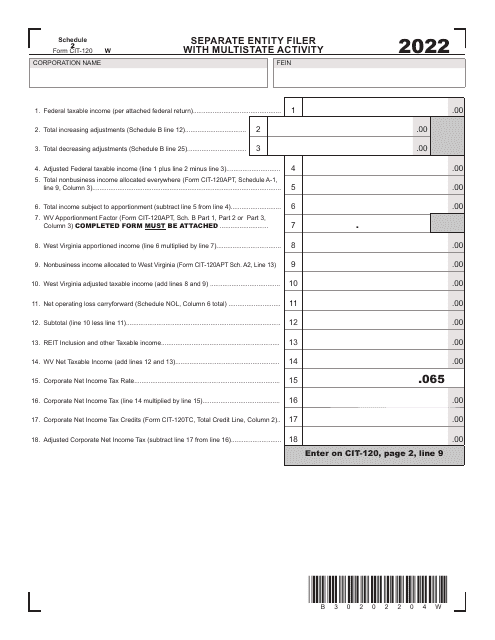

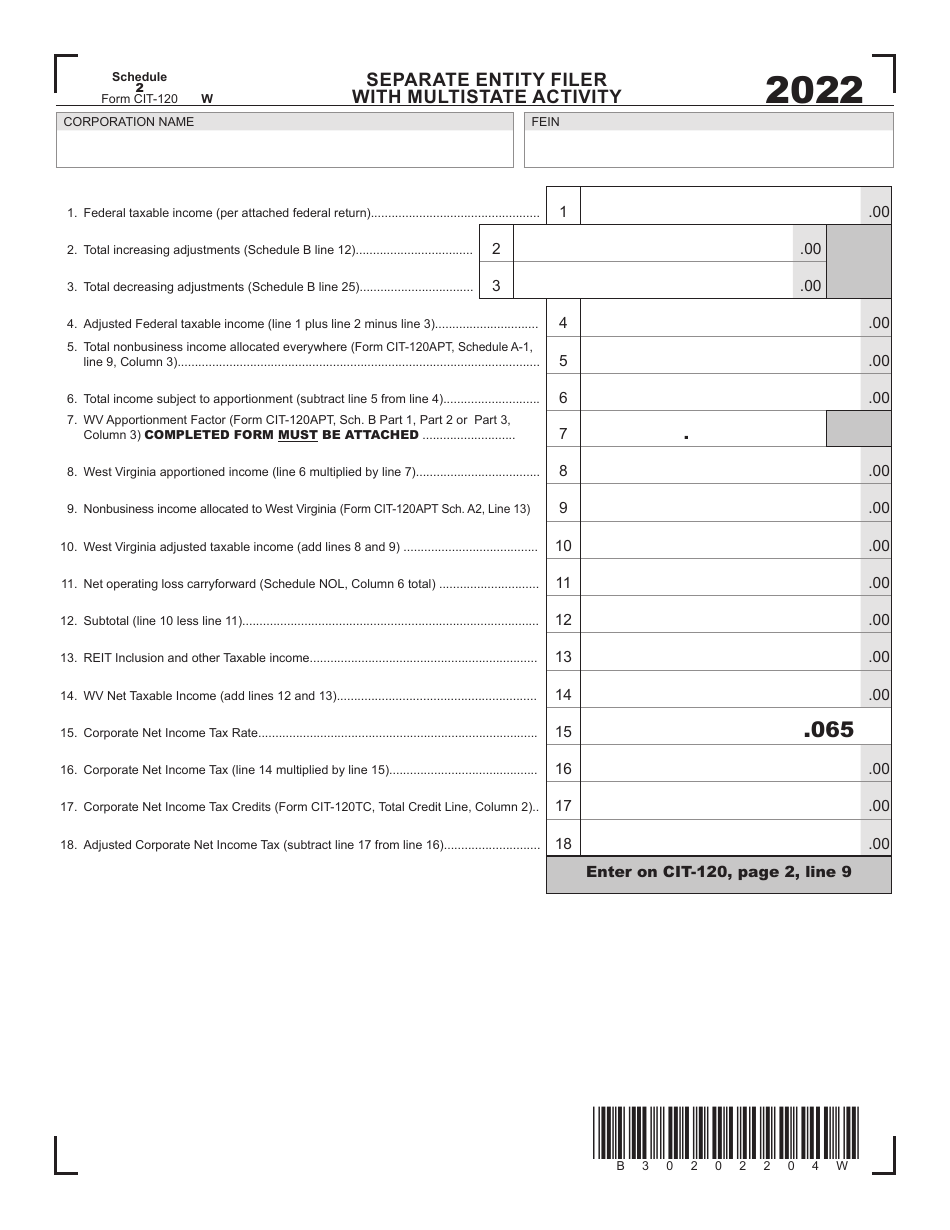

Form CIT-120 Schedule 2

for the current year.

Form CIT-120 Schedule 2 Separate Entity Filer With Multistate Activity - West Virginia

What Is Form CIT-120 Schedule 2?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CIT-120, Check All Applicable Boxes. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIT-120?

A: Form CIT-120 is a schedule for filing taxes as a separate entity with multistate activity in West Virginia.

Q: Who needs to file Form CIT-120?

A: Individuals or businesses that are separate entities and have multistate activity in West Virginia need to file Form CIT-120.

Q: What is a separate entity filer with multistate activity?

A: A separate entity filer with multistate activity refers to individuals or businesses that operate in multiple states and have their own legal entity in West Virginia.

Q: Why do I need to file Form CIT-120?

A: You need to file Form CIT-120 to report and pay taxes on the income earned from your multistate activity in West Virginia.

Q: Is Form CIT-120 specific to West Virginia?

A: Yes, Form CIT-120 is specific to filing taxes for separate entity filers with multistate activity in West Virginia.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 Schedule 2 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.