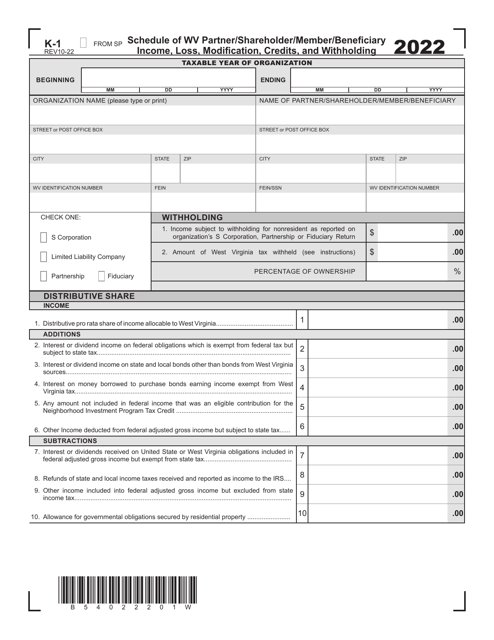

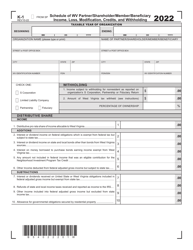

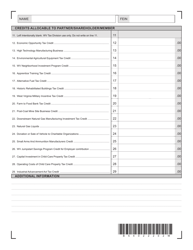

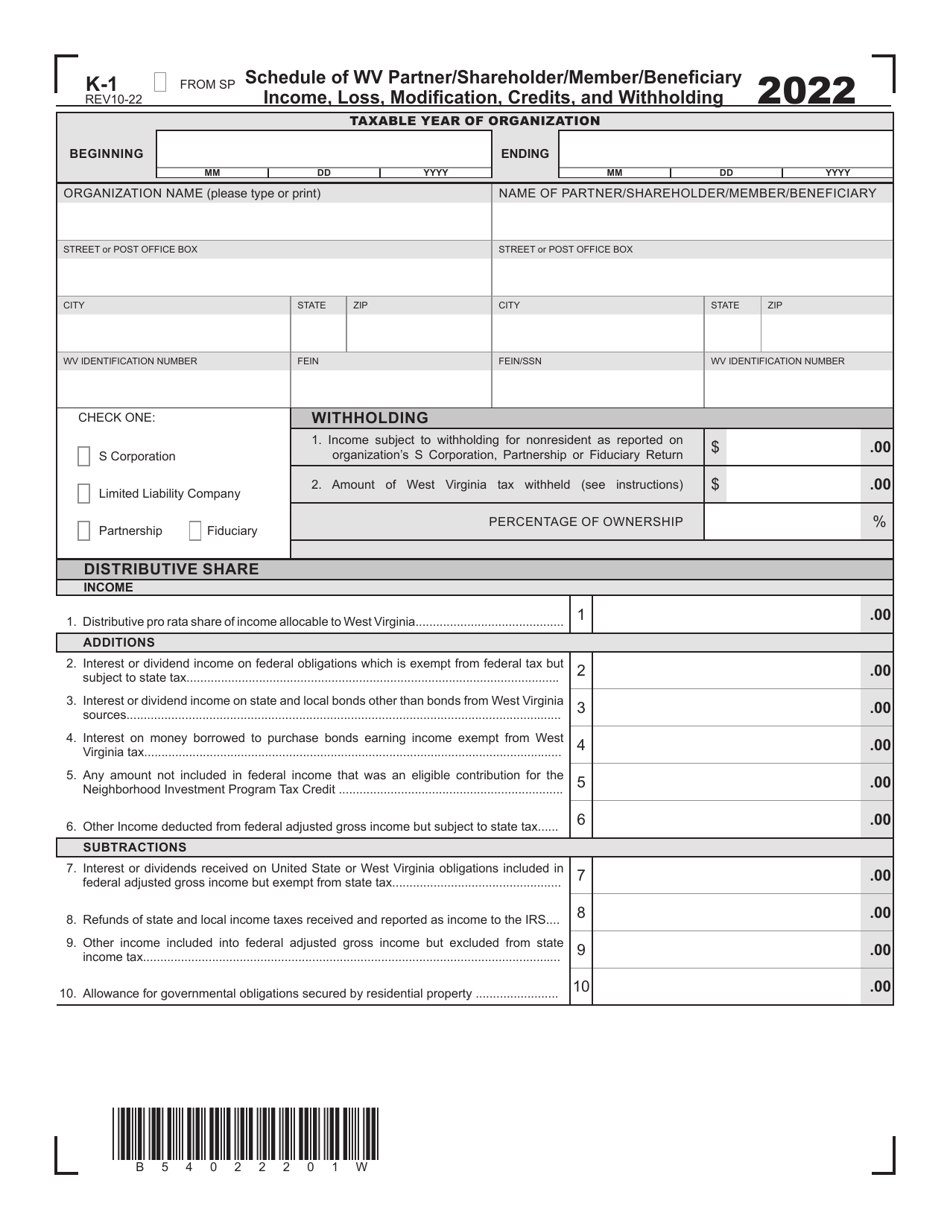

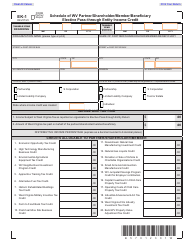

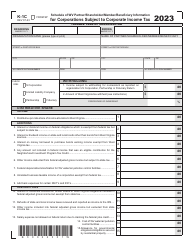

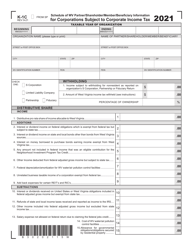

Form K-1 Schedule of Wv Partner / Shareholder / Member / Beneficiary Income, Loss, Modification, Credits, and Withholding - West Virginia

What Is Form K-1?

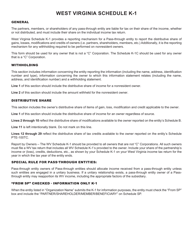

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-1?

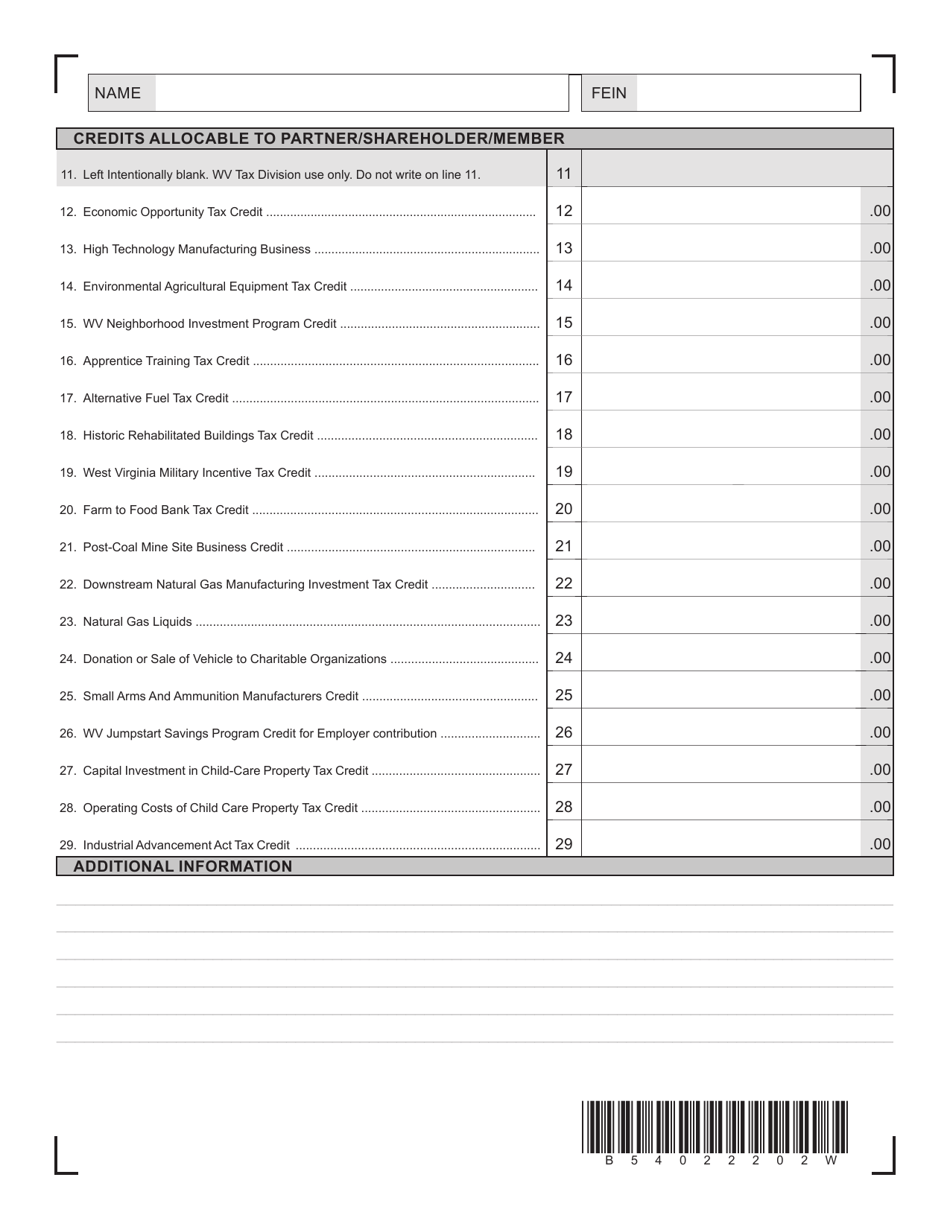

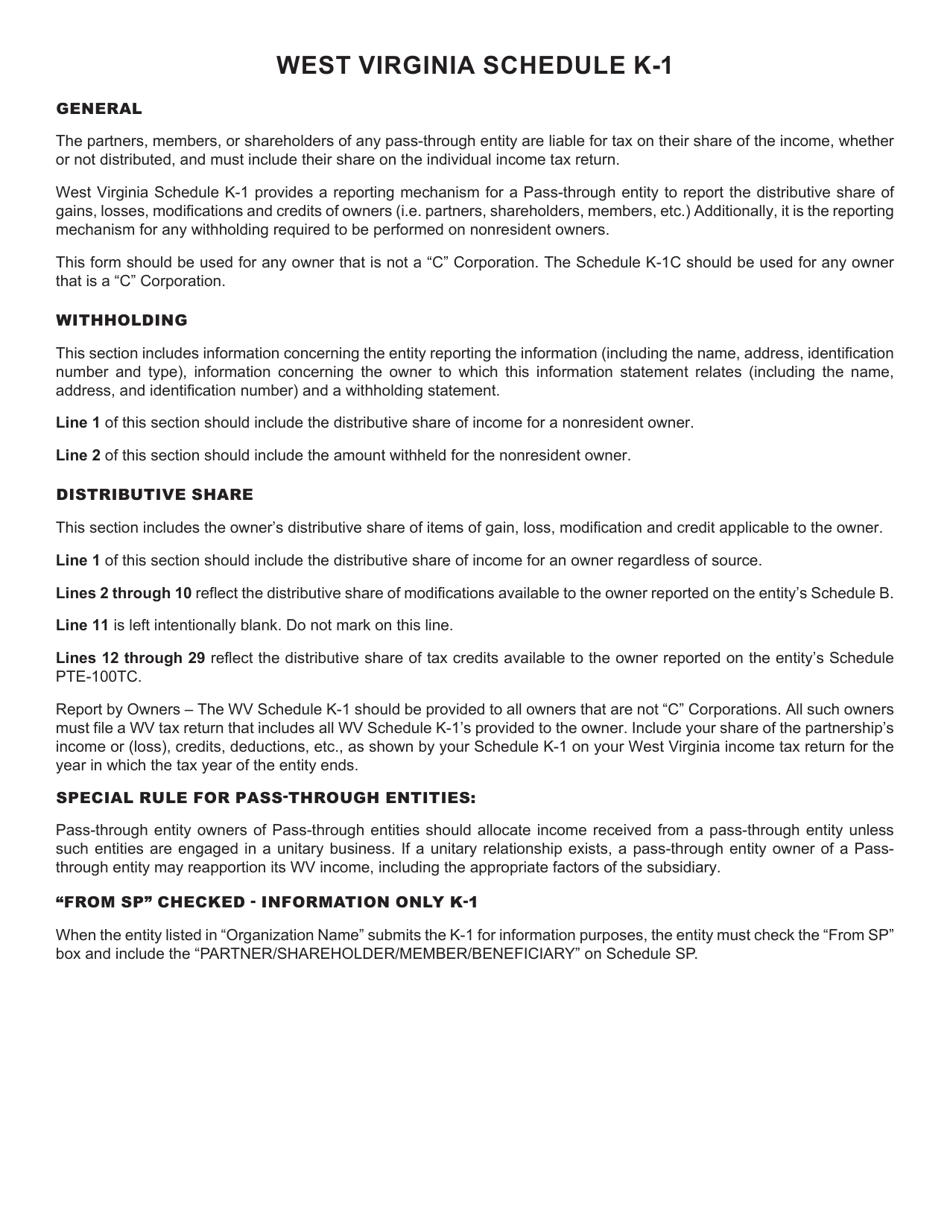

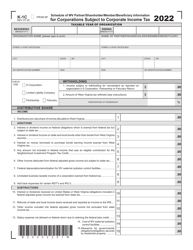

A: Form K-1 is a schedule that reports the income, loss, modifications, credits, and withholding for partners, shareholders, members, and beneficiaries.

Q: What is the purpose of Form K-1?

A: The purpose of Form K-1 is to allocate the income, deductions, and credits of an entity to the partners, shareholders, members, or beneficiaries.

Q: Who needs to file Form K-1?

A: The entity that generated the income or loss must file Form K-1 to report it to their partners, shareholders, members, or beneficiaries.

Q: What information does Form K-1 report?

A: Form K-1 reports income, loss, modifications, credits, and withholding related to a partnership, S corporation, limited liability company, or trust.

Q: What is the role of a partner, shareholder, member, or beneficiary in Form K-1?

A: Partners, shareholders, members, or beneficiaries receive a Form K-1 that reports their share of income, loss, modifications, credits, and withholding.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form K-1 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.