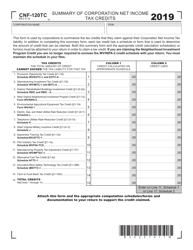

This version of the form is not currently in use and is provided for reference only. Download this version of

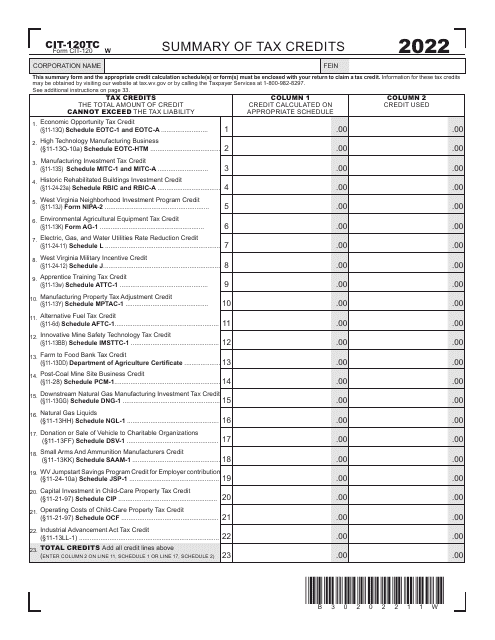

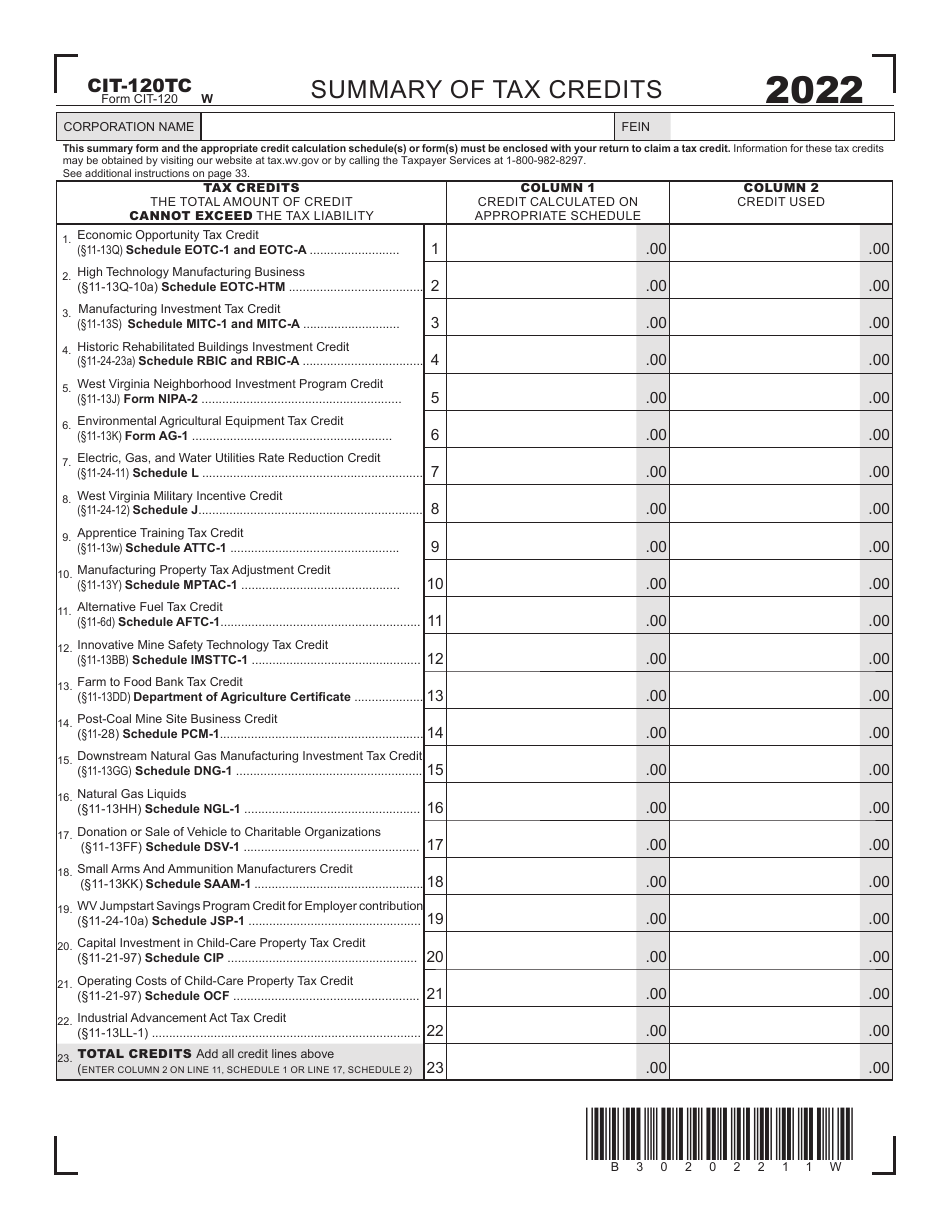

Form CIT-120TC

for the current year.

Form CIT-120TC Summary of Tax Credits - West Virginia

What Is Form CIT-120TC?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-120TC?

A: CIT-120TC is a form for summarizing tax credits in West Virginia.

Q: Who needs to file CIT-120TC?

A: Taxpayers in West Virginia who are claiming tax credits need to file CIT-120TC.

Q: What is the purpose of CIT-120TC?

A: The purpose of CIT-120TC is to provide a summary of tax credits claimed by taxpayers in West Virginia.

Q: What information is required on CIT-120TC?

A: CIT-120TC requires taxpayers to provide information about the tax credits they are claiming, including the credit name, credit code, and amount claimed.

Q: When is the deadline to file CIT-120TC?

A: The deadline for filing CIT-120TC is usually the same as the deadline for filing your West Virginia income tax return, which is April 15th.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120TC by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.