This version of the form is not currently in use and is provided for reference only. Download this version of

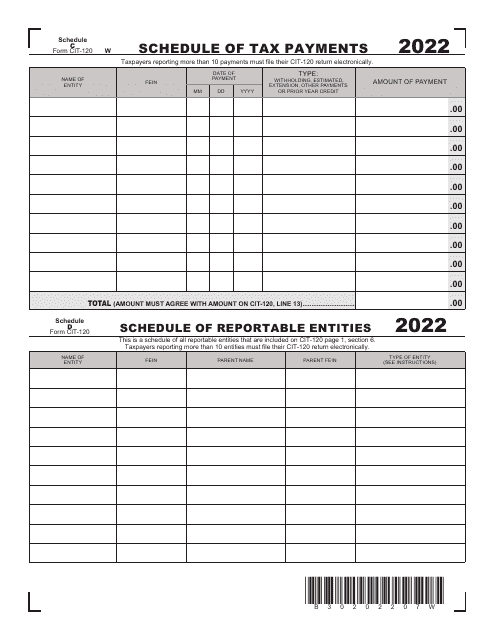

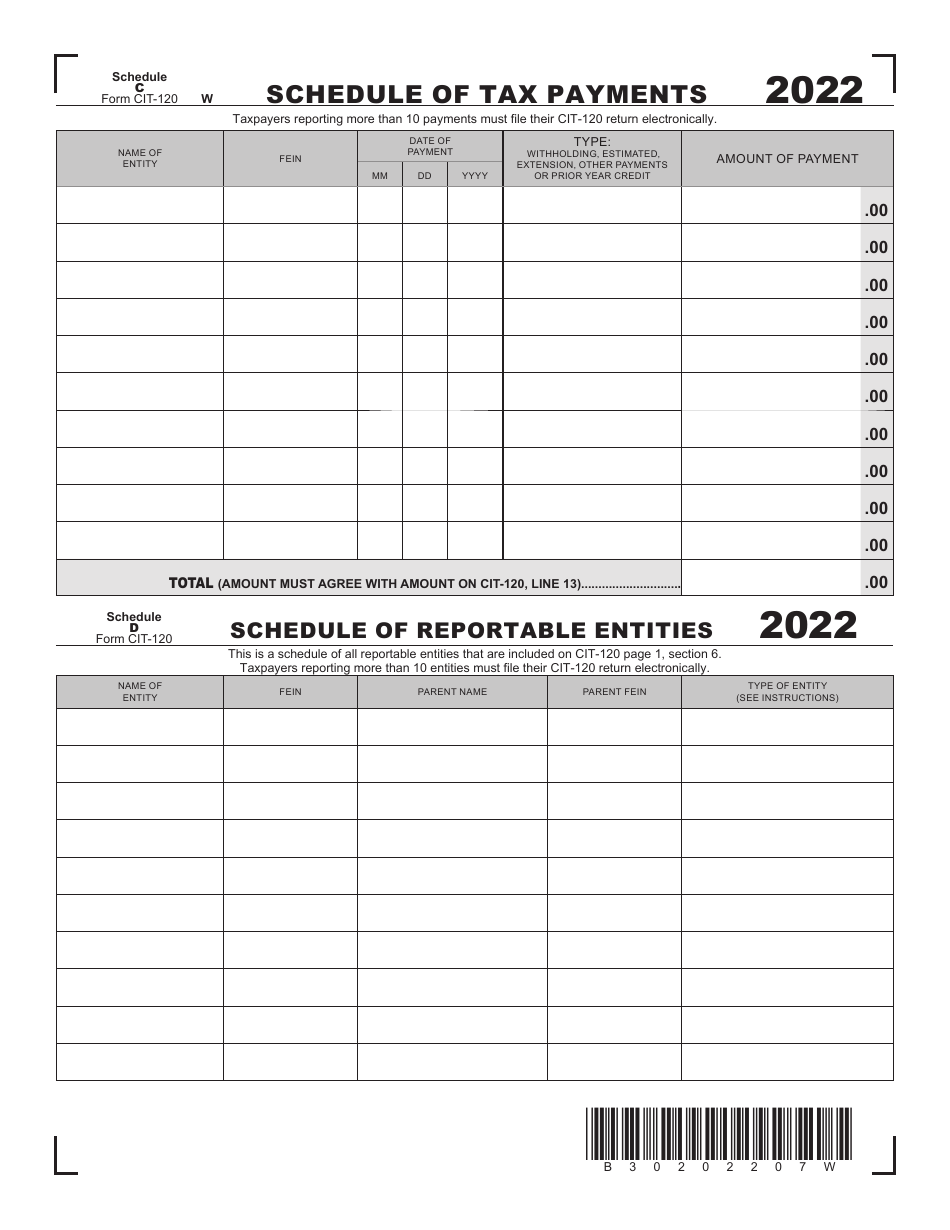

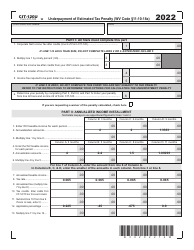

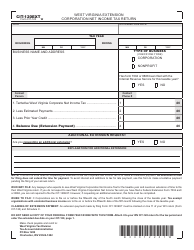

Form CIT-120 Schedule C, D

for the current year.

Form CIT-120 Schedule C, D Schedule of Tax Payments / Schedule of Reportable Entities - West Virginia

What Is Form CIT-120 Schedule C, D?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form CIT-120, Check All Applicable Boxes. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIT-120?

A: Form CIT-120 is a tax form used for reporting tax payments and reportable entities in the state of West Virginia.

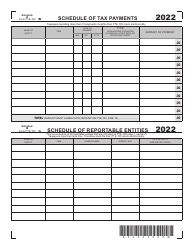

Q: What is Schedule C on Form CIT-120?

A: Schedule C on Form CIT-120 is used for reporting tax payments made by an entity.

Q: What is Schedule D on Form CIT-120?

A: Schedule D on Form CIT-120 is used for reporting reportable entities in West Virginia.

Q: What are tax payments?

A: Tax payments are the funds paid to the government as part of an individual or entity's tax obligation.

Q: What are reportable entities?

A: Reportable entities are entities that are required to be reported to the government for tax purposes.

Q: Who needs to use Form CIT-120?

A: Any entity that has made tax payments or has reportable entities in West Virginia may need to use Form CIT-120.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CIT-120 Schedule C, D by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.