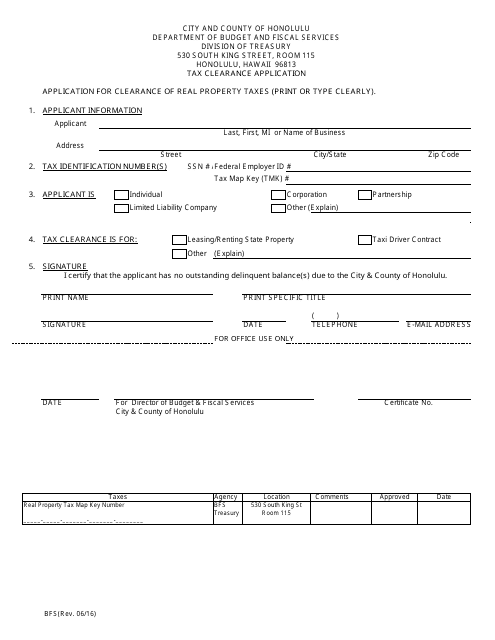

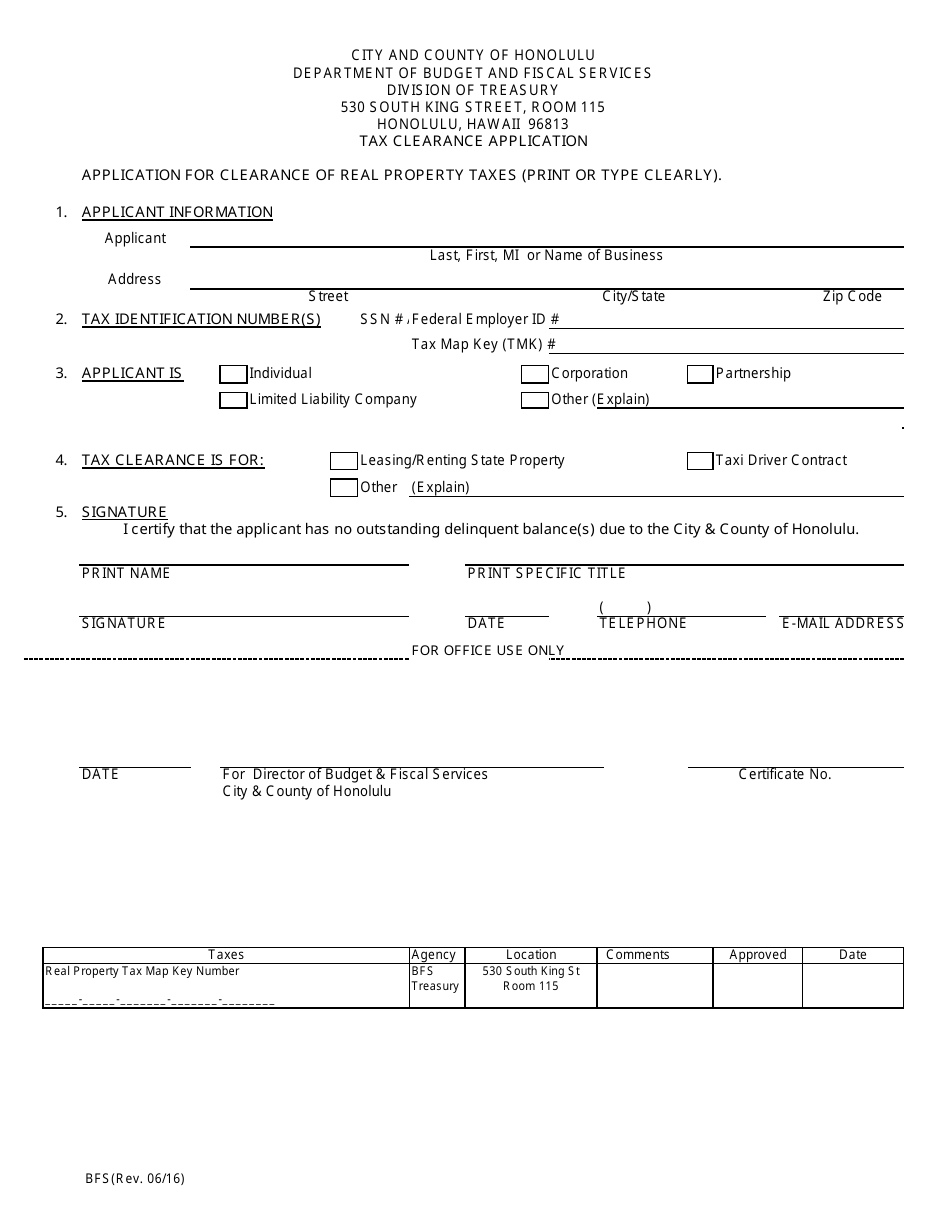

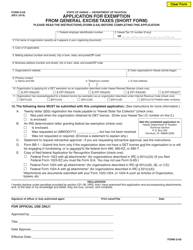

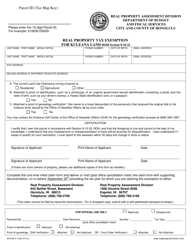

Tax Clearance Application - City and County of Honolulu, Hawaii

Tax Clearance Application is a legal document that was released by the Department of Budget and Fiscal Services - City and County of Honolulu, Hawaii - a government authority operating within Hawaii. The form may be used strictly within City and County of Honolulu.

FAQ

Q: What is a tax clearance application?

A: A tax clearance application is a document that is used to certify that a person or business has no outstanding tax liabilities in the City and County of Honolulu, Hawaii.

Q: Why would I need a tax clearance application?

A: You may need a tax clearance application if you are applying for a business license, bidding on a government contract, or selling real property in the City and County of Honolulu, Hawaii.

Q: How do I apply for a tax clearance?

A: To apply for a tax clearance, you must complete the appropriate application form, provide necessary supporting documentation, and submit it to the Department of Customer Services in the City and County of Honolulu, Hawaii.

Q: What documents do I need to submit with my tax clearance application?

A: The specific documents required may vary depending on the type of application, but generally you will need to provide information about your business, tax returns, and any outstanding liabilities.

Q: How long does it take to process a tax clearance application?

A: The processing time for a tax clearance application can vary, but it is recommended to allow several weeks for the application to be reviewed and processed.

Q: Is there a fee for the tax clearance application?

A: Yes, there is a fee associated with the tax clearance application. The fee amount may vary depending on the type of application.

Q: Can I check the status of my tax clearance application?

A: Yes, you can check the status of your tax clearance application by contacting the Department of Customer Services in the City and County of Honolulu, Hawaii.

Q: What happens if I have outstanding tax liabilities?

A: If you have outstanding tax liabilities, you will need to resolve them before your tax clearance application can be approved.

Q: How long is a tax clearance valid for?

A: A tax clearance is typically valid for a specific period of time, such as 90 days. After that, you may need to apply for a new tax clearance if required for any other purposes.

Form Details:

- Released on June 1, 2016;

- The latest edition currently provided by the Department of Budget and Fiscal Services - City and County of Honolulu, Hawaii;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Budget and Fiscal Services - City and County of Honolulu, Hawaii.