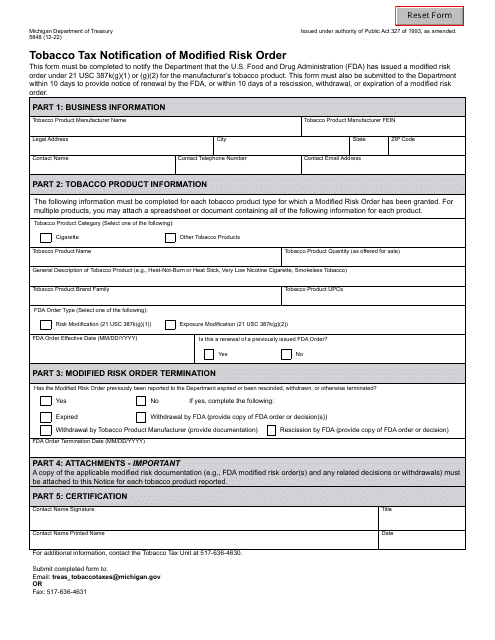

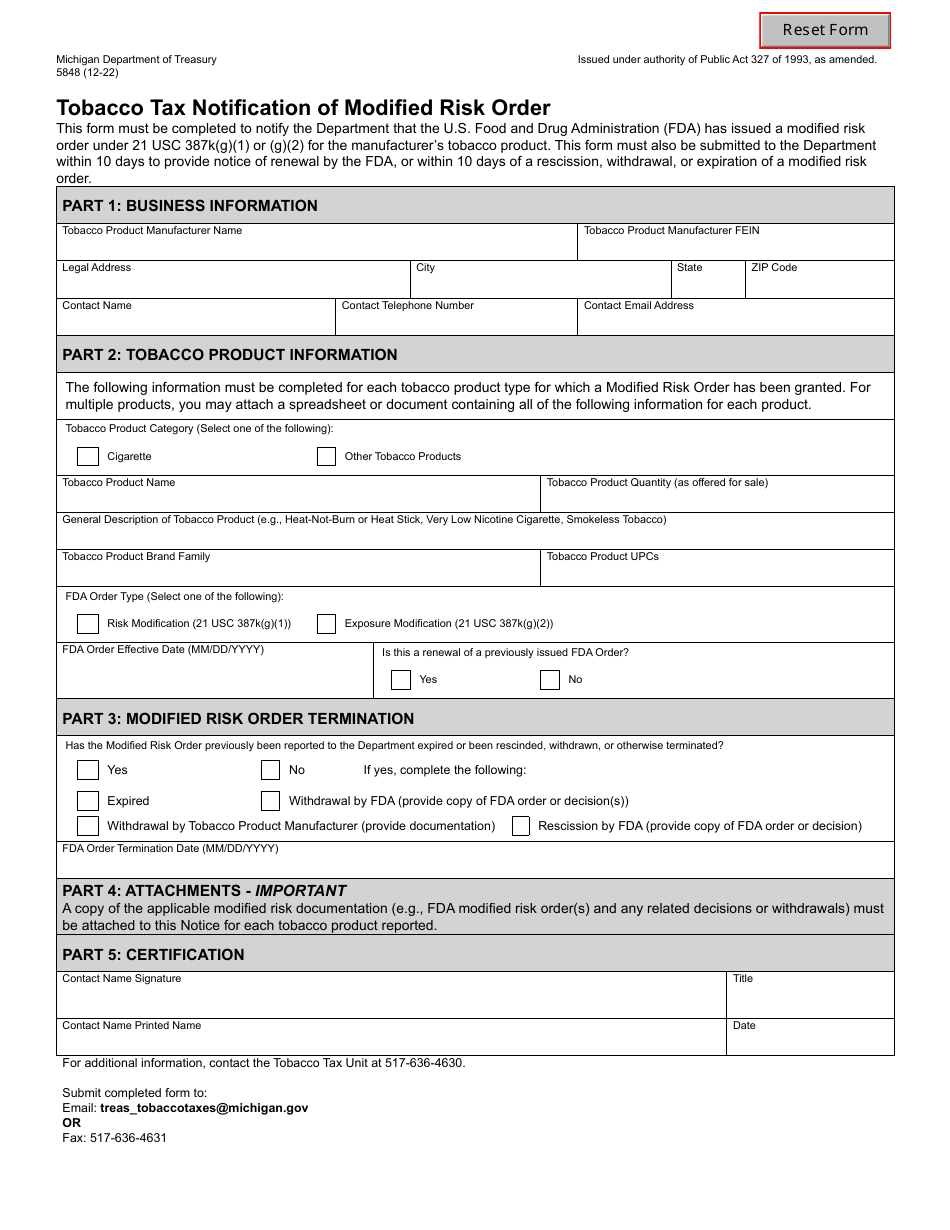

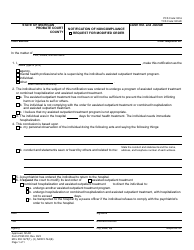

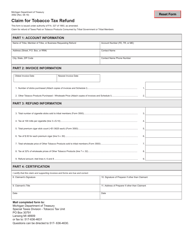

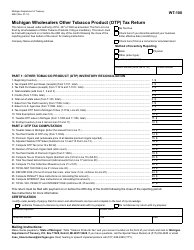

Form 5848 Tobacco Tax Notification of Modified Risk Order - Michigan

What Is Form 5848?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5848?

A: Form 5848 is a Tobacco Tax Notification of Modified Risk Order for the state of Michigan.

Q: Who needs to fill out Form 5848?

A: Any individual or business selling tobacco products within Michigan that wants to claim modified risk status for their products needs to fill out Form 5848.

Q: What is a modified risk tobacco product?

A: A modified risk tobacco product is a tobacco product that is sold, marketed, or presented as having a lower risk of harm than other tobacco products.

Q: What information is required on Form 5848?

A: Form 5848 requires you to provide information about the tobacco products, including brand names, descriptions, and any scientific evidence supporting the modified risk claim.

Q: When is Form 5848 due?

A: Form 5848 is due at least 60 days before the modified risk status is claimed or the tobacco product is offered for sale within the state of Michigan.

Q: Are there any penalties for failing to file Form 5848?

A: Yes, failure to file Form 5848 or providing false information may result in penalties, including fines and suspension of modified risk status.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5848 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.