This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1120-F Schedule I

for the current year.

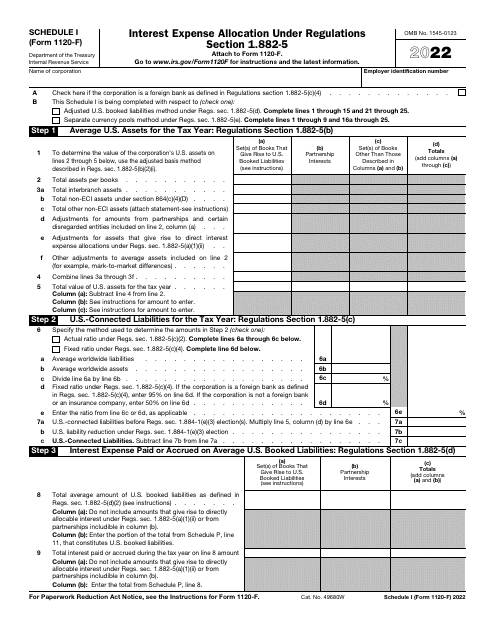

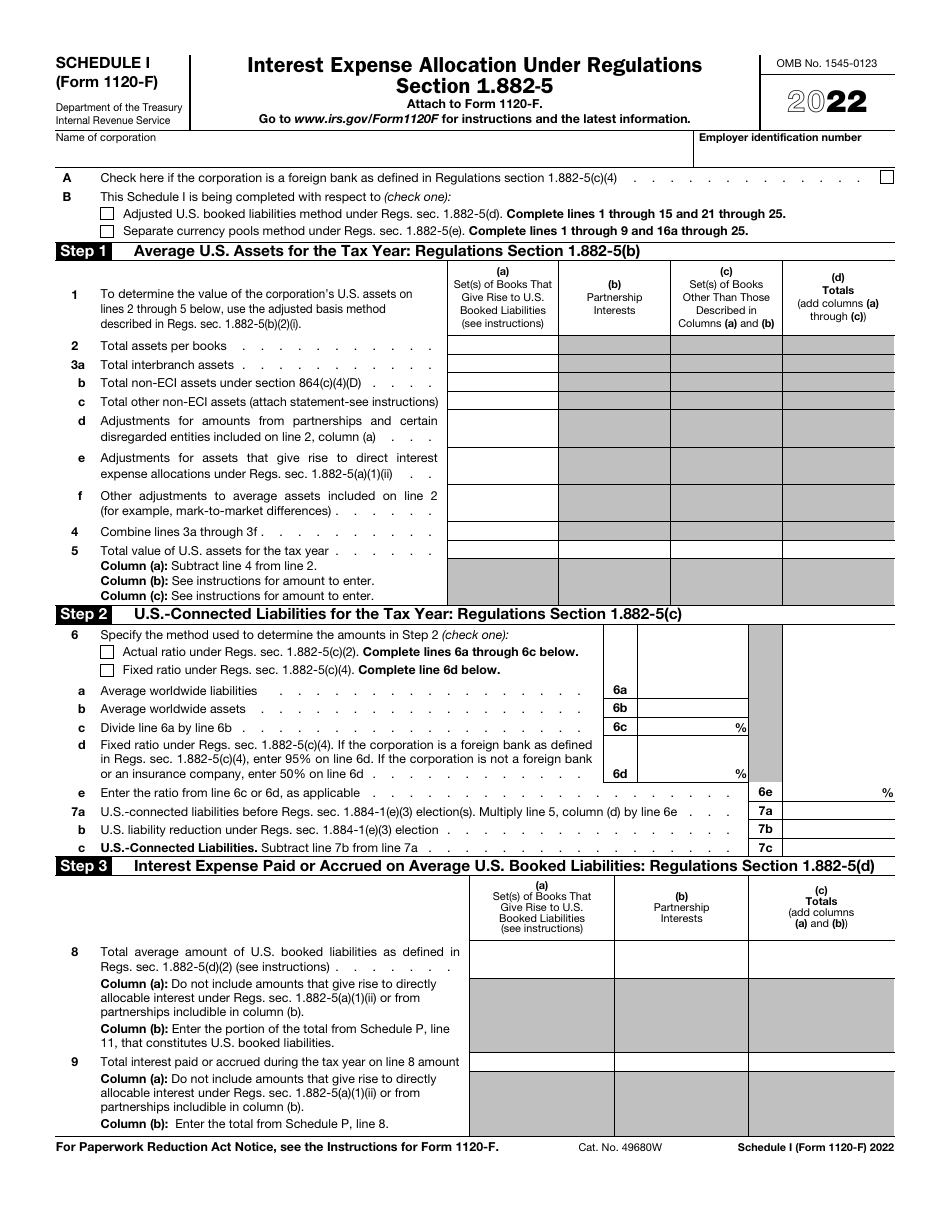

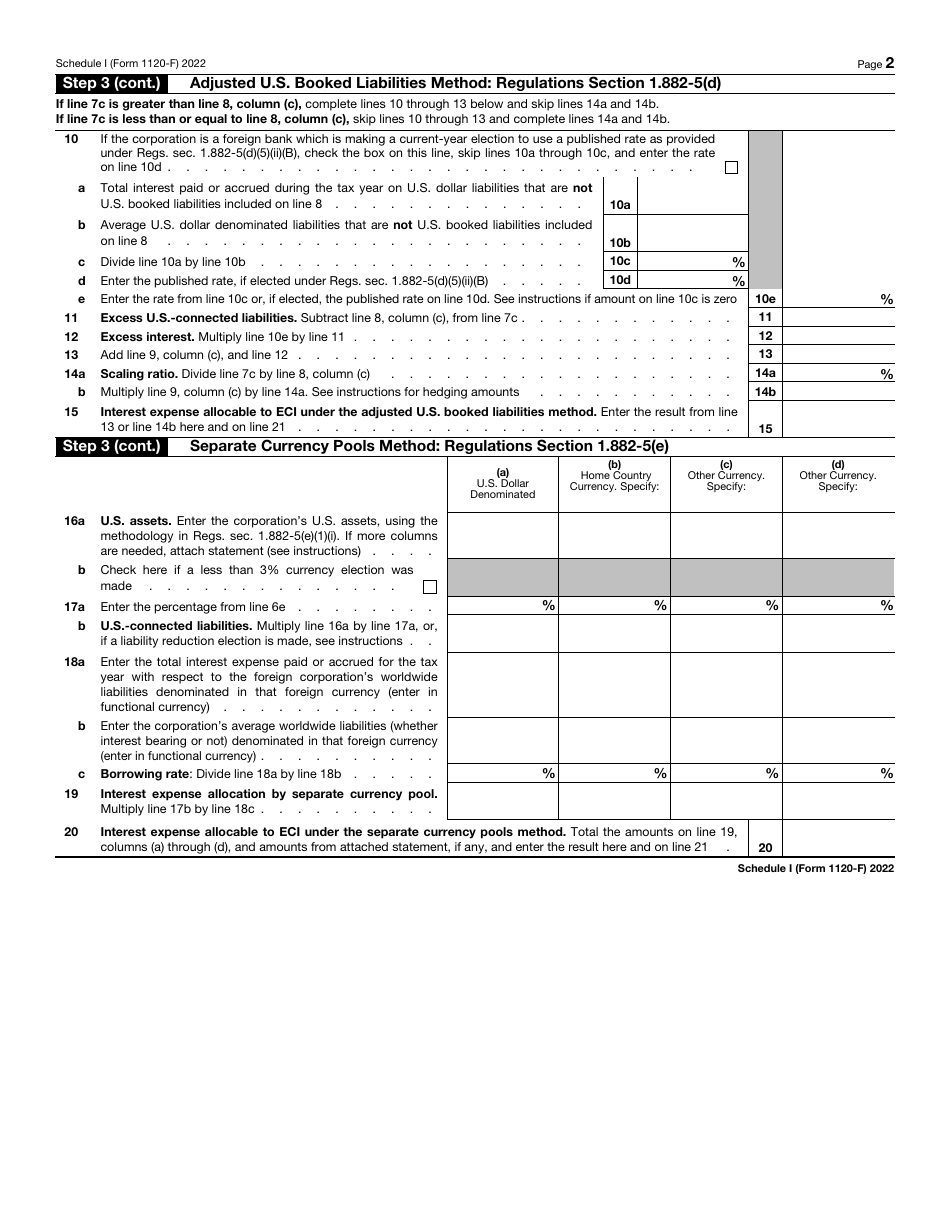

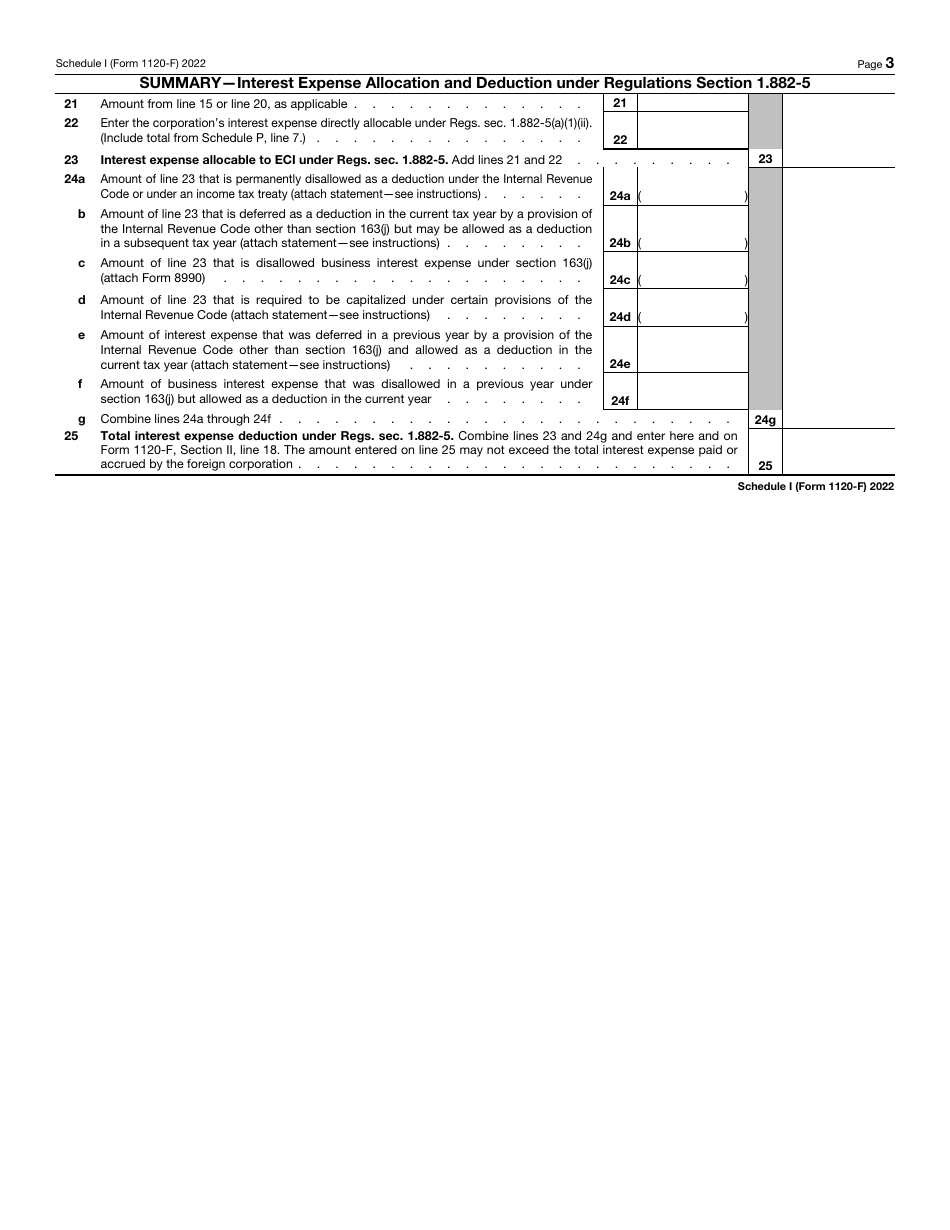

IRS Form 1120-F Schedule I Interest Expense Allocation Under Regulations Section 1.882-5

What Is IRS Form 1120-F Schedule I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-F?

A: IRS Form 1120-F is a tax form used by foreign corporations engaged in a trade or business in the United States to report their income, deductions, and tax liability.

Q: What is Schedule I?

A: Schedule I is an attachment to IRS Form 1120-F used to allocate interest expense according to regulations.

Q: What is interest expense allocation?

A: Interest expense allocation refers to the process of dividing interest expenses among different income categories to determine the allowable deduction for each category.

Q: What are Regulations Section 1.882-5?

A: Regulations Section 1.882-5 is a set of rules provided by the IRS that govern the interest allocation for foreign corporations.

Q: Why do foreign corporations need to allocate interest expense?

A: Foreign corporations need to allocate interest expense to determine the amount of interest deduction that can be claimed in the United States.

Q: How does Schedule I work?

A: Schedule I provides a worksheet that helps foreign corporations calculate the allocation of interest expense based on provisions outlined in Regulations Section 1.882-5.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-F Schedule I through the link below or browse more documents in our library of IRS Forms.