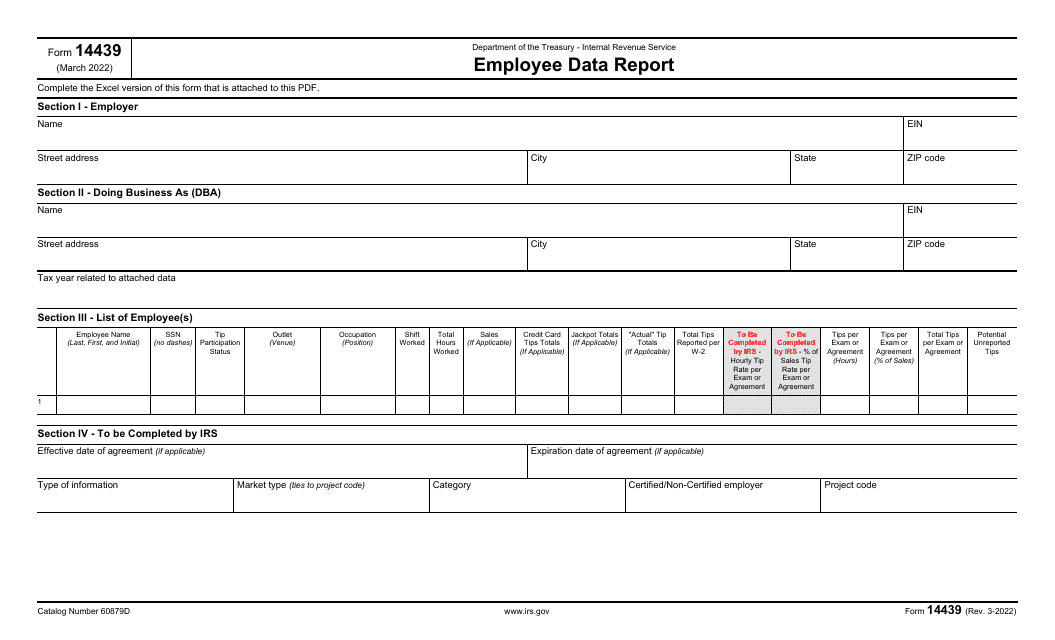

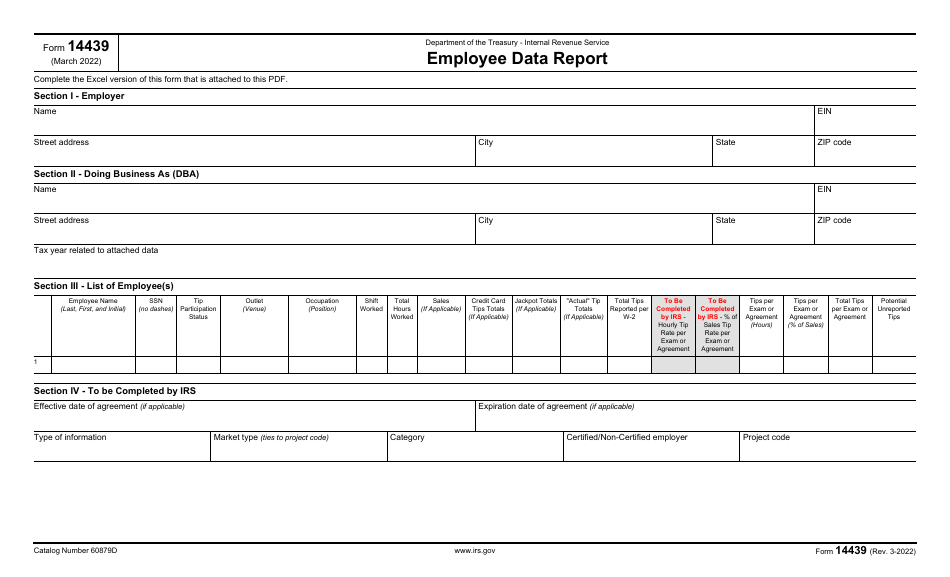

IRS Form 14439 Employee Data Report

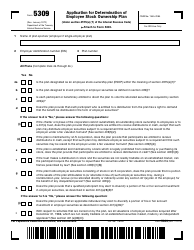

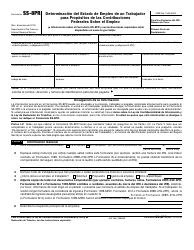

What Is IRS Form 14439?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 14439?

A: Form 14439 is the Employee Data Report.

Q: Who needs to fill out Form 14439?

A: Employers need to fill out Form 14439.

Q: What information is required on Form 14439?

A: Form 14439 requires information about the employer and their employees.

Q: Why is Form 14439 important?

A: Form 14439 is important because it provides the IRS with data about employees and their income.

Q: How do I fill out Form 14439?

A: Follow the instructions provided on Form 14439 to accurately fill out the required information.

Q: When is the deadline for filing Form 14439?

A: The deadline for filing Form 14439 is specified by the IRS and may vary.

Q: Are there any penalties for not filing Form 14439?

A: Failure to file Form 14439 may result in penalties imposed by the IRS.

Q: Can I file Form 14439 electronically?

A: As of now, Form 14439 cannot be filed electronically and must be submitted by mail.

Q: Can I request an extension to file Form 14439?

A: Yes, you can request an extension to file Form 14439 by contacting the IRS.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14439 through the link below or browse more documents in our library of IRS Forms.