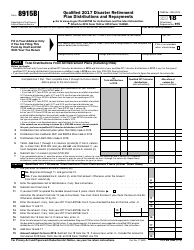

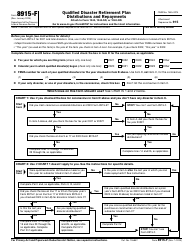

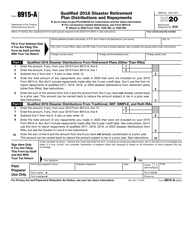

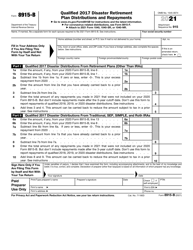

This version of the form is not currently in use and is provided for reference only. Download this version of

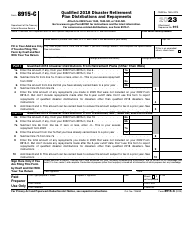

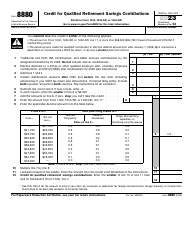

Instructions for IRS Form 8915-D

for the current year.

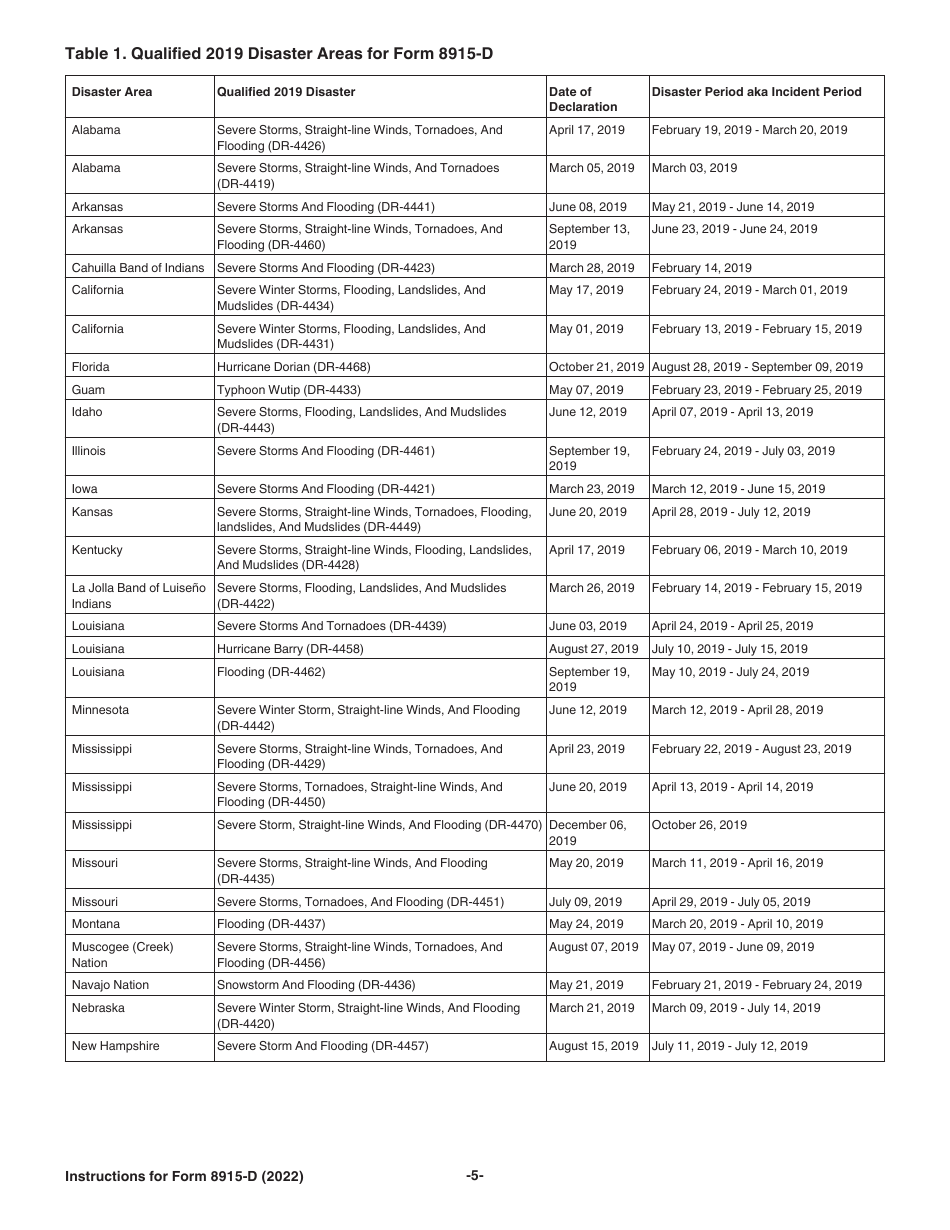

Instructions for IRS Form 8915-D Qualified 2019 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-D , Qualified 2019 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-D is available for download through this link.

FAQ

Q: What is IRS Form 8915-D?

A: IRS Form 8915-D is used for reporting qualified 2019 disaster retirement plan distributions and repayments.

Q: What is a qualified 2019 disaster retirement plan distribution?

A: A qualified 2019 disaster retirement plan distribution is a distribution from a retirement plan that was made in 2019 and is related to a qualified disaster.

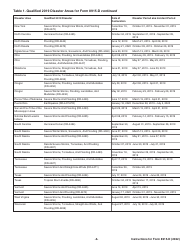

Q: What is a qualified disaster?

A: A qualified disaster is an event declared by the President of the United States or the Federal Emergency Management Agency (FEMA) as a disaster.

Q: Who is eligible to use Form 8915-D?

A: Individuals who received a qualified 2019 disaster retirement plan distribution and want to report it or repay it for tax purposes are eligible to use Form 8915-D.

Q: Can I repay a qualified disaster retirement plan distribution?

A: Yes, you have the option to repay the distribution within 3 years from receiving it, which can help you avoid paying taxes on the distribution.

Q: Are there any special tax rules for qualified disaster retirement plan distributions?

A: Yes, qualified disaster retirement plan distributions can be included in taxable income and are subject to additional tax rules.

Q: When is the deadline for filing Form 8915-D?

A: The deadline for filing Form 8915-D is usually the same as the normal tax filing deadline, which is April 15th. However, it may be extended in certain circumstances, so it's always best to check with the IRS or a tax professional.

Q: Do I need to attach any documents with Form 8915-D?

A: It depends on your situation. The instructions for Form 8915-D will provide guidance on whether you need to attach any supporting documents.

Q: Is Form 8915-D only for residents of the United States?

A: Form 8915-D is primarily used by residents of the United States. However, if you are a resident of Canada and received a qualified 2019 disaster retirement plan distribution from a U.S. retirement plan, you may also need to use this form.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.