This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8915-C

for the current year.

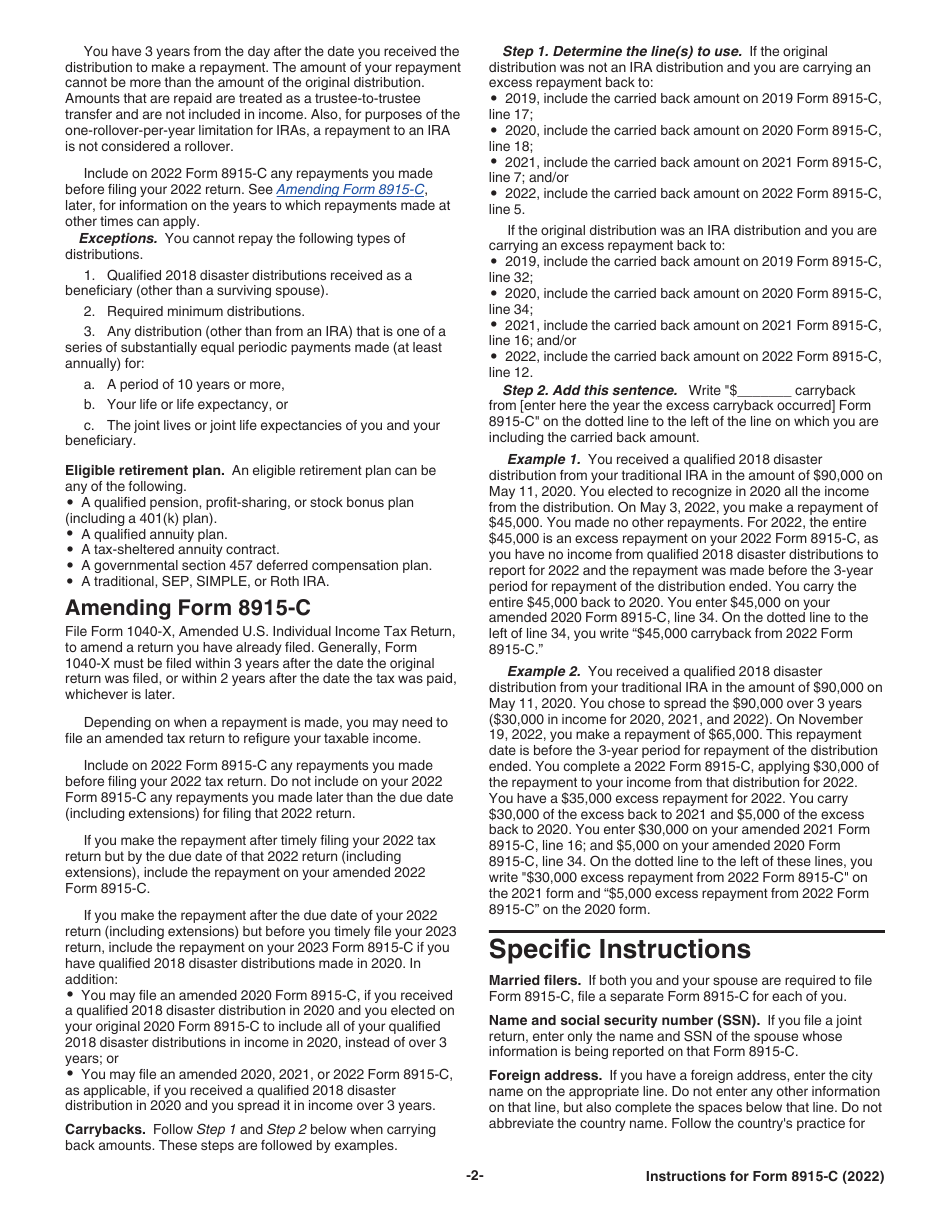

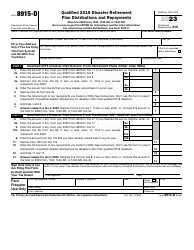

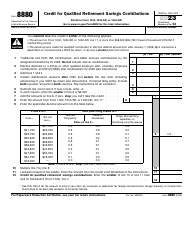

Instructions for IRS Form 8915-C Qualified 2018 Disaster Retirement Plan Distributions and Repayments

This document contains official instructions for IRS Form 8915-C , Qualified 2018 Disaster Retirement Plan Distributions and Repayments - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8915-C is available for download through this link.

FAQ

Q: What is IRS Form 8915-C?

A: IRS Form 8915-C is a form used to report qualified disaster retirement plan distributions and repayments for the year 2018.

Q: What are qualified disaster retirement plan distributions?

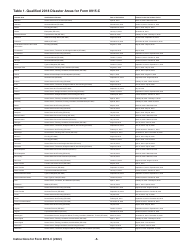

A: Qualified disaster retirement plan distributions are distributions from eligible retirement plans that are made to individuals affected by a 2018 disaster.

Q: Who is eligible to use IRS Form 8915-C?

A: Individuals who received qualified disaster retirement plan distributions in 2018 and wish to report and repay those distributions can use IRS Form 8915-C.

Q: What types of retirement plans are eligible for qualified disaster retirement plan distributions?

A: Qualified disaster retirement plan distributions can include distributions from employer-sponsored retirement plans, such as 401(k) plans, as well as IRAs and certain other retirement plans.

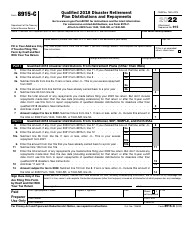

Q: How do I report qualified disaster retirement plan distributions on IRS Form 8915-C?

A: You will need to provide information about the distribution, including the amount, the type of retirement plan, and the specific disaster that made you eligible for the distribution.

Q: Can I repay the qualified disaster retirement plan distributions?

A: Yes, you can choose to repay some or all of the qualified disaster retirement plan distributions you received in 2018. Repayments can be made to the original retirement plan or to another eligible retirement plan.

Q: What are the benefits of repaying qualified disaster retirement plan distributions?

A: By repaying the distributions, you can avoid paying taxes on the distributions and potentially avoid early withdrawal penalties.

Q: Are there any deadline to report and repay qualified disaster retirement plan distributions?

A: Yes, there are specific deadlines for reporting and repaying qualified disaster retirement plan distributions. You should consult the instructions for IRS Form 8915-C for the applicable deadlines.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.