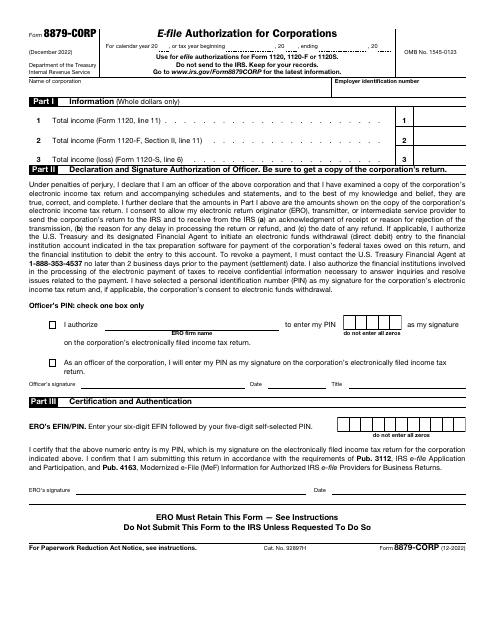

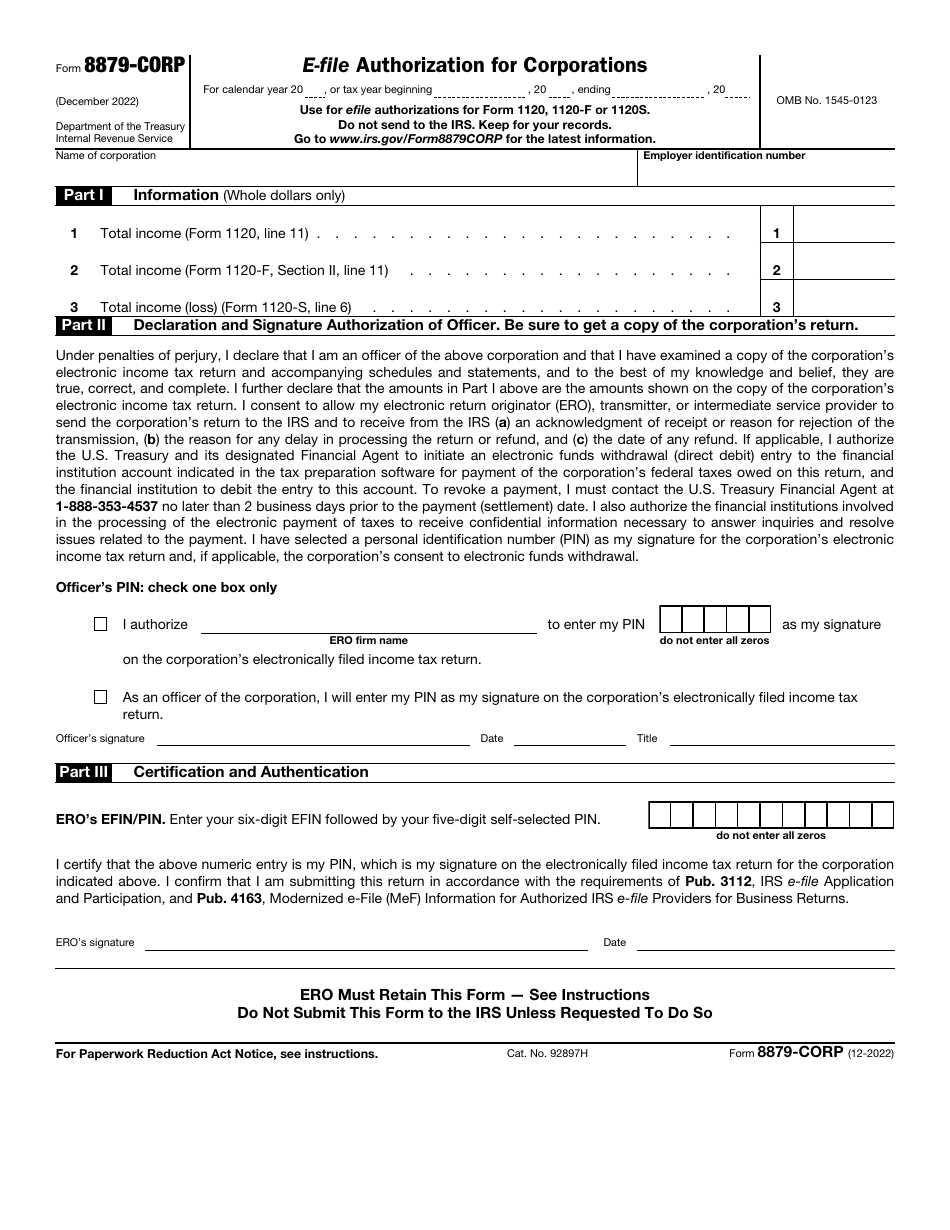

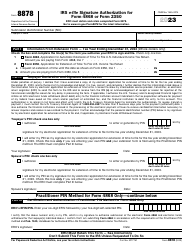

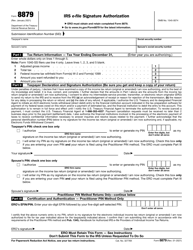

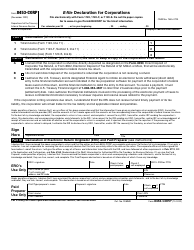

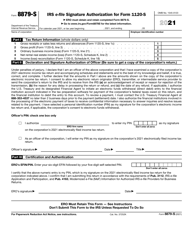

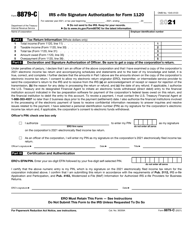

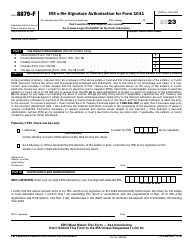

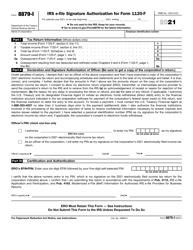

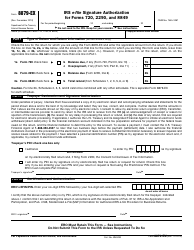

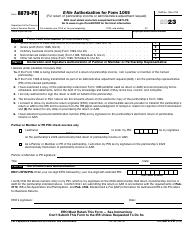

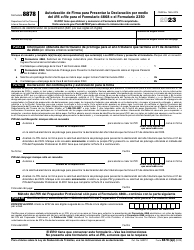

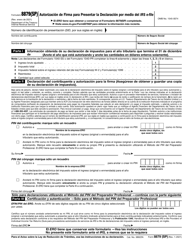

IRS Form 8879-CORP E-File Authorization for Corporations

What Is IRS Form 8879-CORP?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8879-CORP?

A: IRS Form 8879-CORP is the E-File Authorization for Corporations.

Q: What is the purpose of Form 8879-CORP?

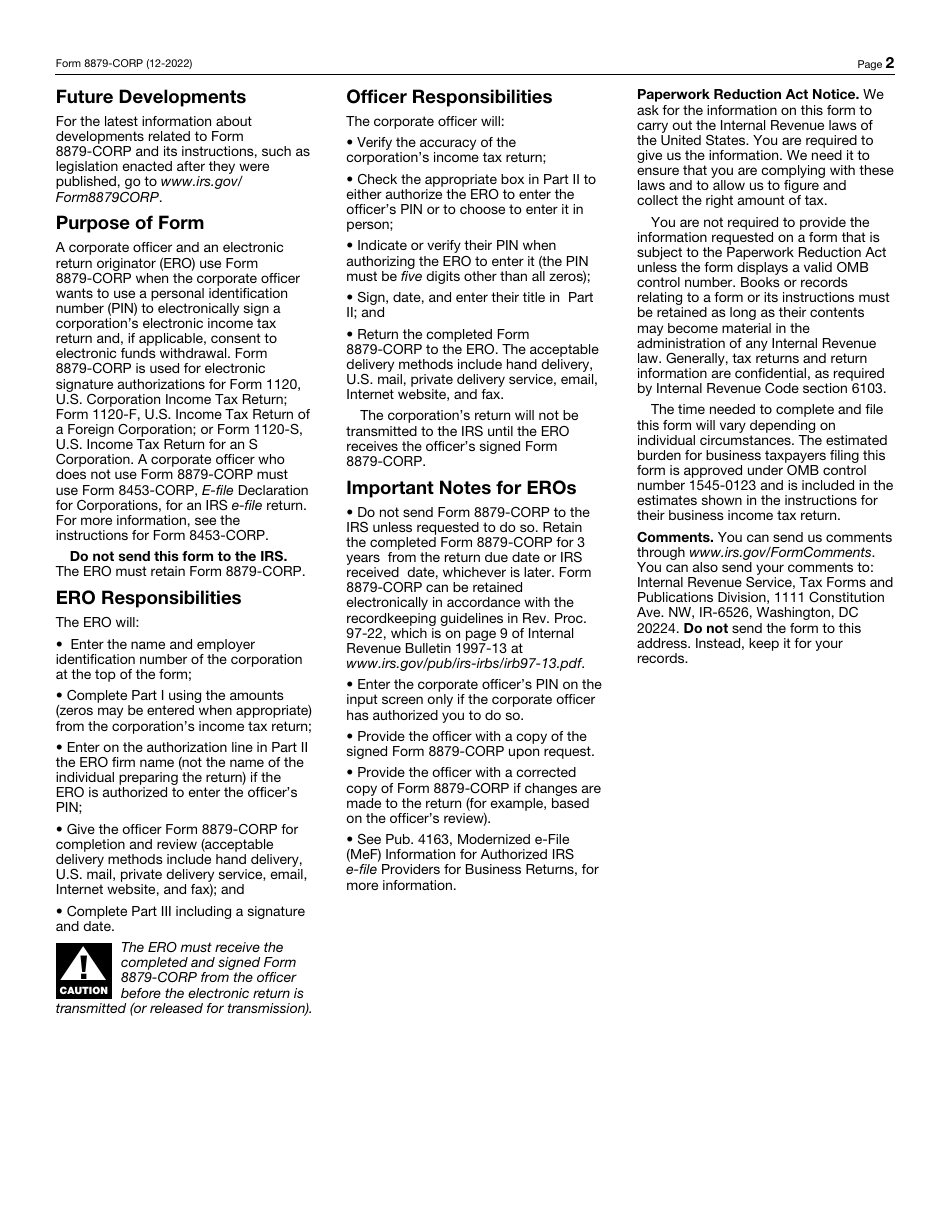

A: The purpose of Form 8879-CORP is to authorize electronic filing of tax returns for corporations.

Q: Who needs to file Form 8879-CORP?

A: Corporations that want to electronically file their tax returns need to file Form 8879-CORP.

Q: When should Form 8879-CORP be filed?

A: Form 8879-CORP should be filed before the electronic filing of a corporation's tax return.

Q: Are there any fees associated with filing Form 8879-CORP?

A: No, there are no fees associated with filing Form 8879-CORP.

Q: Can Form 8879-CORP be filed electronically?

A: Yes, Form 8879-CORP can be filed electronically.

Q: What information is required on Form 8879-CORP?

A: Form 8879-CORP requires information such as the corporation's name, employer identification number (EIN), and signature of the authorized corporate officer.

Q: Is Form 8879-CORP required every year?

A: Yes, corporations need to file Form 8879-CORP each year if they choose to electronically file their tax returns.

Q: What happens after filing Form 8879-CORP?

A: After filing Form 8879-CORP, the corporation will receive an acknowledgement from the IRS confirming receipt of the authorization.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8879-CORP through the link below or browse more documents in our library of IRS Forms.