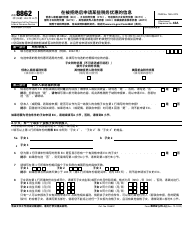

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8862

for the current year.

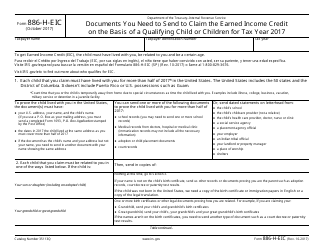

Instructions for IRS Form 8862 Information to Claim Certain Credits After Disallowance

This document contains official instructions for IRS Form 8862 , Information to Claim Certain Credits After Disallowance - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8862 is available for download through this link.

FAQ

Q: What is IRS Form 8862?

A: IRS Form 8862 is a form used to claim certain credits after they have been disallowed.

Q: When should I use IRS Form 8862?

A: You should use IRS Form 8862 if the IRS has disallowed your claim for a credit and you still believe you are eligible.

Q: What credits can I claim using IRS Form 8862?

A: You can claim the Earned Income Credit (EIC), Child Tax Credit (CTC), Additional Child Tax Credit (ACTC), and American Opportunity Credit (AOC) using IRS Form 8862.

Q: What information do I need to provide on IRS Form 8862?

A: You need to provide your name, social security number, the tax year you are filing for, and the specific credit you are claiming.

Q: Are there any eligibility requirements for using IRS Form 8862?

A: Yes, there are specific eligibility requirements for each credit that you need to meet in order to use IRS Form 8862.

Q: What happens after I submit IRS Form 8862?

A: The IRS will review your form and the supporting documentation you provide to determine if you are eligible for the claimed credits.

Instruction Details:

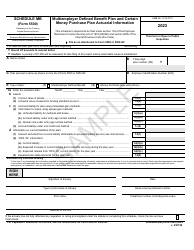

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.