This version of the form is not currently in use and is provided for reference only. Download this version of

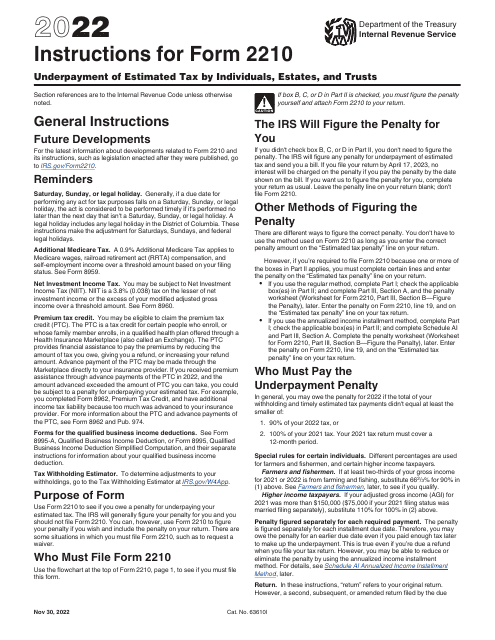

Instructions for IRS Form 2210

for the current year.

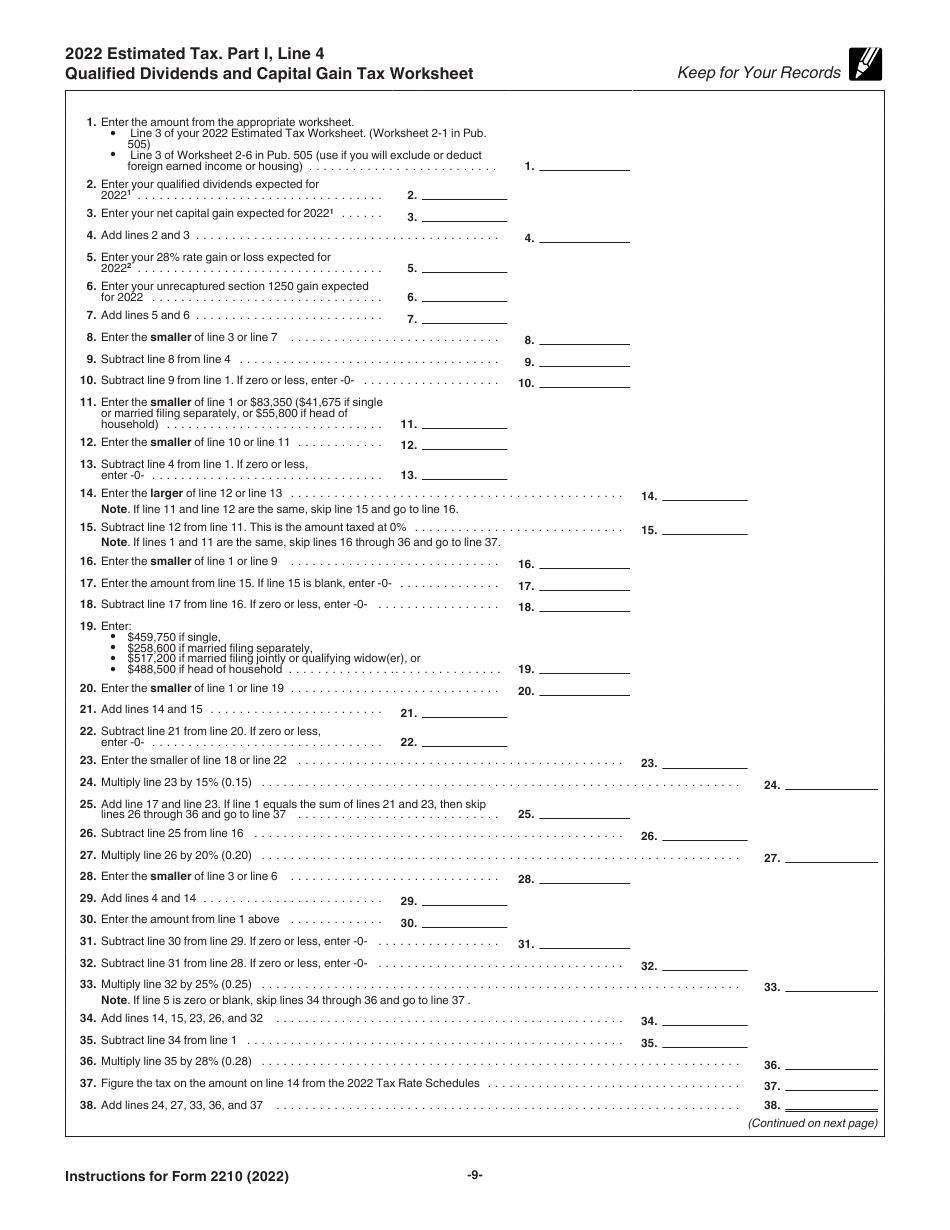

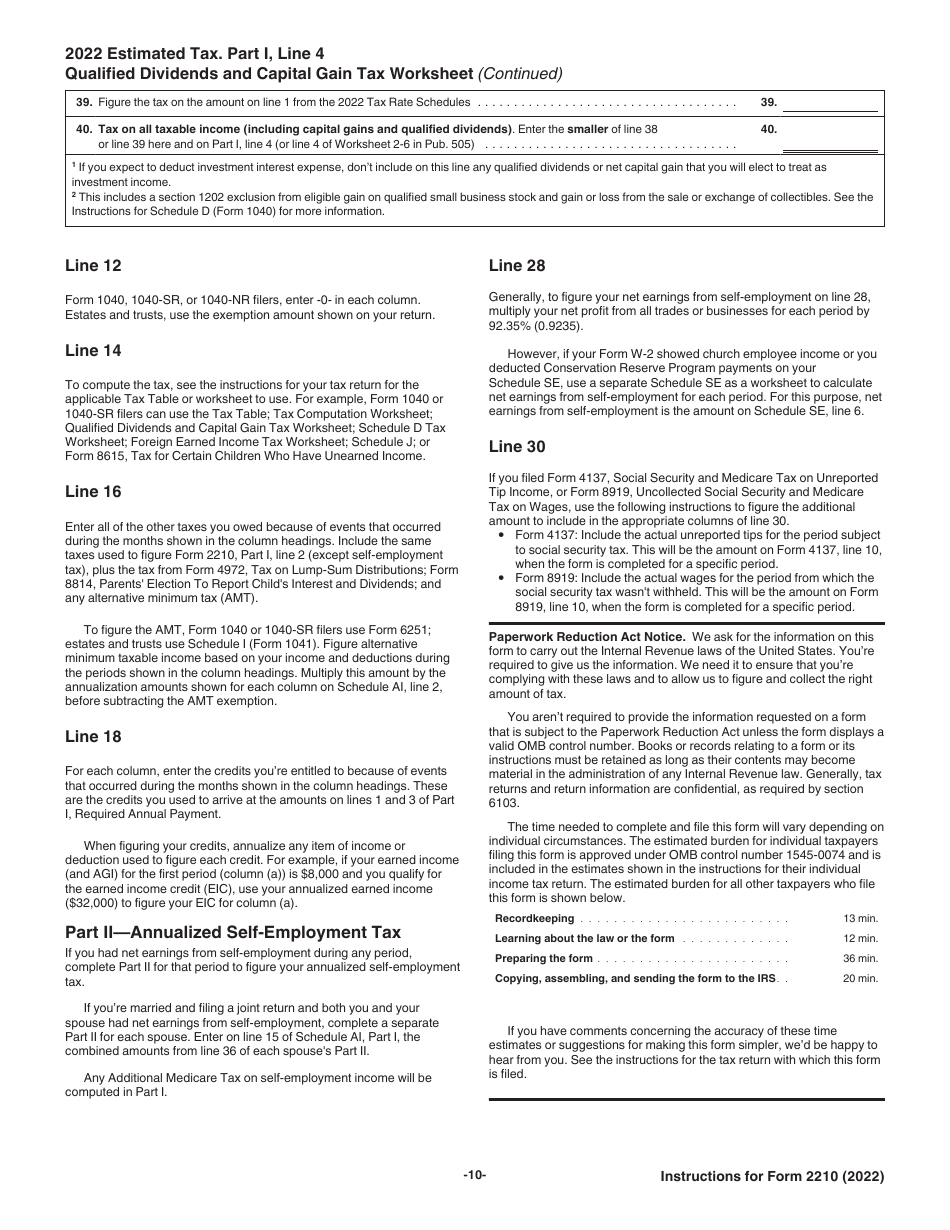

Instructions for IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts

This document contains official instructions for IRS Form 2210 , Underpayment of Estimated Tax by Individuals, Estates, and Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 2210 is available for download through this link.

FAQ

Q: What is IRS Form 2210?

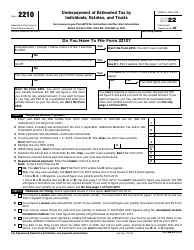

A: IRS Form 2210 is the form used to calculate and pay any penalties for underpayment of estimated tax by individuals, estates, and trusts.

Q: Who needs to file IRS Form 2210?

A: Individuals, estates, and trusts that did not pay enough estimated tax throughout the year may need to file IRS Form 2210.

Q: What is the purpose of IRS Form 2210?

A: The purpose of IRS Form 2210 is to determine if any penalties apply to underpaid estimated tax and to calculate the amount of those penalties.

Q: How do I fill out IRS Form 2210?

A: To fill out IRS Form 2210, you will need to provide information about your income, withholdings, and estimated tax payments.

Q: When is IRS Form 2210 due?

A: IRS Form 2210 is generally due at the same time as your annual tax return, which is typically April 15th for most individuals.

Q: What happens if I don't file IRS Form 2210?

A: If you had underpaid estimated tax but do not file IRS Form 2210, you may be subject to penalties and interest on the unpaid amount.

Q: Can I e-file IRS Form 2210?

A: Yes, you can e-file IRS Form 2210 using approved tax software or through a tax professional.

Q: Do I need to attach supporting documents to IRS Form 2210?

A: In most cases, you do not need to attach supporting documents to IRS Form 2210 unless specifically requested by the IRS.

Q: What if I made a mistake on IRS Form 2210?

A: If you made a mistake on IRS Form 2210, you can generally file an amended form to correct the error.

Instruction Details:

- This 10-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.