This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1120-S Schedule D

for the current year.

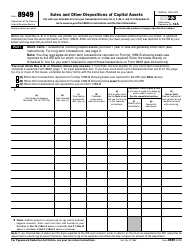

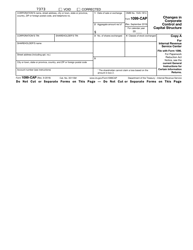

Instructions for IRS Form 1120-S Schedule D Capital Gains and Losses and Built-In Gains

This document contains official instructions for IRS Form 1120-S Schedule D, Capital Gains and Losses and Built-In Gains - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1120-S Schedule D is available for download through this link.

FAQ

Q: What is IRS Form 1120-S Schedule D?

A: IRS Form 1120-S Schedule D is a tax form used by S corporations to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are the profits made from selling capital assets, while capital losses are the losses incurred from selling capital assets.

Q: What is built-in gains?

A: Built-in gains refer to gains that were accrued by a C corporation before it converted to an S corporation.

Q: Who needs to file Form 1120-S Schedule D?

A: S corporations that have capital gains or losses in a tax year are required to file Form 1120-S Schedule D.

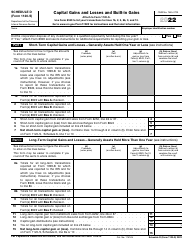

Q: How do I complete Form 1120-S Schedule D?

A: You need to provide the details of each capital asset sold or disposed of during the tax year, along with the corresponding gains or losses.

Q: Are there any special rules for built-in gains?

A: Yes, if an S corporation has built-in gains, it may be subject to a separate tax called the built-in gains tax.

Q: When is the deadline to file Form 1120-S Schedule D?

A: The deadline to file Form 1120-S Schedule D is usually the same as the deadline for filing the S corporation's tax return, which is March 15th for calendar year filers.

Q: Are there any penalties for not filing Form 1120-S Schedule D?

A: Yes, failing to file Form 1120-S Schedule D or filing it incorrectly may result in penalties and interest charges.

Q: Can I e-file Form 1120-S Schedule D?

A: Yes, you can e-file Form 1120-S Schedule D using IRS-approved tax software or through a tax professional.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.