This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

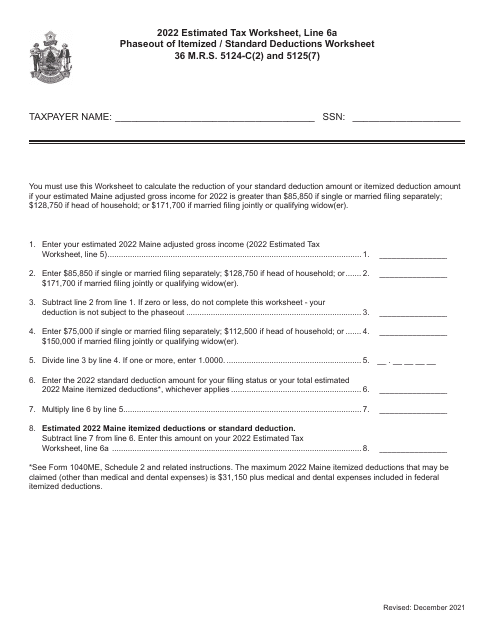

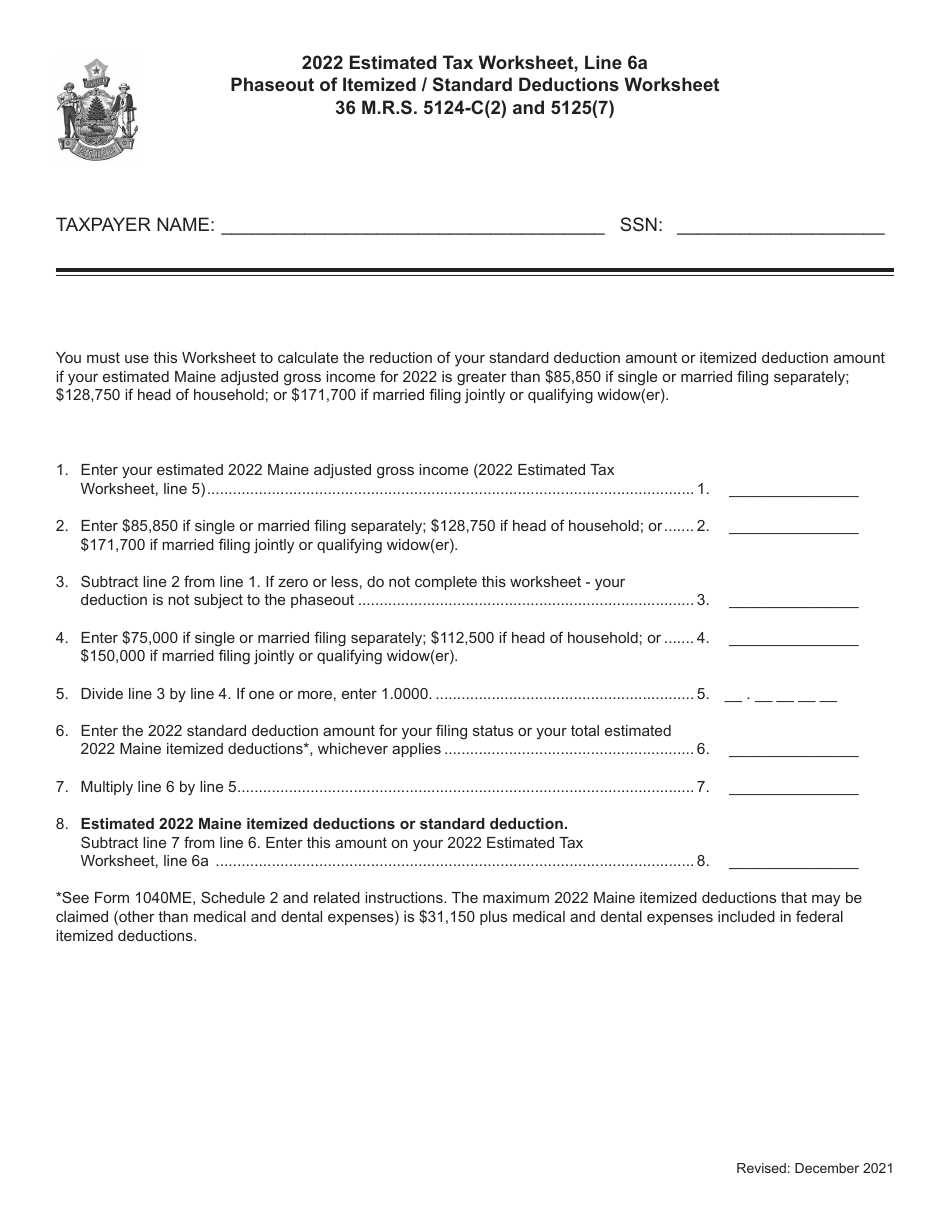

Phaseout of Itemized / Standard Deductions Worksheet - Maine

Phaseout of Itemized/Standard Deductions Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is the phaseout of itemized deductions in Maine?

A: Maine no longer has a phaseout of itemized deductions.

Q: What is the standard deduction in Maine?

A: For tax year 2021, the standard deduction in Maine is $12,750 for individuals and $25,500 for married couples filing jointly.

Q: Can I still claim itemized deductions in Maine?

A: Yes, you can still claim itemized deductions in Maine if they exceed your standard deduction.

Q: Are there any limitations on itemized deductions in Maine?

A: Maine does not have limitations on itemized deductions like some other states.

Q: Should I take the standard deduction or itemize in Maine?

A: It depends on your individual circumstances. If your itemized deductions exceed the standard deduction, it may be beneficial to itemize.

Form Details:

- Released on December 1, 2021;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.