This version of the form is not currently in use and is provided for reference only. Download this version of

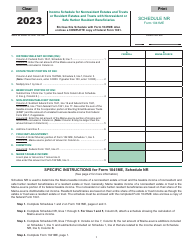

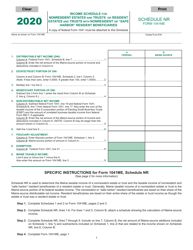

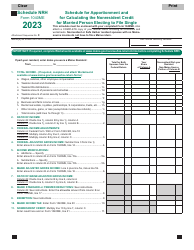

Form 1040ME Schedule NR

for the current year.

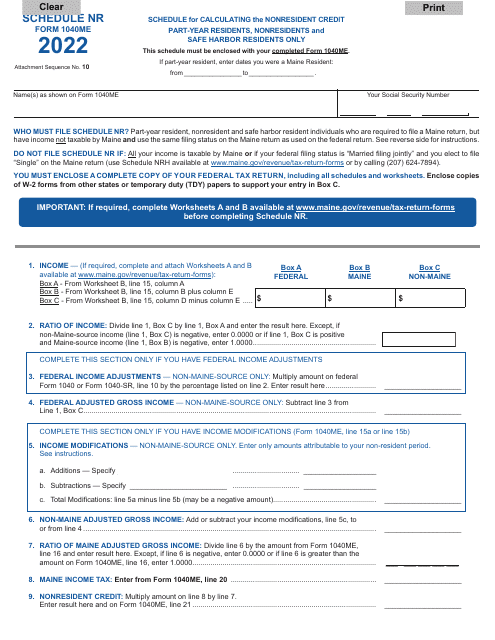

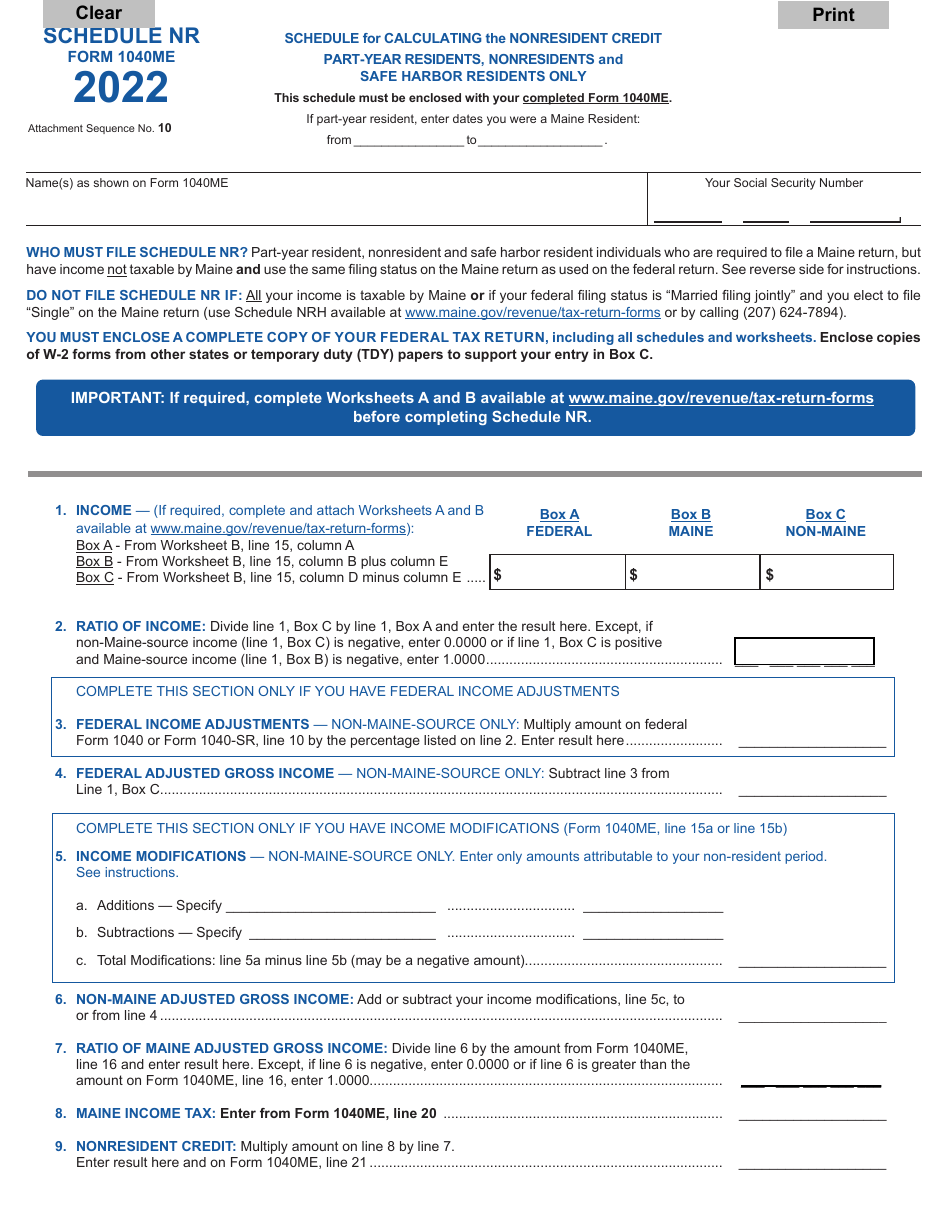

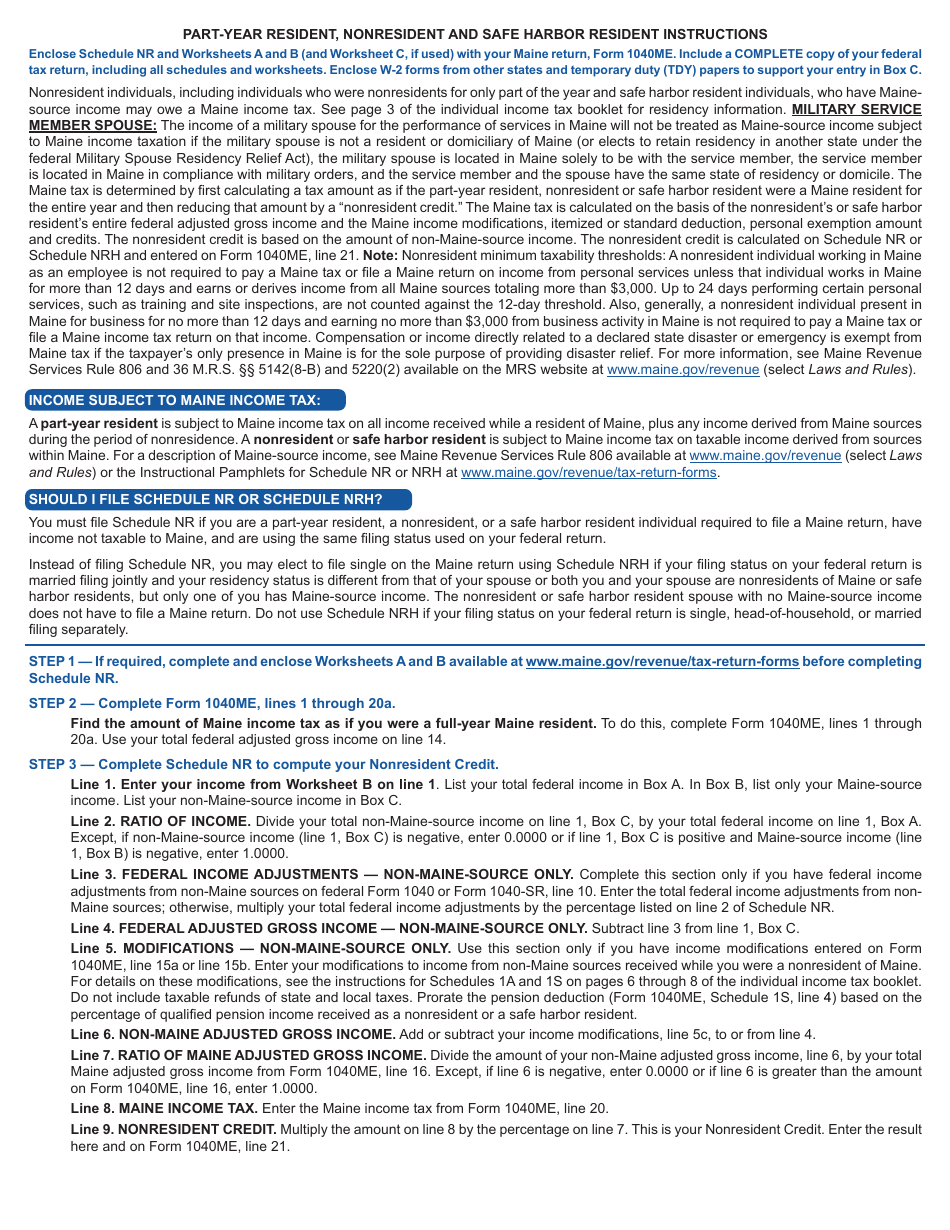

Form 1040ME Schedule NR Schedule for Calculating the Nonresident Credit - Part-Year Residents, Nonresidents and Safe Harbor Residents Only - Maine

What Is Form 1040ME Schedule NR?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

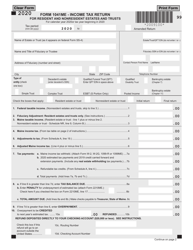

Q: What is Form 1040ME?

A: Form 1040ME is the tax form used by residents of Maine to report their income and calculate their state taxes.

Q: What is Schedule NR on Form 1040ME?

A: Schedule NR is a schedule on Form 1040ME that is used by part-year residents, nonresidents, and safe harbor residents to calculate the nonresident tax credit.

Q: Who should use Schedule NR?

A: Part-year residents, nonresidents, and safe harbor residents should use Schedule NR to calculate their nonresident tax credit.

Q: What is the nonresident tax credit?

A: The nonresident tax credit is a credit that reduces the amount of state tax owed by part-year residents, nonresidents, and safe harbor residents.

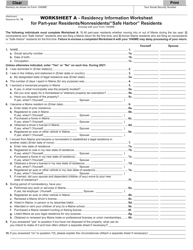

Q: What is a part-year resident?

A: A part-year resident is someone who lived in Maine for only part of the year.

Q: What is a nonresident?

A: A nonresident is someone who did not live in Maine during the tax year.

Q: What is a safe harbor resident?

A: A safe harbor resident is someone who meets certain criteria to be considered a resident of Maine for tax purposes.

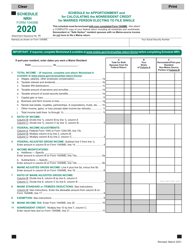

Q: How do I calculate the nonresident tax credit?

A: You can calculate the nonresident tax credit using the instructions and worksheet provided in Schedule NR of Form 1040ME.

Q: What other schedules and forms are required with Form 1040ME?

A: Depending on your individual tax situation, you may need to include other schedules and forms with Form 1040ME. It is best to consult the instructions or a tax professional for guidance.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Schedule NR by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.