This version of the form is not currently in use and is provided for reference only. Download this version of

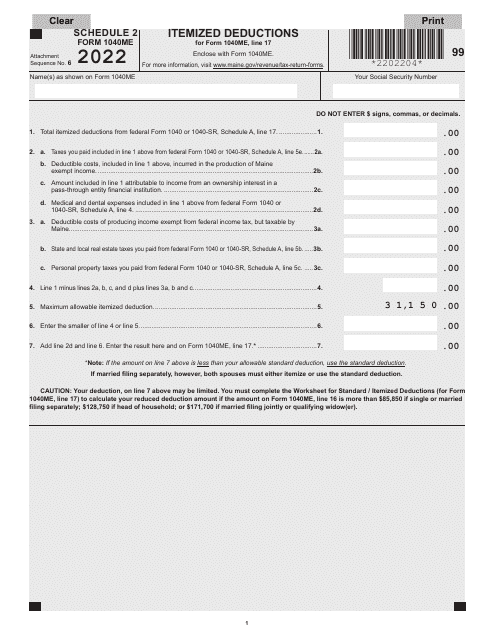

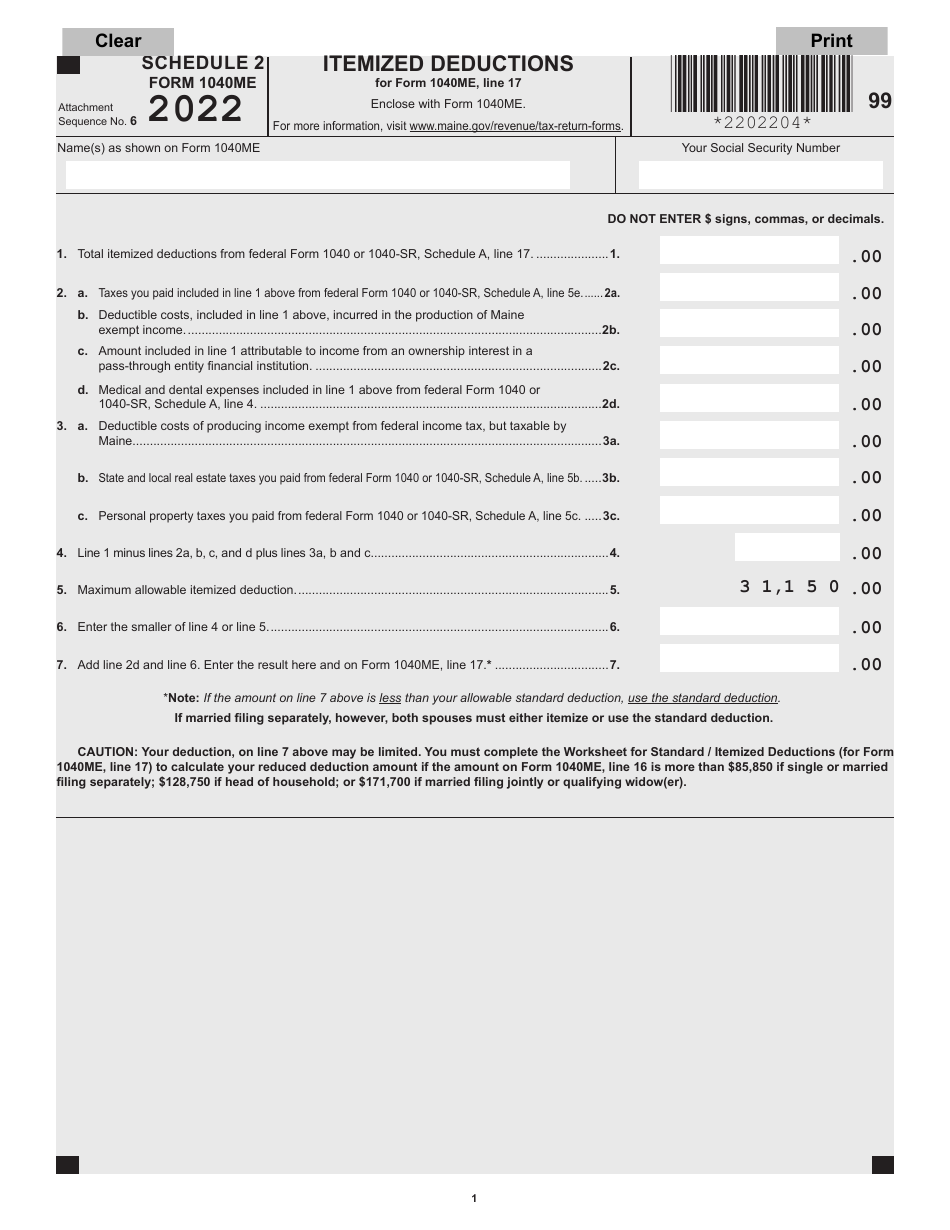

Form 1040ME Schedule 2

for the current year.

Form 1040ME Schedule 2 Itemized Deductions - Maine

What Is Form 1040ME Schedule 2?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule 2?

A: Form 1040ME Schedule 2 is a tax form used by residents of Maine to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that taxpayers can subtract from their taxable income to reduce their overall tax liability.

Q: What expenses can be included as itemized deductions?

A: Common examples of itemized deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: Why would someone choose to itemize deductions instead of taking the standard deduction?

A: Taxpayers may choose to itemize deductions if their total itemized deductions amount to more than the standard deduction, allowing them to lower their taxable income further.

Q: Who should use Form 1040ME Schedule 2?

A: Residents of Maine who choose to itemize deductions on their Maine state tax return should use Form 1040ME Schedule 2.

Q: When is the deadline for filing Form 1040ME Schedule 2?

A: The deadline for filing Form 1040ME Schedule 2 is usually the same as the deadline for filing your Maine state tax return, which is typically April 15th.

Q: Can I e-file Form 1040ME Schedule 2?

A: Yes, you can e-file Form 1040ME Schedule 2 if you are filing your Maine state tax return electronically.

Q: What should I do if I have questions or need assistance with Form 1040ME Schedule 2?

A: If you have questions or need assistance with Form 1040ME Schedule 2, you should contact the Maine Revenue Services or seek help from a tax professional.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040ME Schedule 2 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.