This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

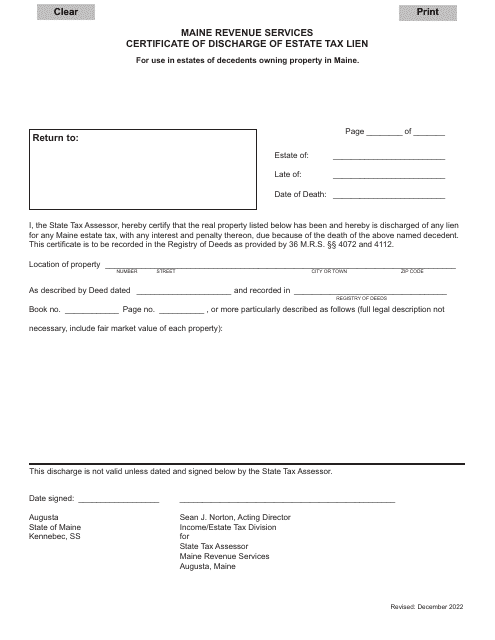

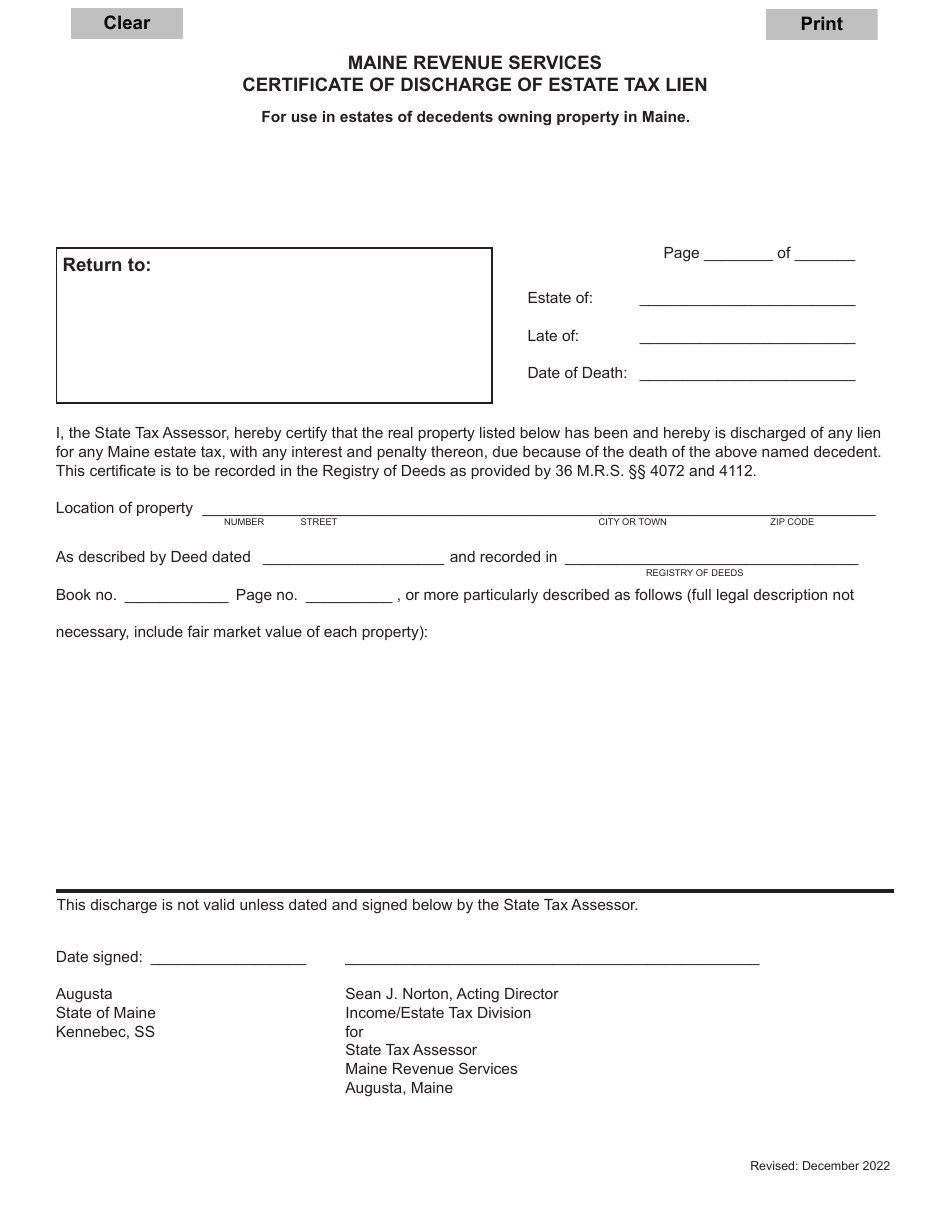

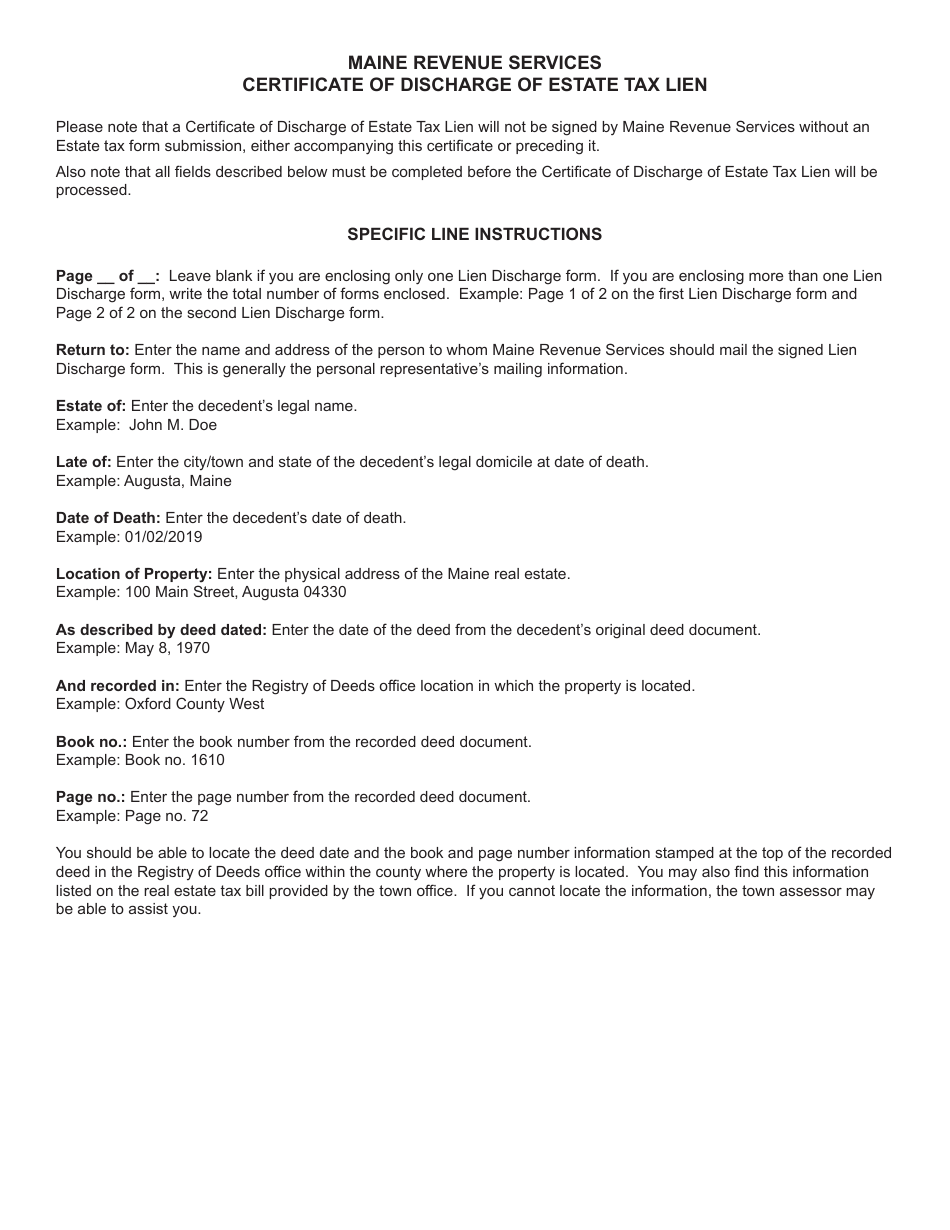

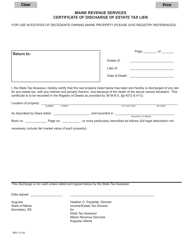

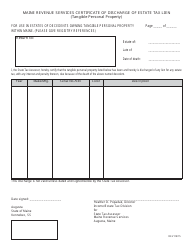

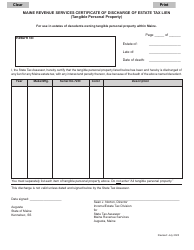

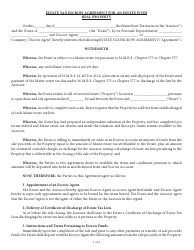

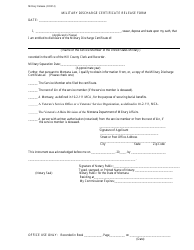

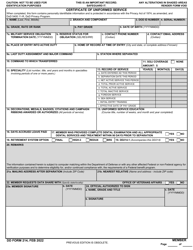

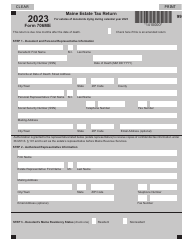

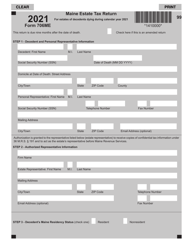

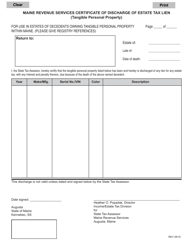

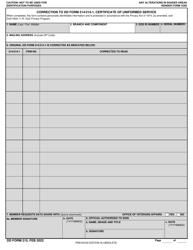

Certificate of Discharge of Estate Tax Lien - Maine

Certificate of Discharge of Estate Tax Lien is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

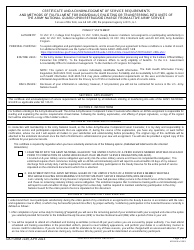

Q: What is a Certificate of Discharge of Estate Tax Lien?

A: A Certificate of Discharge of Estate Tax Lien is a document that releases a lien placed on property by the government to secure payment of estate taxes.

Q: Why would I need a Certificate of Discharge of Estate Tax Lien?

A: You would need a Certificate of Discharge of Estate Tax Lien if you want to sell or transfer property that has a tax lien on it.

Q: How do I obtain a Certificate of Discharge of Estate Tax Lien in Maine?

A: To obtain a Certificate of Discharge of Estate Tax Lien in Maine, you need to submit an application to the Maine Revenue Services with the required documentation and payment of any outstanding taxes.

Q: What documents do I need to submit with my application for a Certificate of Discharge of Estate Tax Lien?

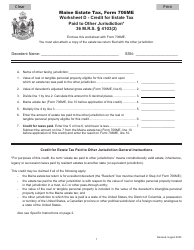

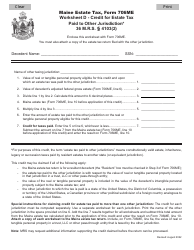

A: You will need to submit a copy of the federal estate tax closing letter, a copy of the estate tax return (Form 706), and any other supporting documentation requested by the Maine Revenue Services.

Q: How long does it take to process a Certificate of Discharge of Estate Tax Lien application in Maine?

A: The processing time for a Certificate of Discharge of Estate Tax Lien application in Maine can vary, but it typically takes several weeks to months.

Q: What happens after I receive a Certificate of Discharge of Estate Tax Lien?

A: After you receive a Certificate of Discharge of Estate Tax Lien, you are free to sell or transfer the property without the tax lien encumbering it.

Q: Can I obtain a Certificate of Discharge of Estate Tax Lien if I still owe estate taxes?

A: No, you cannot obtain a Certificate of Discharge of Estate Tax Lien if you still owe estate taxes. The lien will remain in place until the taxes are paid in full.

Q: Can I appeal a denial of my application for a Certificate of Discharge of Estate Tax Lien?

A: Yes, you can appeal a denial of your application for a Certificate of Discharge of Estate Tax Lien by filing a written request for reconsideration with the Maine Revenue Services.

Form Details:

- Released on December 1, 2022;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.