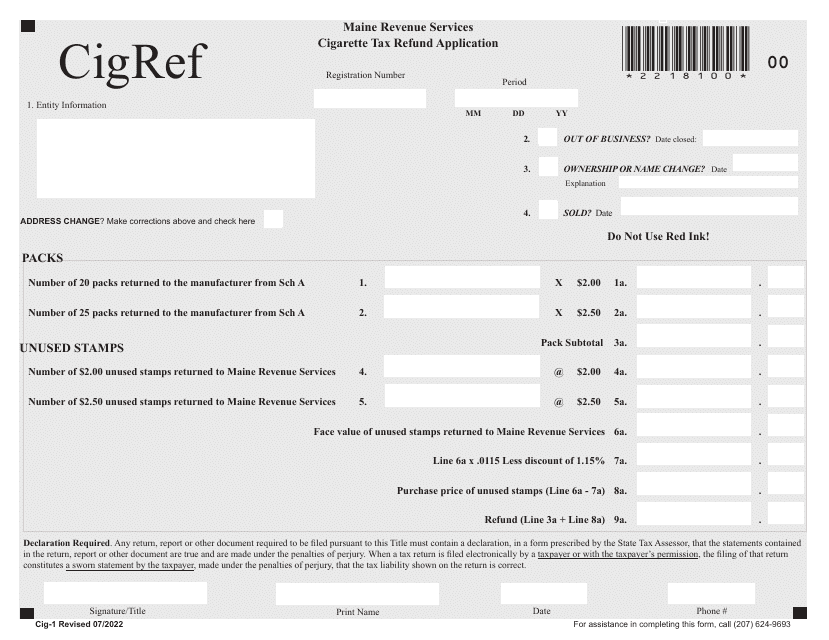

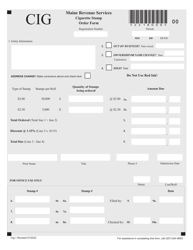

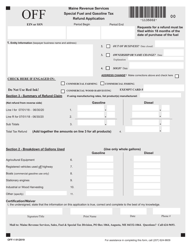

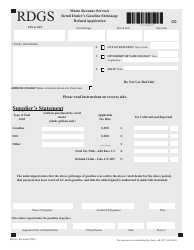

Form CIG-1 Cigarette Tax Refund Application - Maine

What Is Form CIG-1?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG-1?

A: Form CIG-1 is the Cigarette Tax Refund Application for Maine.

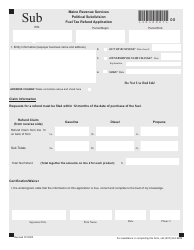

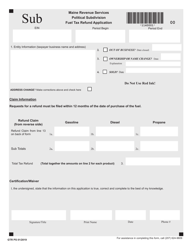

Q: What is the purpose of Form CIG-1?

A: The purpose of Form CIG-1 is to apply for a refund of cigarette taxes paid in Maine.

Q: Who can use Form CIG-1?

A: Form CIG-1 can be used by individuals or businesses who want to claim a refund of cigarette taxes paid in Maine.

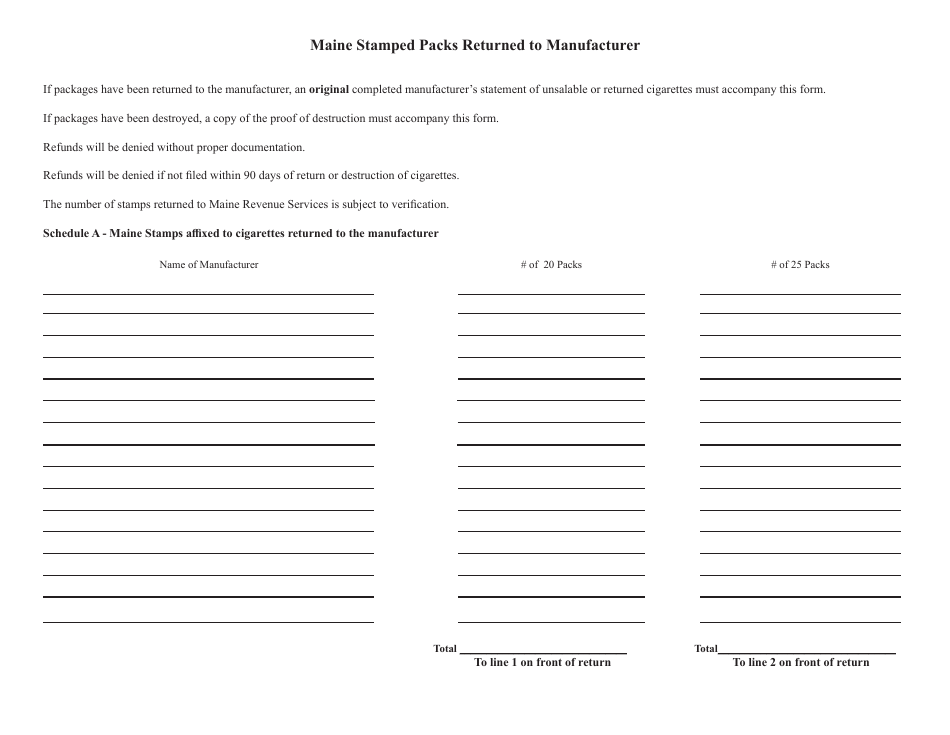

Q: What information is required on Form CIG-1?

A: Form CIG-1 requires information such as the taxpayer's name, address, cigarette purchase details, and proof of payment.

Q: Are there any deadlines for filing Form CIG-1?

A: Yes, Form CIG-1 must be filed within 3 years from the date of the cigarette purchase.

Q: How long does it take to process Form CIG-1?

A: The processing time for Form CIG-1 may vary, but it usually takes several weeks to receive a refund.

Q: What should I do if I have questions about Form CIG-1?

A: If you have questions about Form CIG-1, you can contact the Maine Revenue Services for assistance.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG-1 by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.