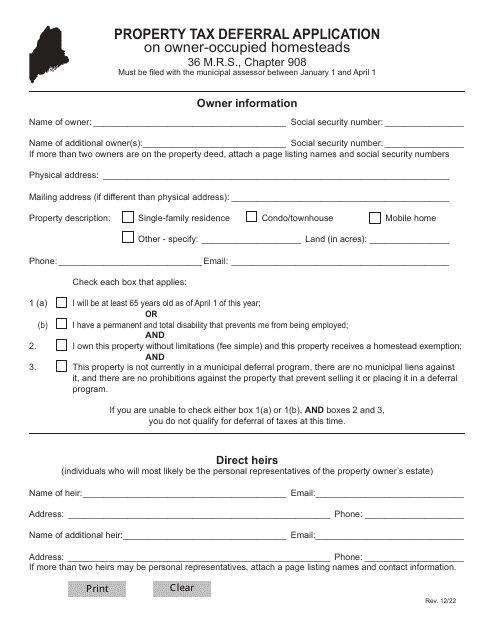

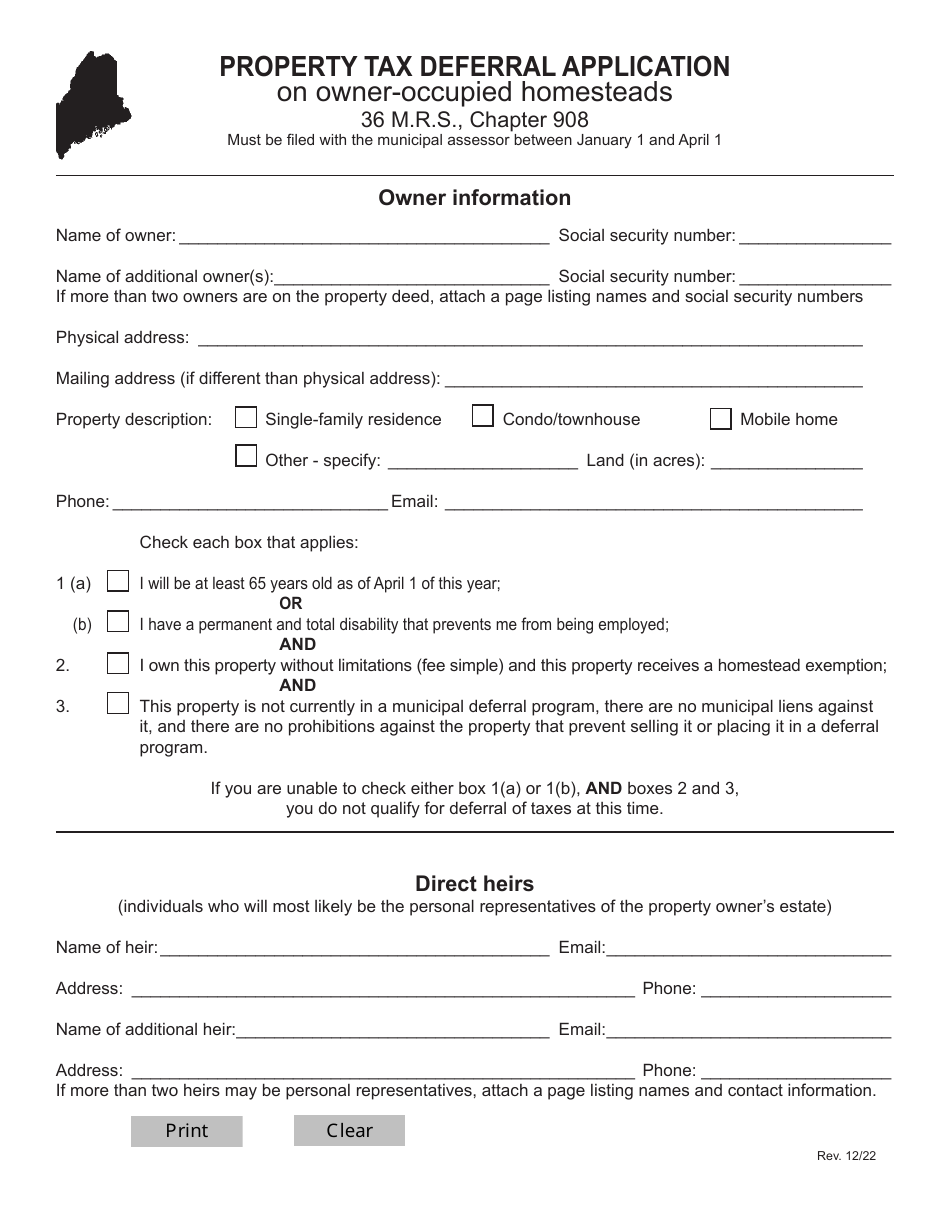

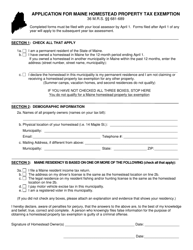

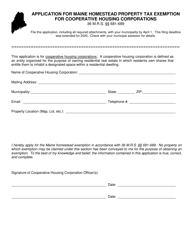

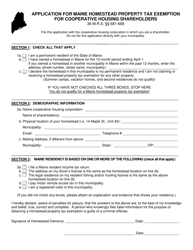

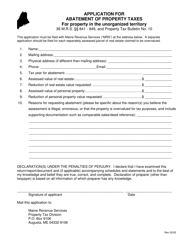

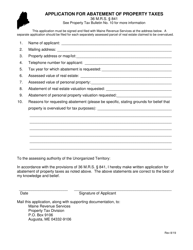

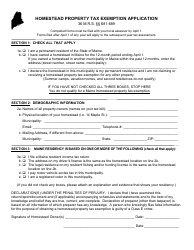

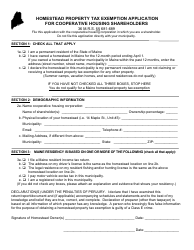

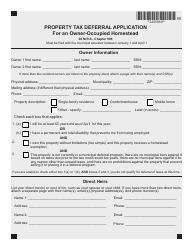

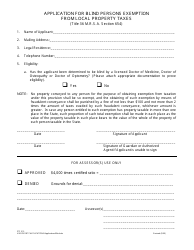

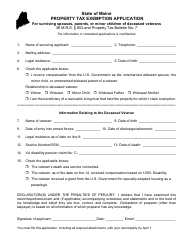

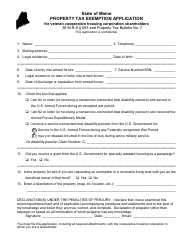

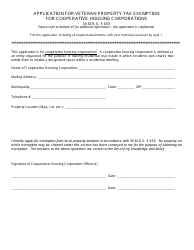

Property Tax Deferral Application on Owner-Occupied Homesteads - Maine

Property Tax Deferral Application on Owner-Occupied Homesteads is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is a property tax deferral?

A: A property tax deferral is a program that allows eligible homeowners to postpone paying property taxes.

Q: What is an owner-occupied homestead?

A: An owner-occupied homestead refers to a property that is the primary residence of the owner.

Q: Who is eligible for the property tax deferral on owner-occupied homesteads in Maine?

A: In Maine, homeowners who are at least 60 years old, have a permanent disability, or are a widow/widower of any age may be eligible for the property tax deferral.

Q: How does the property tax deferral work?

A: Under the program, eligible homeowners can defer paying their property taxes until the property is sold or transferred, at which point the deferred taxes must be paid.

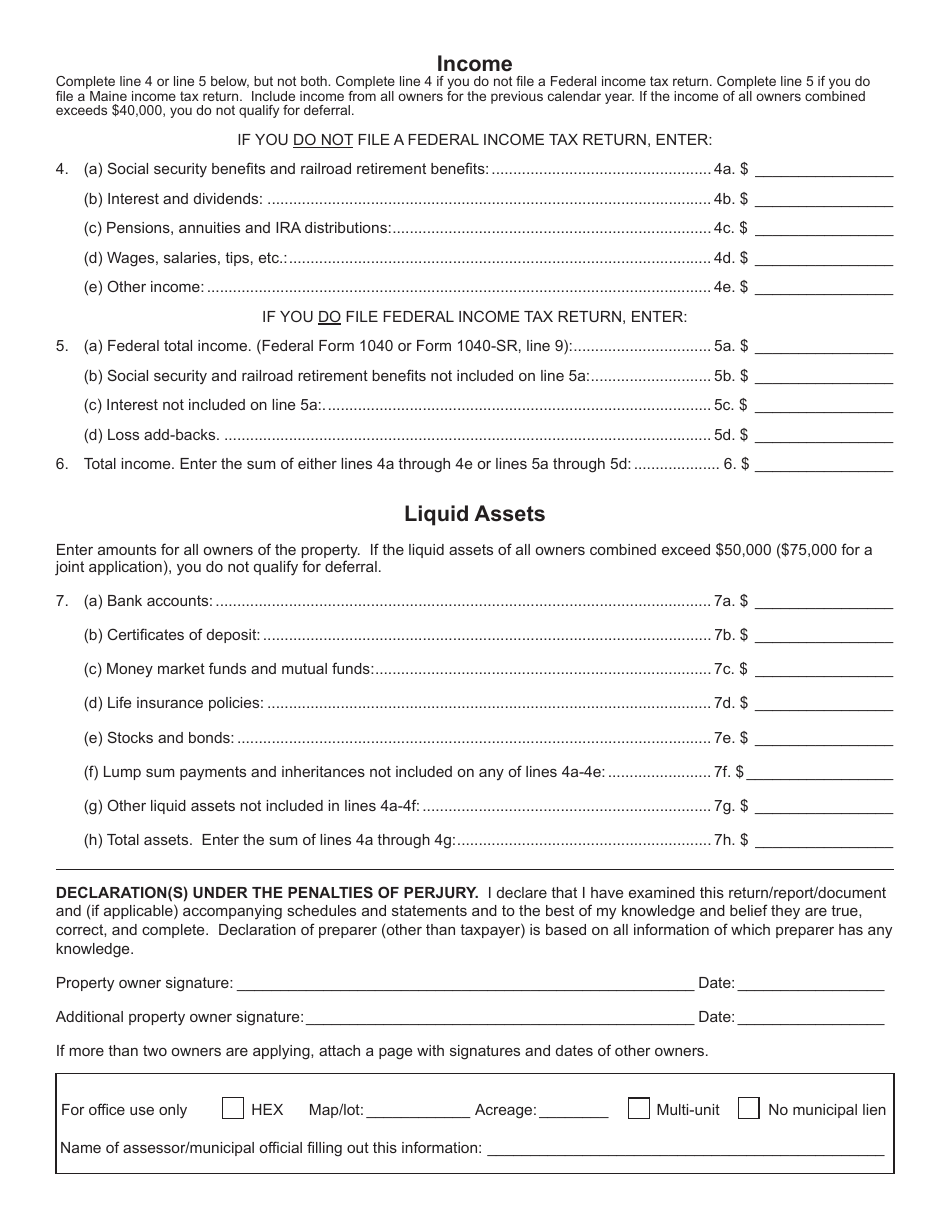

Q: Are there any income requirements for the property tax deferral?

A: Yes, homeowners must have a household income that is below a certain threshold to be eligible for the property tax deferral.

Q: How can I apply for the property tax deferral on my owner-occupied homestead in Maine?

A: To apply for the property tax deferral, you will need to complete an application form available from your town or city assessor's office and submit it with the required supporting documentation.

Q: Is there a deadline to apply for the property tax deferral?

A: Yes, the application deadline is April 1st of each year.

Q: Can I still apply if I miss the deadline?

A: If you miss the April 1st deadline, you may still be able to apply for a partial deferral, but you may incur interest charges.

Q: What happens if I am approved for the property tax deferral?

A: If your application is approved, your property taxes will be deferred, and you will not have to make current-year tax payments.

Q: What happens if I am denied the property tax deferral?

A: If your application is denied, you will be responsible for paying your property taxes as usual.

Q: Are there any potential drawbacks to participating in the property tax deferral program?

A: One potential drawback is that interest will be charged on the deferred taxes, and the deferred amount becomes a lien on the property.

Q: Can I withdraw from the property tax deferral program?

A: Yes, you can withdraw from the program at any time by notifying your town or city assessor's office in writing.

Form Details:

- Released on December 1, 2022;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.