This version of the form is not currently in use and is provided for reference only. Download this version of

Worksheet PTE

for the current year.

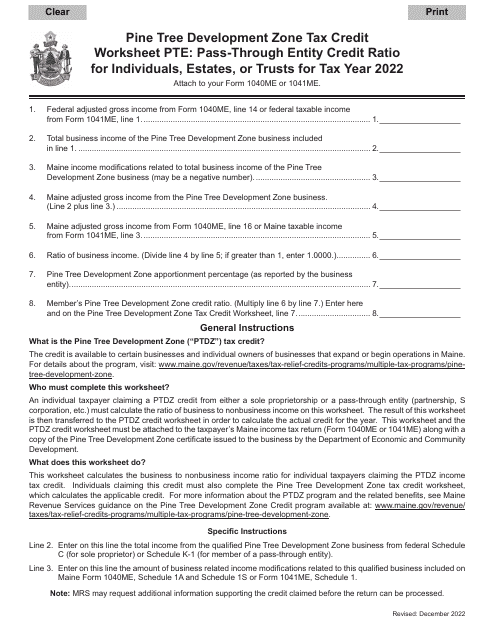

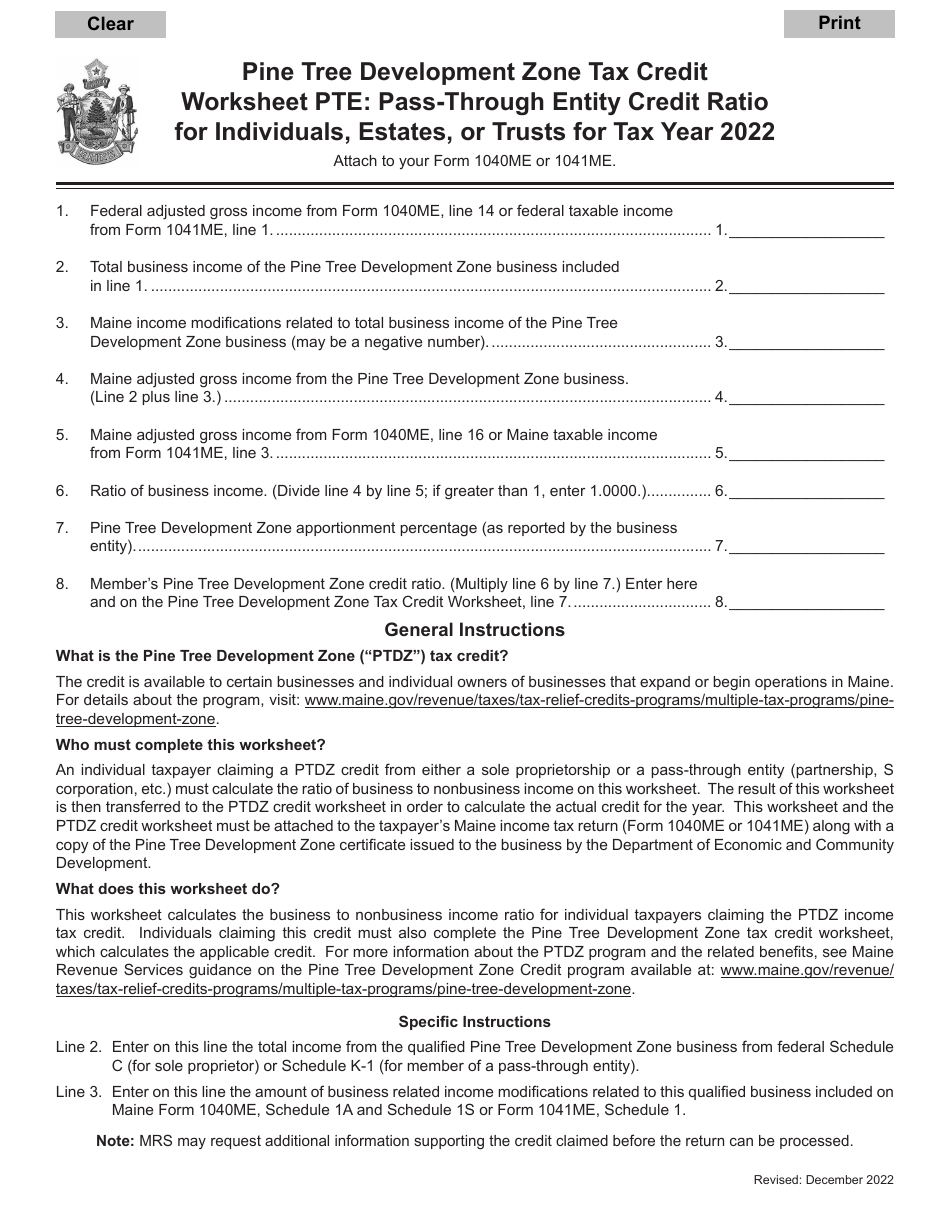

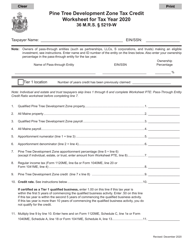

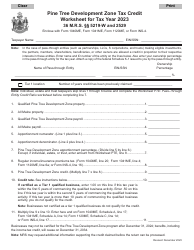

Worksheet PTE Pine Tree Development Zone Tax Credit Worksheet - Pass-Through Entity Credit Ratio for Individuals, Estates, or Trusts - Maine

What Is Worksheet PTE?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PTE Pine Tree Development Zone Tax Credit Worksheet?

A: The PTE Pine Tree Development Zone Tax Credit Worksheet is a document used to calculate the pass-through entity credit ratio for individuals, estates, or trusts in Maine.

Q: What does the pass-through entity credit ratio calculate?

A: The pass-through entity credit ratio calculates the amount of tax credit that individuals, estates, or trusts can claim in relation to their investment in a pass-through entity located in the Pine Tree Development Zone.

Q: What is the Pine Tree Development Zone?

A: The Pine Tree Development Zone is a designated geographic area in Maine that offers various tax incentives and benefits to businesses that operate or invest in the zone.

Q: Who can use this worksheet?

A: This worksheet is specifically designed for individuals, estates, or trusts who have invested in a pass-through entity located in the Pine Tree Development Zone and want to calculate their tax credit.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity, such as a partnership, LLC, or S corporation, where the income or losses 'pass through' to the individual owners who report them on their personal tax returns.

Q: How does the tax credit benefit individuals, estates, or trusts?

A: The tax credit can reduce the amount of tax owed by individuals, estates, or trusts, providing a financial benefit.

Q: Is the PTE Pine Tree Development Zone Tax Credit available in all of Maine?

A: No, the tax credit is only available in the Pine Tree Development Zone, which is a specific geographic area in Maine.

Q: Are there any eligibility requirements to claim the tax credit?

A: Yes, individuals, estates, or trusts must meet certain eligibility requirements, such as investing in a qualified pass-through entity located in the Pine Tree Development Zone.

Form Details:

- Released on December 1, 2022;

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Worksheet PTE by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.