This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

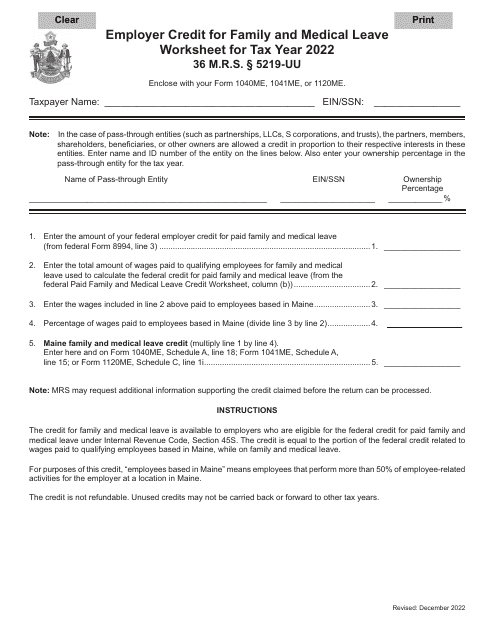

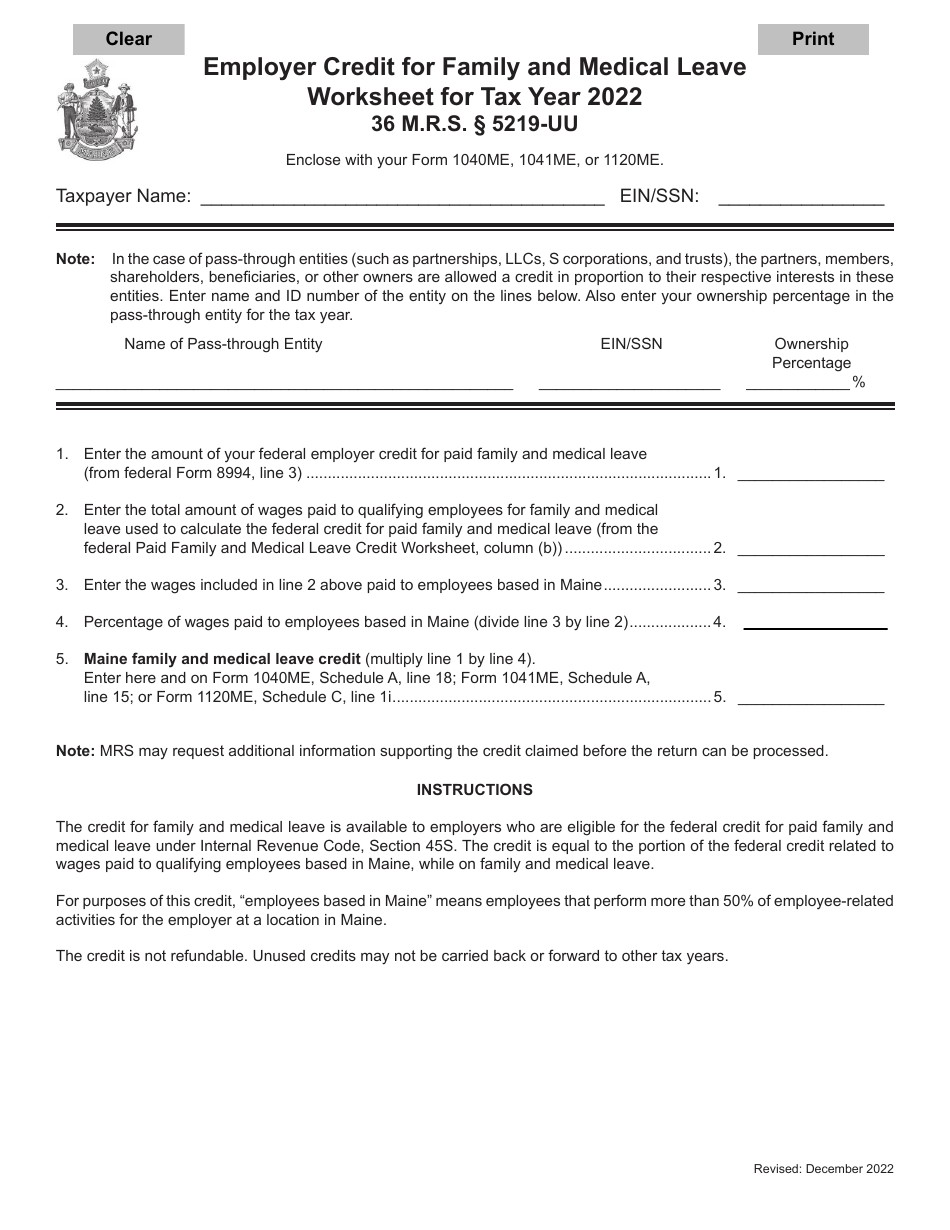

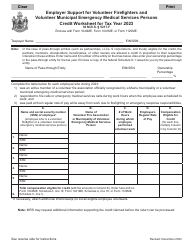

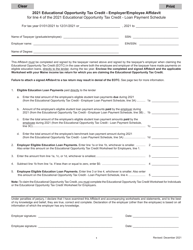

Employer Credit for Family and Medical Leave Worksheet - Maine

Employer Credit for Family and Medical Leave Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

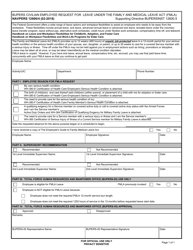

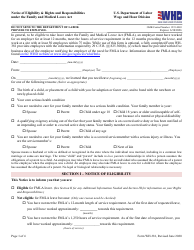

Q: What is the Employer Credit for Family and Medical Leave?

A: The Employer Credit for Family and Medical Leave is a tax credit that eligible employers can claim for paid family and medical leave provided to their employees.

Q: Who is considered an eligible employer?

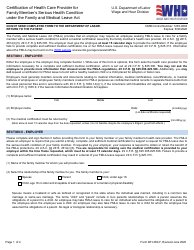

A: An eligible employer is one who provides paid family and medical leave to their employees. They must have a written policy in place that meets certain requirements.

Q: What are the requirements for the written policy?

A: The written policy must provide at least two weeks of annual paid family and medical leave for full-time employees. It must also provide a proportionate amount of leave for part-time employees.

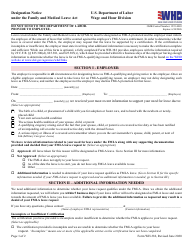

Q: How much is the credit?

A: The credit is generally a percentage of the amount of wages paid to employees who are on family and medical leave. The percentage ranges from 12.5% to 25%.

Q: What are the maximum limits for the credit?

A: The maximum limit for the credit is 12 weeks of paid family and medical leave per employee per year.

Q: Do self-employed individuals qualify for the credit?

A: No, the credit is only available to eligible employers who have employees.

Q: What does the worksheet help employers with?

A: The worksheet helps eligible employers calculate the amount of credit they can claim for family and medical leave provided to their employees.

Form Details:

- Released on December 1, 2022;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.