This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

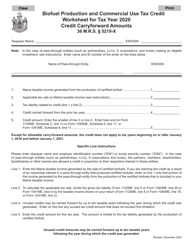

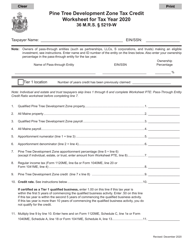

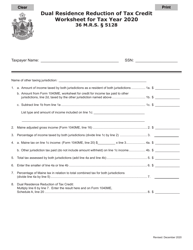

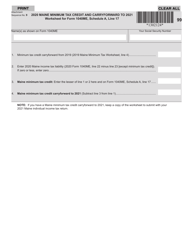

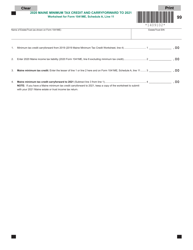

Biofuel Commercial Production and Commercial Use Tax Credit Worksheet - Maine

Biofuel Use Tax Credit Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is the Biofuel Commercial Production and Commercial Use Tax Credit Worksheet?

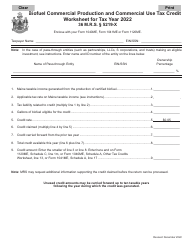

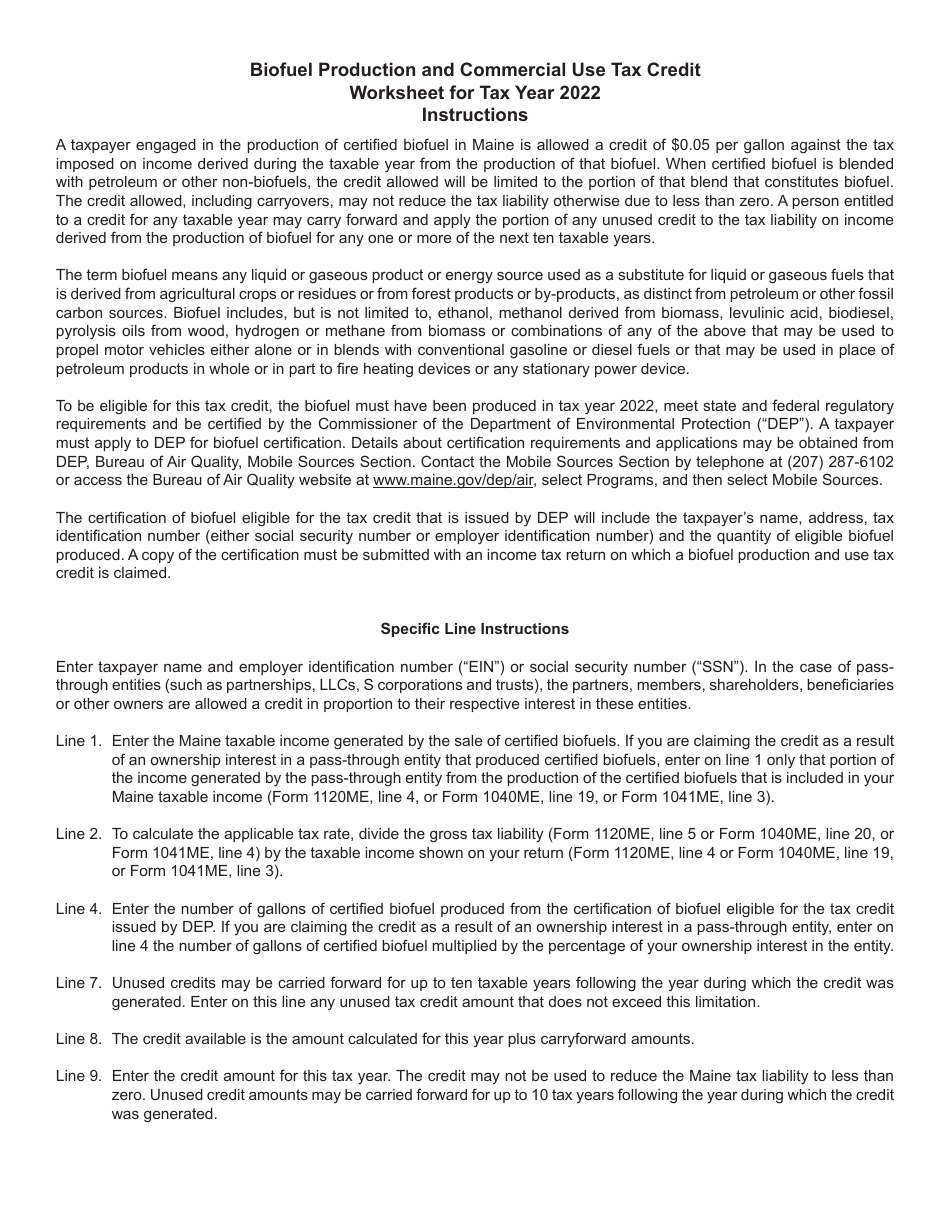

A: The Biofuel Commercial Production and Commercial Use Tax Credit Worksheet is a form used in Maine to calculate tax credits related to the production and use of biofuels.

Q: What is a tax credit?

A: A tax credit is a reduction in the amount of tax owed to the government.

Q: What is biofuel?

A: Biofuel is a type of fuel made from renewable sources, such as plants or vegetable oils.

Q: Who is eligible for the Biofuel Commercial Production and Commercial Use Tax Credit?

A: Businesses in Maine involved in the commercial production and use of biofuels may be eligible for the tax credit.

Q: How is the tax credit calculated?

A: The tax credit is calculated using the information provided on the Biofuel Commercial Production and Commercial Use Tax Credit Worksheet. It takes into account the amount of biofuel produced or used and the applicable tax credit rate.

Q: How do I claim the tax credit?

A: To claim the tax credit, businesses must complete the Biofuel Commercial Production and Commercial Use Tax Credit Worksheet and include it with their Maine tax return.

Q: What is the purpose of the tax credit?

A: The tax credit is intended to incentivize the production and use of biofuels in Maine, which helps reduce dependence on fossil fuels and promotes environmental sustainability.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there may be certain limitations or restrictions on the tax credit, such as a maximum credit amount or a time period during which the credit can be claimed. These details can be found in the instructions for the Biofuel Commercial Production and Commercial Use Tax Credit Worksheet.

Q: Who should I contact for more information about the tax credit?

A: For more information about the Biofuel Commercial Production and Commercial Use Tax Credit, you can contact the Maine Revenue Services or refer to the instructions provided with the worksheet.

Form Details:

- Released on December 1, 2022;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.