This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

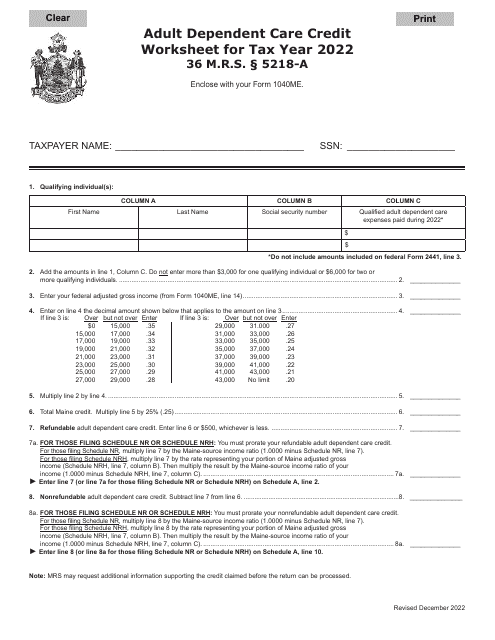

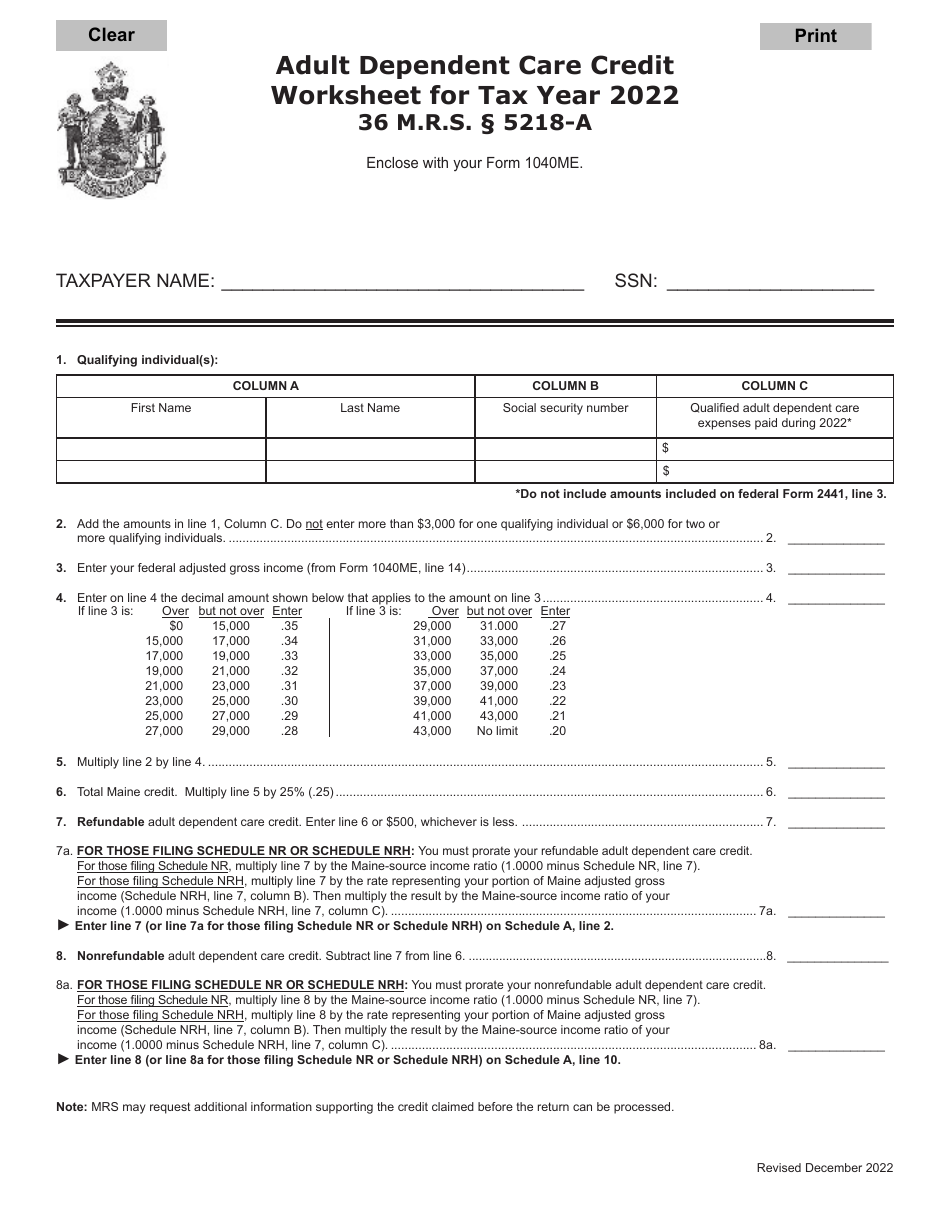

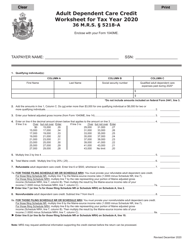

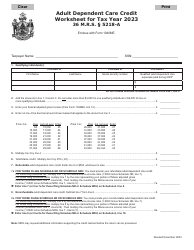

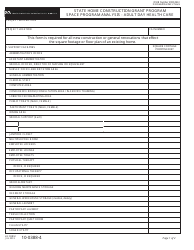

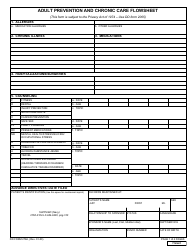

Adult Dependent Care Credit Worksheet - Maine

Adult Dependent Care Credit Worksheet is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

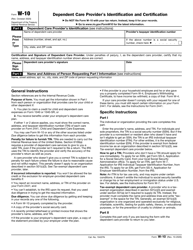

Q: What is the Adult Dependent Care Credit?

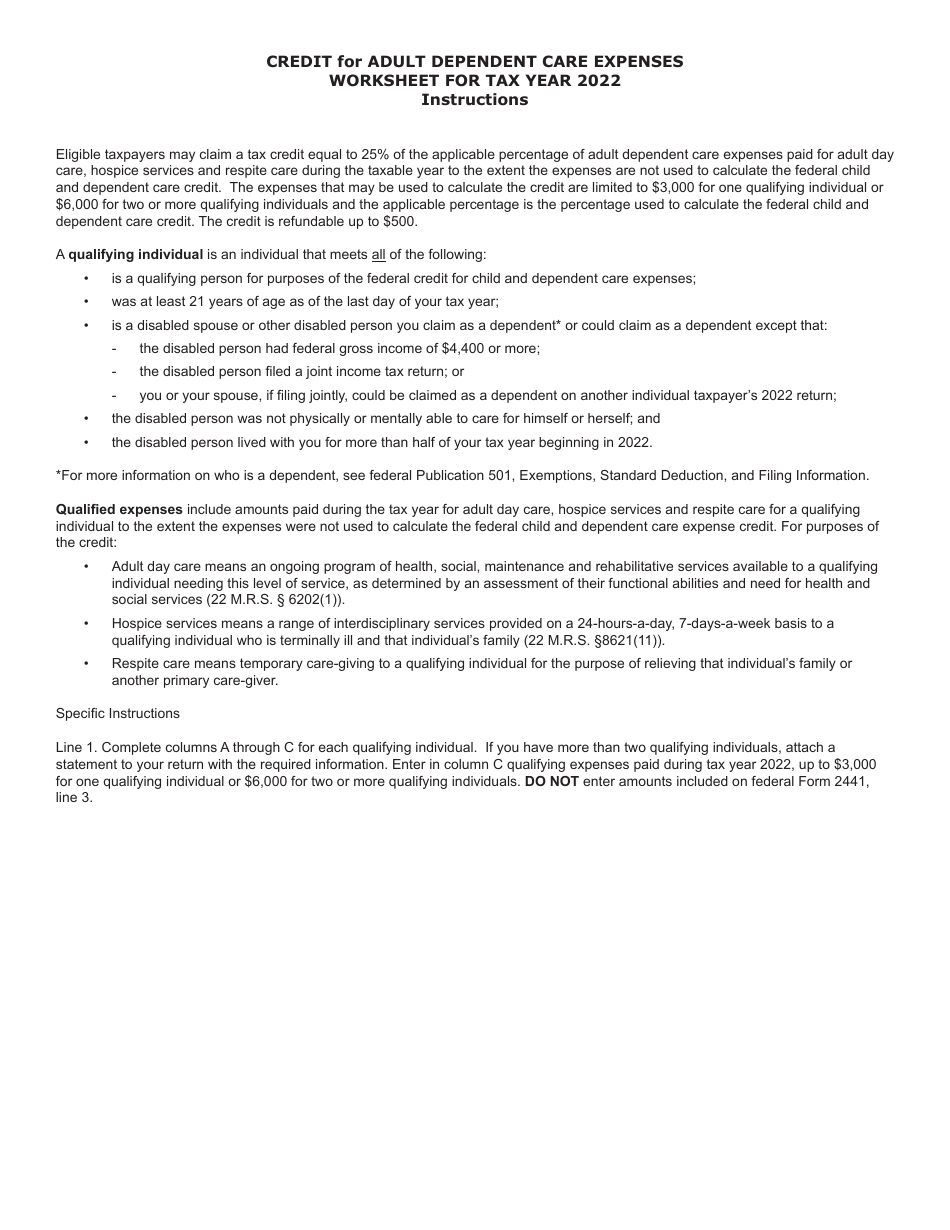

A: The Adult Dependent Care Credit is a tax credit for eligible expenses related to the care of adult dependents.

Q: Who is eligible to claim the Adult Dependent Care Credit?

A: Individuals who paid for eligible care expenses for a qualifying adult dependent may be eligible to claim the credit.

Q: What are eligible care expenses for the Adult Dependent Care Credit?

A: Eligible care expenses include costs for the care of a qualifying adult dependent, as long as the care is necessary for the individual to work or actively look for work.

Q: What is a qualifying adult dependent?

A: A qualifying adult dependent is a person who is physically or mentally incapable of caring for themselves and who lives with the taxpayer for more than half of the year.

Q: What are the income limits for the Adult Dependent Care Credit?

A: The income limits for the credit vary depending on the individual's filing status and are subject to change each year. It is best to consult the current tax guidelines for specific income threshold information.

Q: How much is the Adult Dependent Care Credit worth?

A: The credit amount is a percentage of the eligible care expenses paid by the taxpayer, up to a maximum limit set by the IRS. The exact percentage and maximum limits may vary each year, so it is important to consult the current tax guidelines.

Q: When can I claim the Adult Dependent Care Credit?

A: The credit can be claimed when filing your income tax return for the corresponding tax year.

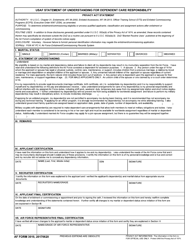

Q: Are there any other requirements to claim the Adult Dependent Care Credit?

A: In addition to the eligibility requirements and income limits, there may be other specific rules and documentation required to claim the credit. It is advisable to consult the current IRS guidelines or seek advice from a tax professional.

Form Details:

- Released on December 1, 2022;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.