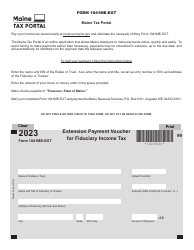

This version of the form is not currently in use and is provided for reference only. Download this version of

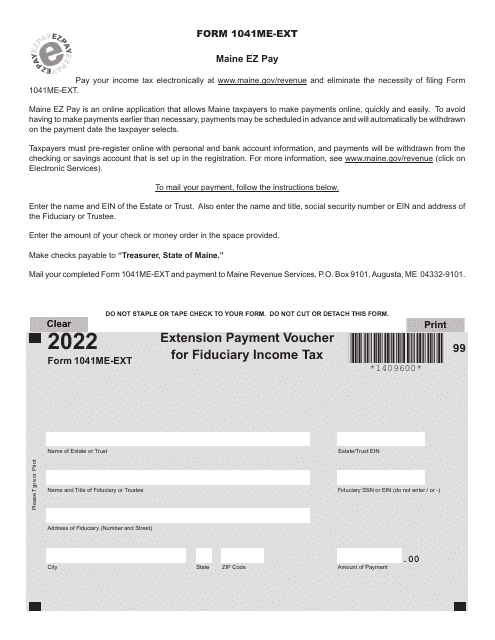

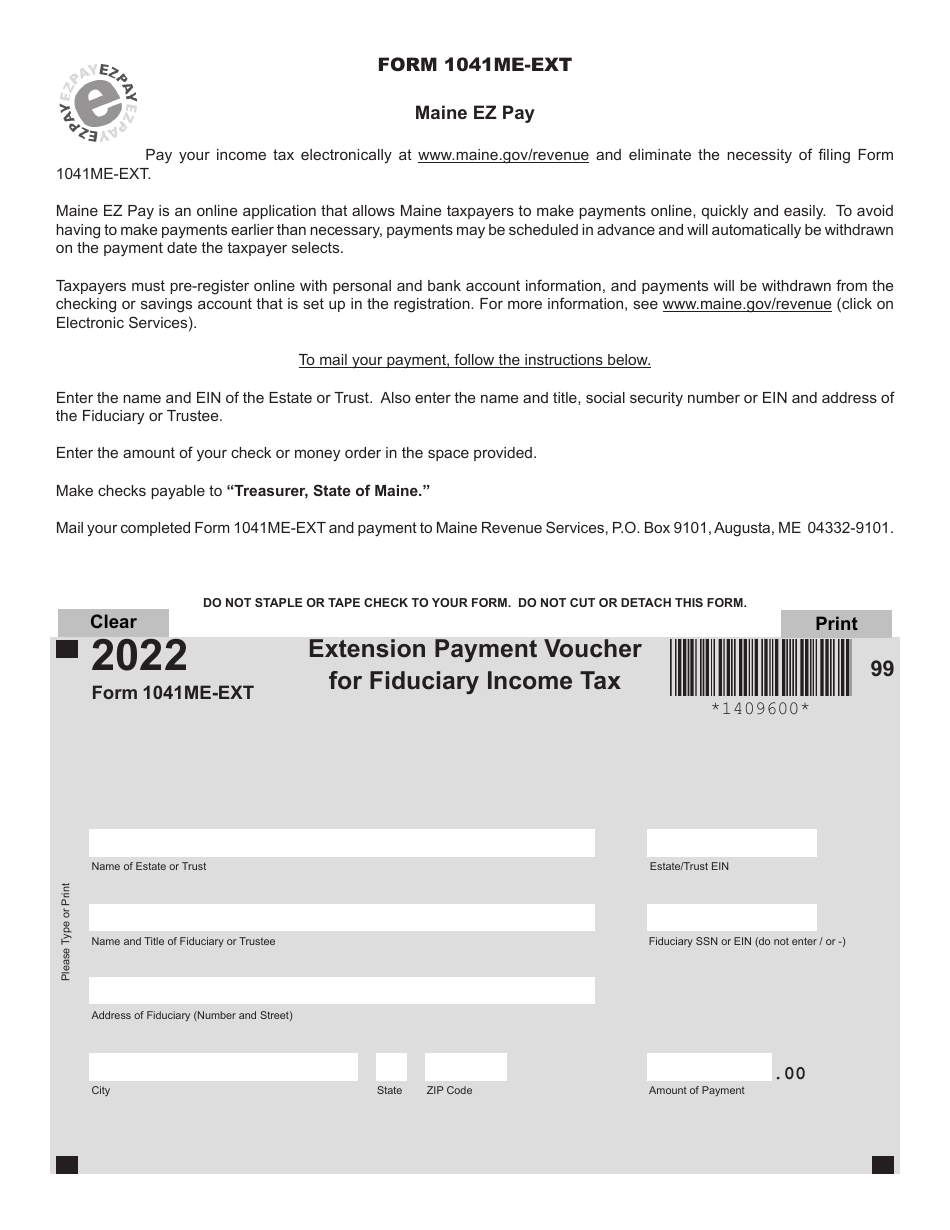

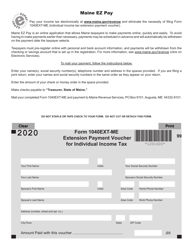

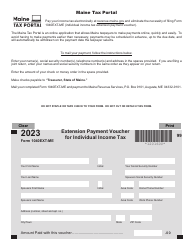

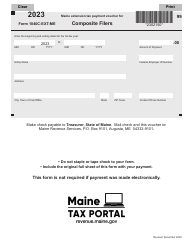

Form 1041ME-EXT

for the current year.

Form 1041ME-EXT Extension Payment Voucher for Fiduciary Income Tax - Maine

What Is Form 1041ME-EXT?

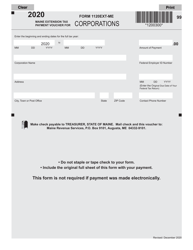

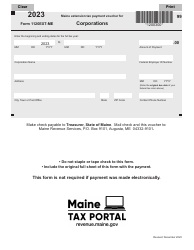

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

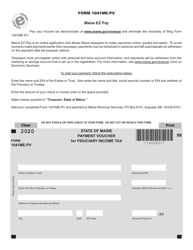

Q: What is Form 1041ME-EXT?

A: Form 1041ME-EXT is a payment voucher for filing an extension for fiduciary income tax in Maine.

Q: Who needs to file Form 1041ME-EXT?

A: Individuals or entities that need an extension for filing their fiduciary income tax in Maine.

Q: What is the purpose of Form 1041ME-EXT?

A: The purpose of Form 1041ME-EXT is to make a payment for the extension of time to file the fiduciary income tax return in Maine.

Q: When is Form 1041ME-EXT due?

A: Form 1041ME-EXT is due on or before the original due date of the Maine fiduciary income tax return.

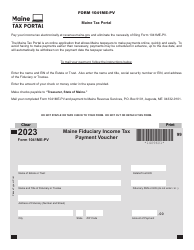

Q: What happens if I don't file Form 1041ME-EXT?

A: If you don't file Form 1041ME-EXT, you may be subject to penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1041ME-EXT by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.