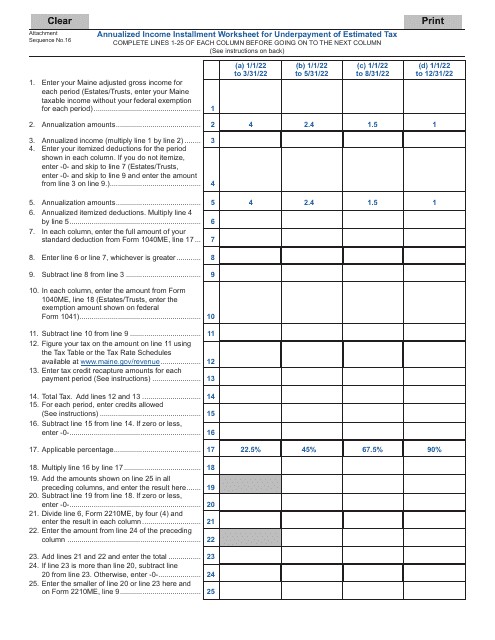

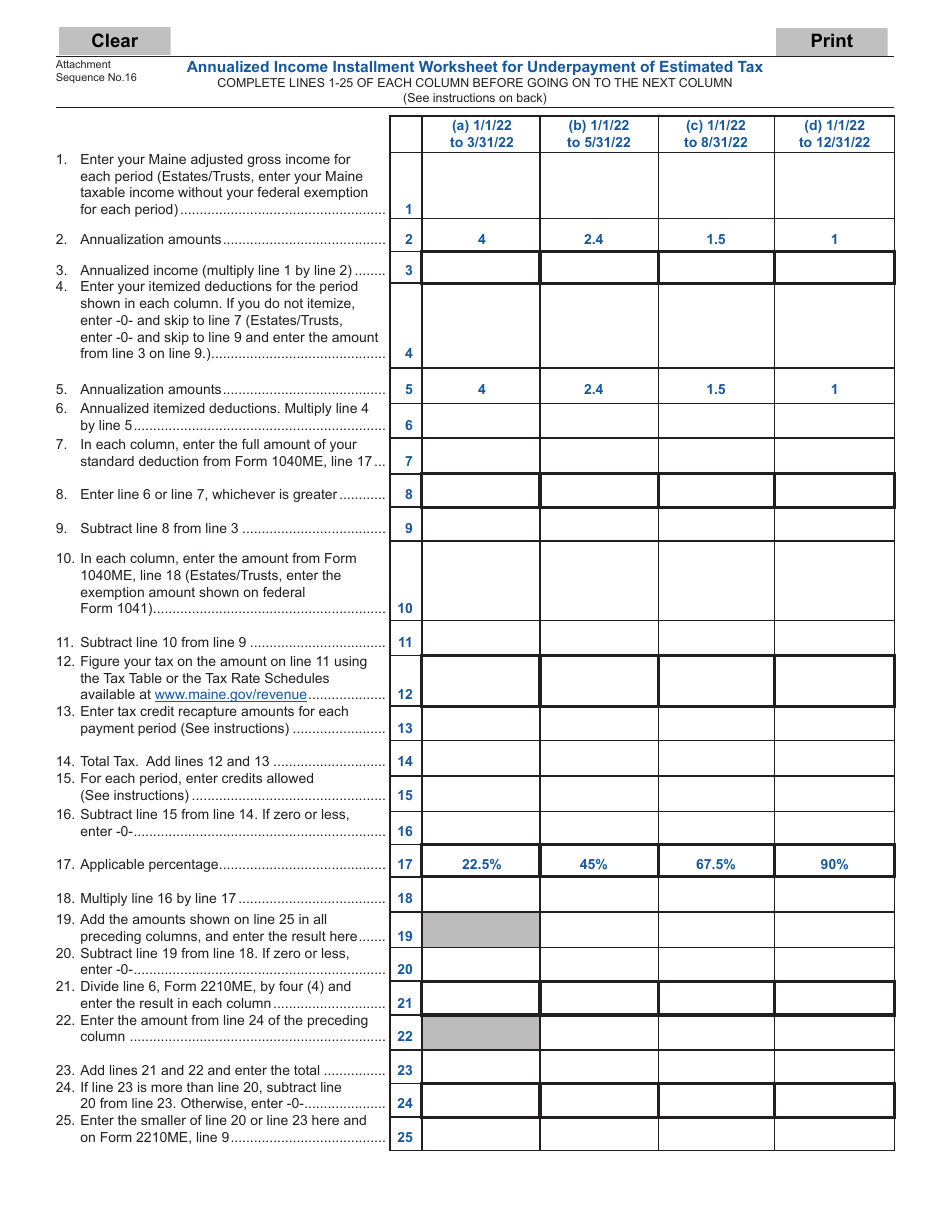

Form 2210ME Annualized Income Installment Worksheet for Underpayment of Estimated Tax - Maine

What Is Form 2210ME?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2210ME?

A: Form 2210ME is the Annualized Income Installment Worksheet for Underpayment of Estimated Tax specifically for taxpayers in Maine.

Q: Who needs to file Form 2210ME?

A: Taxpayers in Maine who have underpaid their estimated taxes and want to calculate any penalty they may owe.

Q: What is the purpose of Form 2210ME?

A: Form 2210ME helps taxpayers determine if they owe a penalty for underpayment of estimated taxes and calculates the amount of the penalty.

Q: How do I complete Form 2210ME?

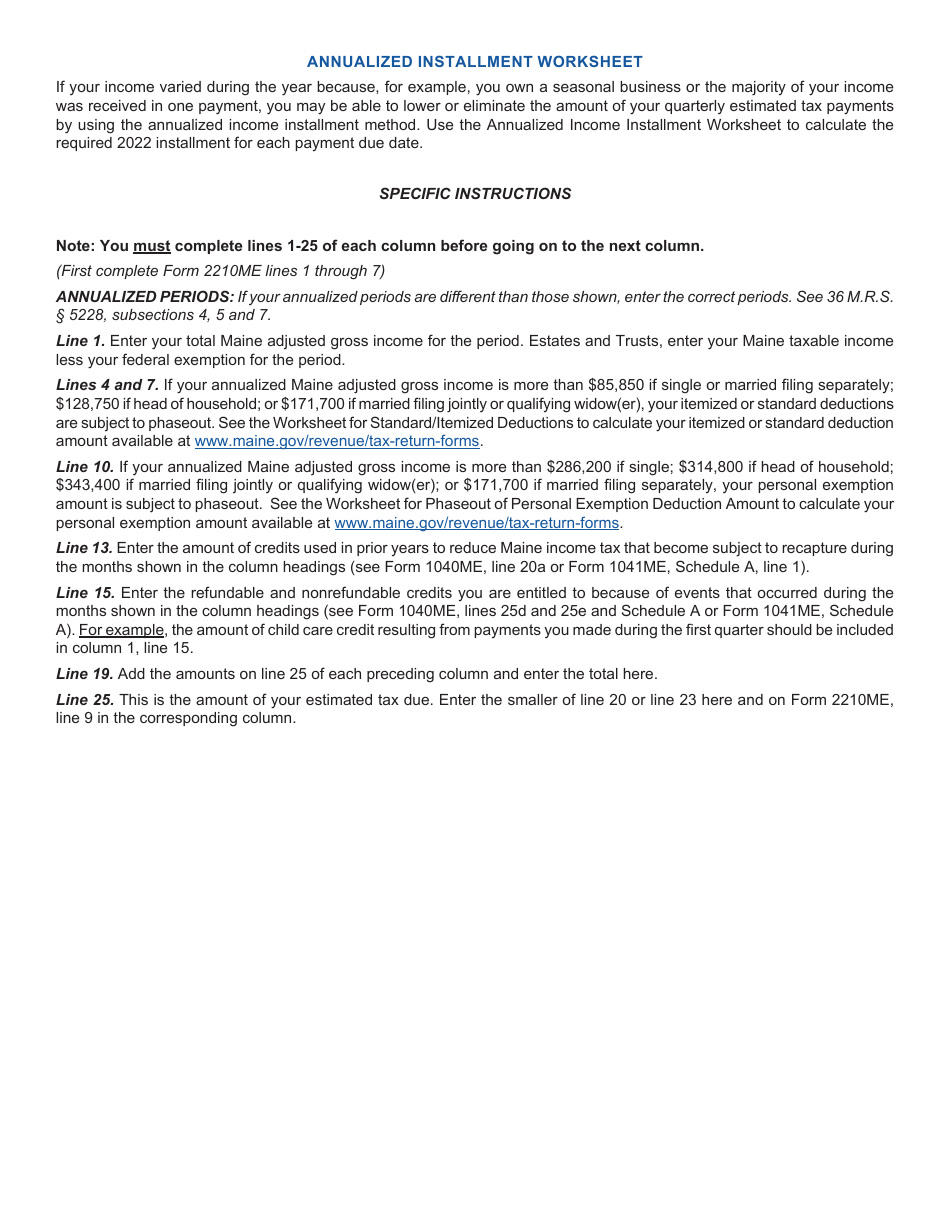

A: You can refer to the instructions provided with the form to complete it accurately. It involves calculating your annualized income, computing your estimated tax due, and determining if you owe a penalty.

Q: When is Form 2210ME due?

A: Form 2210ME is due on the same date as your Maine state income tax return, typically April 15th, or the extended due date if you have requested an extension.

Q: Do I need to attach Form 2210ME to my tax return?

A: In most cases, you should attach a completed and signed Form 2210ME to your Maine state income tax return if you owe a penalty for underpayment of estimated taxes.

Q: What happens if I do not file Form 2210ME?

A: If you owe a penalty for underpayment of estimated taxes in Maine and do not file Form 2210ME, the Maine Revenue Services may assess the penalty based on their estimation.

Q: Can I file Form 2210ME electronically?

A: Yes, you can file Form 2210ME electronically if you are filing your Maine state income tax return electronically.

Q: Can I use Form 2210 instead of Form 2210ME?

A: No, Form 2210 is used for federal tax purposes. If you need to calculate the penalty for underpayment of estimated taxes in Maine, you must use Form 2210ME.

Q: Can I claim any exemptions or exceptions on Form 2210ME?

A: Yes, you can claim certain exceptions or exemptions on Form 2210ME, such as the 'annualized income exception' or the 'farm exception.' You can refer to the instructions for more information.

Q: Is there a minimum penalty threshold on Form 2210ME?

A: Yes, if your penalty amount is less than $1, you are not required to pay it.

Q: Can I request an abatement of the penalty?

A: Yes, if you believe you qualify for an abatement of the underpayment penalty, you can submit a written request to the Maine Revenue Services explaining your reasons.

Q: Can I amend my Form 2210ME?

A: If you made an error on your original Form 2210ME, you can file an amended Form 2210ME to correct it.

Q: What is the deadline to pay the penalty owed?

A: The penalty owed, if any, should be paid by the same due date as your Maine state income tax return, typically April 15th, or the extended due date if you have requested an extension.

Q: Are there any penalties for late payment of the penalty?

A: Yes, if you fail to pay the penalty owed by the due date, you may be subject to additional penalties and interest.

Q: Can I ask for an extension to file Form 2210ME?

A: Yes, if you need additional time to file Form 2210ME, you can request an extension for your Maine state income tax return.

Q: What should I do if I have questions or need assistance with Form 2210ME?

A: If you have questions or need assistance with Form 2210ME, you can contact the Maine Revenue Services or consult a tax professional.

Form Details:

- The latest edition provided by the Maine Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2210ME by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.