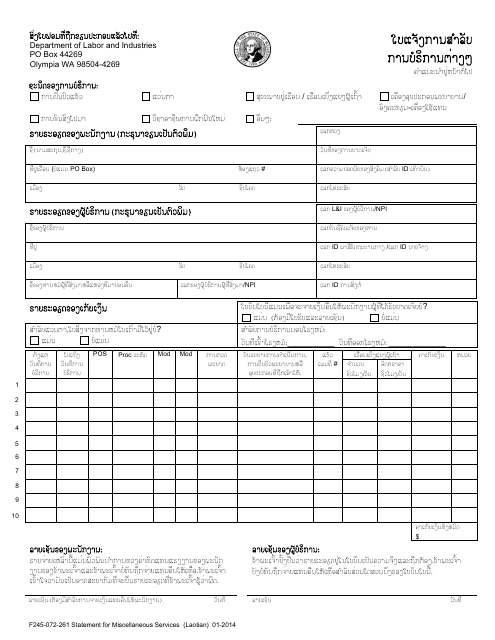

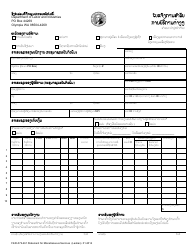

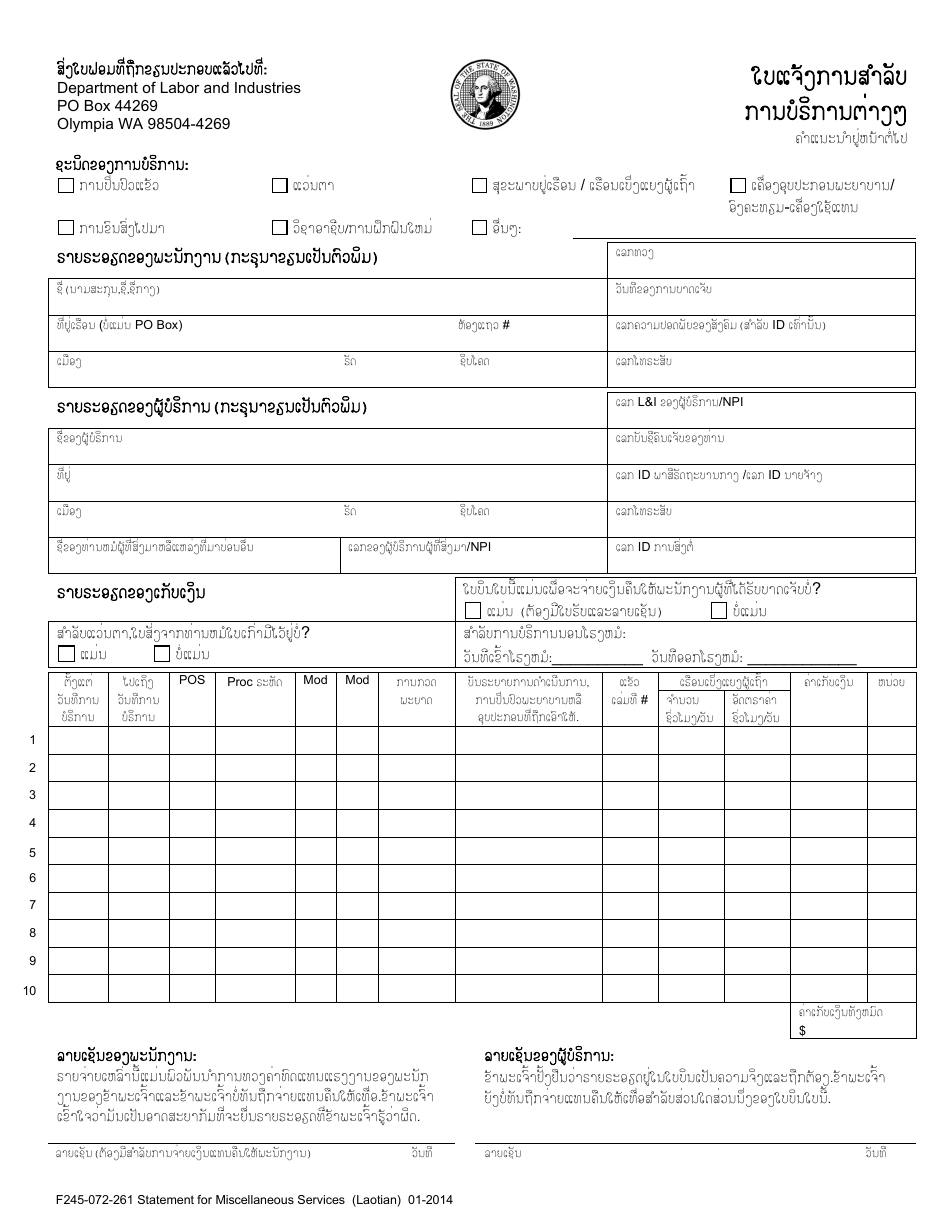

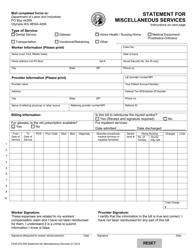

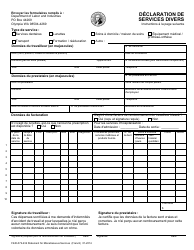

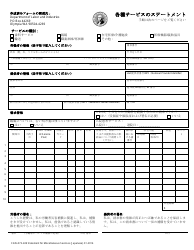

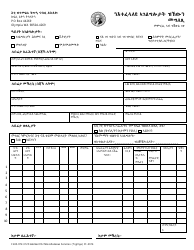

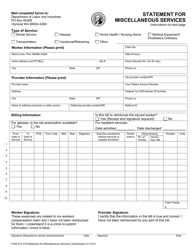

Form F245-072-261 Statement for Miscellaneous Services - Washington

What Is Form F245-072-261?

This is a legal form that was released by the Washington State Department of Labor and Industries - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F245-072-261?

A: Form F245-072-261 is a statement for miscellaneous services in Washington.

Q: Who uses Form F245-072-261?

A: Form F245-072-261 is used by individuals or businesses providing miscellaneous services in Washington.

Q: What is the purpose of Form F245-072-261?

A: The purpose of Form F245-072-261 is to provide a detailed statement of miscellaneous services provided.

Q: Are there any fees for filing Form F245-072-261?

A: There may be filing fees associated with Form F245-072-261. It is best to check with the Washington State Department of Revenue for the most up-to-date information.

Q: What types of services should be included on Form F245-072-261?

A: Any services that do not have a specific reporting requirement should be included on Form F245-072-261.

Q: Do I need to include receipts or documentation with Form F245-072-261?

A: It is not usually necessary to include receipts or documentation with Form F245-072-261, but it is recommended to keep them for your records.

Q: When is Form F245-072-261 due?

A: Form F245-072-261 is due by the 25th of the month following the reporting period.

Q: What happens if I fail to file Form F245-072-261?

A: Failing to file Form F245-072-261 may result in penalties or interest charges.

Q: Are there any exceptions or exemptions for filing Form F245-072-261?

A: There may be exceptions or exemptions based on specific circumstances. It is best to consult the Washington State Department of Revenue for more information.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Washington State Department of Labor and Industries;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F245-072-261 by clicking the link below or browse more documents and templates provided by the Washington State Department of Labor and Industries.