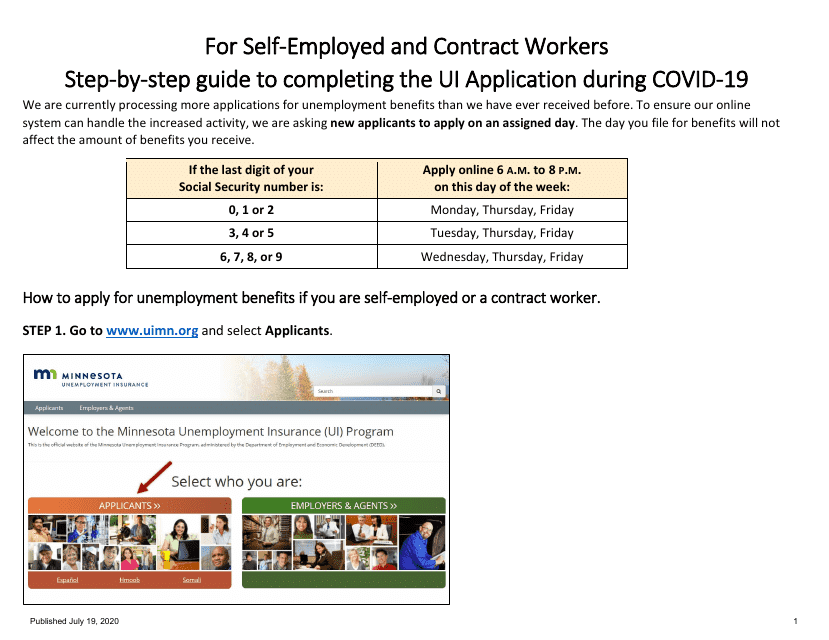

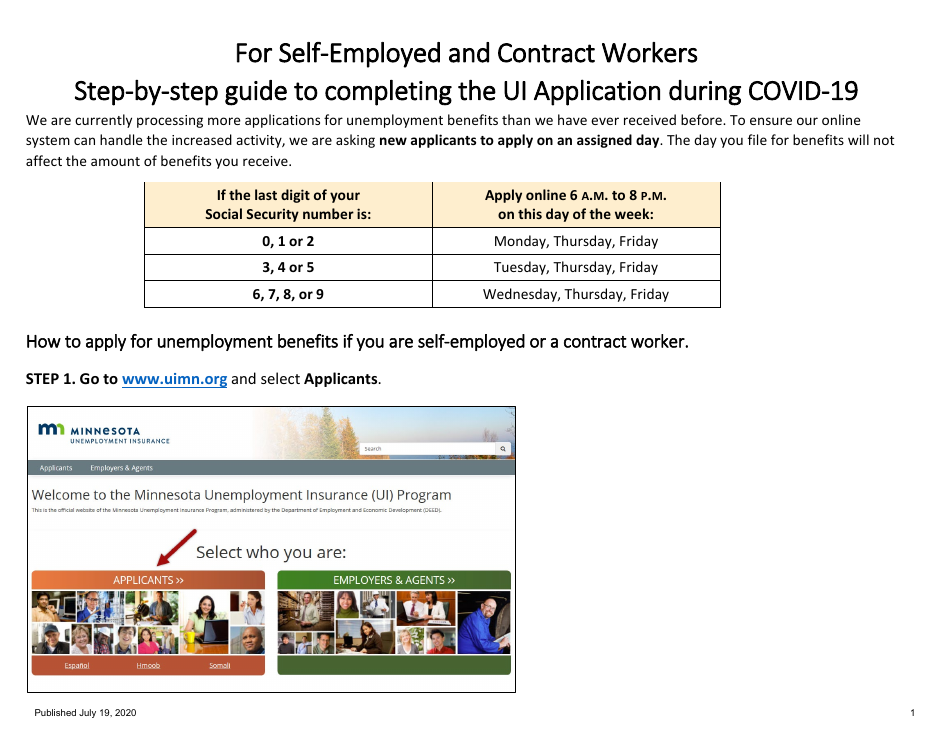

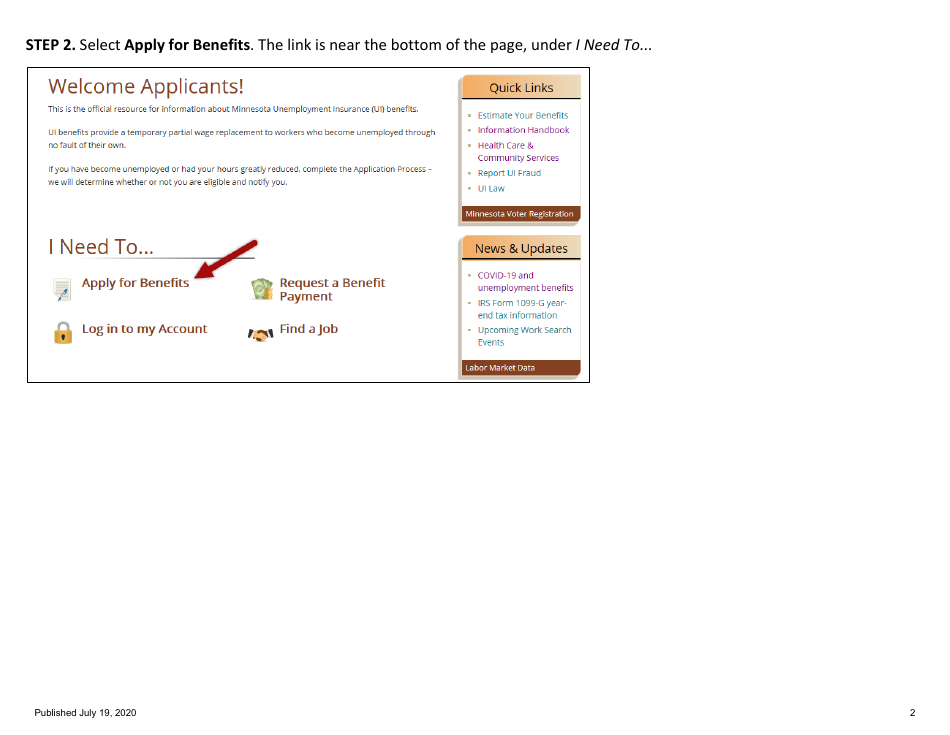

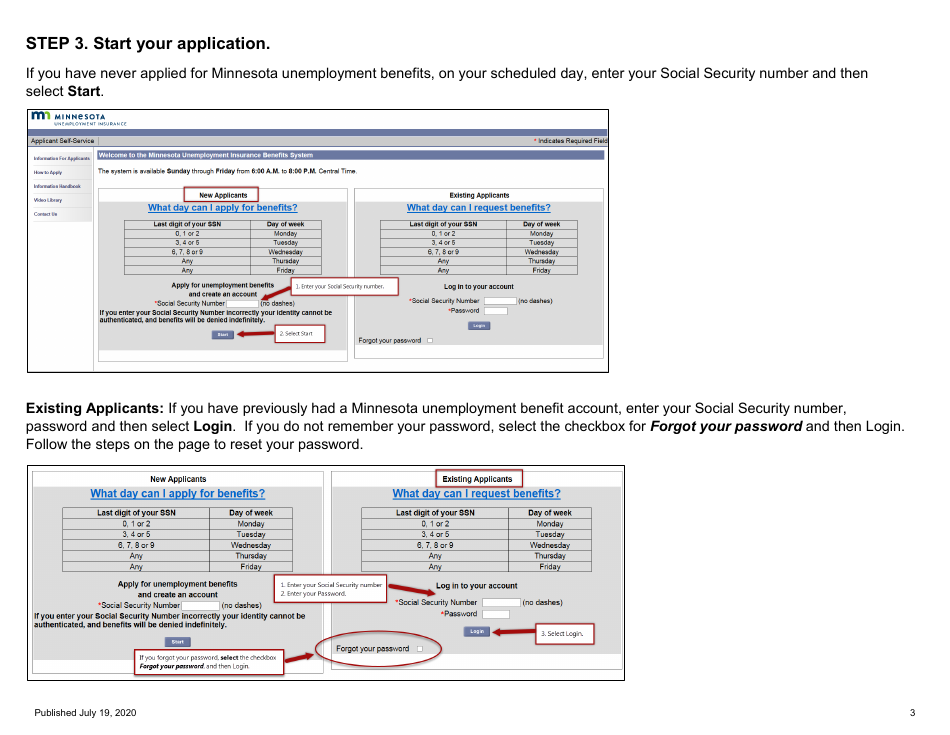

For Self-employed and Contract Workers Step-By-Step Guide to Completing the Ui Application During Covid-19 - Minnesota

For Self-employed and Contract Workers Step-By-Step Guide to Completing the Ui Application During Covid-19 is a legal document that was released by the Minnesota Employment and Economic Development Department - a government authority operating within Minnesota.

FAQ

Q: Who is considered a self-employed and contract worker?

A: Self-employed and contract workers include freelancers, independent contractors, gig workers, and small business owners.

Q: Why do self-employed and contract workers need to apply for unemployment benefits?

A: Self-employed and contract workers are eligible for unemployment benefits under the Pandemic Unemployment Assistance (PUA) program due to the impact of Covid-19 on their income.

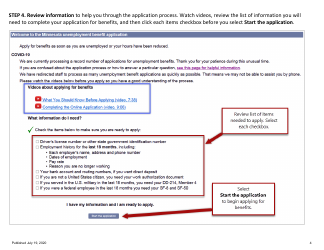

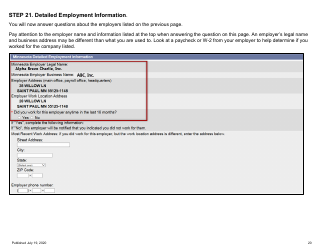

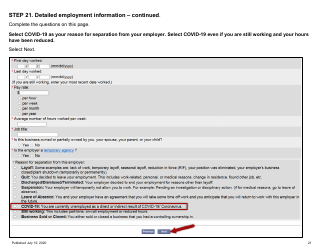

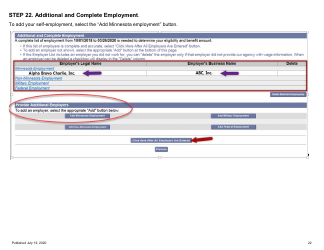

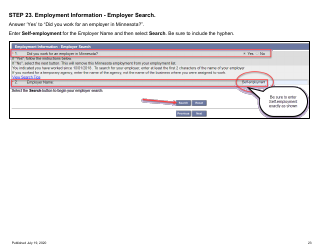

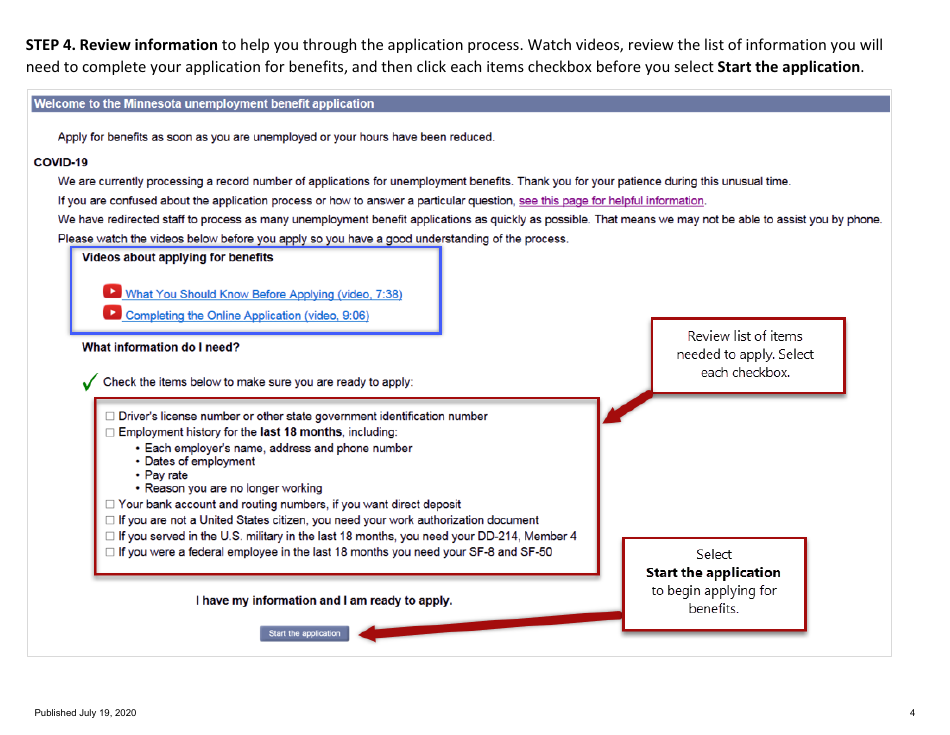

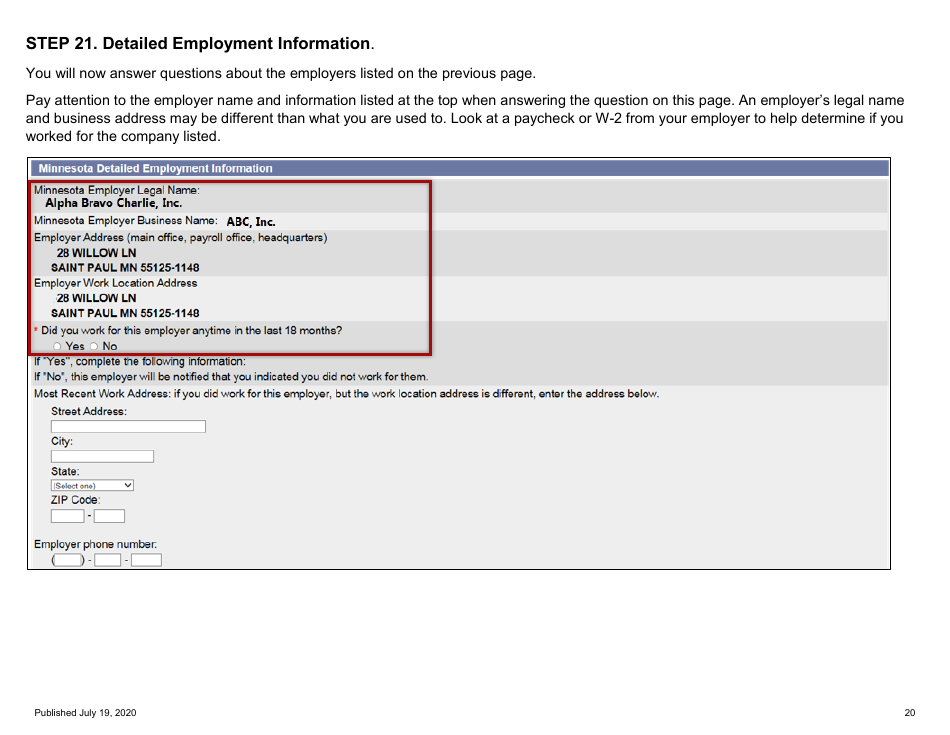

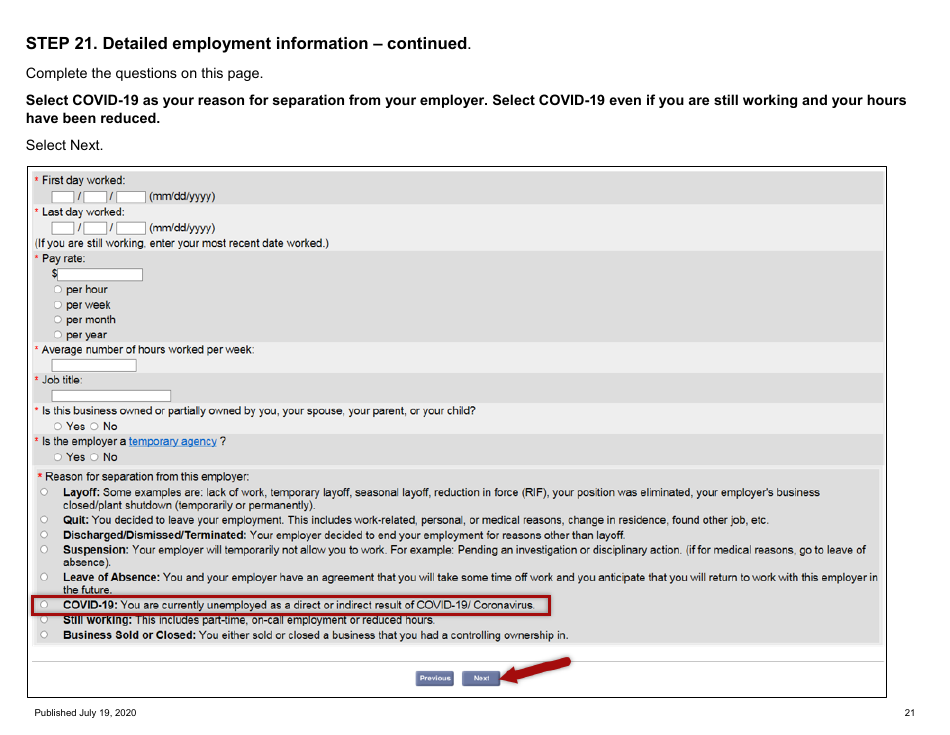

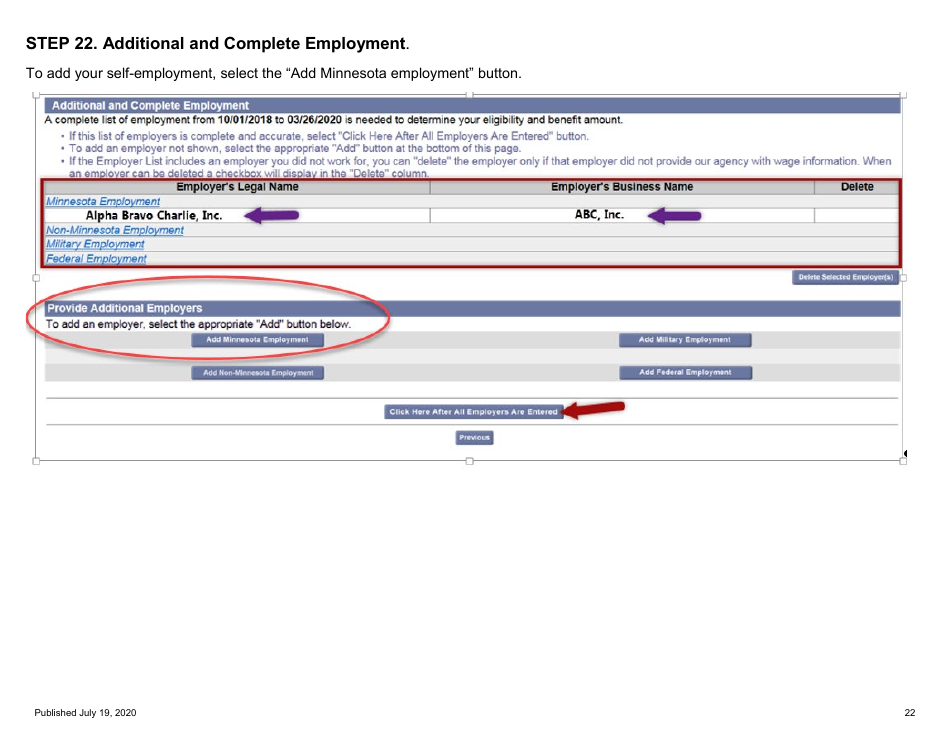

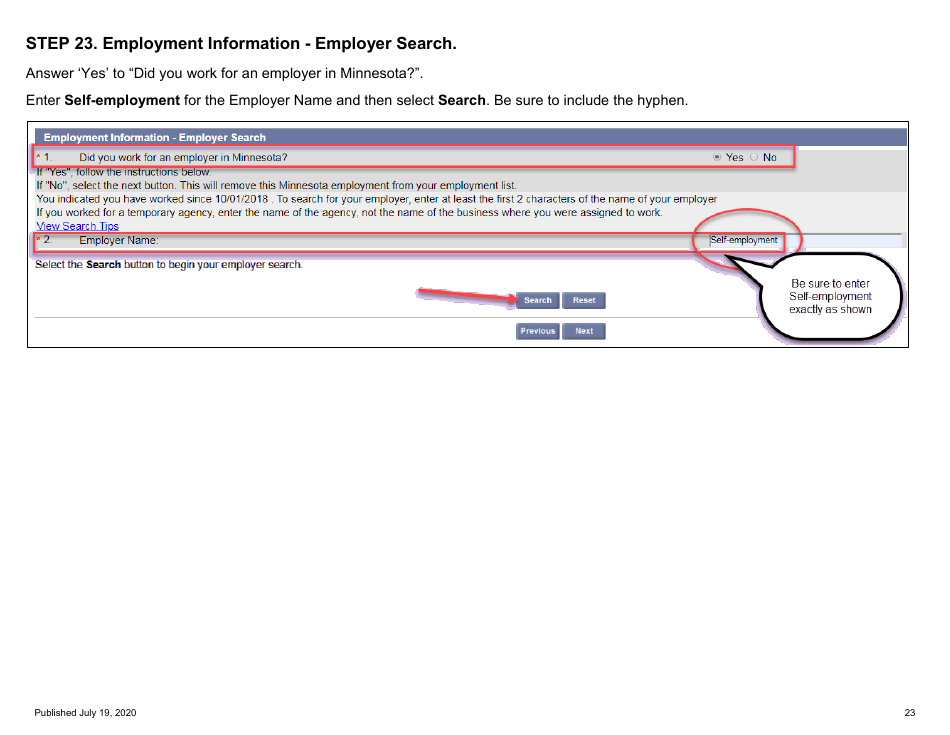

Q: What information do self-employed and contract workers need to provide when applying for unemployment benefits?

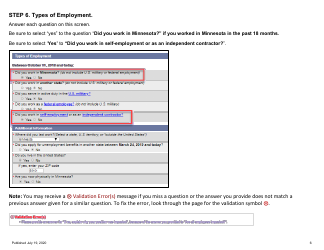

A: Self-employed and contract workers need to provide information about their income, work history, and why they are unemployed as a result of Covid-19.

Q: How long does it take to receive unemployment benefits for self-employed and contract workers?

A: The processing time for unemployment benefits can vary, but self-employed and contract workers may start receiving benefits within a few weeks of their application.

Q: Are self-employed and contract workers eligible for the additional $600 weekly payment under the Federal Pandemic Unemployment Compensation (FPUC) program?

A: Yes, self-employed and contract workers who qualify for unemployment benefits are eligible to receive the additional $600 weekly payment under the FPUC program.

Q: Do self-employed and contract workers need to continue filing weekly claims to receive unemployment benefits?

A: Yes, self-employed and contract workers need to file weekly claims to continue receiving unemployment benefits.

Q: Are self-employed and contract workers required to look for work while receiving unemployment benefits?

A: During the Covid-19 pandemic, self-employed and contract workers are not required to actively look for work to receive unemployment benefits.

Q: How long can self-employed and contract workers receive unemployment benefits?

A: Self-employed and contract workers can receive unemployment benefits for up to 39 weeks, including any extensions provided by the federal government.

Q: Are self-employed and contract workers eligible for other financial assistance programs during Covid-19?

A: Yes, self-employed and contract workers may be eligible for other financial assistance programs, such as the Paycheck Protection Program (PPP) or Economic Injury Disaster Loan (EIDL) program.

Form Details:

- Released on July 19, 2020;

- The latest edition currently provided by the Minnesota Employment and Economic Development Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Employment and Economic Development Department.