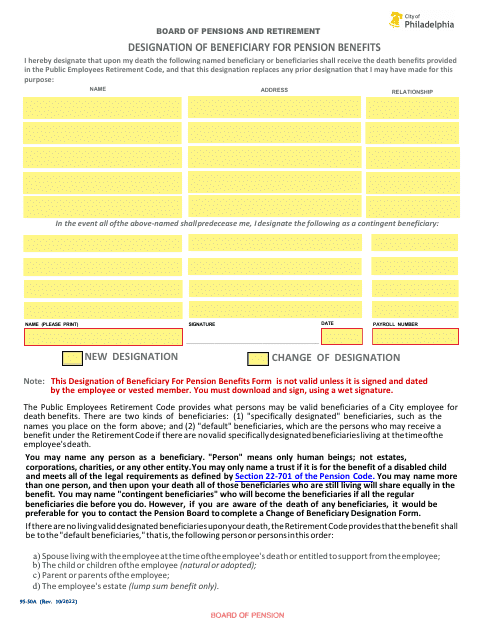

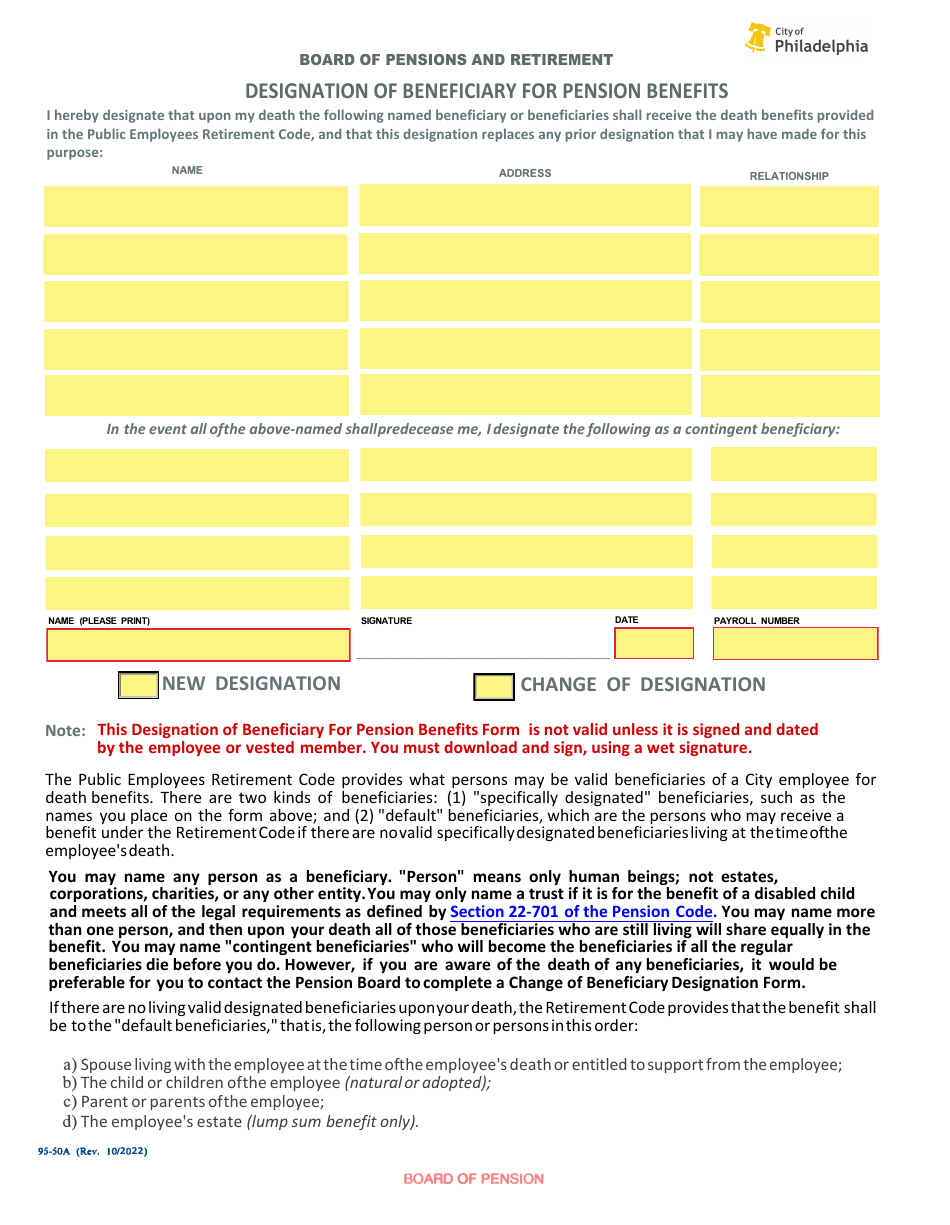

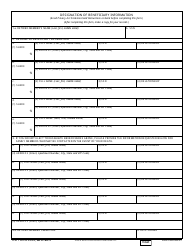

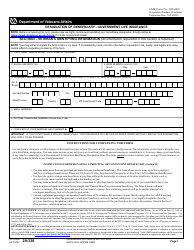

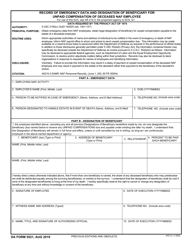

Form 95-50A Designation of Beneficiary for Pension Benefits - City of Philadelphia, Pennsylvania

What Is Form 95-50A?

This is a legal form that was released by the Board of Pensions and Retirement - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 95-50A?

A: Form 95-50A is the Designation of Beneficiary for Pension Benefits form for the City of Philadelphia, Pennsylvania.

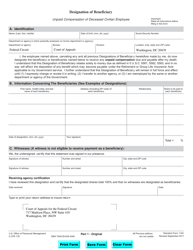

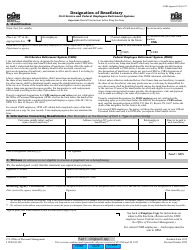

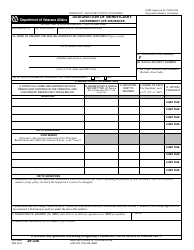

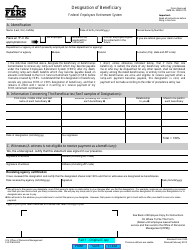

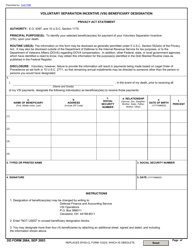

Q: What is the purpose of Form 95-50A?

A: The purpose of Form 95-50A is to designate a beneficiary for pension benefits in the City of Philadelphia.

Q: Who needs to fill out Form 95-50A?

A: Anyone who is eligible for pension benefits in the City of Philadelphia may need to fill out Form 95-50A to designate a beneficiary.

Q: Are there any instructions for filling out Form 95-50A?

A: Yes, there should be instructions accompanying the form. Make sure to read and follow them carefully.

Q: Can I change my designated beneficiary after submitting Form 95-50A?

A: Yes, you may be able to change your designated beneficiary by submitting a new Form 95-50A or through a designated process specified by the City of Philadelphia.

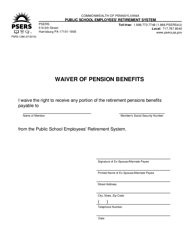

Q: What happens if I don't fill out Form 95-50A?

A: If you don't fill out Form 95-50A, your pension benefits may be distributed according to the default rules or policies of the City of Philadelphia.

Q: Is Form 95-50A specific to the City of Philadelphia?

A: Yes, Form 95-50A is specific to the City of Philadelphia and its pension benefits.

Q: What should I do after filling out Form 95-50A?

A: After filling out Form 95-50A, make sure to submit it according to the instructions provided and keep a copy for your records.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Board of Pensions and Retirement - City of Philadelphia, Pennsylvania;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 95-50A by clicking the link below or browse more documents and templates provided by the Board of Pensions and Retirement - City of Philadelphia, Pennsylvania.