This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

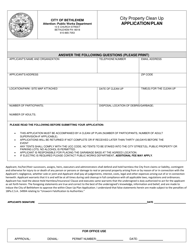

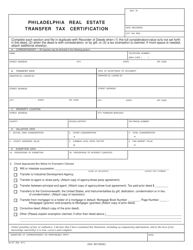

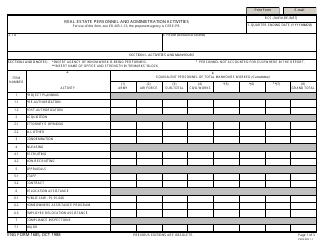

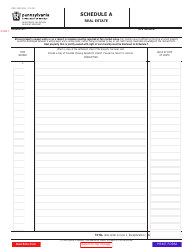

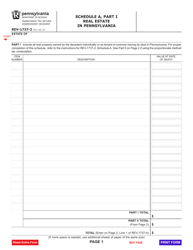

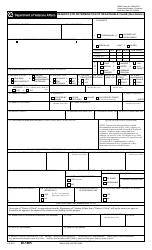

Real Estate Installment Plan - City of Philadelphia, Pennsylvania

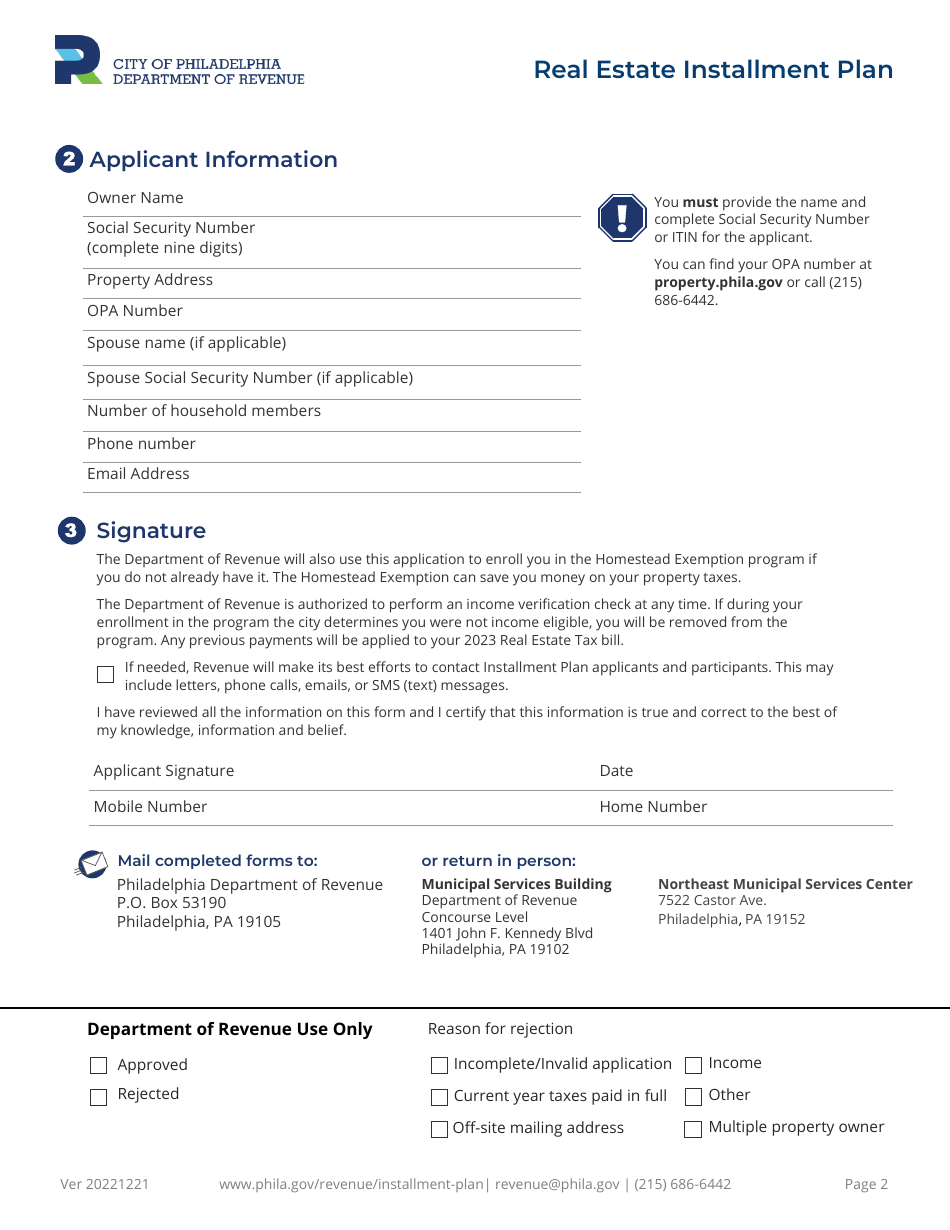

Real Estate Installment Plan is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

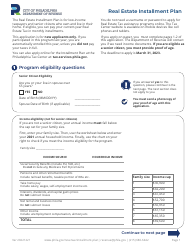

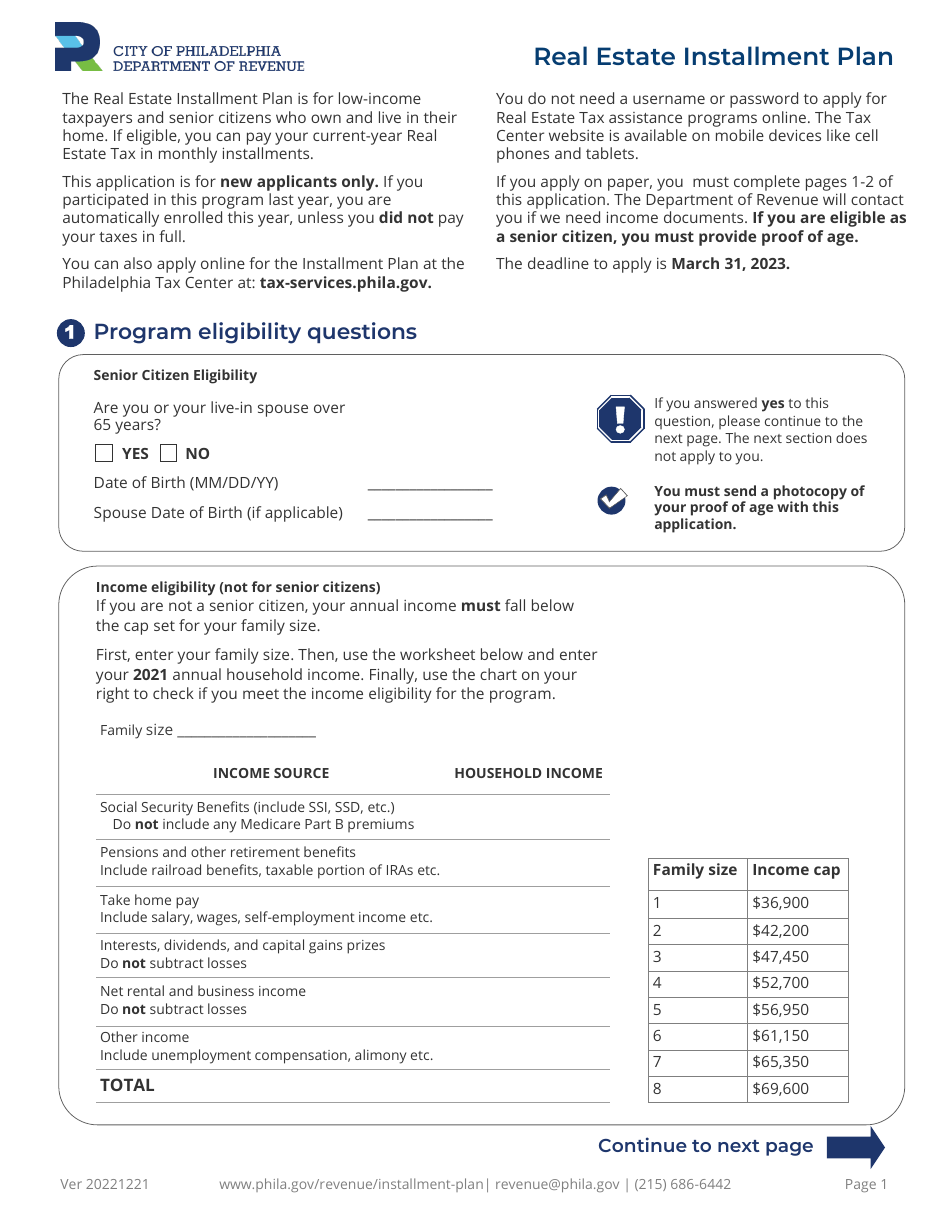

Q: What is the Real Estate Installment Plan in Philadelphia?

A: The Real Estate Installment Plan in Philadelphia is a payment arrangement for homeowners to pay their property taxes in installments instead of a lump sum.

Q: Who is eligible for the Real Estate Installment Plan in Philadelphia?

A: Any homeowner in Philadelphia, Pennsylvania can apply for the Real Estate Installment Plan.

Q: How does the Real Estate Installment Plan work?

A: Under the Real Estate Installment Plan, homeowners can pay their property taxes in monthly installments over a set period of time.

Q: Do I have to pay any fees to enroll in the Real Estate Installment Plan?

A: Yes, homeowners who choose to enroll in the Real Estate Installment Plan may be subject to a small administrative fee.

Q: Can I choose the length of the installment period?

A: Yes, homeowners can choose the length of the installment period, typically ranging from six to twelve months.

Form Details:

- Released on December 21, 2022;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.