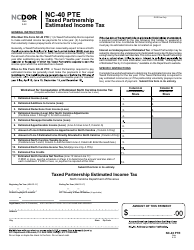

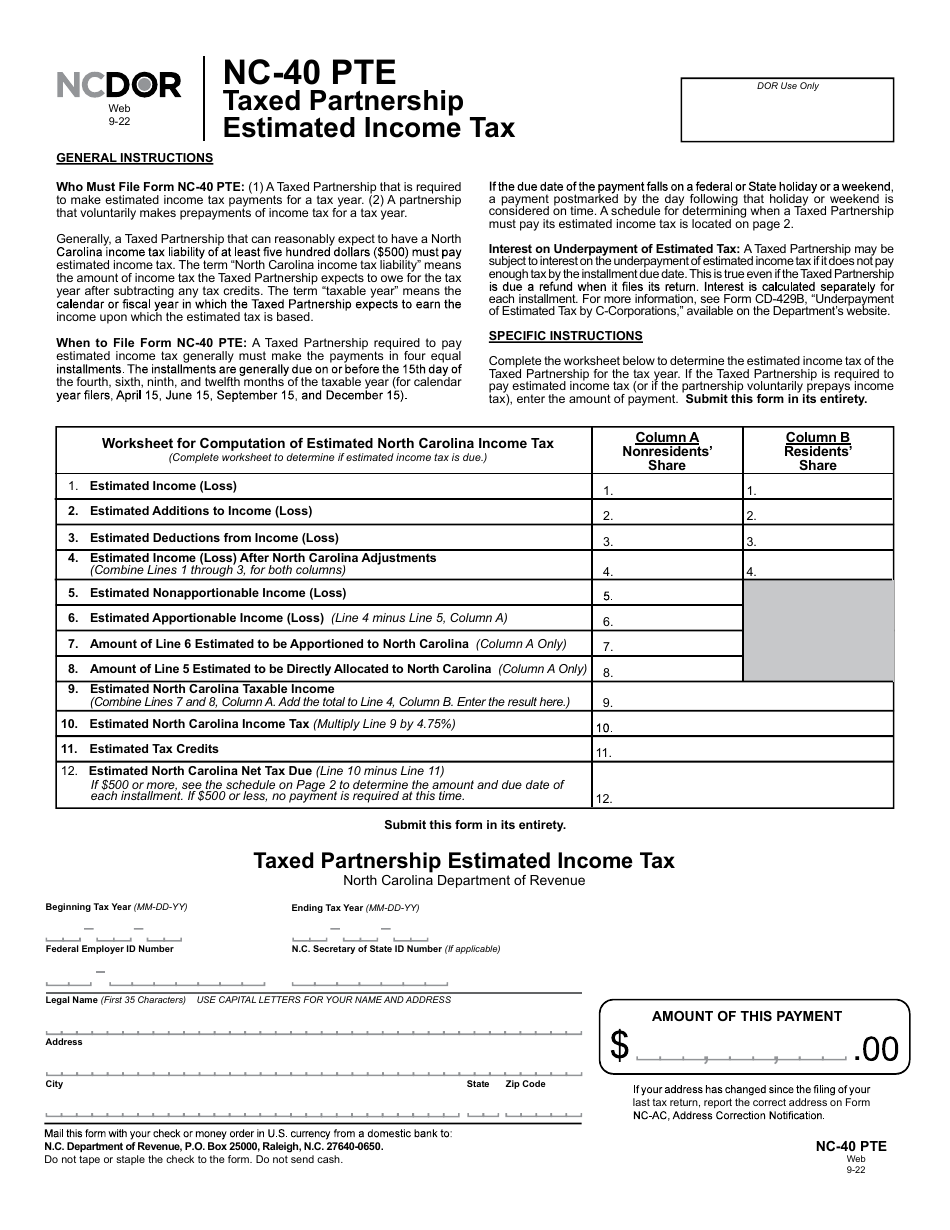

Form NC-40 PTE Taxed Partnership Estimated Income Tax - North Carolina

What Is Form NC-40 PTE?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NC-40?

A: Form NC-40 is a tax form used for reporting estimated income tax for a Partnership Taxed as a Partnership in North Carolina.

Q: Who needs to file Form NC-40?

A: Partnerships that are taxed as partnerships in North Carolina need to file Form NC-40 to report their estimated income tax.

Q: What information is required to complete Form NC-40?

A: Form NC-40 requires information regarding the partnership's estimated income, deductions, tax credits, and other relevant details.

Q: How often should Form NC-40 be filed?

A: Form NC-40 should be filed quarterly, with estimated income tax payments due on April 15th, June 15th, September 15th, and January 15th of the following year.

Q: Are there any penalties for not filing Form NC-40?

A: Yes, there can be penalties for failing to file Form NC-40 or for underpayment of estimated taxes. It's important to file and pay on time to avoid penalties.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NC-40 PTE by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.