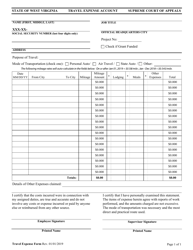

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

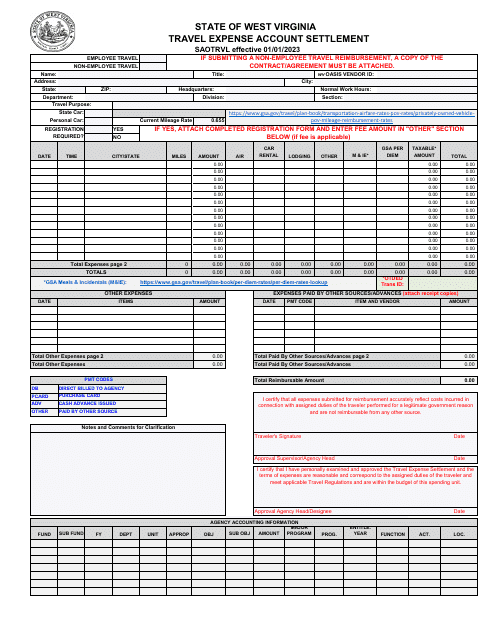

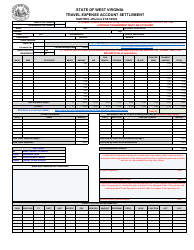

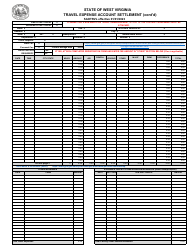

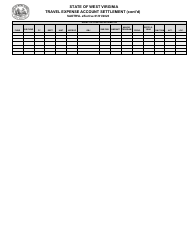

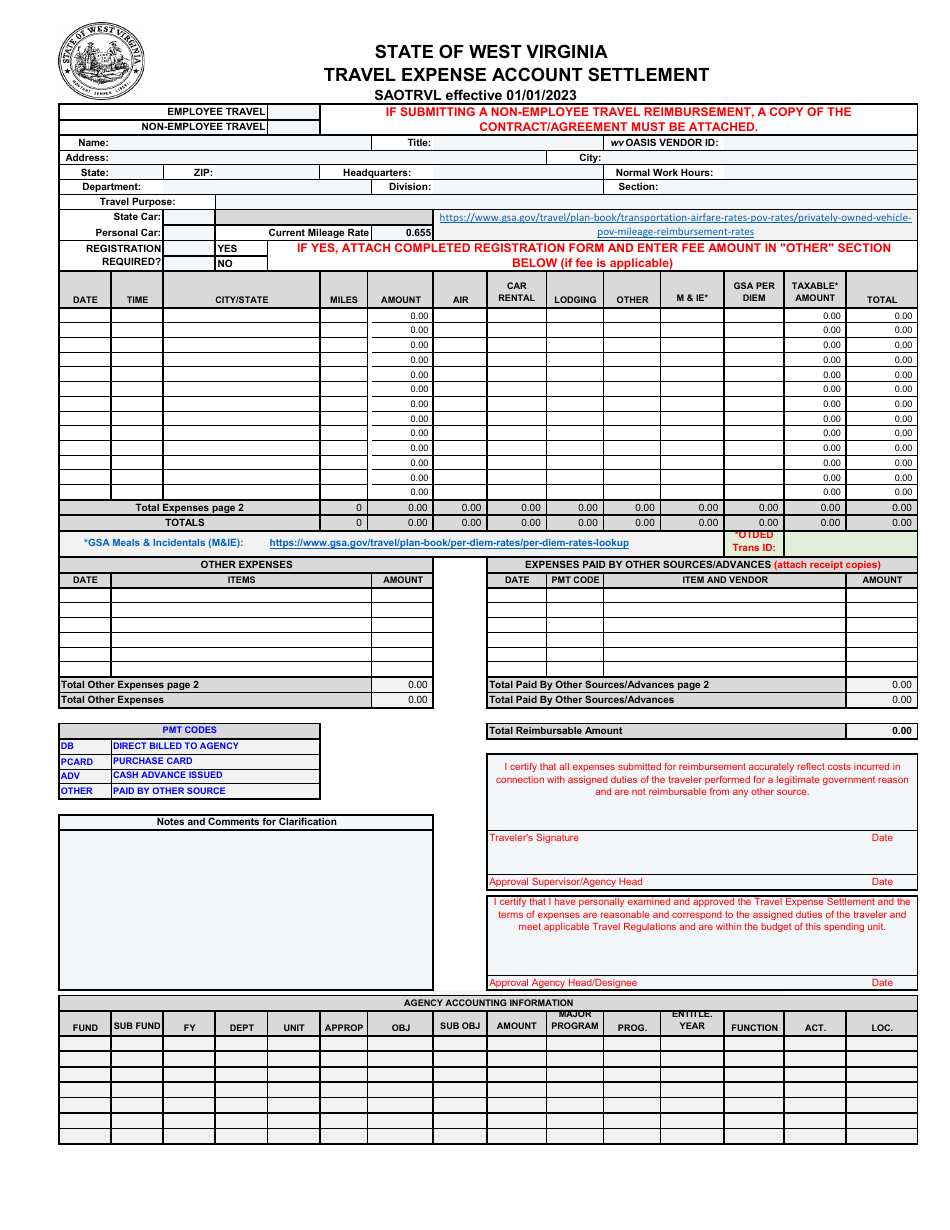

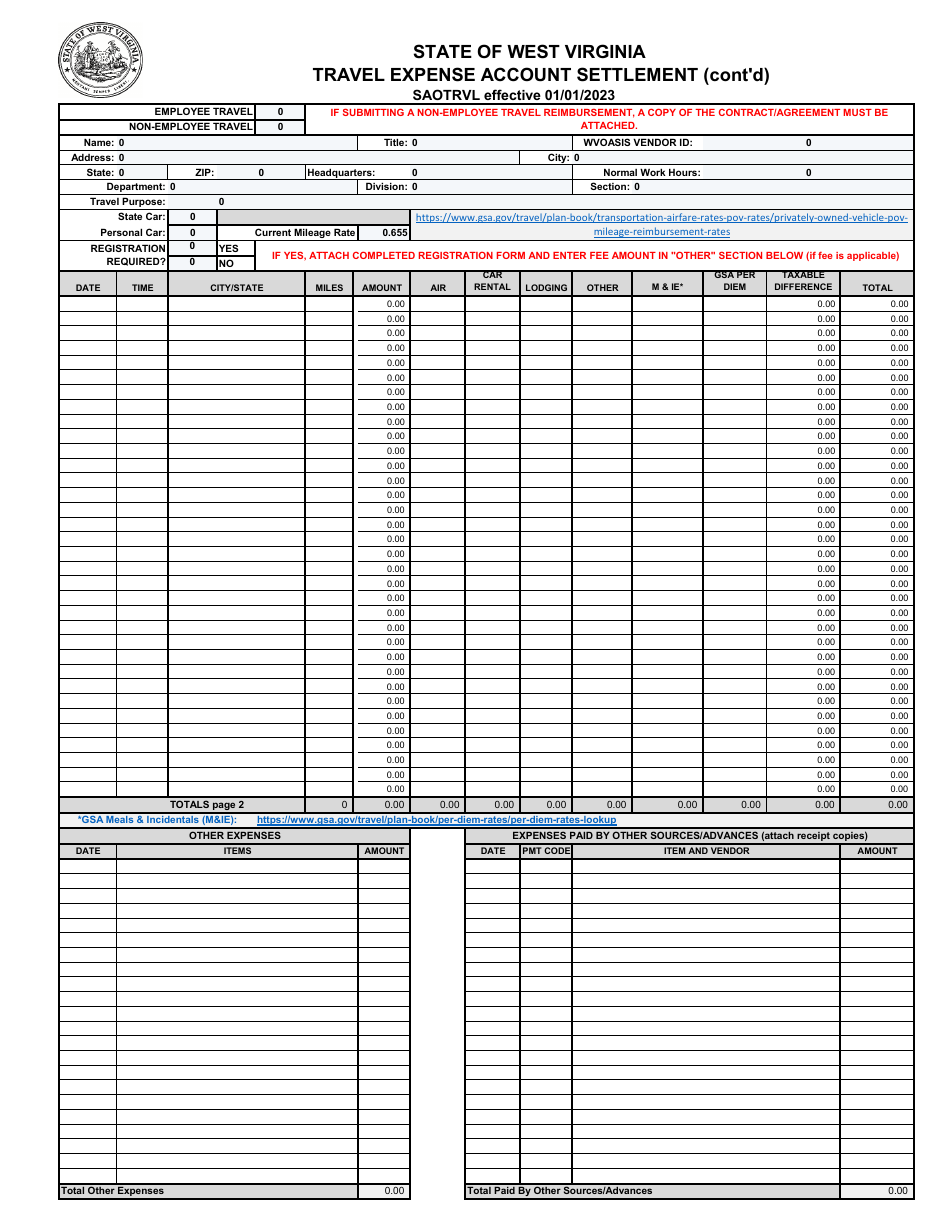

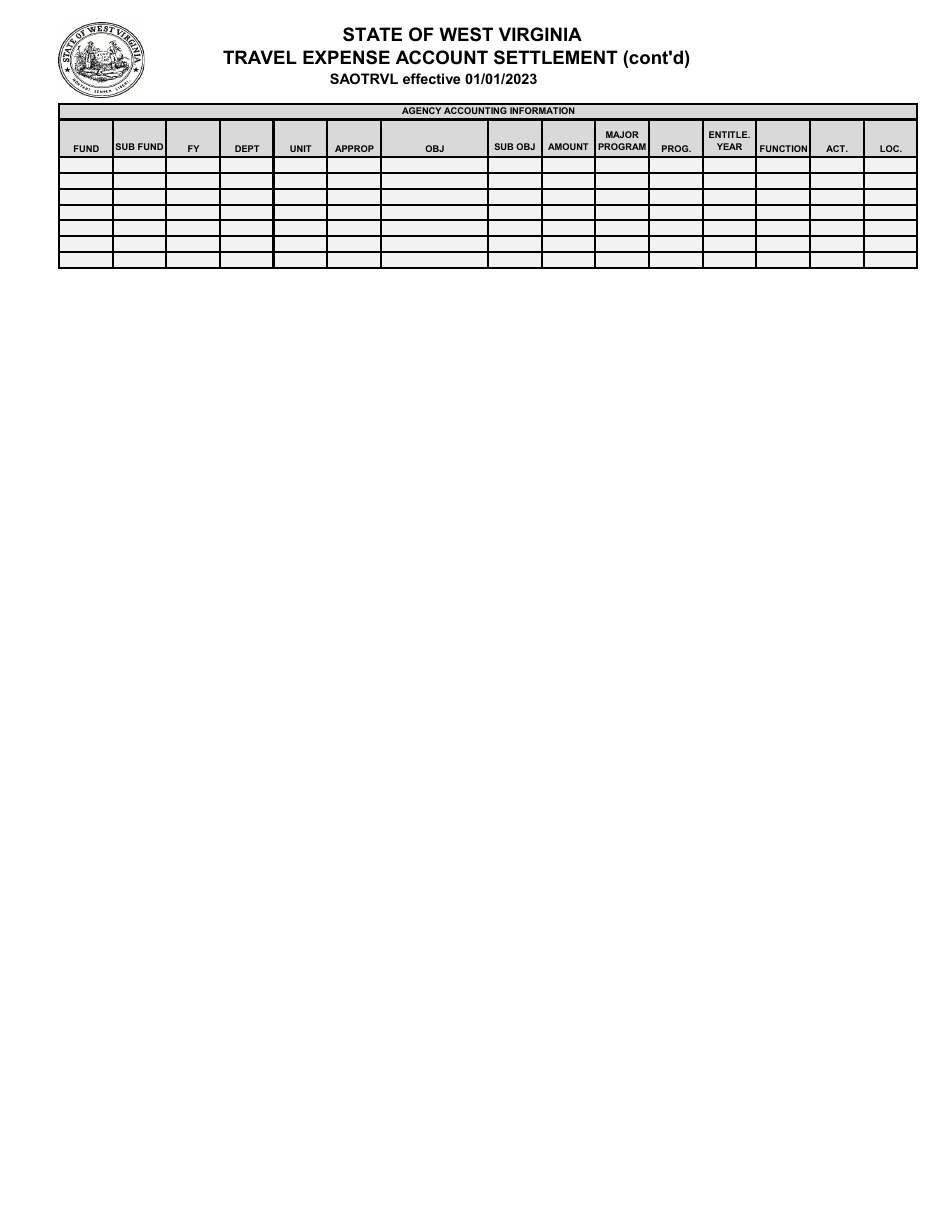

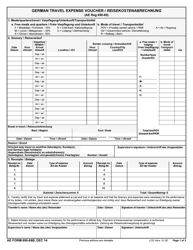

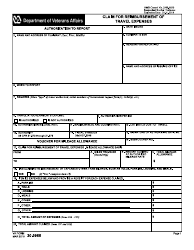

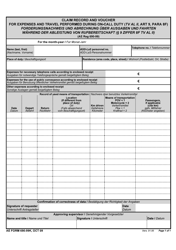

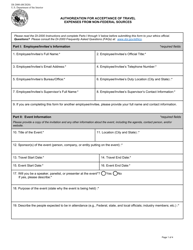

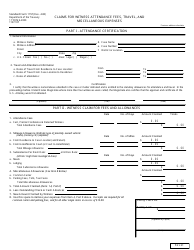

Travel Expense Account Settlement - West Virginia

Travel Expense Account Settlement is a legal document that was released by the West Virginia Department of Administration - Purchasing Division - a government authority operating within West Virginia.

FAQ

Q: What is a travel expense account settlement?

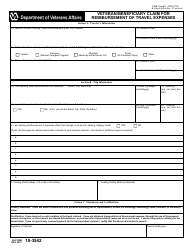

A: A travel expense account settlement is the process of reimbursing an individual for the expenses they incurred while traveling.

Q: Why would I need a travel expense account settlement?

A: You may need a travel expense account settlement if you have traveled for business purposes and need to be reimbursed for the expenses you paid out of your own pocket.

Q: Who is eligible for a travel expense account settlement?

A: Employees who have traveled for business purposes and have incurred expenses that are within the company's reimbursement policy are eligible for a travel expense account settlement.

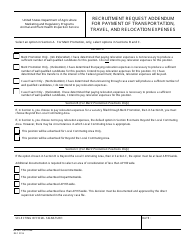

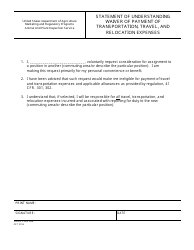

Q: How do I request a travel expense account settlement?

A: To request a travel expense account settlement, you usually need to fill out a reimbursement form provided by your employer and submit it along with the supporting documentation for your expenses.

Q: What types of expenses can be included in a travel expense account settlement?

A: Typically, expenses such as transportation costs, lodging, meals, and other business-related expenses can be included in a travel expense account settlement.

Q: How long does it take to process a travel expense account settlement?

A: The processing time for a travel expense account settlement can vary depending on the company's policies and procedures. It is recommended to check with your employer for a specific timeframe.

Q: Can I claim personal expenses in a travel expense account settlement?

A: No, personal expenses are not normally eligible for reimbursement in a travel expense account settlement. Only business-related expenses should be included.

Q: What should I do if my travel expense account settlement is denied?

A: If your travel expense account settlement is denied, it is best to reach out to your employer or the appropriate department to understand the reason for the denial and to discuss any possible resolutions.

Q: Are travel expense account settlements taxable?

A: Travel expense account settlements are generally considered non-taxable reimbursements for business-related expenses. However, it is recommended to consult with a tax professional or refer to IRS guidelines for specific situations.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the West Virginia Department of Administration - Purchasing Division;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia Department of Administration - Purchasing Division.