This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

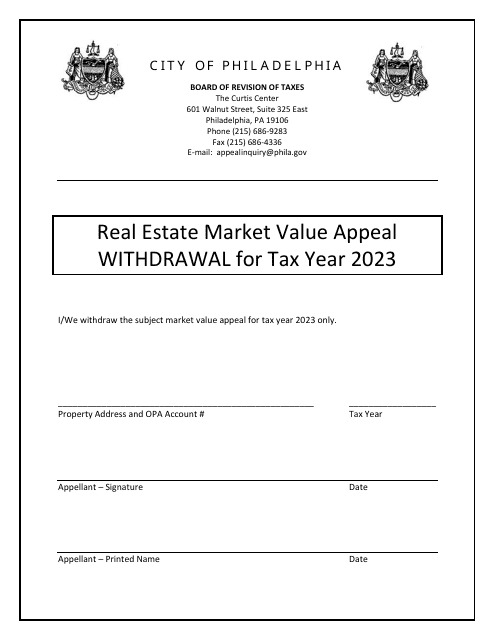

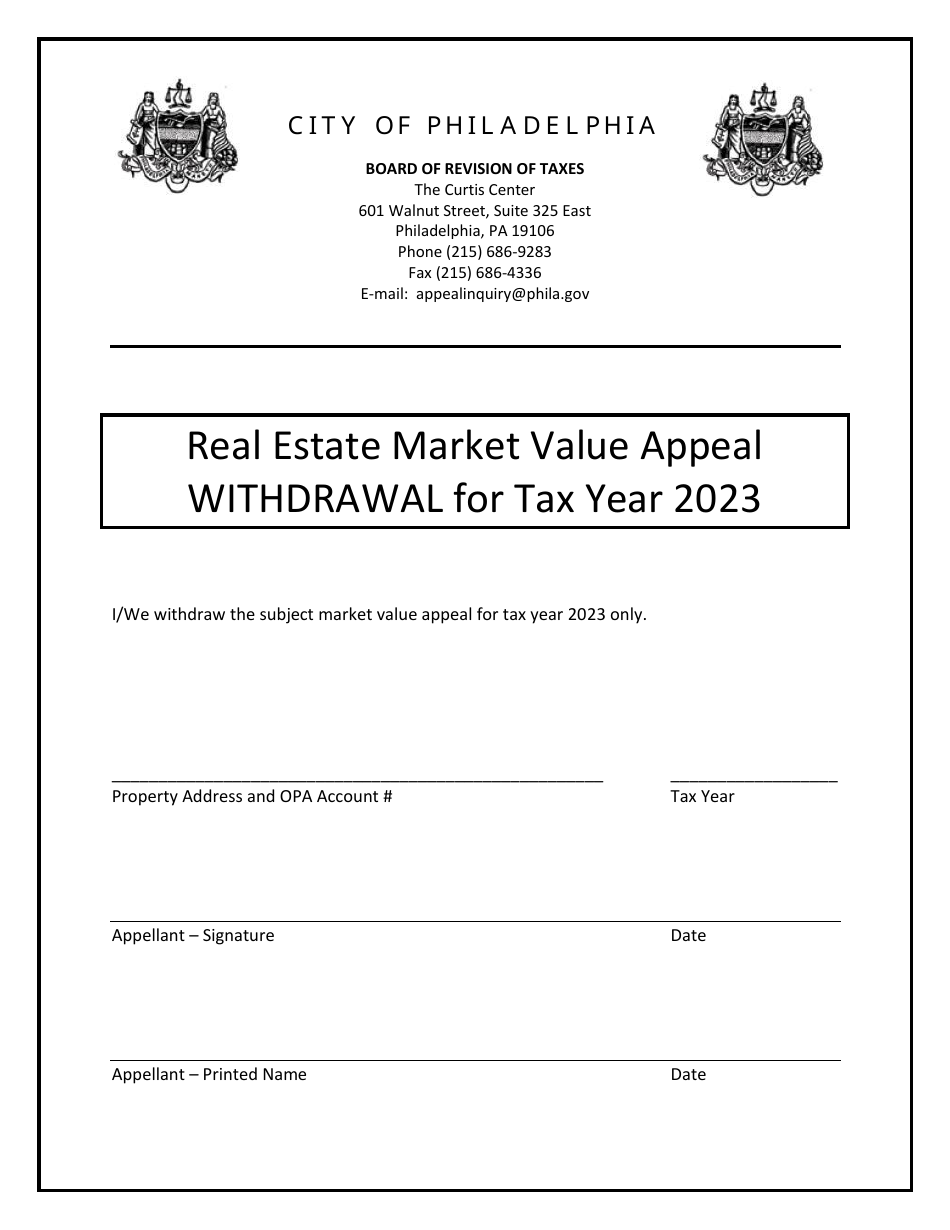

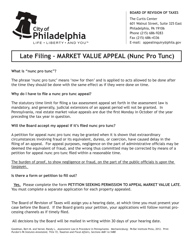

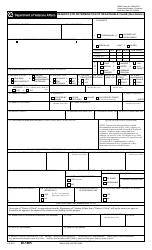

Real Estate Market Value Appeal Withdrawal - City of Philadelphia, Pennsylvania

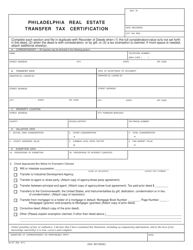

Real Estate Market Value Appeal Withdrawal is a legal document that was released by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is a Real Estate Market Value Appeal Withdrawal?

A: A Real Estate Market Value Appeal Withdrawal is a process in which a property owner in the City of Philadelphia, Pennsylvania seeks to withdraw their appeal to contest the assessed market value of their property.

Q: Why would someone withdraw their Real Estate Market Value Appeal?

A: There can be several reasons for someone to withdraw their Real Estate Market Value Appeal, such as reaching a settlement agreement with the assessor's office, a change in circumstances, or a decision to no longer pursue the appeal process.

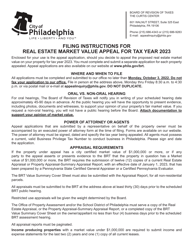

Q: How can a property owner withdraw their Real Estate Market Value Appeal in Philadelphia?

A: A property owner can withdraw their Real Estate Market Value Appeal by submitting a written request to the assessor's office, providing the necessary information and documentation.

Q: Are there any deadlines for withdrawing a Real Estate Market Value Appeal?

A: Yes, there are specific deadlines for withdrawing a Real Estate Market Value Appeal in Philadelphia. It is important to check with the assessor's office for the applicable deadlines.

Q: Will withdrawing a Real Estate Market Value Appeal affect the property owner's assessed market value?

A: Withdrawing a Real Estate Market Value Appeal will generally result in the property owner accepting the current assessed market value of their property, as determined by the assessor's office.

Form Details:

- The latest edition currently provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Board of Revision of Taxes - City of Philadelphia, Pennsylvania.