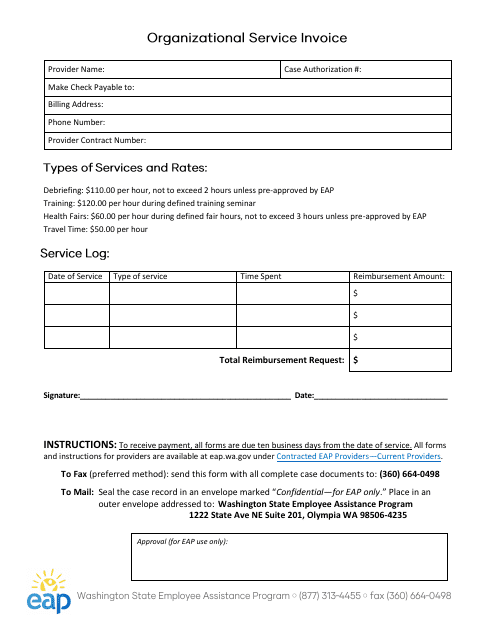

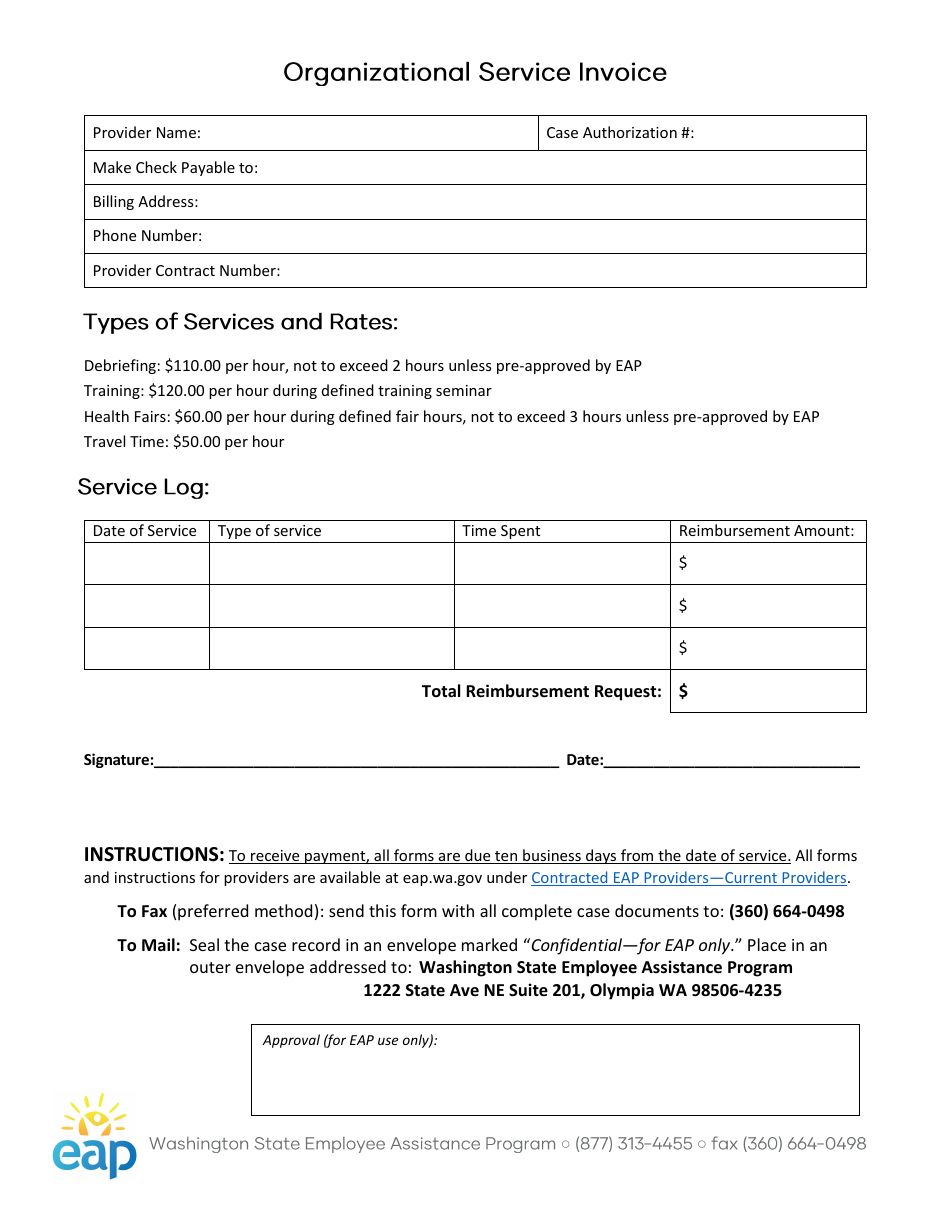

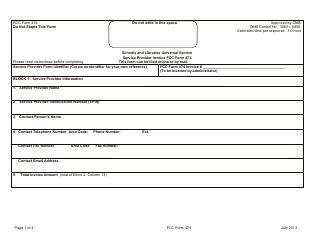

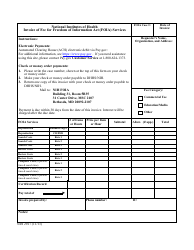

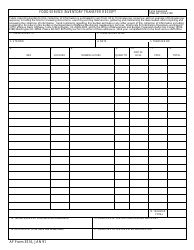

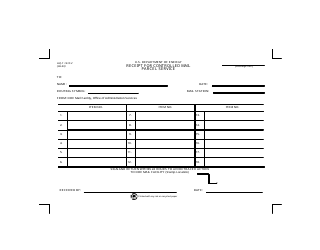

Organizational Service Invoice - Washington

Organizational Service Invoice is a legal document that was released by the Washington State Department of Enterprise Services - a government authority operating within Washington.

FAQ

Q: What is an organizational service invoice?

A: An organizational service invoice is a document that details the services provided by an organization and the associated costs.

Q: Do I need an organizational service invoice?

A: It depends on the situation. If you have received services from an organization and need a record of the services provided and the cost, then an organizational service invoice is necessary.

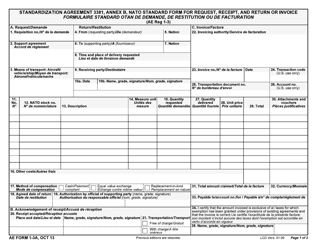

Q: What information is included in an organizational service invoice?

A: An organizational service invoice typically includes details such as the name of the organization, a description of the services provided, the quantity or duration of the services, the cost per service, and the total amount due.

Q: How do I obtain an organizational service invoice?

A: Contact the organization that provided the services and request an organizational service invoice. They should be able to generate and provide it to you.

Q: Do I need to pay an organizational service invoice?

A: Yes, if you have received services from an organization and they have provided you with an invoice, you are generally required to pay the amount specified on the invoice.

Q: Can I dispute an organizational service invoice?

A: Yes, if you believe there is an error or discrepancy in the invoice, you can contact the organization to discuss and potentially resolve the issue.

Q: What happens if I don't pay an organizational service invoice?

A: Failure to pay an organizational service invoice may result in various consequences, including late fees, collection efforts, or legal action taken by the organization to recover the amount owed.

Q: Can an organizational service invoice be used as a tax deduction?

A: It depends on the specific nature of the services provided and the tax laws in your jurisdiction. Consult with a tax professional to determine if an organizational service invoice can be used as a tax deduction.

Form Details:

- The latest edition currently provided by the Washington State Department of Enterprise Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Department of Enterprise Services.