This version of the form is not currently in use and is provided for reference only. Download this version of

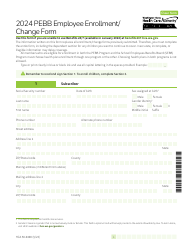

Form HCA50-0098

for the current year.

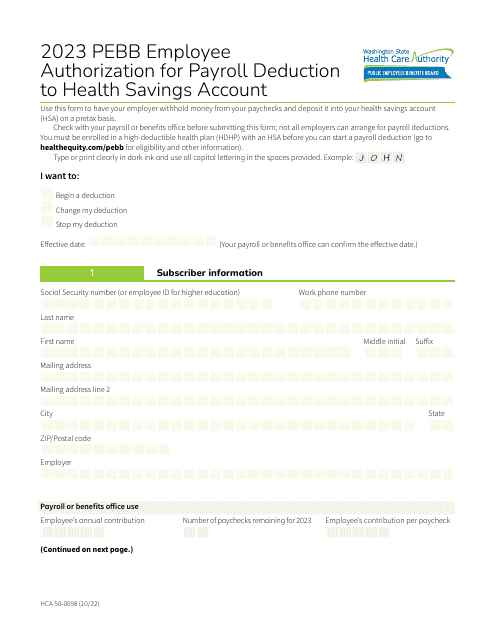

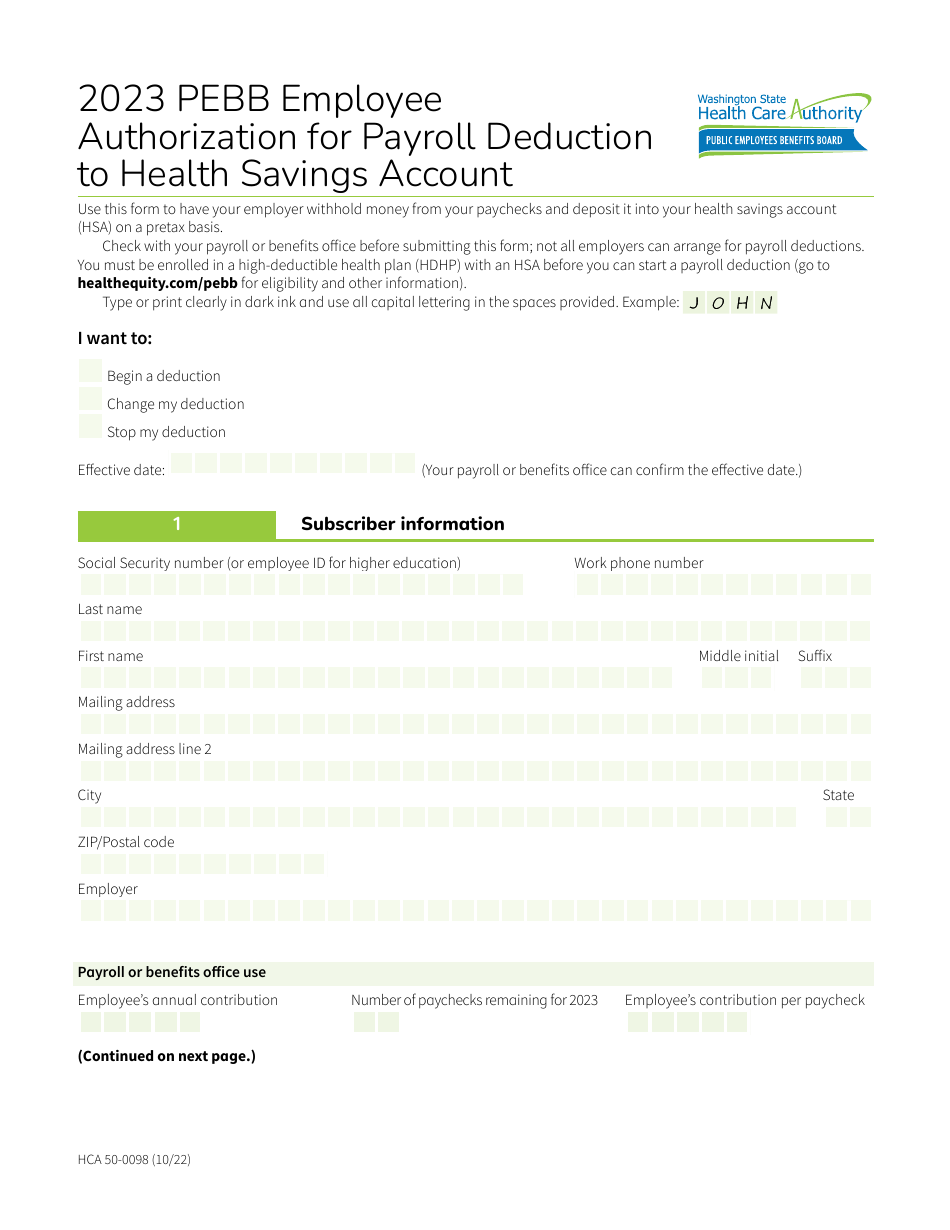

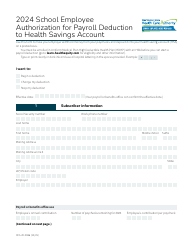

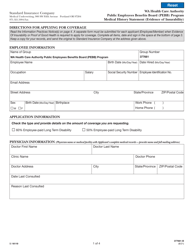

Form HCA50-0098 Pebb Employee Authorization for Payroll Deduction to Health Savings Account - Washington

What Is Form HCA50-0098?

This is a legal form that was released by the Washington State Health Care Authority - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HCA50-0098?

A: Form HCA50-0098 is the Pebb Employee Authorization for Payroll Deduction to Health Savings Account specifically for Washington state.

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a tax-advantaged account that individuals can use to save money for medical expenses.

Q: Who is eligible to use Form HCA50-0098?

A: Employees who are covered by the Pebb health plan and want to authorize payroll deductions to their Health Savings Account (HSA) can use Form HCA50-0098.

Q: What is the purpose of Form HCA50-0098?

A: The purpose of Form HCA50-0098 is to authorize payroll deductions from an employee's salary or wages and deposit the funds into their Health Savings Account (HSA).

Q: Are there any restrictions on the use of funds in a Health Savings Account (HSA)?

A: Yes, funds in a Health Savings Account (HSA) can only be used for qualified medical expenses.

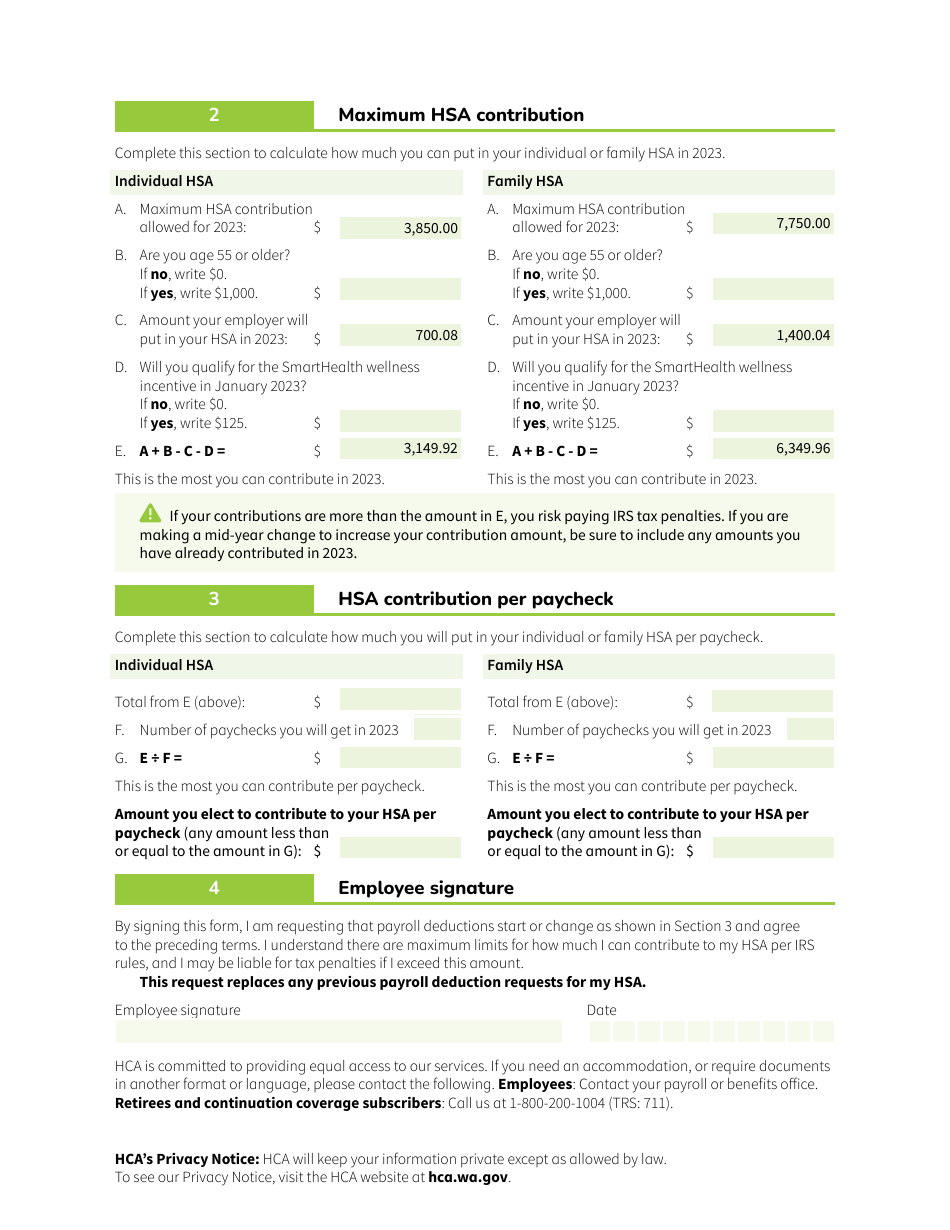

Q: Is there a maximum contribution limit for a Health Savings Account (HSA)?

A: Yes, there are annual contribution limits for Health Savings Accounts (HSAs) that are set by the IRS. The limits may vary each year.

Q: Can I use Form HCA50-0098 to make changes to my Health Savings Account (HSA) deductions?

A: Yes, you can use Form HCA50-0098 to make changes to your Health Savings Account (HSA) deductions.

Q: Do I need to submit Form HCA50-0098 every year?

A: It depends on your employer's policies. Some employers may require an annual submission of Form HCA50-0098, while others may have different processes in place.

Q: Can I withdraw funds from my Health Savings Account (HSA)?

A: Yes, you can withdraw funds from your Health Savings Account (HSA) to pay for qualified medical expenses.

Q: Is there a penalty for non-medical withdrawals from a Health Savings Account (HSA)?

A: Yes, there is a penalty for non-medical withdrawals from a Health Savings Account (HSA) unless you are over the age of 65.

Q: Can I use my Health Savings Account (HSA) to pay for health insurance premiums?

A: In general, you cannot use funds from your Health Savings Account (HSA) to pay for health insurance premiums, but there are some exceptions.

Q: What happens to unused funds in a Health Savings Account (HSA)?

A: Unused funds in a Health Savings Account (HSA) roll over from year to year and continue to grow tax-free.

Q: Can I have multiple Health Savings Accounts (HSAs)?

A: No, you can only have one Health Savings Account (HSA) at a time.

Q: Can I invest the funds in my Health Savings Account (HSA)?

A: Yes, in most cases you can invest the funds in your Health Savings Account (HSA) once it reaches a certain minimum balance.

Q: Can I close my Health Savings Account (HSA)?

A: Yes, you can close your Health Savings Account (HSA) at any time, but there may be tax implications.

Q: Does Form HCA50-0098 apply to residents of states other than Washington?

A: No, Form HCA50-0098 is specifically for residents of Washington state.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Washington State Health Care Authority;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HCA50-0098 by clicking the link below or browse more documents and templates provided by the Washington State Health Care Authority.