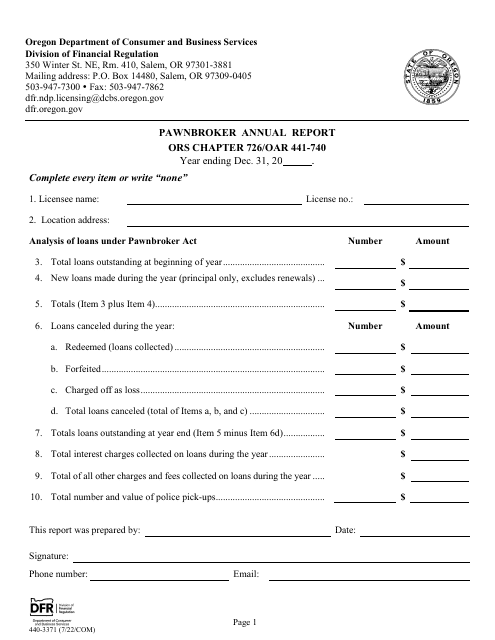

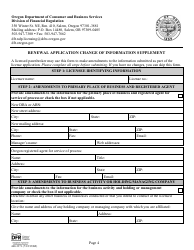

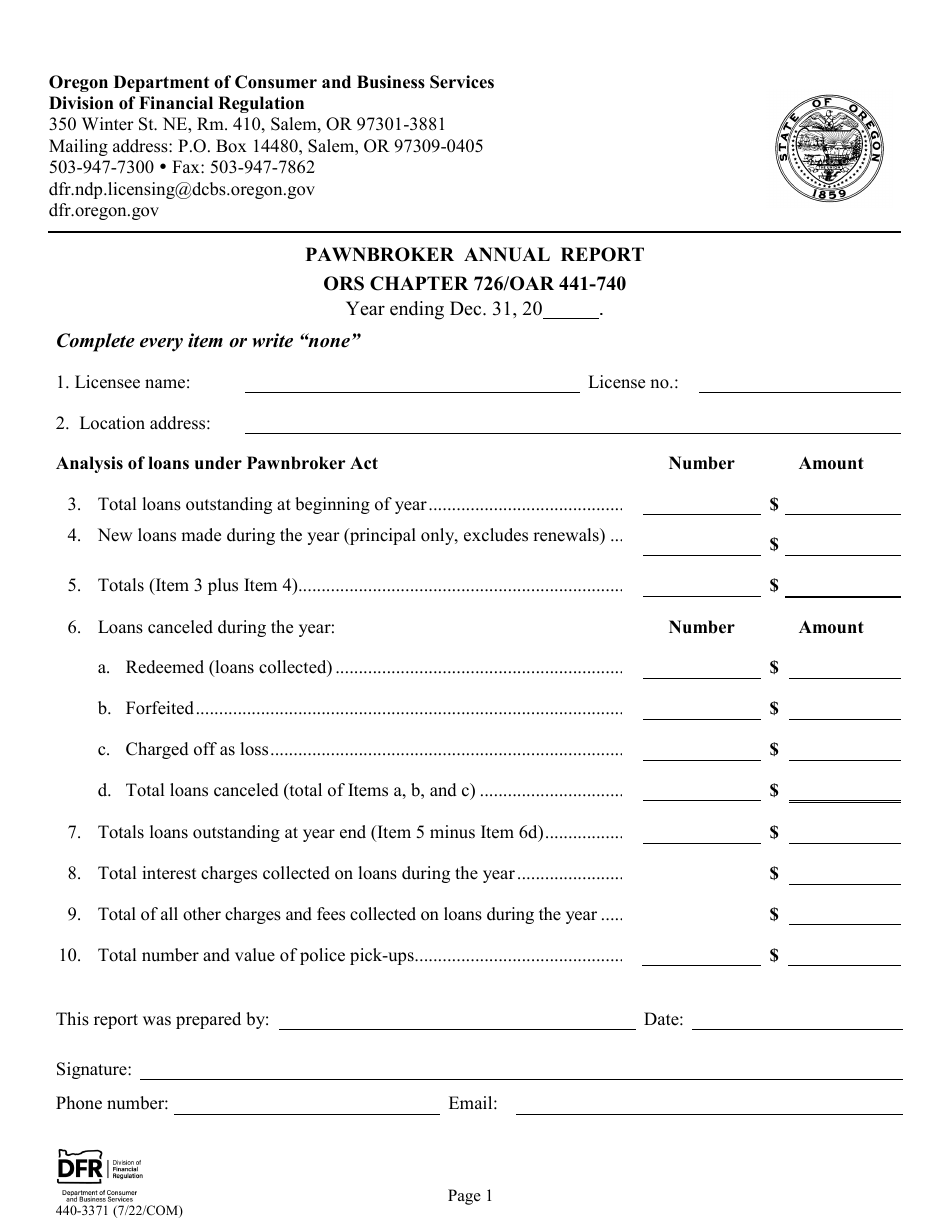

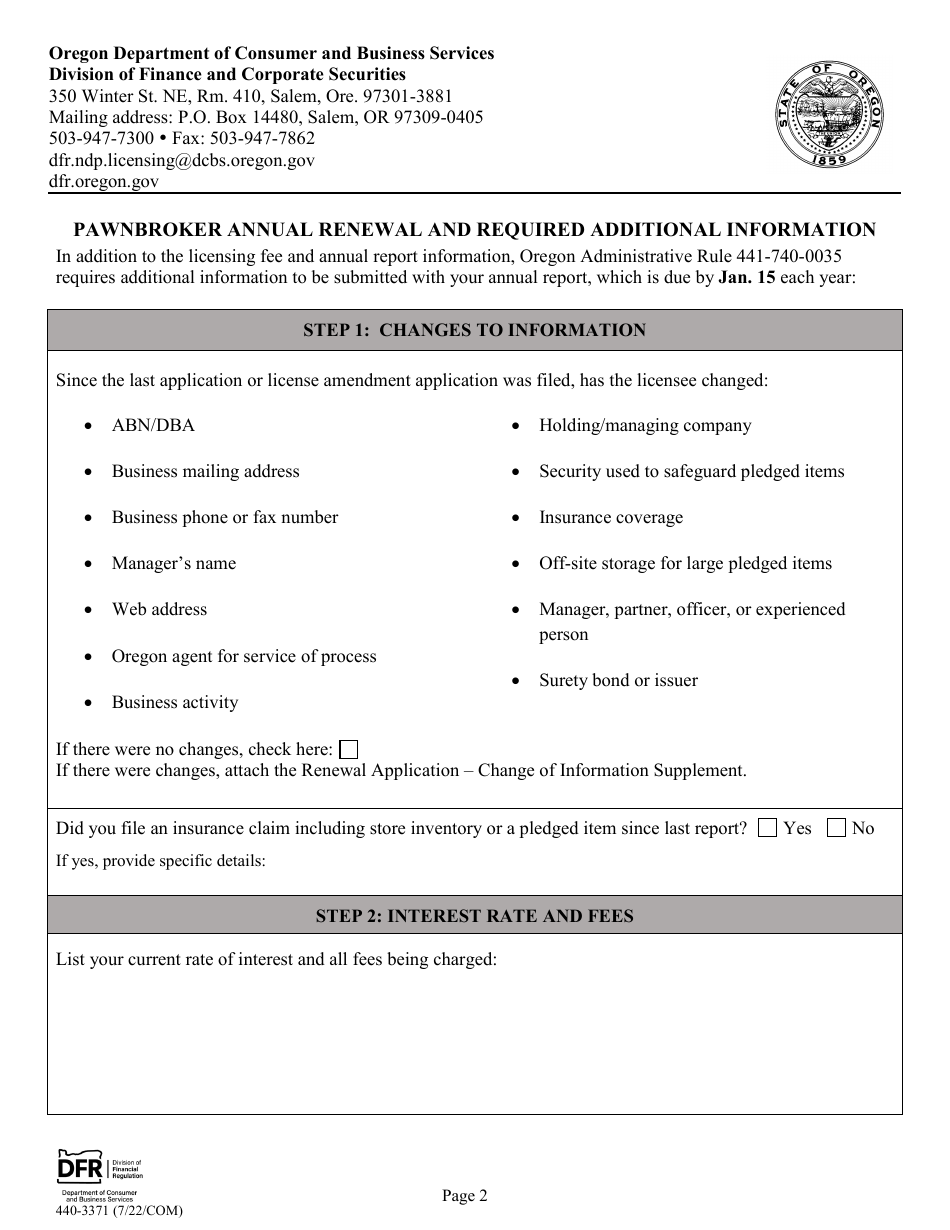

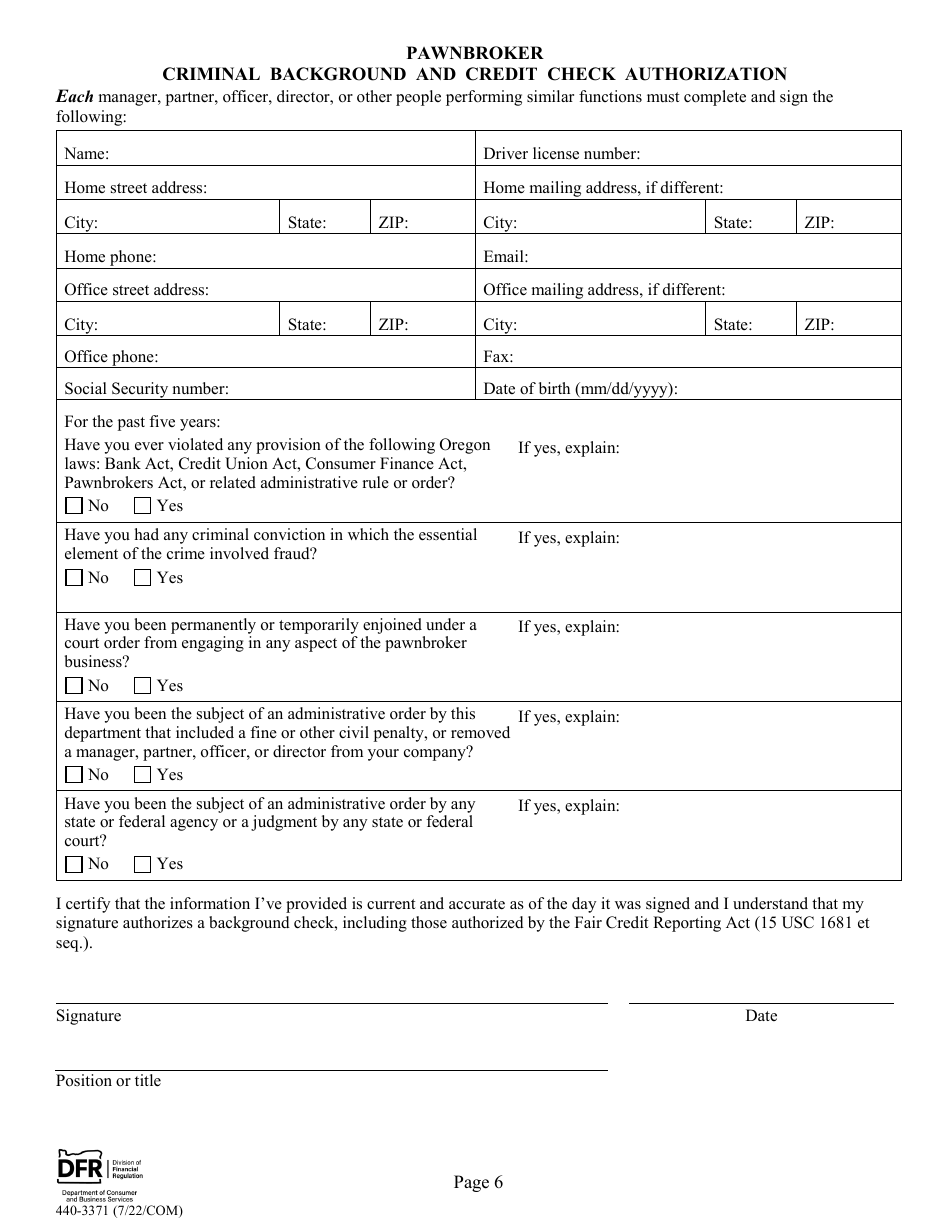

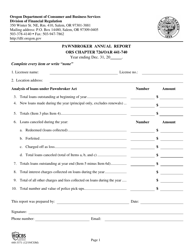

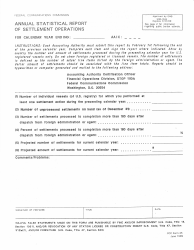

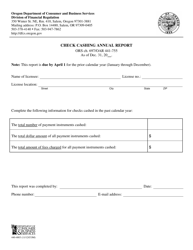

Form 440-3371 Pawnbroker Annual Report - Oregon

What Is Form 440-3371?

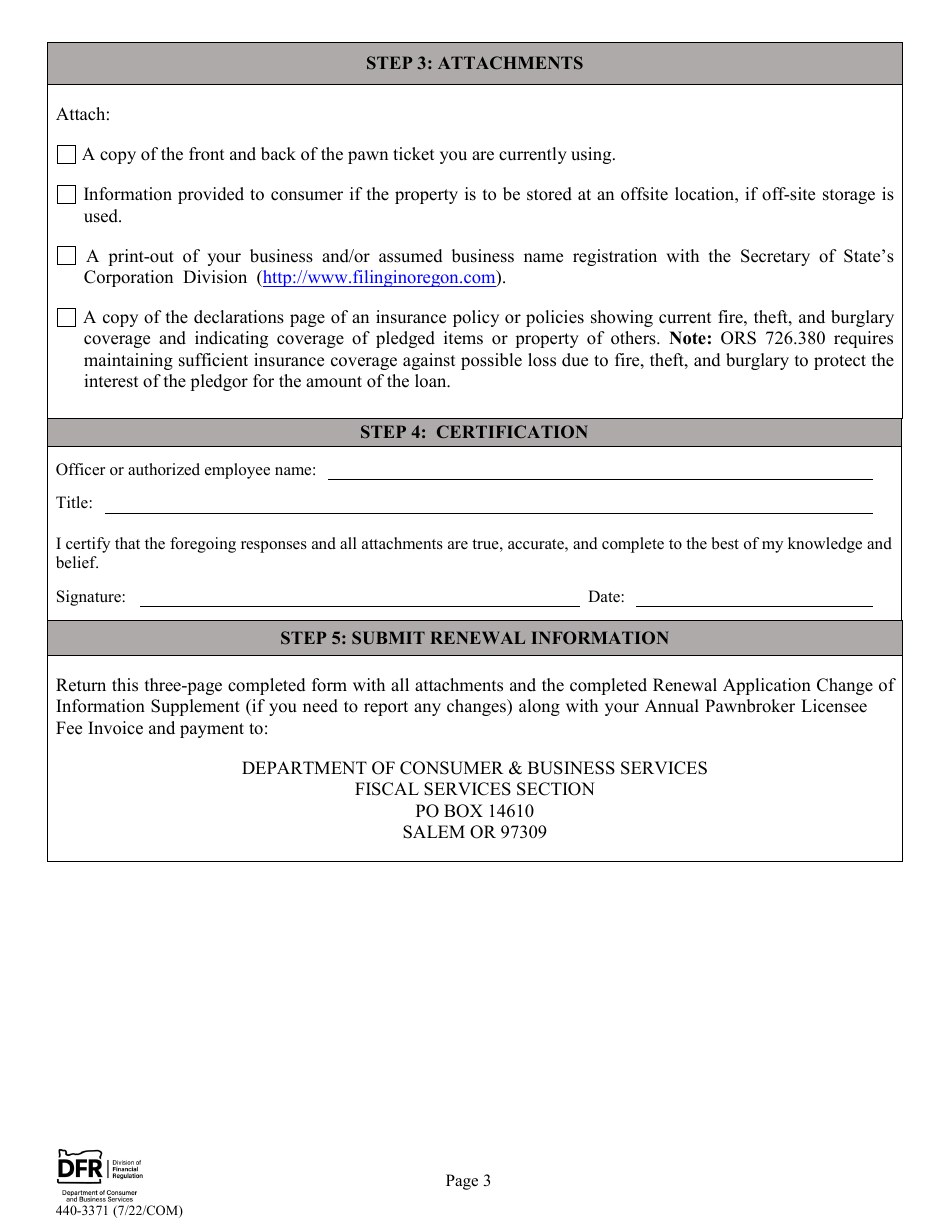

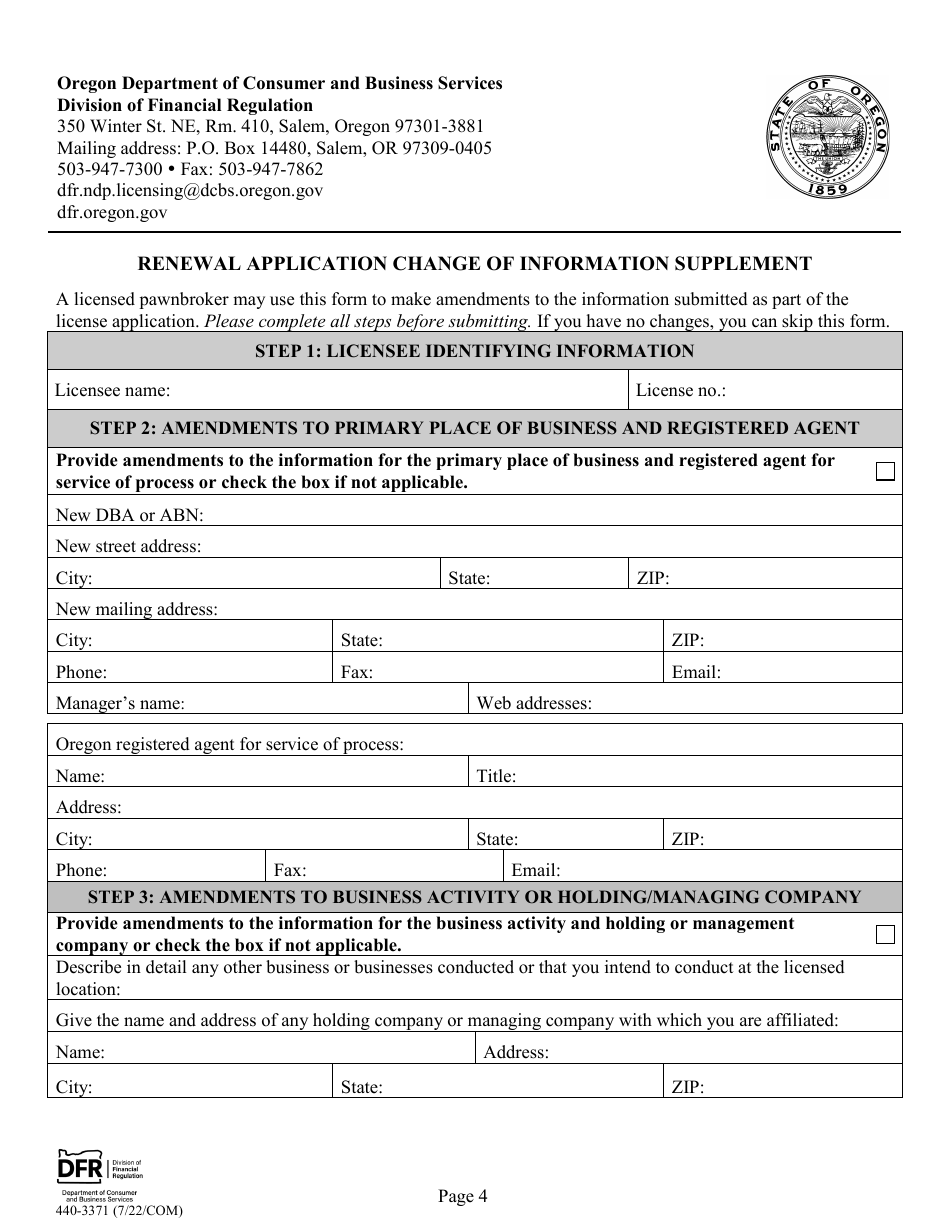

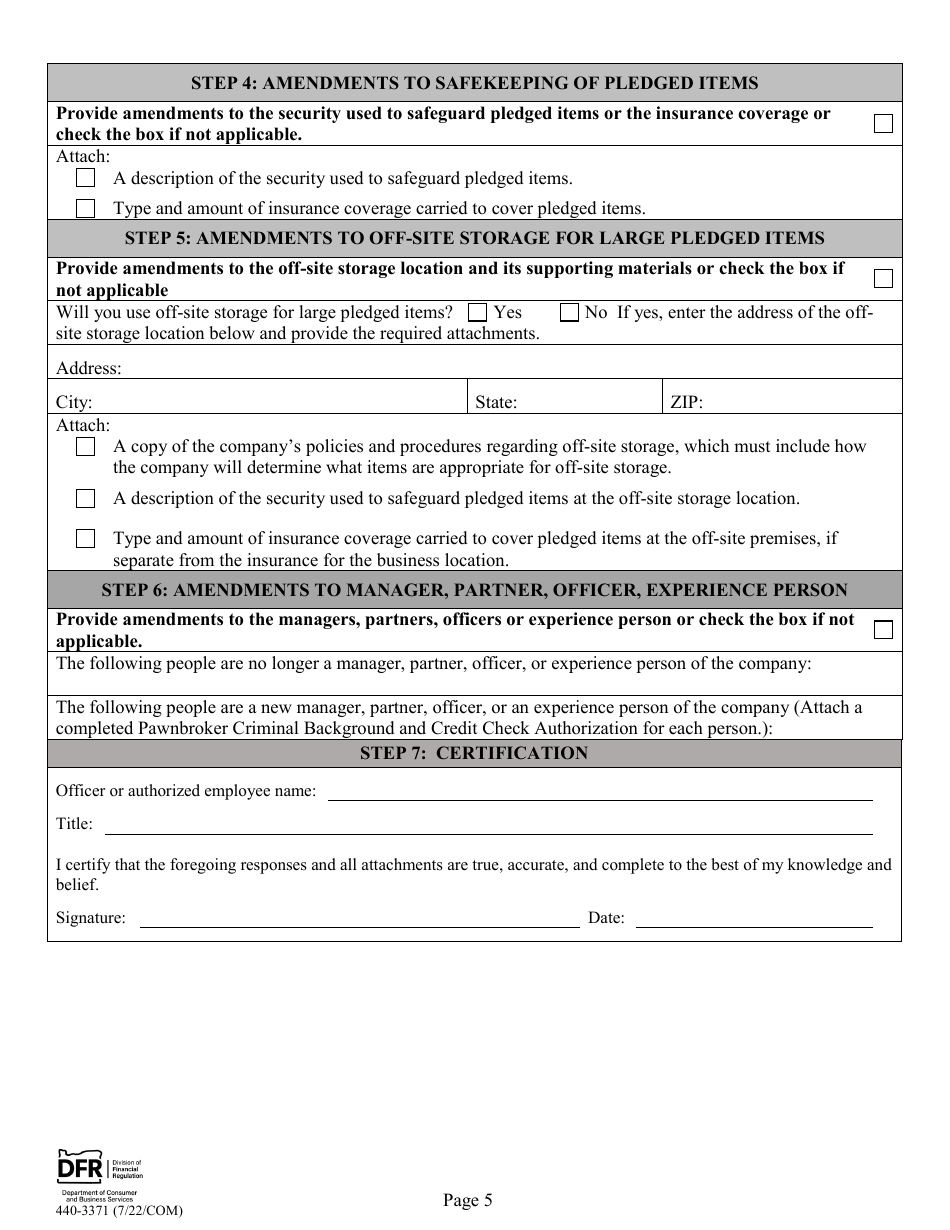

This is a legal form that was released by the Oregon Department of Consumer and Business Services - Division of Financial Regulations - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440-3371?

A: Form 440-3371 is the Pawnbroker Annual Report in Oregon.

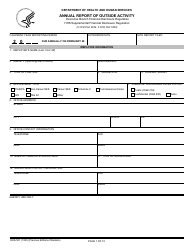

Q: Who needs to file Form 440-3371?

A: Pawnbrokers in Oregon need to file Form 440-3371.

Q: What is the purpose of Form 440-3371?

A: The purpose of Form 440-3371 is to report the pawnbroker's annual activities.

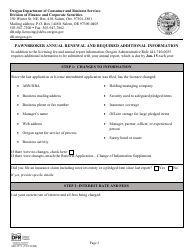

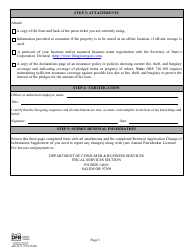

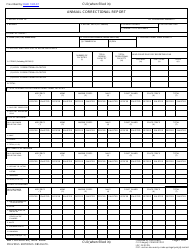

Q: What information is required on Form 440-3371?

A: Form 440-3371 requires information such as the pawnbroker's business details, transactions, and fees collected.

Q: When is Form 440-3371 due?

A: Form 440-3371 is due on or before March 1st of each year.

Q: Are there any penalties for not filing Form 440-3371?

A: Yes, there can be penalties for not filing Form 440-3371, such as late fees or license suspension.

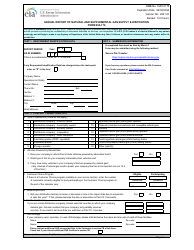

Q: Is Form 440-3371 specific to pawnbrokers in Oregon?

A: Yes, Form 440-3371 is specific to pawnbrokers operating in Oregon.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 440-3371 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services - Division of Financial Regulations.